Valid Promissory Note Form for New York

The New York Promissory Note form serves as a vital financial instrument, facilitating the borrowing and lending of money between parties. This straightforward document outlines the borrower's promise to repay a specified amount to the lender, along with any applicable interest. Key components include the principal amount, interest rate, repayment schedule, and the maturity date, which collectively define the terms of the loan. Additionally, the form may specify the consequences of default, ensuring both parties understand their rights and obligations. It is essential to accurately complete this form to avoid potential disputes and ensure enforceability in a court of law. By adhering to New York's legal requirements, individuals and businesses can utilize this form effectively, promoting transparency and trust in financial transactions.

Common mistakes

-

Not Including All Required Information: One of the most common mistakes is failing to provide all necessary details. Make sure to include the names of both the borrower and the lender, the loan amount, and the interest rate. Missing even one piece of information can lead to confusion later on.

-

Incorrectly Stating the Loan Amount: Double-check the loan amount. A simple typo can lead to significant issues. Ensure that the number is written correctly in both numerical and written form.

-

Omitting Payment Terms: Clearly outline the payment schedule. Specify when payments are due, how much each payment will be, and whether payments will be made monthly, quarterly, or annually. Without this information, both parties may have different expectations.

-

Not Including Default Terms: It's crucial to define what happens in the event of a default. Include details about late fees, acceleration of the loan, and any other consequences. This can protect both parties in case of unforeseen circumstances.

-

Failure to Sign and Date: A promissory note is not valid unless it is signed and dated by both parties. Ensure that both the borrower and lender have signed the document before considering it official.

-

Ignoring State-Specific Requirements: Each state may have specific laws regarding promissory notes. Familiarize yourself with New York's requirements to ensure your document complies with local laws.

-

Not Keeping Copies: After filling out the form, always keep copies for both parties. This ensures that everyone has access to the same information and can refer back to the original agreement if needed.

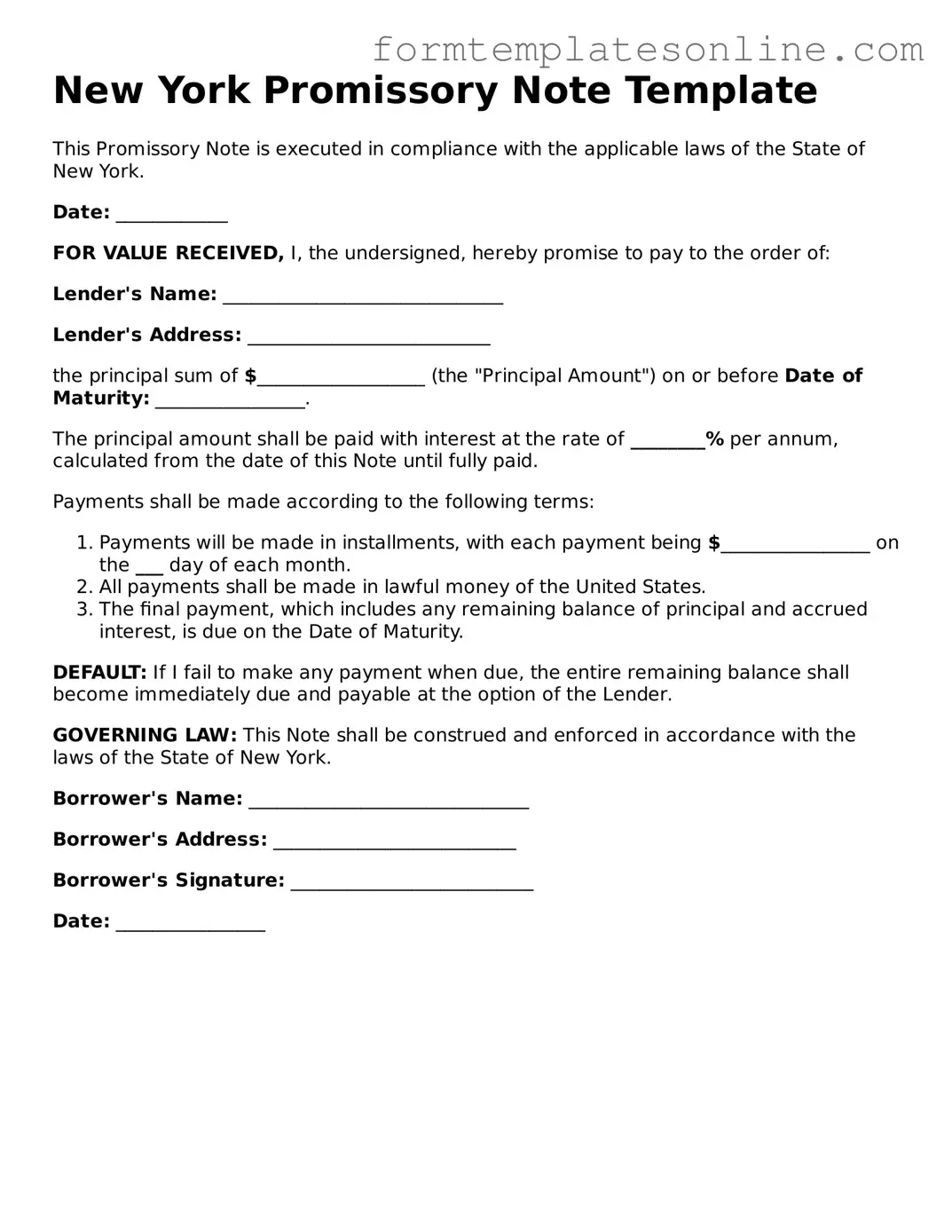

Example - New York Promissory Note Form

New York Promissory Note Template

This Promissory Note is executed in compliance with the applicable laws of the State of New York.

Date: ____________

FOR VALUE RECEIVED, I, the undersigned, hereby promise to pay to the order of:

Lender's Name: ______________________________

Lender's Address: __________________________

the principal sum of $__________________ (the "Principal Amount") on or before Date of Maturity: ________________.

The principal amount shall be paid with interest at the rate of ________% per annum, calculated from the date of this Note until fully paid.

Payments shall be made according to the following terms:

- Payments will be made in installments, with each payment being $________________ on the ___ day of each month.

- All payments shall be made in lawful money of the United States.

- The final payment, which includes any remaining balance of principal and accrued interest, is due on the Date of Maturity.

DEFAULT: If I fail to make any payment when due, the entire remaining balance shall become immediately due and payable at the option of the Lender.

GOVERNING LAW: This Note shall be construed and enforced in accordance with the laws of the State of New York.

Borrower's Name: ______________________________

Borrower's Address: __________________________

Borrower's Signature: __________________________

Date: ________________

More About New York Promissory Note

What is a New York Promissory Note?

A New York Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a defined time or on demand. This document outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments. It serves as a legal record of the debt and the obligations of both parties involved.

Who can use a Promissory Note in New York?

Any individual or business can use a Promissory Note in New York. It is commonly used by lenders and borrowers in personal loans, business loans, or even informal agreements between friends and family. However, it is essential for both parties to understand the terms before signing to ensure clarity and legal enforceability.

What are the essential elements of a New York Promissory Note?

A valid New York Promissory Note should include the following elements: the names of the borrower and lender, the principal amount being borrowed, the interest rate, the repayment schedule, and the maturity date. Additionally, it should specify any late fees or penalties and include signatures from both parties to confirm their agreement.

Is a Promissory Note legally binding in New York?

Yes, a Promissory Note is legally binding in New York as long as it meets the necessary requirements. Both parties must voluntarily agree to the terms, and the document must be signed. If one party fails to uphold their end of the agreement, the other party can take legal action to enforce the terms of the note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to create a written amendment that outlines the modifications and have both parties sign it. This ensures that the changes are documented and legally recognized.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They can pursue legal action to recover the owed amount, which may include filing a lawsuit. Additionally, the lender may be able to report the default to credit bureaus, affecting the borrower's credit score. It is crucial for both parties to understand the consequences of defaulting before entering into the agreement.

Key takeaways

When filling out and using the New York Promissory Note form, it is essential to understand several key aspects to ensure clarity and legal enforceability.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This identification is crucial for establishing the parties involved in the agreement.

- Specify the Loan Amount: Clearly indicate the exact amount of money being borrowed. This figure should be accurate and easily identifiable to avoid any confusion.

- Detail the Interest Rate: If applicable, include the interest rate associated with the loan. This rate should comply with New York state laws regarding usury limits.

- Outline the Payment Terms: Clearly define the repayment schedule, including due dates and the method of payment. This helps both parties understand their obligations.

- Include Default Provisions: Specify what constitutes a default and the consequences that follow. This section protects the lender’s interests in case of non-payment.

- Signatures Required: Ensure that both parties sign and date the document. This step is vital for the document's validity and enforceability.

- Consider Notarization: Although not always required, having the note notarized can provide additional legal protection and credibility to the agreement.

File Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | New York General Obligations Law governs promissory notes in New York. |

| Parties Involved | The note involves two parties: the maker (borrower) and the payee (lender). |

| Payment Terms | The note specifies the amount to be paid, the due date, and any interest rates applicable. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Transferability | Promissory notes can be transferred to another party, making them negotiable instruments. |

| Default Consequences | If the maker defaults, the payee has the right to seek legal remedies, including collection actions. |

| Notarization | While notarization is not required, it can provide additional legal protection. |

| Use Cases | Commonly used in personal loans, business loans, and real estate transactions. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Ohio - Interest rates can be fixed or variable, depending on the agreement between the parties.

Promissory Note Illinois - Signing a Promissory Note creates a formal obligation to repay the stated amount.

When drafting a Michigan Hold Harmless Agreement, it is essential to ensure clarity in its terms to prevent misunderstandings between the parties involved. This legal document not only safeguards one's interests but also outlines responsibilities, ensuring that all parties are aware of their obligations. For those seeking templates or guidance on creating such agreements, resources such as OnlineLawDocs.com can provide valuable assistance in navigating the complexities of liability management.

Create a Promissory Note - Promissory Notes are often enforceable under state contract laws.

Dos and Don'ts

When filling out the New York Promissory Note form, it is essential to follow certain guidelines to ensure accuracy and legality. Here are four things you should and shouldn't do:

- Do: Clearly state the amount of money being borrowed.

- Do: Include the names and addresses of both the borrower and lender.

- Don't: Leave any sections blank; all fields should be completed.

- Don't: Use vague language; be specific about the repayment terms.