Valid Deed in Lieu of Foreclosure Form for New York

In New York, homeowners facing financial difficulties may explore various options to avoid foreclosure, and one such option is the Deed in Lieu of Foreclosure form. This legal document allows a homeowner to voluntarily transfer the ownership of their property back to the lender, thereby bypassing the lengthy and often stressful foreclosure process. By signing this form, the homeowner can potentially relieve themselves of the burden of mortgage debt while also protecting their credit score from the severe impact of a foreclosure. The process typically involves negotiations between the homeowner and the lender, ensuring that both parties agree on the terms of the transfer. Additionally, the form may include clauses that address any remaining liabilities, ensuring clarity on what debts, if any, the homeowner still owes. Understanding this form is crucial for homeowners who wish to make informed decisions about their financial future and explore alternatives to foreclosure in a manner that is both efficient and beneficial.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. Each section of the form must be filled out completely. Omitting details can lead to delays or rejection of the deed.

-

Incorrect Property Description: It is crucial to accurately describe the property being transferred. Errors in the legal description can create complications. Always double-check the address and parcel number.

-

Not Including Necessary Signatures: The deed must be signed by all parties involved. Failing to include a signature can render the document invalid. Ensure that everyone who has a legal interest in the property signs the form.

-

Ignoring Local Laws: Different jurisdictions may have specific requirements for a deed in lieu of foreclosure. Not adhering to these local laws can result in legal issues. Research local regulations before submission.

-

Failing to Notify Lenders: It is essential to communicate with the lender before submitting the deed. Not informing them can lead to misunderstandings or complications in the foreclosure process. Always keep open lines of communication.

-

Not Consulting Professionals: Many individuals attempt to complete the form without professional guidance. This can lead to mistakes that could have been avoided. Consulting with a real estate attorney or a knowledgeable professional can provide valuable insights.

Example - New York Deed in Lieu of Foreclosure Form

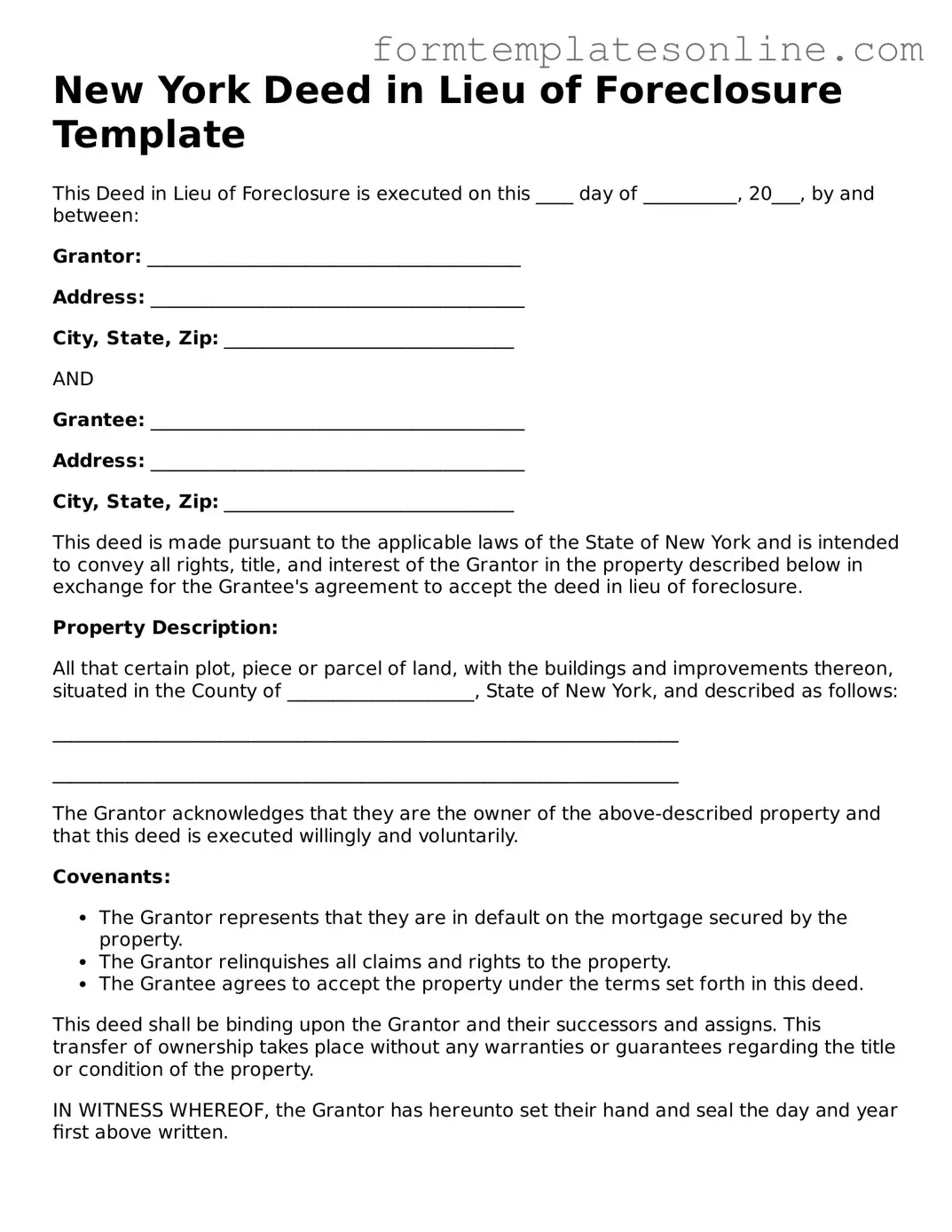

New York Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed on this ____ day of __________, 20___, by and between:

Grantor: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

AND

Grantee: ________________________________________

Address: ________________________________________

City, State, Zip: _______________________________

This deed is made pursuant to the applicable laws of the State of New York and is intended to convey all rights, title, and interest of the Grantor in the property described below in exchange for the Grantee's agreement to accept the deed in lieu of foreclosure.

Property Description:

All that certain plot, piece or parcel of land, with the buildings and improvements thereon, situated in the County of ____________________, State of New York, and described as follows:

___________________________________________________________________

___________________________________________________________________

The Grantor acknowledges that they are the owner of the above-described property and that this deed is executed willingly and voluntarily.

Covenants:

- The Grantor represents that they are in default on the mortgage secured by the property.

- The Grantor relinquishes all claims and rights to the property.

- The Grantee agrees to accept the property under the terms set forth in this deed.

This deed shall be binding upon the Grantor and their successors and assigns. This transfer of ownership takes place without any warranties or guarantees regarding the title or condition of the property.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal the day and year first above written.

__________________________

Signature of Grantor

__________________________

Name of Grantor

__________________________

Witness Signature

__________________________

Witness Name

State of New York

County of ____________________

On the ____ day of __________, 20___, before me, the undersigned, a Notary Public in and for the State of New York, personally appeared ______________________, known to me to be the person whose name is subscribed to this instrument and acknowledged that they executed the same.

__________________________

Notary Public Signature

My commission expires: ________________

More About New York Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. This option can be beneficial for both parties. The homeowner can walk away from the mortgage debt without the damaging impact of a foreclosure on their credit report, while the lender can take possession of the property more quickly and without the costs associated with a foreclosure process.

How does the process work?

The process typically begins with the homeowner contacting their lender to discuss their financial situation. If both parties agree to pursue a Deed in Lieu of Foreclosure, the homeowner will need to complete specific documentation, including the Deed in Lieu form. This form outlines the terms of the transfer and confirms that the homeowner is voluntarily giving up their rights to the property. Once signed, the lender will record the deed with the appropriate local government office, officially transferring ownership.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can provide several advantages. First, it often results in less damage to the homeowner's credit score compared to a foreclosure. Second, the process can be quicker and less costly than going through a formal foreclosure. Homeowners may also have the opportunity to negotiate terms with the lender, such as potential relocation assistance or a waiver of any remaining mortgage debt. This can make the transition smoother and less stressful.

Are there any drawbacks to consider?

While a Deed in Lieu of Foreclosure can be a viable option, there are some potential drawbacks. For instance, not all lenders accept this arrangement, and eligibility may depend on the homeowner's specific circumstances. Additionally, homeowners may still face tax implications, as the Internal Revenue Service may consider forgiven debt as taxable income. It's crucial for homeowners to consult with a financial advisor or tax professional to understand the full impact of this decision.

Key takeaways

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure.

- Eligibility Criteria: Not all homeowners qualify. Check if your mortgage is eligible for this process.

- Consult with Professionals: Before proceeding, consult a real estate attorney or financial advisor for guidance.

- Prepare Required Documents: Gather all necessary documents, including the mortgage agreement and any relevant financial statements.

- Complete the Form Accurately: Fill out the form carefully, ensuring all information is correct to avoid delays.

- Submit the Form: After completing the form, submit it to your lender along with any required documentation.

- Understand the Consequences: Be aware that this action may impact your credit score and future borrowing ability.

File Details

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In New York, the deed in lieu of foreclosure is governed by New York Real Property Actions and Proceedings Law (RPAPL). |

| Eligibility | Typically, borrowers who are struggling to make mortgage payments may qualify for this option, provided they have a valid reason for defaulting. |

| Benefits | One major benefit is that it can help borrowers avoid the lengthy and costly foreclosure process. |

| Impact on Credit | A deed in lieu of foreclosure can have a less severe impact on a borrower’s credit score compared to a full foreclosure. |

| Negotiation | Borrowers can negotiate terms with their lender, such as potential forgiveness of remaining debt or relocation assistance. |

| Documentation | The process requires specific documentation, including a deed, and possibly a release of liability agreement. |

| Timeframe | Completing a deed in lieu of foreclosure can often be quicker than going through the foreclosure process. |

| Legal Advice | It is advisable for borrowers to seek legal advice before proceeding, as each situation can vary significantly. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu of Foreclosure Sample - A Deed in Lieu of Foreclosure can offer a way to reclaim some dignity while exiting a stressful financial situation.

Will I Owe Money After a Deed in Lieu of Foreclosure - A Deed in Lieu can assist in resolving financial difficulties in a straightforward manner.

In today's competitive environment, having a well-drafted Georgia Non-disclosure Agreement is essential for protecting valuable information. By utilizing such a document, individuals and businesses can ensure that sensitive details remain confidential and are not disclosed to unauthorized parties. For more insights on creating a robust NDA, you can visit OnlineLawDocs.com, which offers comprehensive resources and templates tailored for Georgia's legal framework.

California Property Surrender Deed - It is crucial for homeowners to understand all terms before signing a Deed in Lieu.

Deed in Lieu Vs Foreclosure - This document creates a formal record of the transfer of property back to the lender.

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, it's important to proceed with caution. Here are four essential tips on what to do and what to avoid.

- Do: Ensure all information is accurate and complete. Double-check names, addresses, and property details.

- Do: Consult with a legal professional if you have any questions about the process or implications.

- Don't: Rush through the form. Take your time to understand each section before signing.

- Don't: Ignore the potential tax implications. Understand how this action might affect your financial situation.