Valid Deed Form for Michigan

The Michigan Deed form is an essential document used in real estate transactions throughout the state. It serves as a legal instrument that transfers ownership of property from one party to another. Understanding this form is crucial for both buyers and sellers, as it outlines important details such as the names of the parties involved, the legal description of the property, and any conditions or restrictions associated with the transfer. Different types of deeds, including warranty deeds and quitclaim deeds, offer varying levels of protection and assurance regarding the title. Additionally, the form must be properly executed and recorded to ensure its validity and to protect the rights of the new owner. Familiarity with the Michigan Deed form can help individuals navigate the complexities of property transactions with confidence and clarity.

Common mistakes

-

Incorrect Names: One common mistake is misspelling names or using incorrect legal names. Ensure that the names of all parties involved are accurate and match the names on their identification documents.

-

Missing Signatures: All required signatures must be present. If a signature is missing, the deed may not be valid. Double-check that everyone who needs to sign has done so.

-

Improper Notarization: Not having the deed properly notarized can lead to issues. A notary public must witness the signing of the document and provide their seal. Without this step, the deed may not be enforceable.

-

Incorrect Legal Description: The legal description of the property must be precise. Errors in this section can create confusion about what property is being transferred. Always verify that the description matches official records.

-

Failure to Record: After filling out the deed, it must be recorded with the county clerk’s office. Failing to do so means the transfer may not be recognized legally. Always confirm that the recording process is complete.

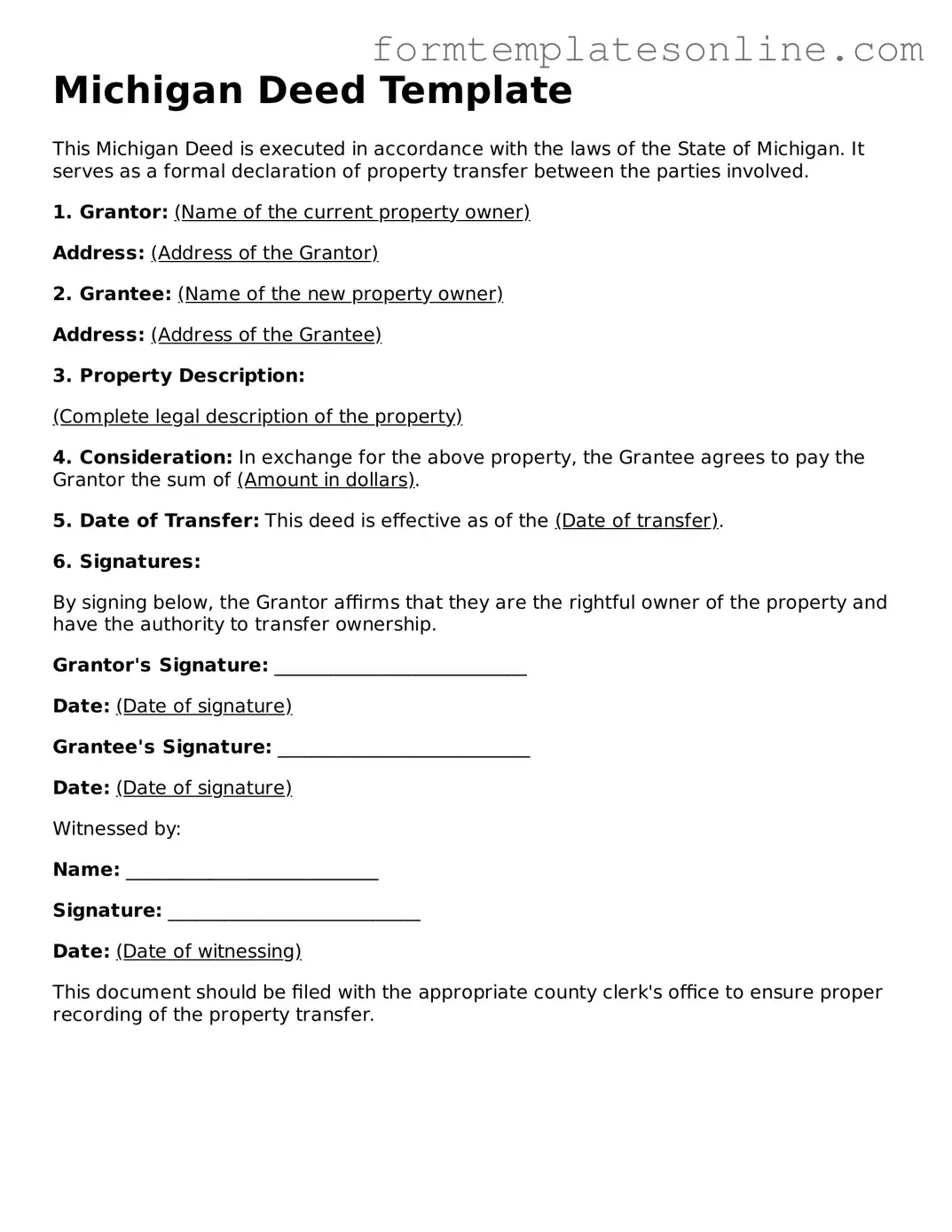

Example - Michigan Deed Form

Michigan Deed Template

This Michigan Deed is executed in accordance with the laws of the State of Michigan. It serves as a formal declaration of property transfer between the parties involved.

1. Grantor: (Name of the current property owner)

Address: (Address of the Grantor)

2. Grantee: (Name of the new property owner)

Address: (Address of the Grantee)

3. Property Description:

(Complete legal description of the property)

4. Consideration: In exchange for the above property, the Grantee agrees to pay the Grantor the sum of (Amount in dollars).

5. Date of Transfer: This deed is effective as of the (Date of transfer).

6. Signatures:

By signing below, the Grantor affirms that they are the rightful owner of the property and have the authority to transfer ownership.

Grantor's Signature: ___________________________

Date: (Date of signature)

Grantee's Signature: ___________________________

Date: (Date of signature)

Witnessed by:

Name: ___________________________

Signature: ___________________________

Date: (Date of witnessing)

This document should be filed with the appropriate county clerk's office to ensure proper recording of the property transfer.

More About Michigan Deed

What is a Michigan Deed form?

A Michigan Deed form is a legal document used to transfer ownership of real property from one party to another in the state of Michigan. It includes essential details such as the names of the grantor (seller) and grantee (buyer), a description of the property, and the signatures of the involved parties. This document is crucial for ensuring that the transfer is recognized by the state and is recorded properly in public records.

What types of deeds are available in Michigan?

Michigan recognizes several types of deeds, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides the highest level of protection to the grantee, ensuring that the property is free of any claims or liens. A Quitclaim Deed, on the other hand, transfers whatever interest the grantor has in the property without any guarantees. Special Warranty Deeds offer a middle ground, protecting against claims that arose during the grantor's ownership.

How do I complete a Michigan Deed form?

To complete a Michigan Deed form, you will need to gather information about the property, including its legal description, and the names and addresses of both the grantor and grantee. Fill out the form accurately, ensuring all details are correct. After completing the form, both parties must sign it in the presence of a notary public to validate the transfer.

Is notarization required for a Michigan Deed?

Yes, notarization is required for a Michigan Deed. Both the grantor and grantee must sign the deed in front of a notary public. This step is essential as it helps verify the identities of the parties involved and ensures that the document is legally binding.

How do I record a Michigan Deed?

To record a Michigan Deed, take the completed and notarized document to the county register of deeds office where the property is located. There, you will need to pay a recording fee. Once recorded, the deed becomes part of the public record, providing official notice of the property transfer.

Are there any fees associated with the Michigan Deed form?

Yes, there are fees associated with the Michigan Deed form. These may include notary fees for notarization and recording fees when you submit the deed to the county register of deeds. The recording fees can vary by county, so it is advisable to check with your local office for the specific amounts.

What should I do if I need assistance with a Michigan Deed form?

If you need assistance with a Michigan Deed form, consider consulting a real estate attorney or a professional familiar with property transfers in Michigan. They can provide guidance on completing the form correctly and ensure that all legal requirements are met. Additionally, many online resources offer templates and instructions to help you through the process.

Key takeaways

When filling out and using the Michigan Deed form, it is essential to keep several key points in mind to ensure the process goes smoothly and legally. Here are some important takeaways:

- Identify the Type of Deed: Understand whether you are using a warranty deed, quitclaim deed, or another type. Each serves a different purpose and offers varying levels of protection.

- Complete the Form Accurately: Fill in all required fields, including the names of the grantor (seller) and grantee (buyer), property description, and signatures. Incomplete forms can lead to legal issues.

- Provide a Clear Property Description: Include a precise legal description of the property. This may include the lot number, block number, and any relevant survey details.

- Signatures Are Crucial: Ensure that the deed is signed by the grantor in the presence of a notary public. Without proper notarization, the deed may not be valid.

- File the Deed with the County: After completing the deed, it must be filed with the county register of deeds. This step is necessary to make the transfer official and public.

- Consider Recording Fees: Be aware that there may be fees associated with recording the deed. Check with your local county office for the exact amounts.

- Consult Legal Advice if Needed: If you are unsure about any part of the process, consider seeking legal advice. This can help prevent mistakes that could affect ownership rights.

By keeping these takeaways in mind, you can navigate the process of filling out and using the Michigan Deed form with greater confidence.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Michigan Deed form is governed by Michigan law, specifically the Michigan Compiled Laws (MCL) 565.1 - 565.48. |

| Types of Deeds | Michigan recognizes several types of deeds, including warranty deeds, quitclaim deeds, and bargain and sale deeds. |

| Signature Requirement | The grantor must sign the deed in the presence of a notary public for it to be valid. |

| Recording | To protect the interests of the grantee, the deed should be recorded with the county clerk's office. |

| Consideration | The deed must state the consideration (payment) for the transfer, though it can be nominal. |

| Legal Description | A complete legal description of the property must be included in the deed. |

| Tax Implications | Transfer taxes may apply when a property is conveyed, and these should be calculated before the transfer. |

| Revocation | Once executed and delivered, a deed cannot be revoked without the consent of the grantee. |

| Witness Requirement | While not mandatory, having a witness sign the deed can provide additional verification of the transaction. |

Consider Some Other Deed Forms for US States

Grant Deed California - Some Deeds may impose restrictions on how a property can be used.

What Does a Deed Look Like in Florida - Lastly, the Deed form serves as a significant document in real estate law.

In addition to being a crucial record of ownership transfer, the Georgia Motorcycle Bill of Sale can be easily accessed and completed through various online resources, such as OnlineLawDocs.com, ensuring that both buyers and sellers have a clear understanding of their rights and responsibilities during the transaction.

Estate Title - Prior to signing a Deed, ensure all details are accurate and clear.

Ohio Warranty Deed - Plays an informative role in local real estate markets and trends.

Dos and Don'ts

When filling out the Michigan Deed form, it is essential to follow specific guidelines to ensure accuracy and compliance with legal requirements. Here is a list of things you should and shouldn't do:

- Do use clear and legible handwriting or type the information.

- Do include the full legal names of all parties involved in the transaction.

- Do provide a complete and accurate description of the property.

- Do ensure that the form is signed by the grantor in the presence of a notary public.

- Do check for any local requirements that may apply to the deed.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use abbreviations for names or property descriptions.

- Don't forget to include the date of the transaction.

- Don't alter the form in any way that might obscure the information provided.

- Don't forget to file the completed deed with the appropriate county clerk's office.

Following these guidelines will help ensure that the deed is properly executed and recorded, protecting the interests of all parties involved in the property transfer.