Valid Transfer-on-Death Deed Form for Michigan

In Michigan, the Transfer-on-Death Deed form offers a straightforward way for property owners to transfer their real estate to designated beneficiaries upon their passing. This form allows individuals to maintain full control of their property during their lifetime while ensuring a smooth transition of ownership after death, bypassing the often lengthy probate process. By filling out this deed, property owners can specify who will inherit their property, making it a valuable tool for estate planning. It is important to understand the requirements for executing this deed, including the need for proper notarization and recording with the county register of deeds. Additionally, the form can be revoked or modified at any time, providing flexibility as circumstances change. With the right information and careful consideration, the Transfer-on-Death Deed can simplify the transfer of property and provide peace of mind for both the owner and their loved ones.

Common mistakes

-

Not Understanding the Purpose: Many individuals fill out the Transfer-on-Death Deed without fully understanding its purpose. This deed allows property to transfer directly to a beneficiary upon the owner’s death, avoiding probate.

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to complications. Ensure that the property address and legal description are precise.

-

Missing Signatures: The deed must be signed by the property owner. Omitting a signature can invalidate the document, making it ineffective.

-

Not Notarizing the Document: Michigan requires the Transfer-on-Death Deed to be notarized. Forgetting this step may render the deed unenforceable.

-

Failing to Record the Deed: After completing the form, it must be recorded with the local register of deeds. Neglecting to do so can prevent the transfer from taking effect.

-

Choosing an Ineligible Beneficiary: Some individuals mistakenly name beneficiaries who are not eligible, such as minors or individuals who cannot accept property.

-

Not Considering Tax Implications: People often overlook potential tax consequences for their beneficiaries. Understanding how the transfer may affect taxes is crucial.

-

Not Revoking Previous Deeds: If there are prior Transfer-on-Death Deeds, failing to revoke them can create confusion about the intended beneficiary.

-

Ignoring State Laws: Each state has specific rules regarding Transfer-on-Death Deeds. Ignoring Michigan's particular requirements can lead to mistakes and complications.

Example - Michigan Transfer-on-Death Deed Form

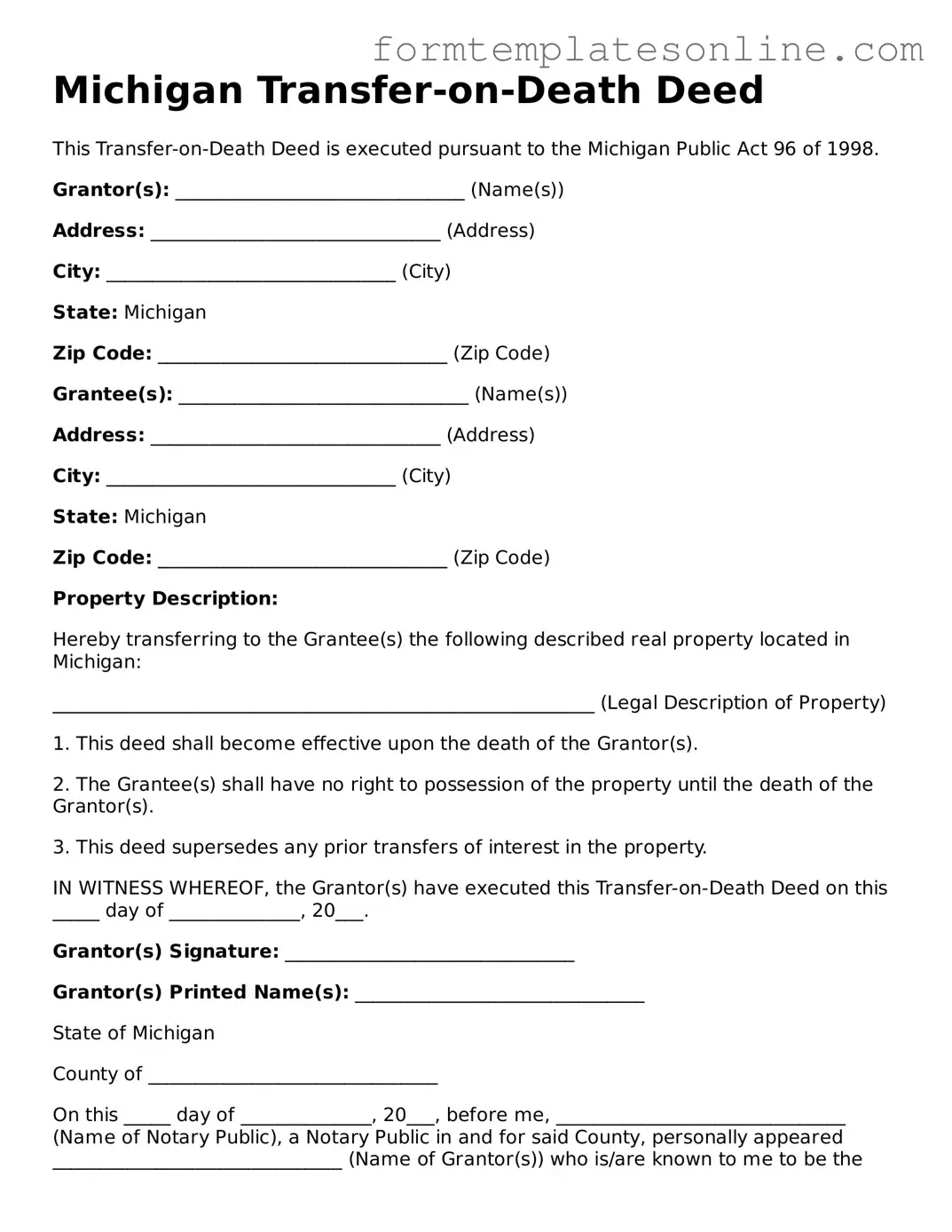

Michigan Transfer-on-Death Deed

This Transfer-on-Death Deed is executed pursuant to the Michigan Public Act 96 of 1998.

Grantor(s): _______________________________ (Name(s))

Address: _______________________________ (Address)

City: _______________________________ (City)

State: Michigan

Zip Code: _______________________________ (Zip Code)

Grantee(s): _______________________________ (Name(s))

Address: _______________________________ (Address)

City: _______________________________ (City)

State: Michigan

Zip Code: _______________________________ (Zip Code)

Property Description:

Hereby transferring to the Grantee(s) the following described real property located in Michigan:

__________________________________________________________ (Legal Description of Property)

1. This deed shall become effective upon the death of the Grantor(s).

2. The Grantee(s) shall have no right to possession of the property until the death of the Grantor(s).

3. This deed supersedes any prior transfers of interest in the property.

IN WITNESS WHEREOF, the Grantor(s) have executed this Transfer-on-Death Deed on this _____ day of ______________, 20___.

Grantor(s) Signature: _______________________________

Grantor(s) Printed Name(s): _______________________________

State of Michigan

County of _______________________________

On this _____ day of ______________, 20___, before me, _______________________________ (Name of Notary Public), a Notary Public in and for said County, personally appeared _______________________________ (Name of Grantor(s)) who is/are known to me to be the person(s) described in and who executed the within instrument and acknowledged that they executed the same as their free act and deed.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________

More About Michigan Transfer-on-Death Deed

What is a Michigan Transfer-on-Death Deed?

A Michigan Transfer-on-Death Deed is a legal document that allows property owners to transfer their real estate to a designated beneficiary upon their death. This deed is effective immediately upon signing but does not transfer ownership until the owner passes away. It provides a way to avoid probate, simplifying the process of transferring property to heirs.

Who can use a Transfer-on-Death Deed in Michigan?

Any individual who owns real property in Michigan can utilize a Transfer-on-Death Deed. This includes single individuals, married couples, or joint owners. However, the property must be solely owned by the person executing the deed. It is important to ensure that the property is not subject to any existing liens or encumbrances that could affect the transfer.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, the property owner must fill out the form with their name, the beneficiary’s name, and a legal description of the property. The deed must be signed in the presence of a notary public. Once completed, the deed should be recorded with the county register of deeds where the property is located. This recording is crucial for the deed to be valid and enforceable.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the property owner. This can be done by executing a new deed that explicitly states the revocation or by recording a revocation document with the county register of deeds. It is advisable to notify the beneficiary of the revocation to avoid any confusion regarding the transfer of property.

Key takeaways

- A Transfer-on-Death Deed (TOD) allows property owners in Michigan to transfer real estate to beneficiaries upon their death.

- The form must be completed and signed by the property owner while they are alive.

- It is important to include the legal description of the property to avoid confusion.

- Beneficiaries should be clearly identified, including their full names and relationships to the owner.

- The deed must be recorded with the county register of deeds to be effective.

- Filing fees may apply when recording the deed, so check with the local office.

- A TOD deed can be revoked or changed at any time before the owner's death.

- Consulting with an attorney is advisable to ensure the deed meets all legal requirements.

- Property transferred via a TOD deed does not go through probate, simplifying the process for beneficiaries.

- It is recommended to keep a copy of the recorded deed in a safe place for reference by beneficiaries.

File Details

| Fact Name | Details |

|---|---|

| Definition | The Michigan Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. |

| Governing Law | This deed is governed by the Michigan Compiled Laws, specifically MCL 565.101 to 565.114. |

| Revocation | The property owner can revoke the Transfer-on-Death Deed at any time during their lifetime, ensuring flexibility in estate planning. |

| Execution Requirements | The deed must be signed by the property owner in the presence of a notary public and recorded with the county register of deeds. |

| Beneficiary Designation | Property owners can designate multiple beneficiaries, and they can specify how the property will be divided among them. |

Consider Some Other Transfer-on-Death Deed Forms for US States

Transfer on Death Affidavit - Must be recorded with the appropriate county office to take effect upon the owner’s passing.

Understanding the implications of a New York Durable Power of Attorney form is essential for anyone considering this legal safeguard. It empowers a trusted agent to handle the principal's financial matters, ensuring that their interests are protected during times of incapacity. For more detailed guidance on this critical document, you can visit OnlineLawDocs.com.

How to Avoid Probate in Pa - It is a legal tool that simplifies the transfer process for heirs and beneficiaries.

Beneficiary Deed Georgia - It serves as an alternative to living trusts for some individuals.

Dos and Don'ts

When filling out the Michigan Transfer-on-Death Deed form, follow these guidelines to ensure accuracy and compliance.

- Do ensure you have the correct legal description of the property.

- Do include the names and addresses of all beneficiaries.

- Do sign the deed in front of a notary public.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the county register of deeds.

- Don't leave any sections of the form blank.

- Don't forget to check for any local filing fees.

- Don't use outdated forms; always use the most current version.

- Don't assume verbal agreements are sufficient; everything must be in writing.

Following these steps will help ensure that the Transfer-on-Death Deed is filled out correctly and is legally binding.