Attorney-Approved Loan Agreement Template

A Loan Agreement form is a crucial document that outlines the terms and conditions of a loan between a borrower and a lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and the duration of the loan. It also specifies the rights and responsibilities of both parties involved. Additional clauses may address late payment penalties, collateral requirements, and what happens in the event of default. By clearly stating these terms, the Loan Agreement helps to protect both the lender’s investment and the borrower’s obligations. Understanding this form is vital for anyone considering taking out a loan or lending money, as it sets the foundation for a transparent financial relationship.

Loan Agreement Document Types

Common mistakes

When filling out a Loan Agreement form, individuals often make various mistakes that can lead to complications or delays in the loan process. Here is a list of nine common errors:

- Incomplete Information: Failing to provide all required details can result in processing delays. Each section of the form must be filled out thoroughly.

- Incorrect Personal Information: Mistakes in names, addresses, or Social Security numbers can create significant issues. Double-checking this information is essential.

- Not Reading the Terms: Overlooking the loan terms and conditions can lead to misunderstandings about interest rates, repayment schedules, and fees. It is crucial to understand what is being agreed upon.

- Providing Inaccurate Financial Information: Misrepresenting income or debts can affect loan approval. Always provide accurate and honest financial details.

- Neglecting to Sign: Forgetting to sign the form can invalidate the agreement. Ensure that all required signatures are provided before submission.

- Missing Supporting Documents: Failing to include necessary documents, such as proof of income or identification, can delay the process. Check the requirements carefully.

- Ignoring Contact Information: Not providing a reliable phone number or email address can hinder communication. Always ensure that contact details are current and accessible.

- Assuming Standard Terms Apply: Each loan agreement can have unique terms. Assuming that previous agreements apply without verifying can lead to unexpected obligations.

- Rushing the Process: Filling out the form hastily can lead to errors. Taking the time to review and complete the form carefully can prevent many issues.

By being aware of these common mistakes, individuals can approach the Loan Agreement process with greater confidence and accuracy, ultimately leading to a smoother borrowing experience.

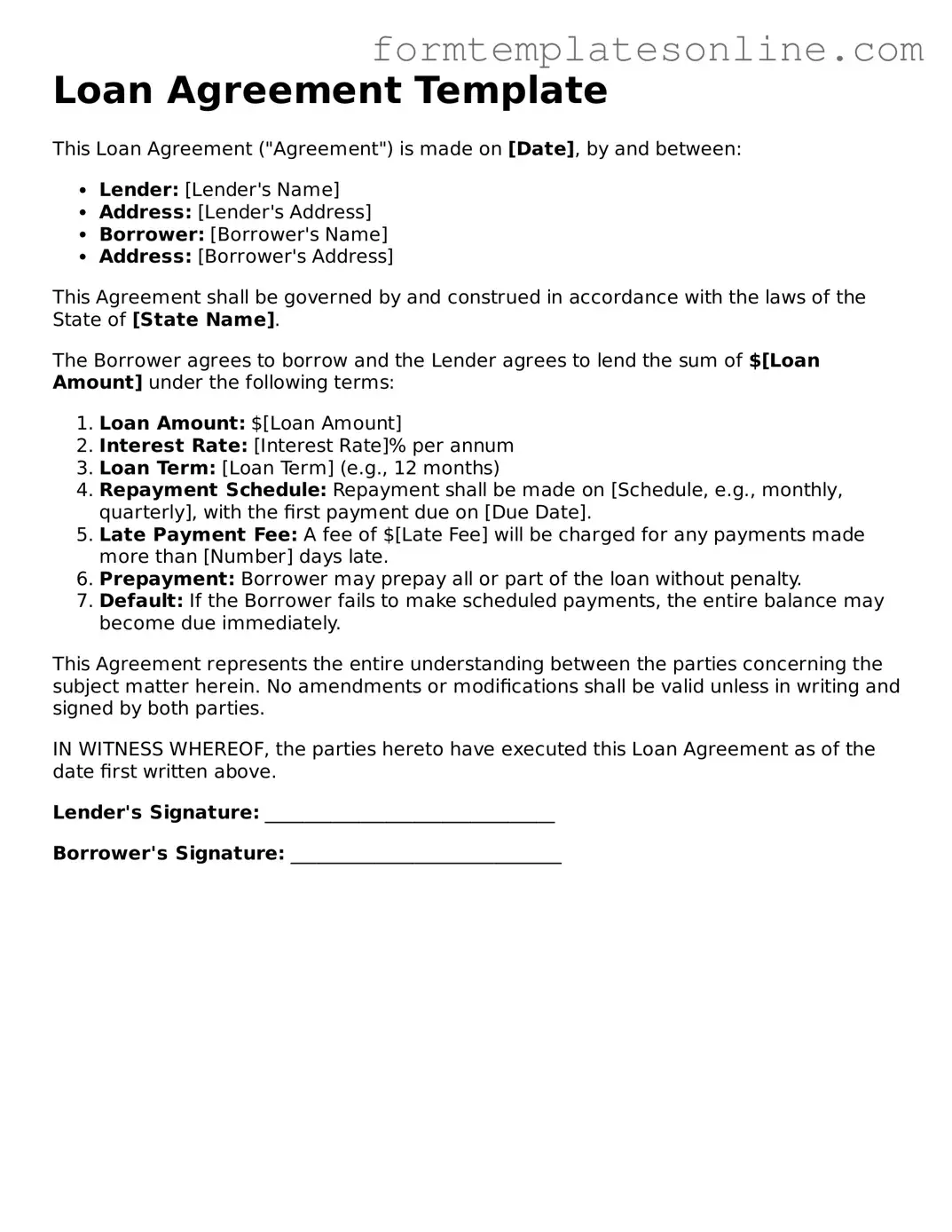

Example - Loan Agreement Form

Loan Agreement Template

This Loan Agreement ("Agreement") is made on [Date], by and between:

- Lender: [Lender's Name]

- Address: [Lender's Address]

- Borrower: [Borrower's Name]

- Address: [Borrower's Address]

This Agreement shall be governed by and construed in accordance with the laws of the State of [State Name].

The Borrower agrees to borrow and the Lender agrees to lend the sum of $[Loan Amount] under the following terms:

- Loan Amount: $[Loan Amount]

- Interest Rate: [Interest Rate]% per annum

- Loan Term: [Loan Term] (e.g., 12 months)

- Repayment Schedule: Repayment shall be made on [Schedule, e.g., monthly, quarterly], with the first payment due on [Due Date].

- Late Payment Fee: A fee of $[Late Fee] will be charged for any payments made more than [Number] days late.

- Prepayment: Borrower may prepay all or part of the loan without penalty.

- Default: If the Borrower fails to make scheduled payments, the entire balance may become due immediately.

This Agreement represents the entire understanding between the parties concerning the subject matter herein. No amendments or modifications shall be valid unless in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the date first written above.

Lender's Signature: _______________________________

Borrower's Signature: _____________________________

More About Loan Agreement

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions under which one party lends money to another. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both the lender and the borrower by clearly defining their rights and obligations.

Why is a Loan Agreement important?

A Loan Agreement is crucial because it provides a clear record of the transaction. It helps prevent misunderstandings between the parties involved. By specifying the terms, it minimizes the risk of disputes over repayment and other obligations. Additionally, having a written agreement can be beneficial if legal action is required in the future.

What should be included in a Loan Agreement?

Key components of a Loan Agreement include the names and contact information of the lender and borrower, the principal amount of the loan, the interest rate, repayment terms, and any fees associated with the loan. It should also outline the consequences of default, such as late fees or legal action, and specify whether the loan is secured or unsecured.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing to ensure clarity and prevent future disputes. Both parties should sign the amended agreement to acknowledge their consent to the new terms.

What happens if a borrower defaults on a Loan Agreement?

If a borrower defaults, the lender has several options depending on the terms outlined in the Loan Agreement. The lender may charge late fees, demand immediate repayment of the remaining balance, or take legal action to recover the owed amount. If the loan is secured, the lender may also have the right to seize the collateral.

Is it necessary to have a lawyer review a Loan Agreement?

While it is not strictly necessary to have a lawyer review a Loan Agreement, it is highly recommended, especially for larger loans or complex agreements. A lawyer can ensure that the terms are fair and legally enforceable. Their expertise can help identify potential pitfalls that might not be obvious to individuals without legal training.

How can I ensure my Loan Agreement is legally binding?

To ensure that a Loan Agreement is legally binding, both parties must sign the document. It is also advisable to have the agreement notarized, as this adds an extra layer of authenticity. Additionally, both parties should receive a copy of the signed agreement for their records. Clear and unambiguous language throughout the document will further strengthen its enforceability.

Key takeaways

Filling out and utilizing a Loan Agreement form is a critical step in ensuring that both parties understand their rights and responsibilities. Here are some key takeaways to keep in mind:

- Clarity is Key: Clearly outline the terms of the loan, including the amount, interest rate, and repayment schedule. This helps prevent misunderstandings later on.

- Document Everything: Ensure that all agreements are documented in writing. Verbal agreements can lead to confusion and disputes.

- Review the Terms: Both parties should thoroughly review the terms before signing. This ensures that everyone is on the same page regarding expectations.

- Legal Compliance: Make sure that the Loan Agreement complies with local and federal laws. This protects both the lender and the borrower.

- Seek Professional Advice: If there are any uncertainties, consider consulting with a legal professional. Their expertise can provide valuable insights and help avoid potential pitfalls.

By following these guidelines, both lenders and borrowers can navigate the loan process with greater confidence and security.

File Details

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form is used to outline the terms and conditions under which one party lends money to another. |

| Key Components | This form typically includes details such as loan amount, interest rate, repayment schedule, and any collateral involved. |

| Governing Law | The governing law may vary by state. For example, in California, the agreement is governed by California Civil Code. |

| Signatures | Both the lender and borrower must sign the agreement to make it legally binding. |

| Types of Loans | Loan agreements can be for personal loans, business loans, or mortgages, each with specific terms. |

| Enforcement | If the borrower defaults, the lender can take legal action based on the terms outlined in the agreement. |

Other Templates:

Fill Out Pdf on Phone - This application process is straightforward—just follow the instructions.

Buying a Motorcycle With No Title - Ensures compliance with local laws regarding vehicle sales.

Dos and Don'ts

When filling out a Loan Agreement form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do read the entire agreement carefully before signing.

- Do provide accurate personal and financial information.

- Do double-check all numbers and figures for correctness.

- Do ask questions if any part of the agreement is unclear.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't sign the agreement without understanding all terms and conditions.

- Don't ignore the importance of keeping a copy for your records.