Valid Articles of Incorporation Form for Michigan

The Michigan Articles of Incorporation form serves as a foundational document for individuals and groups seeking to establish a corporation within the state. This form outlines essential details about the corporation, including its name, purpose, and duration. Additionally, it requires information about the registered agent, who acts as the corporation's official point of contact. Key provisions also address the structure of the board of directors and the number of shares the corporation is authorized to issue. By completing this form, founders not only comply with state regulations but also lay the groundwork for the corporation's legal identity. Understanding the intricacies of this document is crucial for anyone embarking on the journey of incorporation in Michigan, as it encapsulates both the vision and operational framework of the business entity being created.

Common mistakes

-

Incorrect Business Name: Failing to ensure that the chosen business name is unique and not already in use by another entity in Michigan can lead to rejection of the application.

-

Missing Registered Agent Information: Omitting the name and address of the registered agent can cause delays. The registered agent must be a resident of Michigan or a business entity authorized to conduct business in the state.

-

Improperly Stating the Purpose: Writing a vague or overly broad purpose for the corporation can result in confusion. It is important to clearly define the business activities.

-

Not Including the Number of Shares: Failing to specify the number of shares the corporation is authorized to issue may lead to complications. This number should reflect the intended structure of the corporation.

-

Incorrect Incorporator Information: Providing inaccurate or incomplete information about the incorporators can result in processing issues. Each incorporator's name and address must be correctly listed.

-

Not Signing the Document: Forgetting to sign the Articles of Incorporation can halt the filing process. Each incorporator must sign the form to validate it.

-

Ignoring State Fees: Not including the required filing fee can delay the incorporation process. It is essential to check the current fee schedule and submit the correct amount.

-

Failure to Follow Submission Guidelines: Not adhering to the submission guidelines, such as the method of filing or required number of copies, can lead to rejection.

-

Neglecting Ongoing Compliance: After filing, some individuals forget that ongoing compliance is necessary. Annual reports and fees must be maintained to keep the corporation in good standing.

Example - Michigan Articles of Incorporation Form

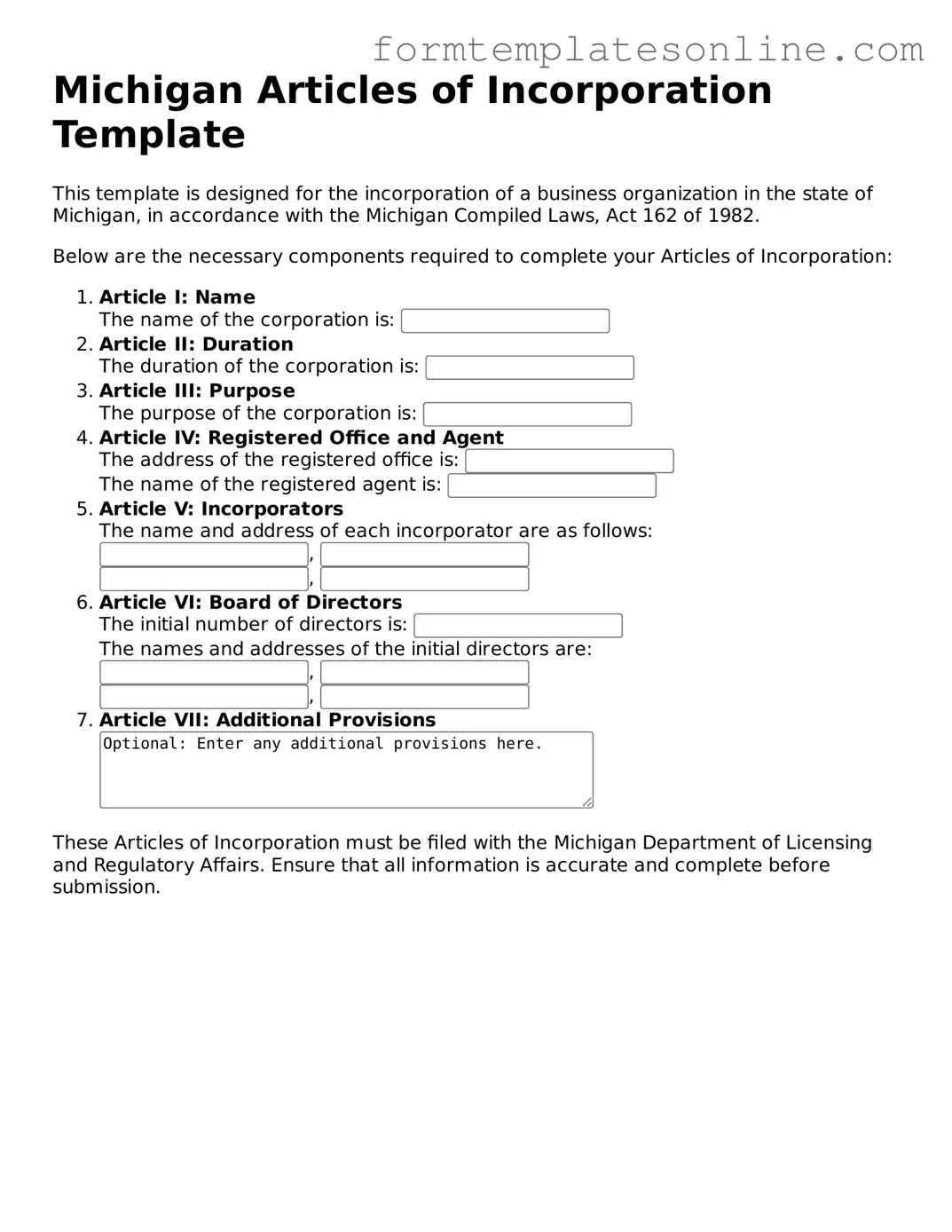

Michigan Articles of Incorporation Template

This template is designed for the incorporation of a business organization in the state of Michigan, in accordance with the Michigan Compiled Laws, Act 162 of 1982.

Below are the necessary components required to complete your Articles of Incorporation:

- Article I: Name

The name of the corporation is: - Article II: Duration

The duration of the corporation is: - Article III: Purpose

The purpose of the corporation is: - Article IV: Registered Office and Agent

The address of the registered office is:

The name of the registered agent is: - Article V: Incorporators

The name and address of each incorporator are as follows:

,

, - Article VI: Board of Directors

The initial number of directors is:

The names and addresses of the initial directors are:

,

, - Article VII: Additional Provisions

These Articles of Incorporation must be filed with the Michigan Department of Licensing and Regulatory Affairs. Ensure that all information is accurate and complete before submission.

More About Michigan Articles of Incorporation

What is the Michigan Articles of Incorporation form?

The Michigan Articles of Incorporation form is a legal document required to establish a corporation in the state of Michigan. This form outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the Michigan Department of Licensing and Regulatory Affairs (LARA) is a crucial step in the incorporation process.

Who needs to file the Articles of Incorporation in Michigan?

Any individual or group wishing to create a corporation in Michigan must file the Articles of Incorporation. This includes businesses ranging from small startups to larger enterprises. Nonprofit organizations also need to complete this form to gain legal recognition. It is important for the founders to understand the requirements and ensure compliance with state laws when filing.

What information is required on the Articles of Incorporation form?

The form requires several key pieces of information. Applicants must provide the name of the corporation, which must be unique and not already in use. The purpose of the corporation must be stated, along with the registered agent's name and address. Additionally, the form asks for details about the number of shares the corporation is authorized to issue and the names and addresses of the incorporators. Accurate and complete information is essential to avoid delays in processing.

How is the Articles of Incorporation form submitted?

The Articles of Incorporation can be submitted online through the Michigan LARA website or by mail. If filing online, applicants can complete the form directly on the website and pay the required fee electronically. For those choosing to file by mail, the completed form must be sent to the appropriate address along with a check for the filing fee. It is advisable to keep a copy of the submitted form for personal records.

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are filed and approved by the state, the corporation is officially formed. The state will issue a Certificate of Incorporation, which serves as proof of the corporation's existence. After incorporation, the business must adhere to ongoing compliance requirements, such as holding annual meetings and filing annual reports. Understanding these responsibilities is critical for maintaining good standing with the state.

Key takeaways

Filling out and using the Michigan Articles of Incorporation form is an important step for anyone looking to establish a corporation in Michigan. Here are some key takeaways to consider:

- The form must be completed accurately to ensure that the corporation is legally recognized.

- Essential information includes the corporation's name, which must be unique and not already in use by another business in Michigan.

- It is necessary to specify the purpose of the corporation clearly. This helps define the business's activities and goals.

- Incorporators must provide their names and addresses. This information is crucial for official communication.

- Filing fees are required when submitting the form. Be sure to check the current fee schedule to avoid delays.

- After filing, it is important to maintain compliance with state regulations, including annual reports and other required filings.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Articles of Incorporation form is used to legally establish a corporation in the state of Michigan. |

| Governing Law | This form is governed by the Michigan Business Corporation Act, specifically Act 284 of 1972. |

| Filing Requirement | Filing the Articles of Incorporation with the Michigan Department of Licensing and Regulatory Affairs is mandatory for incorporation. |

| Information Needed | The form requires details such as the corporation's name, purpose, registered office address, and names of the incorporators. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Processing Time | Processing times can vary, but typically, it takes several business days to receive confirmation of incorporation. |

| Post-Incorporation Steps | After incorporation, corporations must comply with additional requirements, such as obtaining an Employer Identification Number (EIN) and filing annual reports. |

Consider Some Other Articles of Incorporation Forms for US States

Form California Llc - States the purpose of the corporation.

Articles of Incorporation Georgia Template - Filing the Articles can lead to official recognition from the IRS.

Llc Filing Ohio - It defines the corporation's duration, which can be perpetual or for a specified term.

Dos and Don'ts

When filling out the Michigan Articles of Incorporation form, follow these guidelines to ensure accuracy and compliance.

- Do provide the correct name of the corporation as it will appear in official documents.

- Do include a registered agent and their address for service of process.

- Do specify the purpose of the corporation clearly and concisely.

- Do indicate the number of shares the corporation is authorized to issue.

- Don't use abbreviations or informal language in the corporation name.

- Don't forget to sign and date the form before submission.

- Don't leave any required fields blank; ensure all information is complete.