Valid Operating Agreement Form for New York

When forming a Limited Liability Company (LLC) in New York, one of the most crucial documents you will encounter is the Operating Agreement. This form serves as the backbone of your business, outlining the internal workings and management structure of your LLC. It addresses essential aspects such as the roles and responsibilities of members, the distribution of profits and losses, and the procedures for adding or removing members. Furthermore, it provides guidelines for decision-making processes and outlines how the company will handle disputes. By clearly defining these elements, the Operating Agreement helps to prevent misunderstandings and conflicts among members, fostering a cooperative and harmonious business environment. While New York law does not require an Operating Agreement to be filed with the state, having one is highly recommended to protect your interests and ensure your LLC operates smoothly. With this document in place, members can navigate the complexities of business operations with greater confidence and clarity.

Common mistakes

-

Omitting Member Information: One common mistake is failing to include all members' names and addresses. Each member’s information should be accurately listed to avoid future disputes or confusion.

-

Neglecting to Define Roles: Another frequent error involves not clearly defining the roles and responsibilities of each member. Without clear definitions, misunderstandings can arise regarding decision-making authority and operational duties.

-

Ignoring Profit Distribution: Some individuals overlook the importance of specifying how profits and losses will be distributed among members. This can lead to disagreements down the line if expectations are not set from the beginning.

-

Failing to Address Dispute Resolution: Many people forget to include a section on how disputes will be resolved. Having a clear process for handling conflicts can save time and resources in the event of a disagreement.

Example - New York Operating Agreement Form

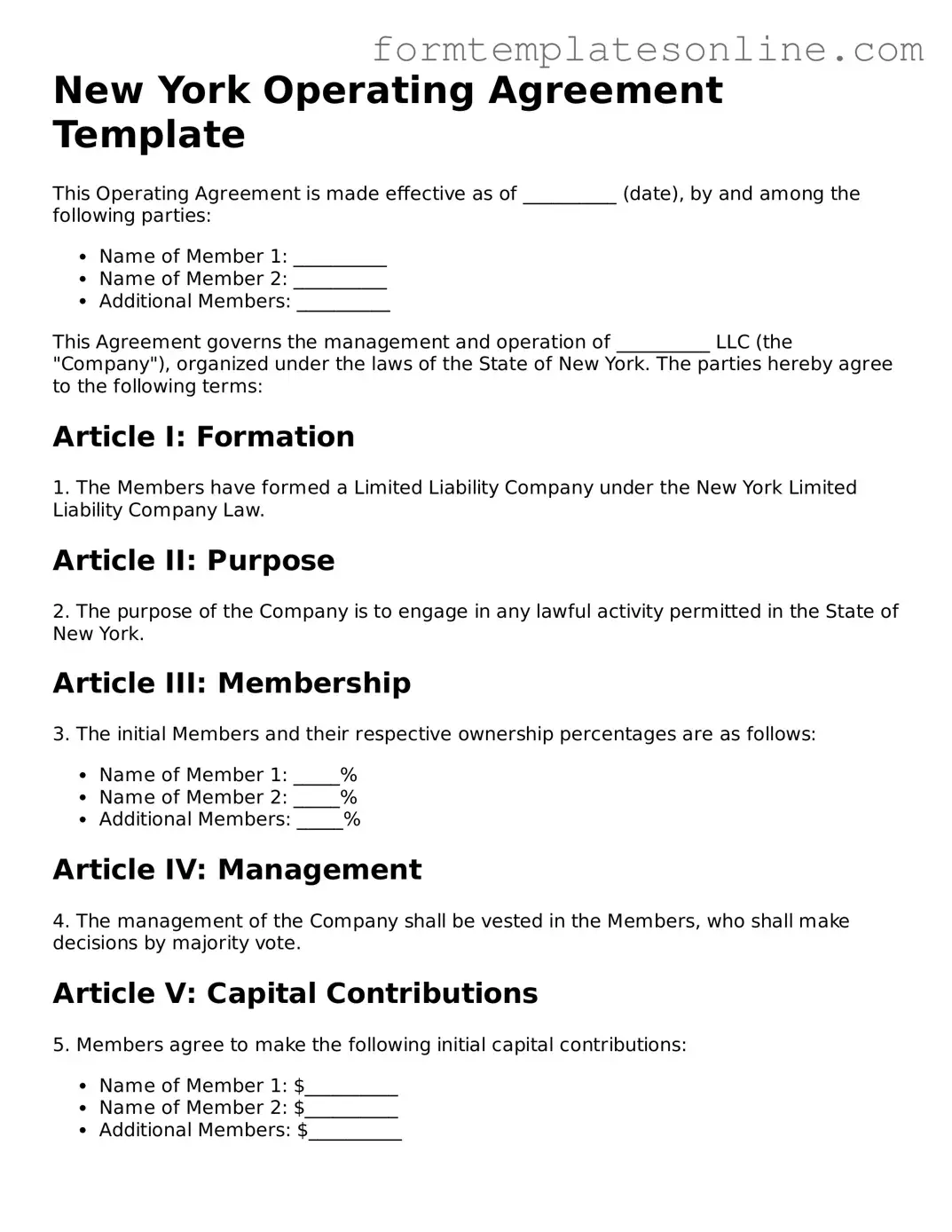

New York Operating Agreement Template

This Operating Agreement is made effective as of __________ (date), by and among the following parties:

- Name of Member 1: __________

- Name of Member 2: __________

- Additional Members: __________

This Agreement governs the management and operation of __________ LLC (the "Company"), organized under the laws of the State of New York. The parties hereby agree to the following terms:

Article I: Formation

1. The Members have formed a Limited Liability Company under the New York Limited Liability Company Law.

Article II: Purpose

2. The purpose of the Company is to engage in any lawful activity permitted in the State of New York.

Article III: Membership

3. The initial Members and their respective ownership percentages are as follows:

- Name of Member 1: _____%

- Name of Member 2: _____%

- Additional Members: _____%

Article IV: Management

4. The management of the Company shall be vested in the Members, who shall make decisions by majority vote.

Article V: Capital Contributions

5. Members agree to make the following initial capital contributions:

- Name of Member 1: $__________

- Name of Member 2: $__________

- Additional Members: $__________

Article VI: Distributions

6. Distributions of profits and losses shall be allocated to Members in proportion to their ownership percentages.

Article VII: Indemnification

7. The Company shall indemnify Members to the fullest extent permitted by law against any liabilities incurred in connection with the Company.

Article VIII: Amendments

8. This Operating Agreement may be amended only with the written consent of all Members.

Article IX: Governing Law

9. This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF, the undersigned Members have executed this Operating Agreement as of the date first above written.

- _____________________________ (Signature of Member 1)

- _____________________________ (Signature of Member 2)

- _____________________________ (Signature of Additional Members)

More About New York Operating Agreement

What is a New York Operating Agreement?

A New York Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in New York. It serves as an internal guide for members, detailing their rights, responsibilities, and the distribution of profits and losses.

Is an Operating Agreement required in New York?

While New York law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having one can help prevent misunderstandings among members and provide a clear framework for operations, which can be crucial in resolving disputes.

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC. However, it is advisable to consult with a legal professional to ensure that the document complies with state laws and adequately reflects the intentions of the members.

What should be included in the Operating Agreement?

Key elements of an Operating Agreement typically include the LLC's name, purpose, duration, member contributions, profit distribution, management structure, and procedures for adding or removing members. Additionally, it should outline how decisions are made and how disputes are resolved.

Can the Operating Agreement be changed?

Yes, the Operating Agreement can be amended. Members must agree to any changes, and it is advisable to document these amendments in writing to maintain clarity and avoid future disputes.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by New York's default laws regarding LLCs. This may not align with the members' intentions and could lead to complications, especially in areas such as profit distribution and decision-making processes.

How does an Operating Agreement affect taxes?

The Operating Agreement itself does not directly affect taxes; however, it can influence how profits and losses are allocated among members. Properly outlining these allocations can help ensure compliance with tax regulations and avoid potential issues with the IRS.

Key takeaways

When filling out and using the New York Operating Agreement form, consider the following key takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational procedures of your LLC.

- Identify Members: Clearly list all members involved in the LLC. This establishes ownership and responsibilities.

- Define Roles: Assign specific roles and responsibilities to each member. This helps prevent misunderstandings.

- Outline Voting Rights: Specify how voting will occur among members. This ensures clarity in decision-making processes.

- Include Profit Distribution: Clearly state how profits and losses will be allocated among members.

- Address Changes: Include procedures for adding or removing members. This prepares the LLC for future changes.

- Compliance with State Laws: Ensure the agreement complies with New York state laws to maintain legal validity.

- Review Regularly: Revisit the Operating Agreement periodically to ensure it remains relevant and reflects any changes in the LLC.

File Details

| Fact Name | Details |

|---|---|

| Definition | The New York Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the New York Limited Liability Company Law. |

| Mandatory Requirement | While not required to be filed with the state, having an operating agreement is essential for LLCs in New York. |

| Member Roles | The agreement specifies the roles and responsibilities of each member involved in the LLC. |

| Profit Distribution | It details how profits and losses will be allocated among the members. |

| Decision-Making Process | The operating agreement outlines the decision-making process, including voting rights and procedures. |

| Amendments | Members can amend the agreement as needed, provided they follow the specified procedures within the document. |

| Dispute Resolution | It may include provisions for resolving disputes among members, such as mediation or arbitration. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a fixed term. |

| Compliance | Having a well-drafted operating agreement helps ensure compliance with state laws and protects member interests. |

Consider Some Other Operating Agreement Forms for US States

How to Write an Operating Agreement - The agreement can specify what constitutes a breach of contract among members.

Cost for Llc - It outlines confidentiality expectations for members.

Llc Operating Agreement Ohio - An Operating Agreement may specify the use of company funds.

Dos and Don'ts

When filling out the New York Operating Agreement form, it is essential to approach the task with care and attention to detail. Here are some key dos and don'ts to consider:

- Do ensure all member names and addresses are accurately listed. This information is crucial for legal recognition.

- Do specify the management structure clearly. Indicate whether the LLC will be member-managed or manager-managed.

- Do outline the distribution of profits and losses. Clarity in this section can prevent disputes among members.

- Do review the document thoroughly before submission. A careful review helps catch any errors that could complicate matters later.

- Don't leave any sections blank. Incomplete information can lead to misunderstandings and legal issues.

- Don't use vague language. Be specific in your terms to avoid ambiguity that could create problems down the line.

- Don't overlook state requirements. Ensure that your agreement complies with New York laws and regulations.

- Don't forget to have all members sign the agreement. Signatures validate the document and signify agreement among all parties involved.