Valid Quitclaim Deed Form for Michigan

The Michigan Quitclaim Deed form serves as a vital instrument in real estate transactions, allowing property owners to transfer their interests in a property without making any guarantees about the title's validity. This straightforward legal document is particularly useful in situations where the parties involved are familiar with each other, such as family members or friends. By utilizing a quitclaim deed, one can quickly and efficiently convey property rights, making it an attractive option for those looking to simplify the transfer process. Importantly, this form does not require extensive legal formalities, though it must still adhere to state-specific requirements to ensure its validity. In Michigan, the form must be signed by the grantor and notarized, and it must also include essential details such as the names of both the grantor and grantee, a description of the property, and the date of transfer. Understanding these key elements can help individuals navigate the complexities of property transfers while ensuring compliance with local laws.

Common mistakes

-

Incorrect Names: People often misspell names or use nicknames instead of legal names. Ensure that all names match the names on legal documents.

-

Missing Signatures: All parties involved must sign the deed. Forgetting a signature can invalidate the document.

-

Wrong Property Description: A detailed and accurate description of the property is essential. Omitting or misdescribing the property can lead to confusion or disputes.

-

Not Notarizing the Document: A quitclaim deed must be notarized to be legally binding. Failing to have it notarized can result in the deed being unenforceable.

-

Incorrect Date: The date on the deed should reflect when the transaction occurs. An incorrect date can lead to legal complications.

-

Not Filing with the County: After completing the deed, it must be filed with the appropriate county office. Neglecting to do so can prevent the transfer of ownership from being recognized.

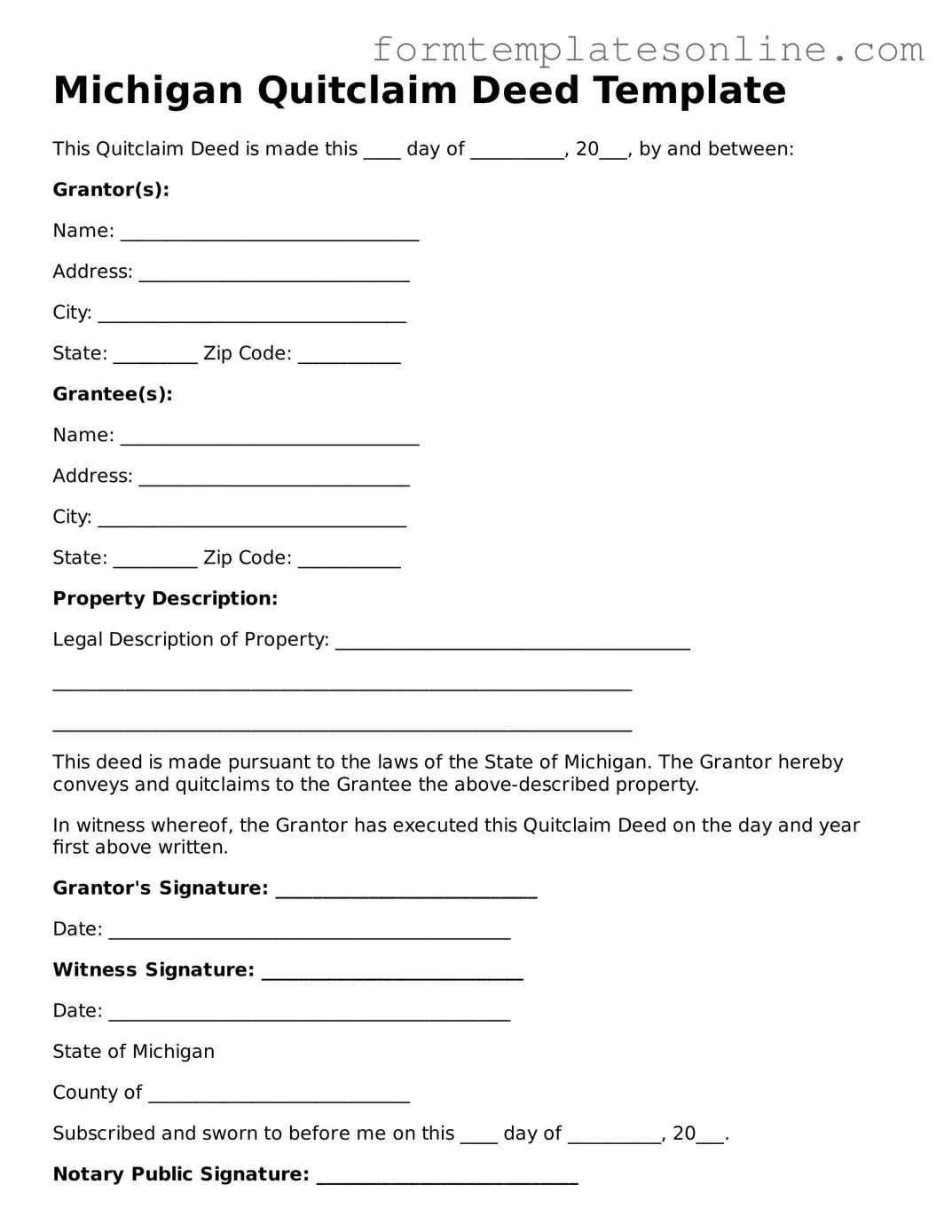

Example - Michigan Quitclaim Deed Form

Michigan Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20___, by and between:

Grantor(s):

Name: ________________________________

Address: _____________________________

City: _________________________________

State: _________ Zip Code: ___________

Grantee(s):

Name: ________________________________

Address: _____________________________

City: _________________________________

State: _________ Zip Code: ___________

Property Description:

Legal Description of Property: ______________________________________

______________________________________________________________

______________________________________________________________

This deed is made pursuant to the laws of the State of Michigan. The Grantor hereby conveys and quitclaims to the Grantee the above-described property.

In witness whereof, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor's Signature: ____________________________

Date: ___________________________________________

Witness Signature: ____________________________

Date: ___________________________________________

State of Michigan

County of ____________________________

Subscribed and sworn to before me on this ____ day of __________, 20___.

Notary Public Signature: ____________________________

My commission expires: ______________________________

More About Michigan Quitclaim Deed

What is a Quitclaim Deed in Michigan?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees. In Michigan, this type of deed allows the grantor, or seller, to convey whatever interest they have in the property to the grantee, or buyer. It is often used in situations where the parties know each other, such as family transfers or divorce settlements, since it does not provide the same level of protection as a warranty deed.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in several scenarios. Common situations include transferring property between family members, clearing up title issues, or when one spouse is relinquishing their interest in a property during a divorce. It is important to note that while a Quitclaim Deed is simple and quick, it does not protect the grantee against any claims or liens on the property.

What information is required on a Quitclaim Deed in Michigan?

A Quitclaim Deed in Michigan must include specific information to be valid. This includes the names and addresses of both the grantor and grantee, a legal description of the property, and the date of the transfer. Additionally, the document must be signed by the grantor in front of a notary public. It is also advisable to include the property’s tax identification number for clarity.

Do I need to have the Quitclaim Deed notarized?

Yes, in Michigan, a Quitclaim Deed must be notarized to be legally effective. The grantor must sign the deed in the presence of a notary public, who will then affix their seal. This step is crucial as it helps to prevent fraud and ensures that the document is recognized by the state and recorded properly.

How do I record a Quitclaim Deed in Michigan?

To record a Quitclaim Deed in Michigan, you must submit the completed and notarized document to the local county register of deeds. There may be a small fee associated with the recording process. Once recorded, the deed becomes part of the public record, which helps establish the new ownership of the property.

What are the tax implications of using a Quitclaim Deed?

Using a Quitclaim Deed can have tax implications, particularly regarding property taxes and potential capital gains taxes. In Michigan, transferring property may trigger a reassessment of property taxes. Additionally, if the property is sold in the future, the grantee may be responsible for capital gains taxes based on the original purchase price of the property. It is advisable to consult with a tax professional for specific guidance.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, the grantor can create a new deed that explicitly states the intention to revoke the previous transfer. This new deed must also be recorded to ensure that the change is recognized legally. It is important to approach this process carefully, as the implications can be significant for all parties involved.

Key takeaways

Filling out and using the Michigan Quitclaim Deed form can be straightforward. Here are some key takeaways to keep in mind:

- The Quitclaim Deed is used to transfer property ownership without guaranteeing the title's quality.

- It is essential to include the names of both the grantor (seller) and grantee (buyer) clearly.

- Make sure to provide a complete legal description of the property being transferred.

- Signatures must be notarized for the deed to be valid in Michigan.

- Check if there are any local requirements or additional forms needed for your specific county.

- Once completed, the deed should be filed with the county register of deeds.

- Consider consulting with a real estate professional if you're unsure about any part of the process.

- Keep a copy of the completed Quitclaim Deed for your records.

File Details

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal instrument that transfers interest in real property from one party to another without any warranties. |

| Governing Law | The Michigan Quitclaim Deed is governed by the Michigan Compiled Laws, specifically MCL 565.25. |

| Parties Involved | The parties involved in a quitclaim deed are the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| Use Cases | Quitclaim deeds are often used among family members, in divorce settlements, or to clear up title issues. |

| Form Requirements | The deed must be in writing, signed by the grantor, and must include a description of the property. |

| Recording | While not required, recording the quitclaim deed with the county register of deeds is recommended to provide public notice of the transfer. |

| Consideration | Consideration is not required for a quitclaim deed to be valid, although it is common to include a nominal amount. |

| Limitations | A quitclaim deed does not guarantee that the grantor has any ownership interest in the property. |

| Tax Implications | Transfer taxes may apply when using a quitclaim deed, depending on the value of the property being transferred. |

| Common Mistakes | Failing to include a legal description of the property or not properly executing the deed can lead to issues in the transfer process. |

Consider Some Other Quitclaim Deed Forms for US States

Pennsylvania Quit Claim Deed Form - A Quitclaim Deed can simplify property contributions in partnerships.

The Dirt Bike Bill of Sale form is a crucial document used when buying or selling a dirt bike in New York. This form serves to record the transaction, providing both parties with proof of ownership and details about the sale. For a comprehensive understanding and to access the form, you can visit https://documentonline.org/blank-new-york-dirt-bike-bill-of-sale/, which can help ensure a smooth and legal transfer of ownership.

Quit Claim Deed Blank Form - Documentation of the Quitclaim Deed is vital to ensure the transfer is legally recognized.

Dos and Don'ts

When filling out the Michigan Quitclaim Deed form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do ensure that all names are spelled correctly. Mistakes can lead to confusion and delays.

- Do provide a complete legal description of the property. This information is crucial for identifying the exact location.

- Do sign the form in front of a notary public. This step adds legitimacy to your document.

- Do include the date of the transaction. This helps establish a timeline for the transfer of ownership.

- Do check for any local requirements. Some counties may have specific rules regarding quitclaim deeds.

- Don’t leave any blank spaces on the form. Every section should be filled out to avoid complications.

- Don’t forget to include the grantee's address. This information is necessary for future correspondence.

- Don’t use outdated forms. Always obtain the latest version to ensure compliance with current laws.

- Don’t rush the process. Take your time to review the document for accuracy before submitting it.

By following these guidelines, you can help ensure that your Quitclaim Deed is filled out correctly and efficiently.