Valid Lady Bird Deed Form for Michigan

The Michigan Lady Bird Deed form is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This deed enables the property owner to maintain control over the property, including the right to live in it, sell it, or change the beneficiaries at any time. One of the key advantages of the Lady Bird Deed is that it helps avoid probate, which can be a lengthy and costly process. Additionally, the transfer of property through this deed may offer tax benefits, as it often allows for a step-up in basis for the beneficiaries. Understanding the specific requirements and implications of the Lady Bird Deed is essential for anyone considering this option as part of their estate planning strategy. Overall, it serves as a flexible and efficient way to manage property transfer while ensuring that the owner’s wishes are respected.

Common mistakes

-

Incomplete Information: Failing to provide all required information can lead to delays or rejection of the deed. Ensure that all fields are filled out accurately.

-

Incorrect Property Description: A common mistake is not accurately describing the property. Use the legal description found in the property deed, rather than a simple address.

-

Not Identifying Beneficiaries Clearly: It's important to clearly identify who the beneficiaries are. Ambiguous language can create confusion and potential disputes later.

-

Omitting Signatures: All required signatures must be included. This includes the grantor's signature and, in some cases, the signature of a witness or notary.

-

Failing to Notarize: A Lady Bird Deed typically requires notarization. Skipping this step can invalidate the deed.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding property transfers. Make sure to follow Michigan’s specific guidelines when filling out the form.

-

Not Keeping Copies: After submitting the deed, it’s essential to keep copies for your records. This ensures that you have proof of the transfer and can resolve any future issues.

Example - Michigan Lady Bird Deed Form

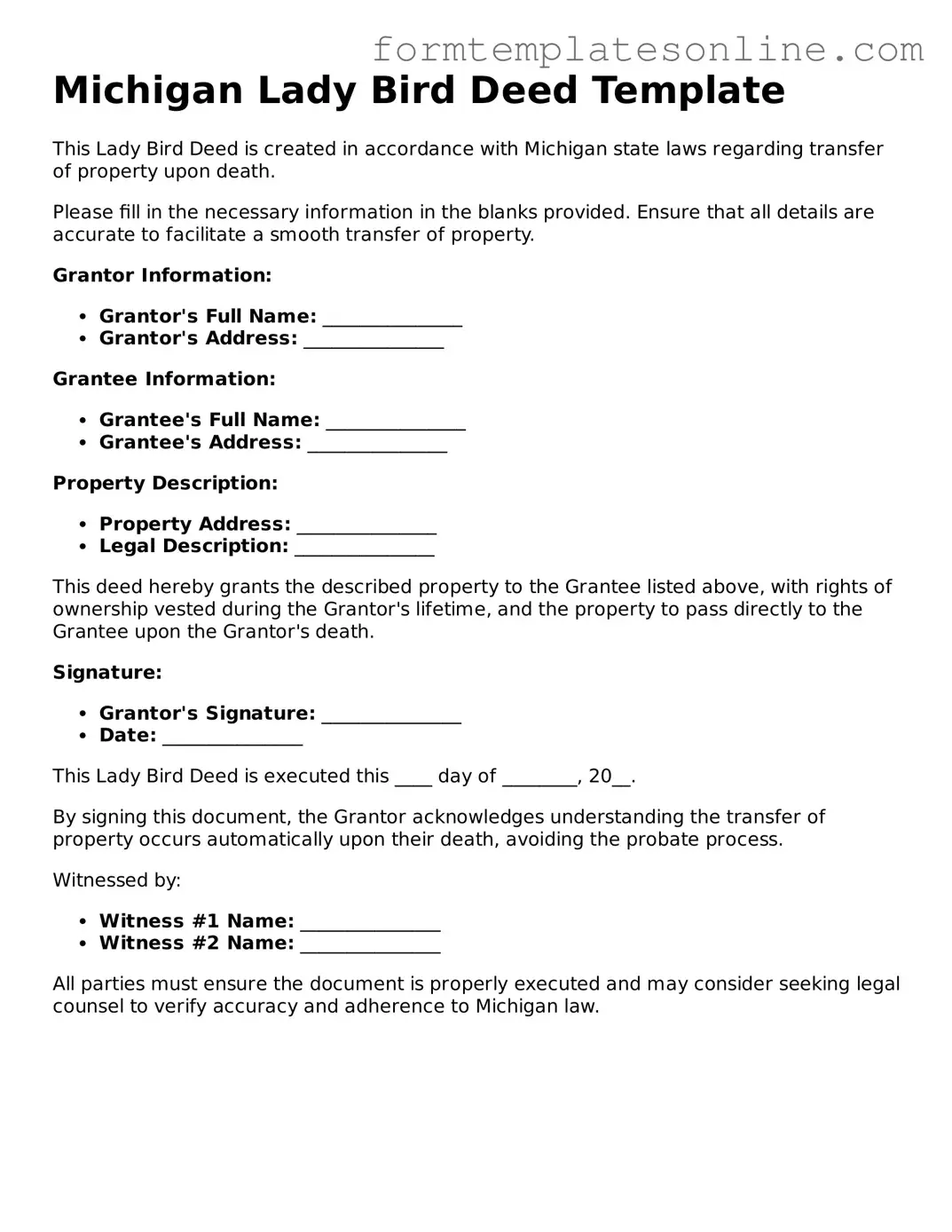

Michigan Lady Bird Deed Template

This Lady Bird Deed is created in accordance with Michigan state laws regarding transfer of property upon death.

Please fill in the necessary information in the blanks provided. Ensure that all details are accurate to facilitate a smooth transfer of property.

Grantor Information:

- Grantor's Full Name: _______________

- Grantor's Address: _______________

Grantee Information:

- Grantee's Full Name: _______________

- Grantee's Address: _______________

Property Description:

- Property Address: _______________

- Legal Description: _______________

This deed hereby grants the described property to the Grantee listed above, with rights of ownership vested during the Grantor's lifetime, and the property to pass directly to the Grantee upon the Grantor's death.

Signature:

- Grantor's Signature: _______________

- Date: _______________

This Lady Bird Deed is executed this ____ day of ________, 20__.

By signing this document, the Grantor acknowledges understanding the transfer of property occurs automatically upon their death, avoiding the probate process.

Witnessed by:

- Witness #1 Name: _______________

- Witness #2 Name: _______________

All parties must ensure the document is properly executed and may consider seeking legal counsel to verify accuracy and adherence to Michigan law.

More About Michigan Lady Bird Deed

What is a Lady Bird Deed in Michigan?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners in Michigan to transfer their property to beneficiaries while retaining control during their lifetime. This means the owner can sell, mortgage, or change the property as they wish. Upon the owner's death, the property automatically transfers to the named beneficiaries without going through probate.

Who can use a Lady Bird Deed?

Any property owner in Michigan can use a Lady Bird Deed. This includes individuals who own their home or other real estate. It is particularly useful for those who want to ensure a smooth transfer of property to their heirs while avoiding the lengthy and costly probate process.

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed. First, it allows the property owner to maintain control over the property during their lifetime. Second, it avoids probate, which can save time and money. Additionally, it can help protect the property from creditors and Medicaid claims after the owner's death, depending on specific circumstances.

Are there any drawbacks to a Lady Bird Deed?

While there are many benefits, there are also potential drawbacks. For instance, if the property owner needs to sell the property, they must ensure that all beneficiaries agree to the sale. Additionally, if the owner wishes to change beneficiaries, they must execute a new deed. It’s important to consider these factors and consult with a legal professional to ensure it fits your needs.

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, you need to prepare the deed document, which includes the names of the current owner(s) and the beneficiaries. It must be signed and notarized. After that, you should file the deed with the local county register of deeds. It’s advisable to seek legal assistance to ensure that the deed is properly executed and meets all legal requirements.

Can I revoke a Lady Bird Deed?

Yes, a Lady Bird Deed can be revoked or changed at any time during the property owner's lifetime. To do this, the owner must create a new deed that explicitly revokes the previous one. This flexibility is one of the key benefits of using a Lady Bird Deed, allowing property owners to adapt their estate plans as circumstances change.

Do I need an attorney to create a Lady Bird Deed?

While it is not legally required to have an attorney to create a Lady Bird Deed, it is highly recommended. An attorney can help ensure that the deed is drafted correctly and complies with Michigan law. They can also provide guidance on how the deed fits into your overall estate plan, which can be invaluable for your peace of mind.

Key takeaways

Here are some key takeaways about filling out and using the Michigan Lady Bird Deed form:

- The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- This type of deed can help avoid probate, making the transfer process smoother for your loved ones.

- Filling out the form requires accurate information about the property and the beneficiaries.

- It’s important to include a legal description of the property, not just the address.

- Both the property owner and the beneficiaries must be clearly identified in the deed.

- Once completed, the deed must be signed and notarized to be valid.

- After signing, the deed should be recorded with the county clerk to ensure it is legally recognized.

- Consulting with an attorney can help clarify any questions and ensure the deed meets all legal requirements.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining the right to use the property during their lifetime. |

| Governing Law | This deed is governed by Michigan Compiled Laws, specifically MCL 565.451 et seq. |

| Revocability | The property owner can revoke or change the deed at any time before their death. |

| Tax Benefits | The Lady Bird Deed may help avoid probate, which can save time and reduce costs for the beneficiaries. |

| Eligibility | Any individual who owns real estate in Michigan can create a Lady Bird Deed, provided they are of sound mind. |

Consider Some Other Lady Bird Deed Forms for US States

Lady Bird Deed San Antonio - This strategy is especially useful for avoiding conflict among heirs by clearly defining property transfer plans.

Filing the IRS 2553 form is a vital step for small businesses that wish to benefit from S corporation status and enjoy the advantages that come with it, such as pass-through taxation. For detailed guidance on completing this form, resources like OnlineLawDocs.com can provide valuable assistance to ensure compliance and maximize benefits.

Ladybird Deed Florida - It allows seniors to age in place while securing their future property succession plans.

Dos and Don'ts

When filling out the Michigan Lady Bird Deed form, it’s important to keep certain things in mind. Here is a list of what you should and shouldn't do:

- Do ensure that you have the correct legal description of the property.

- Don't leave any sections blank; fill out all required fields.

- Do include the names of all parties involved in the deed.

- Don't use abbreviations or nicknames for names; use full legal names.

- Do consult with a legal professional if you have questions.

- Don't rush through the process; take your time to avoid mistakes.

- Do make sure to sign the document in front of a notary public.

- Don't forget to provide a witness signature if required.

- Do keep a copy of the completed deed for your records.

Following these guidelines can help ensure that the process goes smoothly. If you have any doubts, seeking professional advice is always a good choice.