Valid Operating Agreement Form for Michigan

When forming a limited liability company (LLC) in Michigan, one of the essential documents to consider is the Operating Agreement. This form serves as the foundational blueprint for the company, outlining the rights, responsibilities, and obligations of its members. It addresses key aspects such as the management structure, profit distribution, and decision-making processes, ensuring that all members are aligned and aware of their roles. Importantly, the Operating Agreement also includes provisions for adding new members, transferring ownership interests, and resolving disputes, thereby providing a framework for the company’s future. While Michigan law does not mandate the creation of an Operating Agreement, having one in place is highly advisable. It not only protects the members’ interests but also enhances the LLC’s credibility with banks, investors, and potential partners. By clearly defining the operational procedures and expectations, this document helps prevent misunderstandings and conflicts, paving the way for a smoother business operation.

Common mistakes

When filling out the Michigan Operating Agreement form, individuals often encounter several common mistakes. Being aware of these can help ensure that the form is completed accurately and effectively. Here are four mistakes to watch out for:

-

Incomplete Information: Many people neglect to fill in all required fields. This can lead to delays or even rejection of the agreement. Ensure that all sections are filled out completely, including names, addresses, and roles of members.

-

Incorrect Member Designations: It’s crucial to accurately designate members and their respective roles within the organization. Mislabeling members or failing to specify their responsibilities can create confusion and legal issues down the line.

-

Failure to Specify Voting Rights: Some individuals overlook the importance of detailing voting rights and decision-making processes. Clearly outlining how decisions will be made helps prevent disputes among members in the future.

-

Not Reviewing the Agreement: Skipping the review process can lead to oversight of critical details. After completing the form, take the time to review it thoroughly. Consider having a trusted advisor or legal professional look it over as well.

By avoiding these common pitfalls, you can ensure that your Michigan Operating Agreement is properly completed and serves its intended purpose effectively.

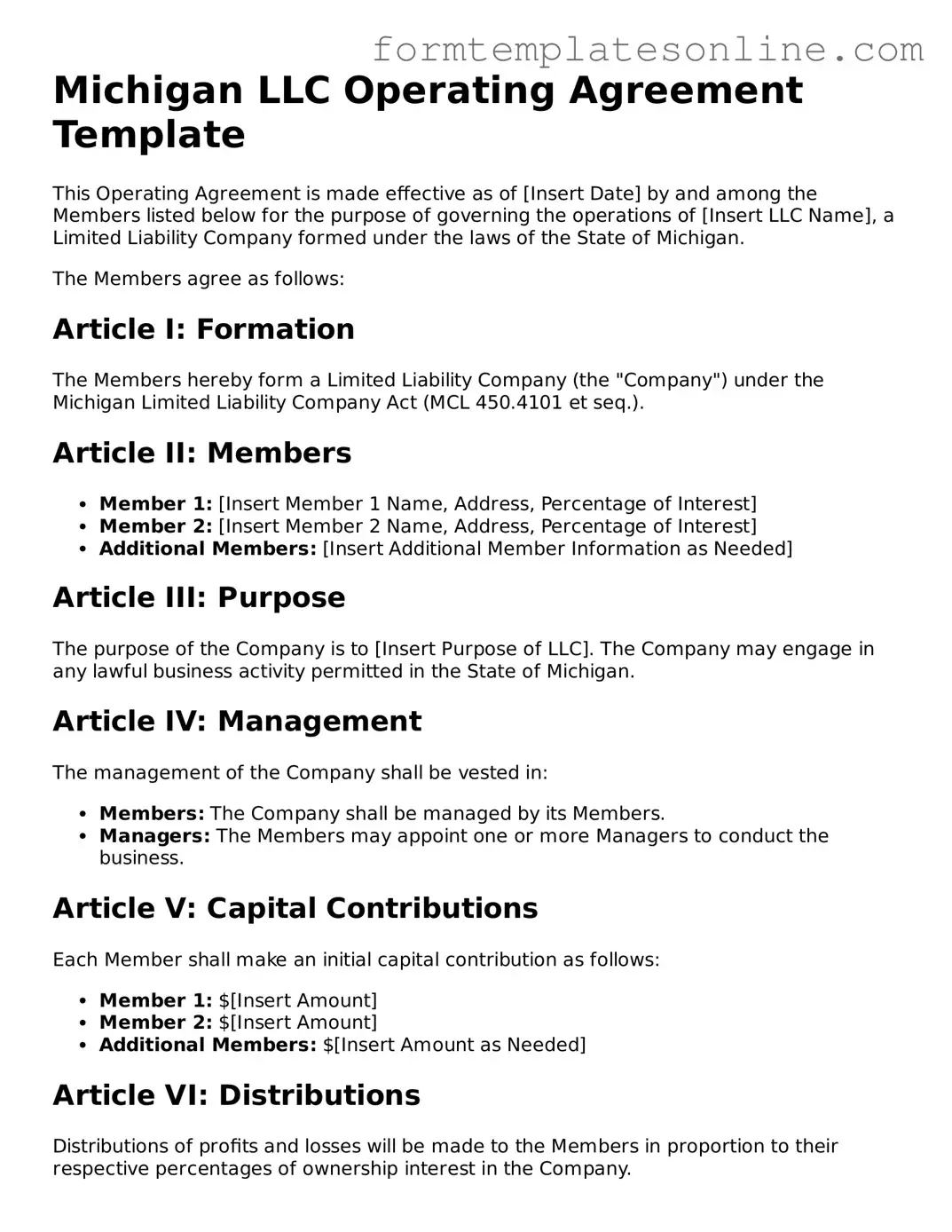

Example - Michigan Operating Agreement Form

Michigan LLC Operating Agreement Template

This Operating Agreement is made effective as of [Insert Date] by and among the Members listed below for the purpose of governing the operations of [Insert LLC Name], a Limited Liability Company formed under the laws of the State of Michigan.

The Members agree as follows:

Article I: Formation

The Members hereby form a Limited Liability Company (the "Company") under the Michigan Limited Liability Company Act (MCL 450.4101 et seq.).

Article II: Members

- Member 1: [Insert Member 1 Name, Address, Percentage of Interest]

- Member 2: [Insert Member 2 Name, Address, Percentage of Interest]

- Additional Members: [Insert Additional Member Information as Needed]

Article III: Purpose

The purpose of the Company is to [Insert Purpose of LLC]. The Company may engage in any lawful business activity permitted in the State of Michigan.

Article IV: Management

The management of the Company shall be vested in:

- Members: The Company shall be managed by its Members.

- Managers: The Members may appoint one or more Managers to conduct the business.

Article V: Capital Contributions

Each Member shall make an initial capital contribution as follows:

- Member 1: $[Insert Amount]

- Member 2: $[Insert Amount]

- Additional Members: $[Insert Amount as Needed]

Article VI: Distributions

Distributions of profits and losses will be made to the Members in proportion to their respective percentages of ownership interest in the Company.

Article VII: Indemnification

The Company shall indemnify its Members and Managers to the fullest extent permissible under Michigan law.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Michigan.

Article X: Signatures

IN WITNESS WHEREOF, the Members hereby execute this Operating Agreement as of the date first above written.

Member Signatures:

- ______________________________ [Member 1 Name]

- ______________________________ [Member 2 Name]

- ______________________________ [Additional Member Name]

More About Michigan Operating Agreement

What is a Michigan Operating Agreement?

A Michigan Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Michigan. It serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and the distribution of profits and losses.

Is an Operating Agreement required in Michigan?

No, an Operating Agreement is not legally required in Michigan. However, it is highly recommended. Having an Operating Agreement can help prevent misunderstandings among members and provides a clear framework for the operation of the LLC.

Who should draft the Operating Agreement?

What should be included in the Operating Agreement?

The Operating Agreement should include various key elements, such as the LLC's name, purpose, member contributions, profit distribution, management structure, and procedures for adding or removing members. Additionally, it can address dispute resolution and what happens if a member leaves the LLC.

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Members can agree to changes as needed. It is important to document any amendments in writing and have all members sign the updated agreement to ensure clarity and legal standing.

How does the Operating Agreement affect liability protection?

While the Operating Agreement itself does not provide liability protection, it helps establish the LLC as a separate legal entity. This separation is crucial for protecting personal assets from business liabilities. A well-drafted Operating Agreement can reinforce the LLC's status and help maintain liability protections.

Is it necessary to file the Operating Agreement with the state?

No, the Operating Agreement does not need to be filed with the state of Michigan. It is an internal document that should be kept with the LLC’s records. However, members should have access to it for reference and to resolve any disputes that may arise.

How often should the Operating Agreement be reviewed?

It is a good practice to review the Operating Agreement periodically, especially when there are significant changes in the business or membership. Regular reviews can help ensure that the agreement remains relevant and effective in guiding the LLC's operations.

What happens if the LLC does not have an Operating Agreement?

If an LLC does not have an Operating Agreement, Michigan's default LLC laws will govern the operation of the business. This may not align with the members' intentions and can lead to disputes. Without a clear agreement, members may face challenges in decision-making and profit distribution.

Key takeaways

When filling out and using the Michigan Operating Agreement form, there are several important points to keep in mind. Understanding these takeaways can help ensure that the agreement serves its intended purpose effectively.

- Clarity of Purpose: Clearly define the purpose of your business in the agreement. This sets the foundation for operations and helps avoid misunderstandings among members.

- Member Roles: Specify the roles and responsibilities of each member. This clarity helps in maintaining accountability and ensures that everyone knows their contributions to the business.

- Profit Distribution: Outline how profits and losses will be distributed among members. Establishing this upfront can prevent disputes later on.

- Decision-Making Process: Include a detailed decision-making process. Specify how decisions will be made, whether by majority vote or unanimous consent, to streamline operations.

- Amendment Procedures: Describe how the Operating Agreement can be amended in the future. This flexibility allows the agreement to evolve as the business grows.

- Legal Compliance: Ensure that the agreement complies with Michigan state laws. Consulting with a legal expert can help you avoid potential pitfalls.

By keeping these key takeaways in mind, you can create a comprehensive and effective Operating Agreement that supports your business's success.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Operating Agreement outlines the management structure and operational guidelines for a limited liability company (LLC) in Michigan. |

| Governing Law | This agreement is governed by the Michigan Limited Liability Company Act, specifically MCL 450.4101 et seq. |

| Member Rights | The agreement details the rights and responsibilities of each member, including profit sharing and decision-making processes. |

| Flexibility | Michigan law allows for flexibility in how the operating agreement is structured, enabling members to tailor it to their specific needs. |

| Importance of Written Agreement | While an oral agreement is possible, having a written operating agreement is crucial for clarity and legal protection among members. |

Consider Some Other Operating Agreement Forms for US States

Operating Agreement Llc Pa Template - This document facilitates the smooth operation of the LLC by providing clear guidance.

For those interested in the legalities surrounding firearm transactions, understanding the comprehensive Florida Firearm Bill of Sale form is crucial. This official document facilitates the transfer process by capturing necessary details like the identities of the buyer and seller and specifics regarding the firearm itself. For more information, refer to the provisions outlined in the step-by-step guide to the Firearm Bill of Sale.

How to Write an Operating Agreement - This document may specify the duration of the LLC and conditions for dissolution.

Dos and Don'ts

When filling out the Michigan Operating Agreement form, it is crucial to approach the task with care. Here are nine essential do's and don'ts to guide you through the process.

- Do read the entire form thoroughly before starting.

- Do provide accurate and complete information for all sections.

- Do consult with a legal professional if you have questions.

- Do keep a copy of the completed form for your records.

- Do ensure all members sign the agreement where required.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any fields blank unless specifically instructed.

- Don't use ambiguous language; be clear and precise.

- Don't ignore state-specific requirements that may apply.