Valid Loan Agreement Form for New York

When entering into a financial arrangement, clarity and mutual understanding are essential. The New York Loan Agreement form serves as a vital document in this process, outlining the terms and conditions under which a loan is provided. This form typically includes key elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it addresses the responsibilities of both the lender and borrower, ensuring that each party is aware of their obligations. Important provisions, such as default consequences and dispute resolution methods, are also included to protect both sides. By utilizing this standardized form, individuals and businesses in New York can navigate the complexities of borrowing and lending with greater confidence, fostering transparent and fair financial transactions.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Leaving sections blank can lead to delays or even rejection of the application.

-

Incorrect Personal Details: Errors in names, addresses, or Social Security numbers can cause significant issues. Double-checking this information is crucial for smooth processing.

-

Failure to Sign: Some applicants overlook the importance of signing the document. Without a signature, the agreement is not valid.

-

Not Reading the Terms: Skimming through the terms and conditions can lead to misunderstandings. It’s essential to understand all obligations before agreeing.

-

Inaccurate Financial Information: Providing incorrect income details or misrepresenting financial status can result in denial. Ensure that all figures are accurate and up-to-date.

-

Missing Required Documentation: Failing to attach necessary documents, such as proof of income or identification, can halt the application process. Make a checklist to ensure all items are included.

-

Ignoring Deadlines: Each loan agreement has specific timelines for submission. Missing these deadlines may lead to forfeiting the loan opportunity.

Example - New York Loan Agreement Form

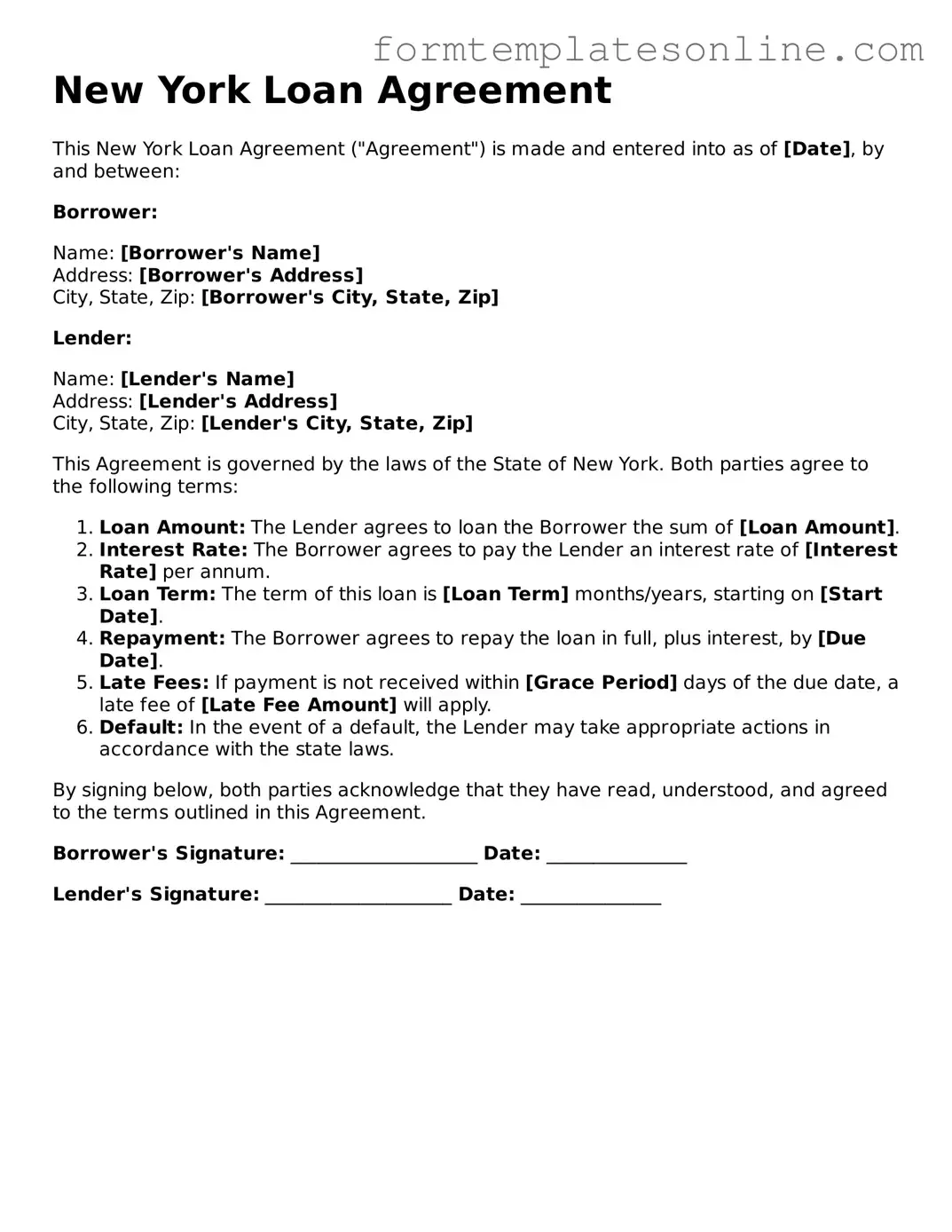

New York Loan Agreement

This New York Loan Agreement ("Agreement") is made and entered into as of [Date], by and between:

Borrower:

Name: [Borrower's Name]

Address: [Borrower's Address]

City, State, Zip: [Borrower's City, State, Zip]

Lender:

Name: [Lender's Name]

Address: [Lender's Address]

City, State, Zip: [Lender's City, State, Zip]

This Agreement is governed by the laws of the State of New York. Both parties agree to the following terms:

- Loan Amount: The Lender agrees to loan the Borrower the sum of [Loan Amount].

- Interest Rate: The Borrower agrees to pay the Lender an interest rate of [Interest Rate] per annum.

- Loan Term: The term of this loan is [Loan Term] months/years, starting on [Start Date].

- Repayment: The Borrower agrees to repay the loan in full, plus interest, by [Due Date].

- Late Fees: If payment is not received within [Grace Period] days of the due date, a late fee of [Late Fee Amount] will apply.

- Default: In the event of a default, the Lender may take appropriate actions in accordance with the state laws.

By signing below, both parties acknowledge that they have read, understood, and agreed to the terms outlined in this Agreement.

Borrower's Signature: ____________________ Date: _______________

Lender's Signature: ____________________ Date: _______________

More About New York Loan Agreement

What is a New York Loan Agreement form?

A New York Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount of money being borrowed, the interest rate, repayment schedule, and any collateral involved. This form serves to protect both parties by clearly defining their rights and obligations in the lending arrangement.

Who can use a New York Loan Agreement form?

Anyone involved in a lending transaction can use this form. This includes individuals, businesses, or financial institutions that are lending or borrowing money. It is especially useful for personal loans, business loans, or any informal lending situation where the parties want to ensure clarity and legal protection.

What are the key components of a New York Loan Agreement?

The key components typically include the loan amount, interest rate, repayment terms, due dates, and any fees associated with the loan. Additionally, it may outline the consequences of default, any collateral securing the loan, and the governing law, which in this case would be New York law.

Is it necessary to have a lawyer review the Loan Agreement?

While it is not legally required to have a lawyer review the Loan Agreement, it is highly advisable. A legal professional can help ensure that the document is comprehensive, enforceable, and compliant with New York laws. This can prevent misunderstandings or disputes down the line.

Can the terms of the Loan Agreement be modified after it is signed?

Yes, the terms of a Loan Agreement can be modified after it is signed, but both parties must agree to any changes. It is essential to document any modifications in writing and have both parties sign the amended agreement to maintain clarity and legal standing.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may have the right to take certain actions as outlined in the agreement. This can include demanding immediate repayment of the remaining loan balance, charging late fees, or pursuing legal action. The specifics will depend on the terms set forth in the Loan Agreement.

How can I obtain a New York Loan Agreement form?

You can obtain a New York Loan Agreement form from various sources, including legal websites, financial institutions, or by consulting with a lawyer. Many online legal services offer customizable templates that can be tailored to fit your specific needs.

Key takeaways

When filling out and using the New York Loan Agreement form, keep these key takeaways in mind:

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. This ensures that all parties are properly recognized in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This avoids any confusion about the financial terms of the agreement.

- Detail the Interest Rate: Include the interest rate applicable to the loan. Make sure to specify whether it is fixed or variable.

- Outline Repayment Terms: Clearly define the repayment schedule, including due dates and the method of payment. This helps both parties understand their obligations.

- Include Late Fees: If applicable, specify any late fees that may be incurred for missed payments. This encourages timely repayment.

- Address Default Conditions: Clearly outline what constitutes a default and the consequences that may follow. This protects the lender’s interests.

- Consider Collateral: If the loan is secured, describe the collateral being offered. This provides security for the lender.

- Seek Legal Review: It’s wise to have the agreement reviewed by a legal professional. This ensures that all terms are fair and legally binding.

- Keep Copies: After signing, ensure that both parties retain a copy of the agreement. This serves as a reference for the future.

By following these key points, you can create a clear and effective Loan Agreement that protects the interests of both the lender and the borrower.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The New York Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York, ensuring compliance with state regulations. |

| Key Components | Important elements of the form include loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

| Dispute Resolution | The form may include clauses outlining how disputes will be resolved, often specifying mediation or arbitration processes. |

Consider Some Other Loan Agreement Forms for US States

Promissory Note Illinois - The document can be tailored to meet specific needs of the borrower and lender.

For those navigating the complexities of estate transfer, understanding the specifics of a Small Estate Affidavit can be invaluable. This document serves as a key tool in facilitating the efficient management of assets following a death. To learn more about the process, you can refer to our guide on how to fill out a Small Estate Affidavit form effectively at how to fill out a Small Estate Affidavit form.

Florida Promissory Note Template - Defines what happens in case of missed payments or default.

Promissory Note Template Georgia - The form can evolve to reflect changes in financial circumstances.

Dos and Don'ts

When filling out the New York Loan Agreement form, it’s important to pay attention to certain details. Here are some guidelines to help you navigate the process effectively.

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information.

- Do double-check all numbers and dates for correctness.

- Do sign and date the form where required.

- Don't leave any required fields blank.

- Don't use white-out or erase any information.

- Don't rush through the process; take your time.

- Don't submit the form without making a copy for your records.

By following these dos and don'ts, you can help ensure that your Loan Agreement is completed correctly and efficiently.