Mortgage Statement PDF Form

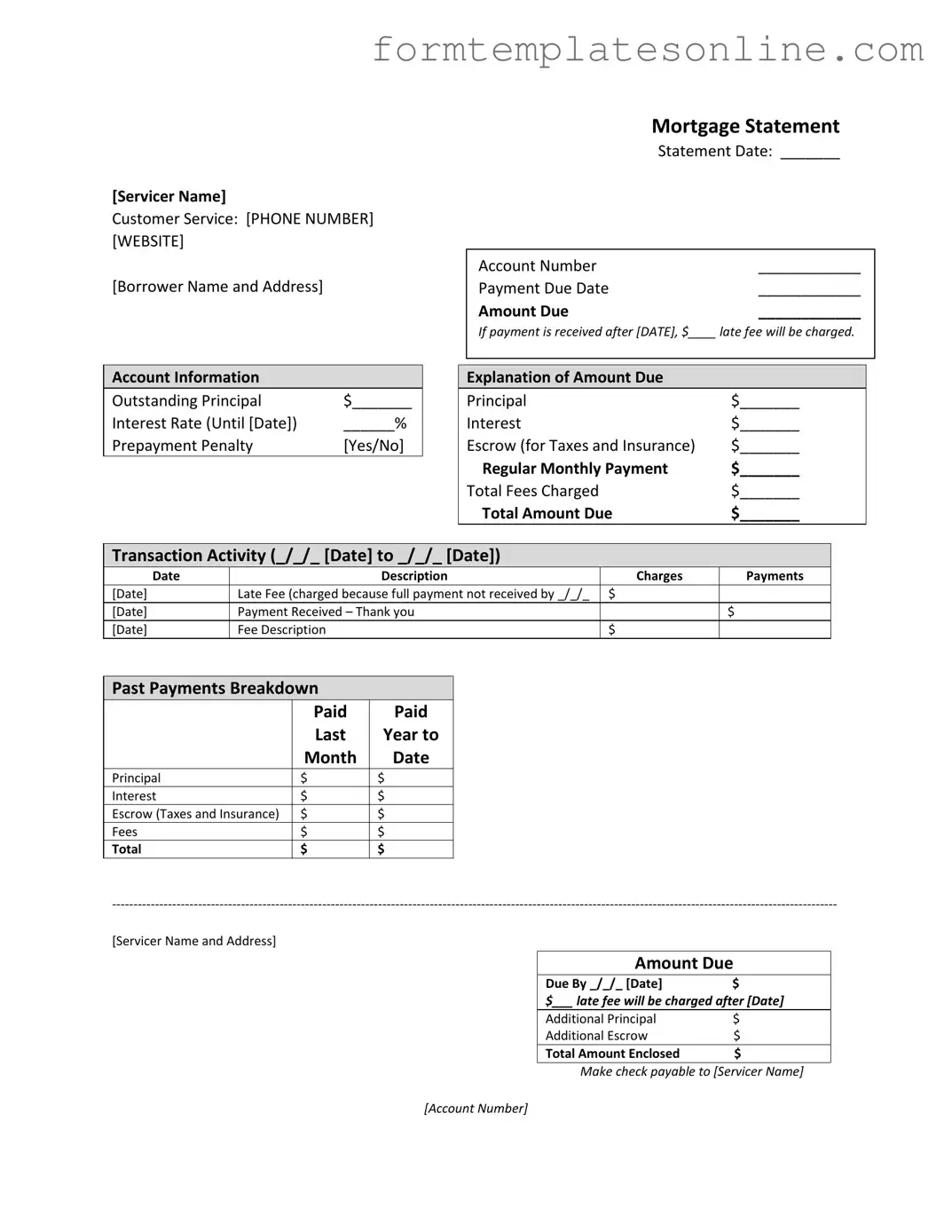

The Mortgage Statement form serves as a crucial document for homeowners, providing a comprehensive overview of their mortgage account. At the top of the statement, the servicer's name and contact information, including a customer service phone number and website, ensure that borrowers can easily reach out for assistance. The statement includes vital details such as the borrower's name and address, the statement date, account number, payment due date, and the total amount due. It also outlines the consequences of late payments, specifying any applicable late fees if payment is not received by the designated date. A breakdown of account information reveals the outstanding principal, interest rate, and whether a prepayment penalty applies. The form meticulously details the explanation of the amount due, which includes principal, interest, escrow for taxes and insurance, and total fees charged. Additionally, it presents transaction activity over a specified period, listing charges, payments, and any late fees incurred. A past payments breakdown offers transparency, summarizing the amounts paid for principal, interest, escrow, and fees over the previous year. Important messages highlight the implications of partial payments and delinquency, emphasizing the potential risks of foreclosure. For those facing financial difficulties, the statement directs borrowers to resources for mortgage counseling or assistance, underscoring the importance of communication and support in maintaining homeownership.

Common mistakes

-

Incorrect Account Information: Failing to accurately enter your account number can lead to delays in processing your payment. Always double-check that this number matches the one provided by your mortgage servicer.

-

Missing Payment Due Date: Leaving the payment due date blank can cause confusion. Make sure to fill in the exact date to avoid late fees and ensure timely processing.

-

Inaccurate Amount Due: If the amount due is entered incorrectly, it may result in either overpayment or underpayment. Review the statement carefully to confirm the total amount before submitting.

-

Ignoring Late Fee Information: Not paying attention to the late fee details can lead to unexpected charges. Be aware of the date after which a late fee will be applied, and plan your payment accordingly.

-

Omitting Contact Information: Failing to include your name and address can complicate communication with your servicer. Ensure that this information is clearly stated to avoid any issues.

-

Neglecting to Review Transaction Activity: Not checking the transaction history can lead to missed payments or misunderstandings about your account status. Always review this section to stay informed about your payment history and any fees incurred.

Example - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

More About Mortgage Statement

What is a Mortgage Statement?

A Mortgage Statement is a document provided by your mortgage servicer that outlines the details of your mortgage account. It includes important information such as the outstanding principal balance, interest rate, payment due date, and the total amount due. This statement serves as a summary of your mortgage activity, including payments made, fees charged, and any outstanding balances. It is essential for tracking your mortgage payments and understanding your financial obligations.

How do I read my Mortgage Statement?

Your Mortgage Statement is structured to present key information clearly. Look for the account number and statement date at the top. The amount due section will indicate how much you need to pay and when it is due. Below this, you will find a breakdown of the total amount due, including principal, interest, and escrow for taxes and insurance. Additionally, transaction activity details will show recent payments and any fees incurred. Understanding these sections will help you manage your mortgage effectively.

What happens if I miss a payment?

If a payment is missed, a late fee will be charged as indicated on your Mortgage Statement. The statement will specify the amount of the late fee and the date by which the payment must be received to avoid this fee. Missing payments can lead to further consequences, including potential foreclosure if the loan becomes significantly delinquent. It is crucial to communicate with your mortgage servicer if you anticipate difficulties in making payments.

What is a partial payment and how does it affect my mortgage?

Partial payments are amounts that are less than the total required payment. According to the information in your Mortgage Statement, any partial payments you make are not applied directly to your mortgage balance. Instead, they are held in a separate suspense account. To have these funds applied to your mortgage, you must pay the remaining balance of the partial payment. It is advisable to make full payments whenever possible to avoid complications.

What should I do if I am experiencing financial difficulties?

If you are facing financial challenges that affect your ability to make mortgage payments, your Mortgage Statement may provide resources for mortgage counseling or assistance. It is important to reach out to your mortgage servicer as soon as possible. They can offer guidance and discuss options that may be available to help you manage your payments and avoid foreclosure. Early communication is key to finding a solution that works for you.

Key takeaways

When filling out and using the Mortgage Statement form, it is essential to pay close attention to several key aspects. Here are four important takeaways to consider:

- Accurate Information: Ensure that all details, such as your name, address, account number, and payment due date, are filled out correctly. Mistakes can lead to delays in processing your payment.

- Understand Fees: Be aware of any late fees that may apply if your payment is not received by the due date. The statement clearly indicates the amount of the late fee and the date after which it will be charged.

- Payment Breakdown: Review the explanation of the amount due, which includes principal, interest, and escrow for taxes and insurance. This breakdown helps you understand where your money is going and can assist in budgeting for future payments.

- Addressing Delinquency: If you are behind on payments, the statement provides a delinquency notice. Take this seriously, as continued delinquency can lead to additional fees or even foreclosure. It is crucial to act promptly to avoid further complications.

By keeping these points in mind, you can navigate your Mortgage Statement form more effectively and ensure that you stay on track with your mortgage obligations.

Form Attributes

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Borrower Details | It lists the borrower's name and address, ensuring that the statement is personalized. |

| Statement Date | The date the statement is issued is clearly marked, helping borrowers track their account status. |

| Payment Due Date | The statement specifies when the next payment is due, which is crucial for timely payments. |

| Late Fee Information | If payment is not received by the due date, a late fee will be charged. This amount is clearly stated. |

| Account Information | Outstanding principal and interest rates are detailed, providing transparency about the loan status. |

| Escrow Details | The statement outlines escrow amounts for taxes and insurance, showing the total monthly payment breakdown. |

| Transaction Activity | It includes a history of transactions, showing dates, descriptions, charges, and payments made. |

| Delinquency Notice | If payments are late, the statement warns about potential fees and foreclosure risks, emphasizing the importance of staying current. |

| Financial Assistance | The statement provides information about mortgage counseling or assistance for borrowers facing financial difficulties. |

Other PDF Forms

Printable Direction of Payment Form - A comprehensive document for streamlined financial transactions in auto repairs.

To facilitate the transfer of ownership, it is essential to complete a Mobile Home Bill of Sale, which not only serves as proof of the sale but also includes critical details such as the purchase price and the date of transaction. For those in need of a template, a useful resource is the Mobile Home Bill of Sale form, which simplifies the process and helps ensure that all necessary information is accurately documented.

Dl Online - False information on the DL 44 can lead to criminal prosecution by the DMV.

Dos and Don'ts

When filling out the Mortgage Statement form, it is crucial to approach the task with care. Here are five important do's and don'ts to keep in mind:

- Do double-check your personal information. Ensure that your name and address are accurate to avoid any processing issues.

- Do review the payment details thoroughly. Confirm the payment due date and the amount due to prevent late fees.

- Do keep a record of your payments. Document the dates and amounts paid to maintain a clear history of your account.

- Don't ignore the late fee policy. Be aware of the consequences of late payments to avoid additional charges.

- Don't submit partial payments without understanding their implications. Remember that partial payments may not be applied to your mortgage and could lead to further complications.

By following these guidelines, you can ensure that your mortgage statement is filled out correctly and that you remain in good standing with your lender.