Louisiana act of donation PDF Form

When it comes to transferring property in Louisiana, the Act of Donation form plays a crucial role. This legal document allows a person, known as the donor, to voluntarily give a gift of property to another individual, referred to as the donee. The form outlines essential details, such as the description of the property being donated, the identities of both the donor and donee, and any conditions or restrictions that may apply to the gift. It is important to note that this form must be executed in accordance with specific legal requirements to ensure its validity. Additionally, the Act of Donation can cover various types of property, including real estate, personal belongings, and even financial assets. Understanding the nuances of this form is vital for anyone considering making a donation, as it not only facilitates a smooth transfer but also helps avoid potential disputes in the future.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required sections of the form. Ensure that every part is completed to avoid delays.

-

Incorrect Signatures: Failing to sign the document correctly can lead to invalidation. All parties must sign where indicated.

-

Improper Witnesses: The form requires witnesses to be present during signing. Not having the correct number of witnesses can render the act ineffective.

-

Missing Notarization: Some individuals overlook the need for notarization. Ensure that the document is notarized to meet legal requirements.

-

Failure to Specify Property: Clearly describe the property being donated. Vague descriptions can lead to disputes or confusion later on.

-

Ignoring State Laws: Each state has specific laws regarding donations. Familiarize yourself with Louisiana's requirements to ensure compliance.

-

Not Keeping Copies: After submission, many forget to keep a copy of the signed document. Retain a copy for your records and future reference.

Example - Louisiana act of donation Form

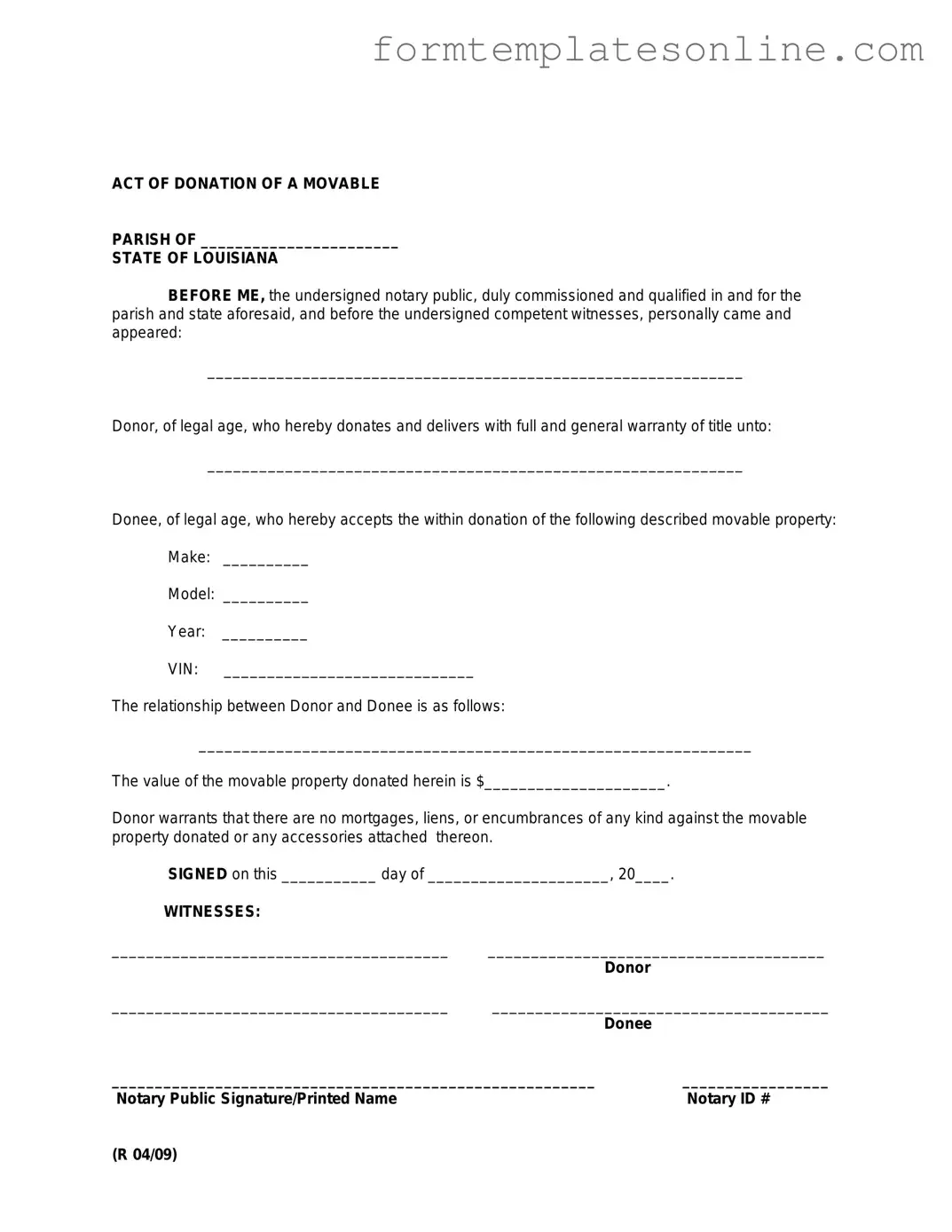

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

More About Louisiana act of donation

What is the Louisiana Act of Donation form?

The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another without any exchange of money. This form is essential for ensuring that the donation is recognized legally and can help avoid disputes in the future.

Who can use the Louisiana Act of Donation form?

Any individual or entity wishing to donate property in Louisiana can use this form. Donors must be of sound mind and legal age, while recipients must also be capable of accepting the donation. It is important to ensure that both parties understand the implications of the donation.

What types of property can be donated using this form?

Various types of property can be donated, including real estate, vehicles, and personal belongings. However, specific requirements may apply depending on the type of property. Always confirm that the property is eligible for donation under Louisiana law.

Is the Louisiana Act of Donation form legally binding?

Yes, once properly executed, the Louisiana Act of Donation form is legally binding. It creates a formal record of the transfer of ownership. To ensure its validity, both the donor and the recipient should sign the document in the presence of a notary public.

Do I need a lawyer to complete the Louisiana Act of Donation form?

While it is not mandatory to hire a lawyer, consulting one can be beneficial. A legal professional can help ensure that the form is filled out correctly and that all necessary legal requirements are met. This can prevent potential issues down the line.

What happens if the donor changes their mind after signing the form?

Once the Louisiana Act of Donation form is signed and notarized, the donation is generally considered final. However, if the donor wishes to revoke the donation, they may need to take specific legal steps to do so. It is advisable to seek legal counsel in such situations.

Are there any tax implications associated with donating property?

Yes, there may be tax implications for both the donor and the recipient. The donor may be eligible for a tax deduction, while the recipient may face tax responsibilities upon receiving the property. Consulting a tax professional can provide clarity on these matters.

Can the Louisiana Act of Donation form be used for future donations?

The form can be used for multiple donations, but each donation should be documented separately. Each instance requires a new form to ensure clarity and legal standing. This helps maintain accurate records of all transactions.

Where can I obtain a Louisiana Act of Donation form?

The Louisiana Act of Donation form can typically be obtained online through legal websites or local government offices. Many legal aid organizations also provide templates. Ensure you are using the most current version of the form to comply with Louisiana law.

What should I do after completing the Louisiana Act of Donation form?

After completing the form, both the donor and recipient should sign it in front of a notary public. It is advisable to keep copies of the signed document for personal records. If the property is real estate, consider recording the donation with the local parish clerk's office to provide public notice of the transfer.

Key takeaways

When filling out and using the Louisiana Act of Donation form, it is essential to keep several key points in mind:

- Understand the Purpose: The Act of Donation is a legal document that allows one person to give property or assets to another without expecting anything in return.

- Complete All Sections: Ensure that every section of the form is filled out completely and accurately to avoid delays or complications.

- Signatures Matter: Both the donor and the recipient must sign the form for it to be legally binding. Witness signatures may also be required.

- Consult Legal Advice: It is often beneficial to seek legal advice to ensure that the donation complies with all applicable laws and regulations.

By keeping these points in mind, individuals can navigate the process of completing the Louisiana Act of Donation form more effectively.

Form Attributes

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 to 1491. |

| Types of Donations | It can be used for both movable and immovable property donations. |

| Requirements | The form must be signed by both the donor and the donee. |

| Notarization | Notarization is required for the transfer to be legally binding. |

| Revocation | Donations can be revoked under specific circumstances, such as ingratitude or non-fulfillment of conditions. |

| Tax Implications | Donations may have gift tax implications under federal law. |

| Consideration | No consideration is required for a valid donation. |

| Witnesses | Witness signatures are not required, but they can provide additional validation. |

| Filing | The form does not need to be filed with any government agency to be valid, but it is advisable to keep it in a safe place. |

Other PDF Forms

Can I Get My Pay Stubs From My Bank - Manage your financial health with the information on the ADP Pay Stub.

Security Guard How to Write a Security Incident Report - Essential for maintaining compliance with industry regulations.

To ensure a smooth transfer of ownership when purchasing a motorcycle, it's important to complete a Georgia Motorcycle Bill of Sale form, which can be conveniently obtained from resources like OnlineLawDocs.com. This form neatly encapsulates the transaction details, including motorcycle descriptions and signatures from both the buyer and seller, providing essential proof of purchase for registration and tax needs.

Dvla D2 Form - Personal data must be updated, especially if you've moved or changed your name.

Dos and Don'ts

When filling out the Louisiana act of donation form, it’s important to approach the task with care and attention to detail. Here are some essential do's and don'ts to keep in mind:

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate and complete information to avoid delays.

- Do use clear and legible handwriting if filling out the form by hand.

- Do double-check all entries for accuracy before submitting.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; this could lead to processing issues.

- Don't use correction fluid or tape on the form, as this can make it difficult to read.

- Don't submit the form without ensuring that all necessary signatures are present.

- Don't forget to check the submission deadline to ensure timely processing.

By following these guidelines, you can help ensure that your Louisiana act of donation form is completed correctly and efficiently. Your attention to detail can make a significant difference in the outcome of your submission.