Valid Promissory Note Form for Michigan

The Michigan Promissory Note form serves as a crucial document in financial transactions, outlining the terms under which one party agrees to pay another a specific amount of money. This form typically includes essential details such as the principal amount, interest rate, repayment schedule, and any applicable late fees. It may also specify whether the note is secured or unsecured, which can impact the lender's rights in case of default. Additionally, the form often includes provisions for prepayment and the governing law, ensuring clarity for both parties involved. By clearly stating the obligations and expectations, the Michigan Promissory Note helps to protect the interests of both the borrower and the lender, making it a vital tool in personal and business finance. Understanding this form is essential for anyone entering into a loan agreement in Michigan.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. Borrowers should ensure that their names, addresses, and contact details are fully filled out. Lenders must also include their information accurately.

-

Incorrect Loan Amount: Entering the wrong loan amount can lead to confusion and potential legal issues. Double-check the figures to ensure they match the agreed-upon amount. Any discrepancies may cause problems later.

-

Missing Signatures: Both the borrower and lender must sign the document. Failing to obtain all necessary signatures can render the note unenforceable. Make sure to check that all parties have signed before submitting the form.

-

Neglecting to Date the Document: A date is crucial for the promissory note. Without it, there may be disputes regarding when the loan was issued. Always include the date of signing to establish a clear timeline.

-

Ignoring State-Specific Requirements: Each state may have specific requirements for promissory notes. Be aware of Michigan's laws and ensure compliance. Not adhering to these rules could affect the enforceability of the note.

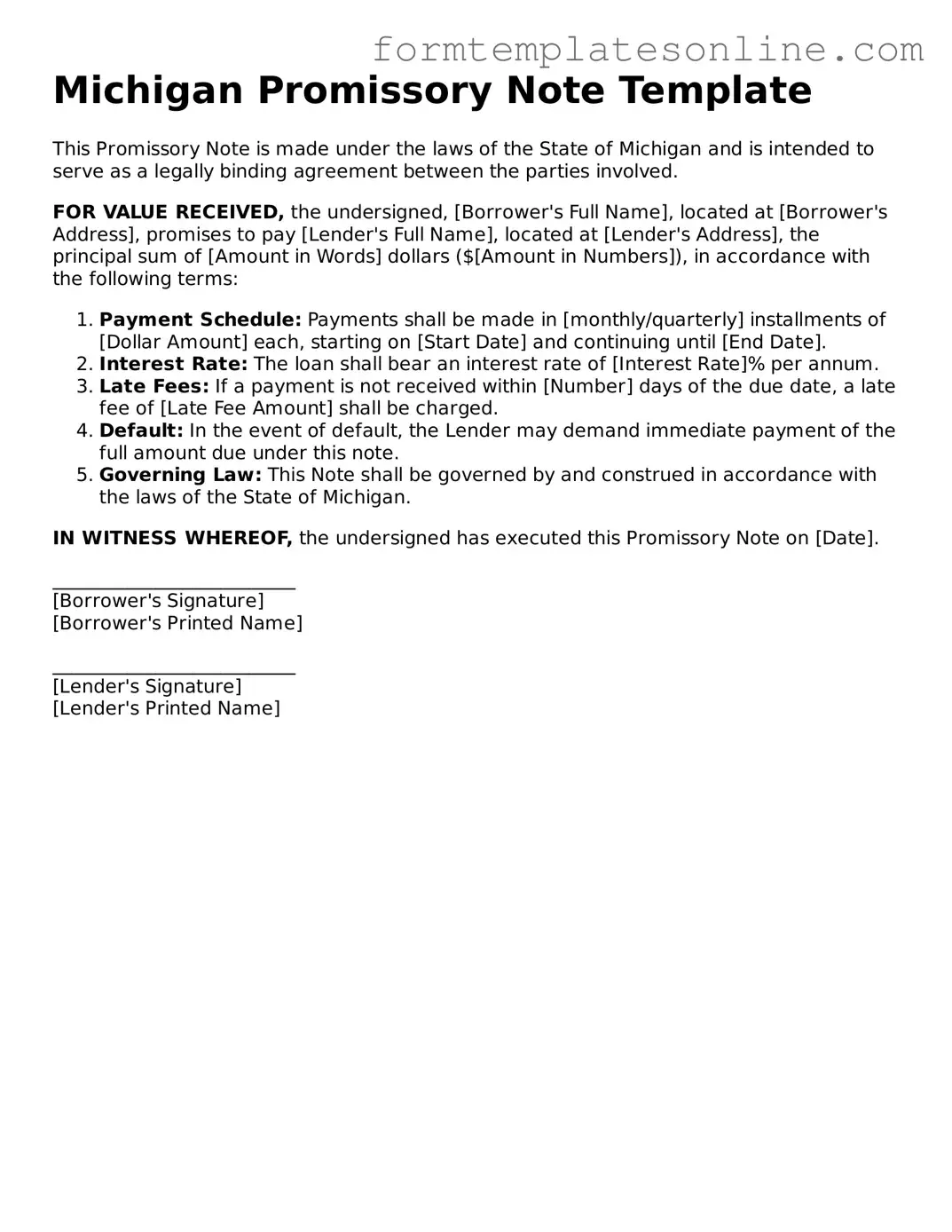

Example - Michigan Promissory Note Form

Michigan Promissory Note Template

This Promissory Note is made under the laws of the State of Michigan and is intended to serve as a legally binding agreement between the parties involved.

FOR VALUE RECEIVED, the undersigned, [Borrower's Full Name], located at [Borrower's Address], promises to pay [Lender's Full Name], located at [Lender's Address], the principal sum of [Amount in Words] dollars ($[Amount in Numbers]), in accordance with the following terms:

- Payment Schedule: Payments shall be made in [monthly/quarterly] installments of [Dollar Amount] each, starting on [Start Date] and continuing until [End Date].

- Interest Rate: The loan shall bear an interest rate of [Interest Rate]% per annum.

- Late Fees: If a payment is not received within [Number] days of the due date, a late fee of [Late Fee Amount] shall be charged.

- Default: In the event of default, the Lender may demand immediate payment of the full amount due under this note.

- Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Michigan.

IN WITNESS WHEREOF, the undersigned has executed this Promissory Note on [Date].

__________________________

[Borrower's Signature]

[Borrower's Printed Name]

__________________________

[Lender's Signature]

[Lender's Printed Name]

More About Michigan Promissory Note

What is a Michigan Promissory Note?

A Michigan Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This note serves as a written acknowledgment of debt and includes important details such as the loan amount, interest rate, repayment schedule, and any applicable penalties for late payment. It is a crucial tool for both parties, providing clarity and legal protection in the lending process.

Who typically uses a Promissory Note in Michigan?

Promissory Notes are commonly used by individuals, businesses, and financial institutions. For instance, a person may use one when borrowing money from a friend or family member, while a business might issue a note to secure funding from investors or banks. Essentially, anyone involved in a lending agreement can benefit from the structure and security that a Promissory Note provides.

What information should be included in a Michigan Promissory Note?

A comprehensive Michigan Promissory Note should include several key elements. First, the names and addresses of both the borrower and the lender must be clearly stated. Second, the principal amount of the loan and the interest rate should be specified. Additionally, the repayment terms, including the schedule for payments and any grace periods, should be outlined. Lastly, the note should address what happens in the event of default, including any late fees or penalties that may apply.

Is a Michigan Promissory Note legally binding?

Yes, a properly executed Michigan Promissory Note is legally binding. Once signed by both parties, it creates a contractual obligation for the borrower to repay the loan according to the terms outlined in the document. If the borrower fails to meet these obligations, the lender has the right to take legal action to recover the owed amount. This enforceability is what makes the Promissory Note a valuable tool in financial transactions.

Can a Promissory Note be modified after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing, as this helps maintain clarity and prevents misunderstandings. A modification might include changes to the repayment schedule, interest rate adjustments, or other terms. Both parties should sign the revised document to ensure its validity.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They may choose to pursue legal action to recover the owed amount, which could involve filing a lawsuit. In some cases, the lender may also be entitled to additional fees or penalties as specified in the note. It is essential for both parties to understand the consequences of default before entering into the agreement.

Do I need a lawyer to create a Promissory Note in Michigan?

While it is not legally required to have a lawyer draft a Promissory Note, seeking legal advice can be beneficial. A lawyer can ensure that the document complies with Michigan law and adequately protects your interests. For those unfamiliar with legal documents, having professional guidance may help avoid potential pitfalls and ensure that all necessary terms are included.

Where can I find a Michigan Promissory Note template?

Templates for Michigan Promissory Notes can be found online through various legal websites and resources. Many of these templates are customizable, allowing you to input specific details relevant to your agreement. However, it is wise to review any template carefully and consider consulting with a legal professional to ensure that it meets your needs and complies with state laws.

Key takeaways

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan under specific terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender to avoid any confusion.

- Specify the Loan Amount: Clearly write the total amount being borrowed. This figure is crucial for both parties.

- Outline the Interest Rate: Include the interest rate, if applicable. This affects the total repayment amount.

- Set a Repayment Schedule: Define when payments are due. This can be a single payment or a series of payments.

- Include Late Fees: If you plan to charge late fees, specify the amount and when they will be applied.

- Signatures Required: Both parties must sign and date the document. This confirms agreement to the terms.

- Keep Copies: After signing, ensure both parties retain a copy of the note for their records.

File Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Michigan Promissory Note is governed by the Michigan Uniform Commercial Code (UCC), specifically Article 3. |

| Parties Involved | Typically, the parties involved are the borrower (maker) and the lender (payee). |

| Payment Terms | The note specifies the amount to be paid, the interest rate, and the payment schedule. |

| Default Clause | Most notes include a default clause, outlining the consequences if the borrower fails to make payments. |

| Transferability | Promissory notes can be transferred to another party, making them negotiable instruments. |

| Signature Requirement | The note must be signed by the borrower to be enforceable. |

| Witnesses/Notarization | While not required, having the note witnessed or notarized can provide additional legal protection. |

| State-Specific Considerations | Michigan law may impose specific requirements for interest rates and enforcement actions in case of default. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Ohio - The document can be created for informal or formal loans.

Promissory Note Illinois - The lender benefits from a Promissory Note as it provides a clear record of the debt.

Promissory Note Template California Word - State-specific guidelines may affect how a Promissory Note should be structured.

For those requiring legal authority in pivotal decisions, understanding the nuances of a General Power of Attorney is vital. This documentation is necessary for anyone navigating responsibilities, and you can explore more about how to create this important form at our guide on the importance of a General Power of Attorney document.

Promissory Note Friendly Loan Agreement Format - Some Promissory Notes can allow for incidental fees or adjustments based on risk factors.

Dos and Don'ts

When filling out the Michigan Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are seven things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable, and ensure it complies with state regulations.

- Don't leave any required fields blank; this may cause delays or rejection.

- Don't use unclear language or abbreviations that could lead to misunderstandings.

- Don't forget to sign and date the form; an unsigned note may not be enforceable.