Valid Deed Form for New York

When it comes to transferring property ownership in New York, understanding the New York Deed form is crucial for both buyers and sellers. This legal document serves as the official record of the transfer, ensuring that the new owner has clear title to the property. The form typically includes essential information such as the names of the grantor and grantee, a detailed description of the property being conveyed, and any relevant terms or conditions that may apply to the transfer. Additionally, the New York Deed form may require notarization and must be filed with the appropriate county clerk's office to be legally binding. Familiarity with this form not only streamlines the transaction process but also protects the interests of all parties involved, making it a vital component of real estate dealings in the state. Whether you are a seasoned investor or a first-time homebuyer, grasping the intricacies of the New York Deed form can significantly impact your real estate experience.

Common mistakes

-

Incorrect Names: One of the most common mistakes is misspelling names or using the wrong legal names. Ensure that the names of all parties involved are spelled correctly and match their identification documents.

-

Missing Signatures: Failing to sign the deed is a critical error. All necessary parties must provide their signatures. Without them, the deed may not be valid.

-

Improper Notarization: Not having the deed properly notarized can lead to issues. A notary public must witness the signing of the document. Ensure that the notary’s information is correctly filled out.

-

Incorrect Property Description: A vague or incorrect description of the property can create confusion. Use the legal description from previous deeds or property records to ensure accuracy.

-

Omitting Consideration Amount: Not including the consideration amount—the value exchanged for the property—can lead to complications. This amount should be clearly stated in the deed.

-

Failure to File: After completing the deed, some individuals forget to file it with the appropriate county office. This step is crucial for the deed to be legally recognized.

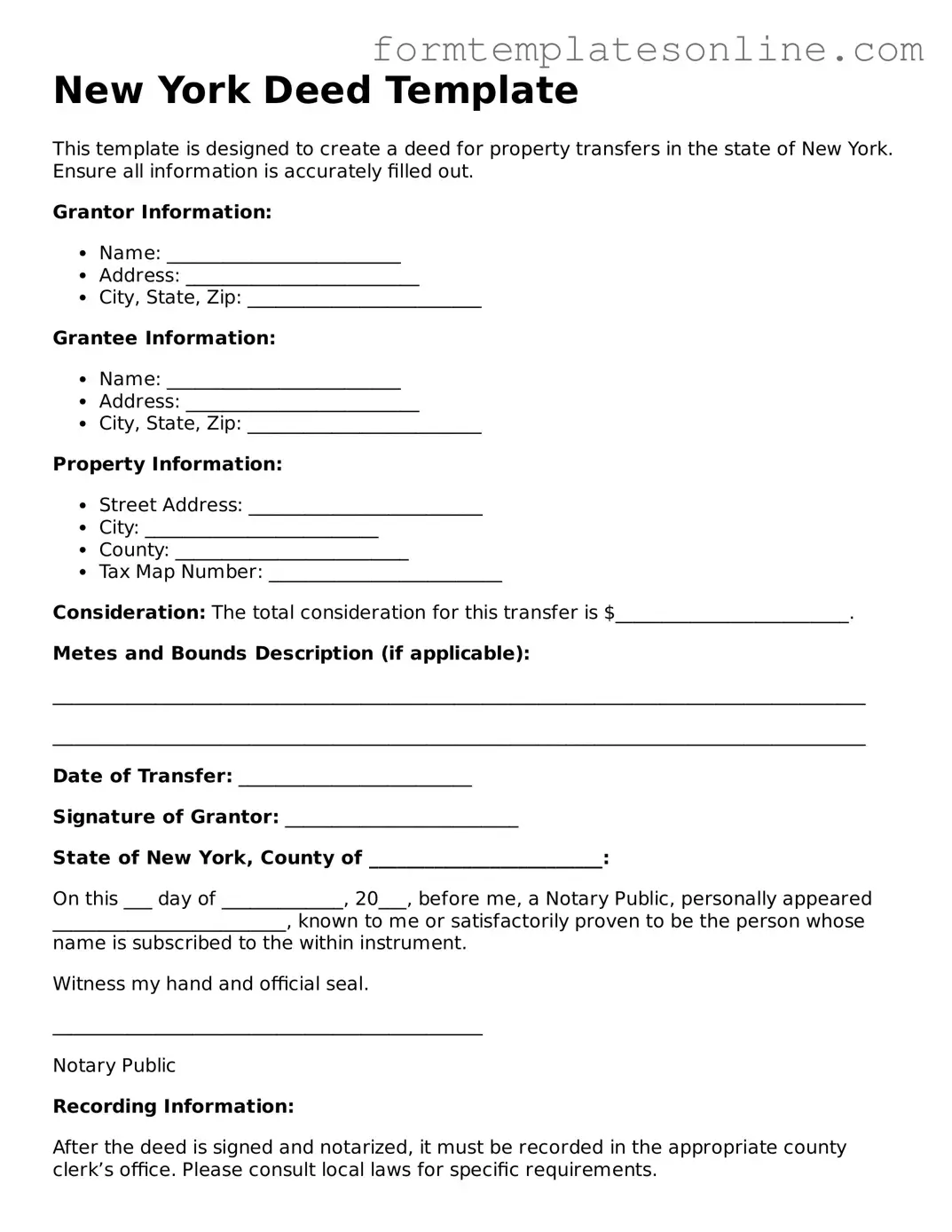

Example - New York Deed Form

New York Deed Template

This template is designed to create a deed for property transfers in the state of New York. Ensure all information is accurately filled out.

Grantor Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

Grantee Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

Property Information:

- Street Address: _________________________

- City: _________________________

- County: _________________________

- Tax Map Number: _________________________

Consideration: The total consideration for this transfer is $_________________________.

Metes and Bounds Description (if applicable):

_______________________________________________________________________________________

_______________________________________________________________________________________

Date of Transfer: _________________________

Signature of Grantor: _________________________

State of New York, County of _________________________:

On this ___ day of _____________, 20___, before me, a Notary Public, personally appeared _________________________, known to me or satisfactorily proven to be the person whose name is subscribed to the within instrument.

Witness my hand and official seal.

______________________________________________

Notary Public

Recording Information:

After the deed is signed and notarized, it must be recorded in the appropriate county clerk’s office. Please consult local laws for specific requirements.

More About New York Deed

What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property from one party to another within the state of New York. This form serves as a record of the transaction and must be filed with the county clerk's office where the property is located. It includes essential information such as the names of the grantor (the seller) and grantee (the buyer), a description of the property, and the date of the transfer. Different types of deeds, such as warranty deeds and quitclaim deeds, may be used depending on the nature of the transfer and the level of protection desired by the parties involved.

Who needs to sign the New York Deed form?

The New York Deed form must be signed by the grantor, who is the individual or entity transferring the property. In some cases, additional signatures may be required, such as those of witnesses or a notary public, to validate the document. If the grantor is a corporation or other legal entity, an authorized representative must sign on its behalf. It is crucial that all signatures are properly executed to ensure the deed is legally binding and enforceable.

How is a New York Deed form filed?

Are there any taxes associated with filing a New York Deed form?

Yes, there are taxes that may be associated with filing a New York Deed form. The most common is the Real Property Transfer Tax, which is imposed on the transfer of real estate in New York. The amount of tax varies depending on the sale price of the property. Additionally, local municipalities may impose their own transfer taxes. It is advisable for individuals involved in a property transfer to consult with a tax professional or legal advisor to understand the specific tax implications and ensure compliance with all applicable regulations.

Key takeaways

When filling out and using the New York Deed form, there are several important points to keep in mind. Understanding these key takeaways can help ensure a smooth process.

- Ensure that all parties involved in the transaction are clearly identified. This includes the grantor (seller) and grantee (buyer).

- Provide a complete legal description of the property. This description should be accurate and match what is recorded in public records.

- Include the date of the transaction. This helps establish the timeline of ownership.

- Be aware of the type of deed you are using. Different types (like warranty deeds or quitclaim deeds) serve different purposes.

- Sign the deed in the presence of a notary public. This step is crucial for the deed to be legally valid.

- Check for any local requirements or additional forms that may be necessary for your specific county.

- Record the deed with the county clerk's office. This step makes the transfer of ownership official and public.

- Keep copies of the signed deed for your records. Having documentation can be important for future reference.

- Consult with a real estate professional or attorney if you have questions. They can provide guidance tailored to your situation.

By following these key points, you can navigate the process of filling out and using the New York Deed form with greater confidence.

File Details

| Fact Name | Description |

|---|---|

| Definition | A New York Deed is a legal document that transfers ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Bargain and Sale Deeds. |

| Governing Law | The New York Real Property Law governs the creation and execution of deeds in New York State. |

| Signature Requirement | The grantor must sign the deed for it to be valid, and this signature must be acknowledged by a notary public. |

| Recording | Deeds should be recorded in the county where the property is located to provide public notice of the ownership transfer. |

| Consideration | While a deed may state a consideration (price), it is not required for the deed to be valid. |

| Legal Description | The deed must include a legal description of the property being transferred, which identifies the boundaries and location. |

| Tax Implications | New York imposes a transfer tax on the sale of real property, which must be paid at the time of recording the deed. |

| Delivery Requirement | The deed must be delivered to the grantee or their representative to complete the transfer of ownership. |

| Revocation | Once a deed is executed and delivered, it cannot be revoked unilaterally; it requires mutual agreement or specific legal grounds. |

Consider Some Other Deed Forms for US States

Deed Transfer Michigan - Completing a Deed is a crucial step in real estate transactions.

Utilizing a Georgia Non-disclosure Agreement (NDA) form is essential for individuals and businesses aiming to protect their sensitive information, as highlighted by resources like OnlineLawDocs.com. This legal document not only helps to prevent the unauthorized sharing of trade secrets and proprietary data but also reinforces the commitment of all parties involved to uphold confidentiality and safeguard vital information.

Property Deed Form - Real estate agents often assist with the preparation of the necessary deed forms.

Dos and Don'ts

When filling out the New York Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check the property description for accuracy.

- Do include the names of all parties involved in the transaction.

- Do sign the form in the presence of a notary public.

- Do ensure that the date of the transaction is clearly indicated.

- Don’t leave any sections blank; fill out all required fields.

- Don’t use abbreviations for names or addresses.

- Don’t forget to include any necessary attachments or additional documents.

- Don’t submit the form without reviewing it for errors.