Valid Durable Power of Attorney Form for New York

In New York, the Durable Power of Attorney (DPOA) serves as a vital legal tool, empowering individuals to designate a trusted person to make financial and legal decisions on their behalf when they are unable to do so themselves. This form is particularly important for planning ahead, as it ensures that your financial affairs can be managed seamlessly in the event of incapacity. The DPOA remains effective even if the principal becomes mentally incapacitated, providing a layer of protection and continuity in managing assets. Key components of the form include the designation of the agent, specific powers granted, and the principal’s signature, all of which must be executed with care to meet state requirements. Additionally, the DPOA allows for customization, enabling individuals to specify which powers are granted and under what circumstances. Understanding the implications and responsibilities associated with this document is crucial for both the principal and the appointed agent, making it an essential aspect of comprehensive estate planning.

Common mistakes

-

Not naming an agent. Failing to designate a specific person as your agent can lead to confusion about who has the authority to act on your behalf.

-

Choosing the wrong agent. Selecting someone who may not act in your best interest can create problems. It’s crucial to choose someone trustworthy and reliable.

-

Forgetting to sign the form. A Durable Power of Attorney is not valid unless you sign it. Ensure your signature is present before submitting the document.

-

Not having the form witnessed or notarized. In New York, the form must be signed in the presence of a notary public or two witnesses. Skipping this step can invalidate the document.

-

Leaving sections blank. Incomplete forms can cause issues. Make sure all relevant sections are filled out completely to avoid any misunderstandings.

-

Using outdated forms. Laws change, and using an old version of the Durable Power of Attorney form may not comply with current regulations.

-

Failing to specify powers. Not clearly outlining the powers granted to the agent can lead to confusion. Specify what decisions your agent can make on your behalf.

-

Not reviewing the document regularly. Life changes, and so may your needs. Regularly review and update your Durable Power of Attorney to reflect your current situation.

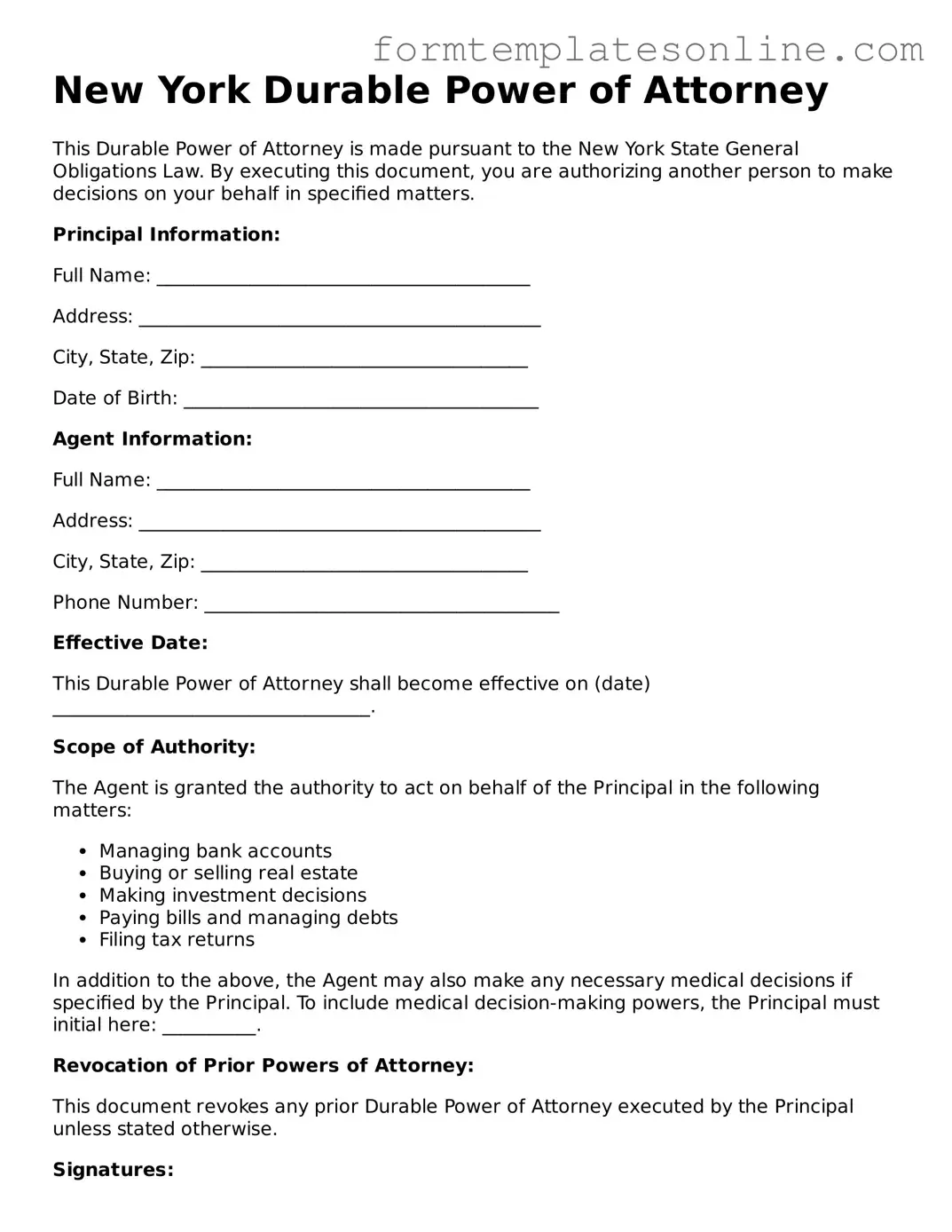

Example - New York Durable Power of Attorney Form

New York Durable Power of Attorney

This Durable Power of Attorney is made pursuant to the New York State General Obligations Law. By executing this document, you are authorizing another person to make decisions on your behalf in specified matters.

Principal Information:

Full Name: ________________________________________

Address: ___________________________________________

City, State, Zip: ___________________________________

Date of Birth: ______________________________________

Agent Information:

Full Name: ________________________________________

Address: ___________________________________________

City, State, Zip: ___________________________________

Phone Number: ______________________________________

Effective Date:

This Durable Power of Attorney shall become effective on (date) __________________________________.

Scope of Authority:

The Agent is granted the authority to act on behalf of the Principal in the following matters:

- Managing bank accounts

- Buying or selling real estate

- Making investment decisions

- Paying bills and managing debts

- Filing tax returns

In addition to the above, the Agent may also make any necessary medical decisions if specified by the Principal. To include medical decision-making powers, the Principal must initial here: __________.

Revocation of Prior Powers of Attorney:

This document revokes any prior Durable Power of Attorney executed by the Principal unless stated otherwise.

Signatures:

Principal Signature: _________________________________

Date: _____________________________________________

Witnesses:

Witness 1: _________________________________________

Witness 2: _________________________________________

Notarization:

State of New York

County of __________________________________________

On this ____ day of ____________, 20___, before me, a Notary Public, personally appeared __________________________________, who is known to me or proved to me on the basis of satisfactory evidence to be the person whose name is subscribed above.

Notary Public Signature: ____________________________

My Commission Expires: ___________________________

More About New York Durable Power of Attorney

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make financial and legal decisions on their behalf. The term "durable" means that the authority granted to the agent remains effective even if the principal becomes incapacitated.

Why should I consider creating a Durable Power of Attorney?

Creating a DPOA can be beneficial for several reasons. It ensures that someone you trust can manage your financial affairs if you are unable to do so due to illness, injury, or other circumstances. This can help prevent delays in managing your finances and provide peace of mind knowing that your affairs will be handled according to your wishes.

Who can be appointed as my agent in a Durable Power of Attorney?

In New York, you can appoint any competent adult as your agent. This could be a family member, friend, or a trusted professional, such as an attorney or accountant. It is essential to choose someone who understands your values and will act in your best interest.

What powers can I grant my agent in the Durable Power of Attorney?

You have the flexibility to grant a wide range of powers to your agent. These can include managing bank accounts, paying bills, buying or selling property, and handling tax matters. You can specify which powers your agent has or limit them to certain areas, depending on your preferences.

How do I create a Durable Power of Attorney in New York?

To create a DPOA in New York, you must complete a specific form that meets state requirements. The form should be signed by you, the principal, and witnessed by two individuals or acknowledged by a notary public. It is advisable to keep the original document in a safe place and provide copies to your agent and any relevant financial institutions.

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your DPOA at any time as long as you are still competent. To revoke the document, you should create a written revocation and notify your agent and any institutions that have a copy of the original DPOA. This ensures that your wishes are clear and prevents any potential confusion.

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may need to appoint a guardian to manage your affairs. This process can be lengthy, costly, and may not align with your preferences. Having a DPOA in place allows you to avoid this situation and ensures that your chosen agent can act on your behalf without court intervention.

Are there any limitations to the Durable Power of Attorney?

Yes, there are some limitations. A DPOA cannot grant your agent the authority to make healthcare decisions for you; for that, a separate document, such as a Health Care Proxy, is required. Additionally, your agent must act in your best interest and cannot use the authority for personal gain unless explicitly permitted in the document.

Is a Durable Power of Attorney effective immediately?

A DPOA can be effective immediately upon signing, or you may choose to make it effective only upon your incapacitation. This choice should be clearly stated in the document. If you want to ensure that your agent can only act when you are unable to do so, specify this condition in the form.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer to create a DPOA, consulting with one can provide valuable guidance. A legal professional can help ensure that the document meets all legal requirements and accurately reflects your wishes. This can be particularly important if your situation is complex or if you have specific concerns about the powers you wish to grant.

Key takeaways

Understanding the New York Durable Power of Attorney form is essential for anyone looking to designate someone to manage their financial affairs. Here are key takeaways to consider:

- Purpose: This form allows you to appoint an agent to act on your behalf in financial matters, ensuring your interests are protected if you become unable to make decisions.

- Durability: The term "durable" means that the power of attorney remains effective even if you become incapacitated.

- Agent Selection: Choose someone you trust. This person will have significant authority over your financial decisions.

- Specific Powers: You can specify what powers you grant your agent. This may include handling bank transactions, managing investments, or paying bills.

- Revocation: You can revoke the power of attorney at any time, as long as you are mentally competent to do so.

- Witness and Notary: The form must be signed in the presence of a notary public and two witnesses to be valid.

- State-Specific Requirements: Ensure you are using the correct form for New York, as requirements may vary by state.

- Review Regularly: Regularly review your power of attorney to ensure it still reflects your wishes and circumstances.

- Legal Guidance: Consider consulting with an attorney to ensure that the document meets your needs and complies with New York law.

By keeping these points in mind, you can effectively utilize the Durable Power of Attorney form to secure your financial future.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows one person to make financial decisions on behalf of another, even if the principal becomes incapacitated. |

| Governing Law | The DPOA in New York is governed by the New York General Obligations Law, specifically Section 5-1501 et seq. |

| Durability | This type of power of attorney remains effective even after the principal is unable to make decisions due to illness or incapacity. |

| Principal | The person who creates the DPOA is known as the principal. They grant authority to another individual, known as the agent or attorney-in-fact. |

| Agent Responsibilities | The agent has a fiduciary duty to act in the best interests of the principal, ensuring that their financial matters are handled responsibly. |

| Execution Requirements | The DPOA must be signed by the principal in the presence of a notary public and at least one witness. |

| Revocation | The principal can revoke the DPOA at any time, as long as they are mentally competent to do so. |

| Limitations | While a DPOA allows broad financial powers, it cannot authorize the agent to make healthcare decisions unless specifically stated. |

| Statutory Form | New York provides a statutory form for the Durable Power of Attorney, which can simplify the process for individuals. |

| Importance of Clarity | It's crucial for the DPOA to clearly outline the powers granted to the agent to avoid confusion and potential disputes. |

Consider Some Other Durable Power of Attorney Forms for US States

Pa Durable Power of Attorney Form - A Durable Power of Attorney remains valid as long as you are alive, even if disabled.

What Does a Durable Power of Attorney Allow You to Do - Enhances your control over future decision-making processes.

How Do I Get Power of Attorney in Florida - This form is not just for the elderly; anyone can benefit from having a Durable Power of Attorney.

Durable Power of Attorney North Carolina - Failure to plan can lead to complications; a Durable Power of Attorney is a solution.

Dos and Don'ts

When filling out the New York Durable Power of Attorney form, it is important to follow certain guidelines to ensure that the document is valid and effective. Below is a list of things you should and shouldn't do.

- Do ensure that you are of sound mind when completing the form.

- Do clearly identify the agent you are appointing, including their full name and address.

- Do specify the powers you are granting to your agent in clear and understandable terms.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank; fill in all required information.

- Don't appoint someone who may have conflicting interests or who may not act in your best interest.

- Don't forget to discuss your wishes with your agent before completing the form.

- Don't assume that a verbal agreement is sufficient; the form must be written and signed.