Attorney-Approved LLC Share Purchase Agreement Template

The LLC Share Purchase Agreement form plays a crucial role in the transaction of ownership interests in a Limited Liability Company (LLC). This document outlines the terms and conditions under which a buyer agrees to purchase shares from a seller, ensuring that both parties understand their rights and obligations. Key components of the agreement include the purchase price, payment terms, and the number of shares being transferred. Additionally, it addresses representations and warranties made by both the seller and the buyer, which serve to protect each party by providing assurances about the company's status and the validity of the shares being sold. The agreement may also include provisions for confidentiality, dispute resolution, and conditions for closing the sale. By clearly defining these elements, the LLC Share Purchase Agreement helps facilitate a smooth transaction and minimizes potential conflicts between the parties involved.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers must ensure that their names, addresses, and other relevant information are fully and accurately filled in.

-

Incorrect Valuation: Miscalculating the value of the shares can lead to disputes later. It’s essential to conduct a proper valuation to avoid undervaluing or overvaluing the shares being sold.

-

Missing Signatures: All parties involved must sign the agreement. Forgetting to obtain signatures can render the document unenforceable, leading to potential legal complications.

-

Neglecting to Include Terms: Important terms such as payment structure, due dates, and conditions of the sale should be clearly outlined. Omitting these details can create confusion and conflict.

-

Ignoring State Laws: Each state has specific regulations regarding LLCs and share transfers. Failing to adhere to these laws can invalidate the agreement.

-

Not Consulting Professionals: Skipping legal or financial advice can be a costly error. Engaging professionals ensures that the agreement meets all legal requirements and protects your interests.

-

Overlooking Confidentiality Clauses: If sensitive information is involved, it’s crucial to include confidentiality provisions. Without them, there’s a risk of information leakage.

-

Forgetting to Address Future Disputes: It’s wise to include a dispute resolution clause. This can save time and money if disagreements arise after the sale.

-

Failing to Keep Copies: After the agreement is signed, both parties should retain copies. Not doing so can lead to misunderstandings about the terms of the sale.

Example - LLC Share Purchase Agreement Form

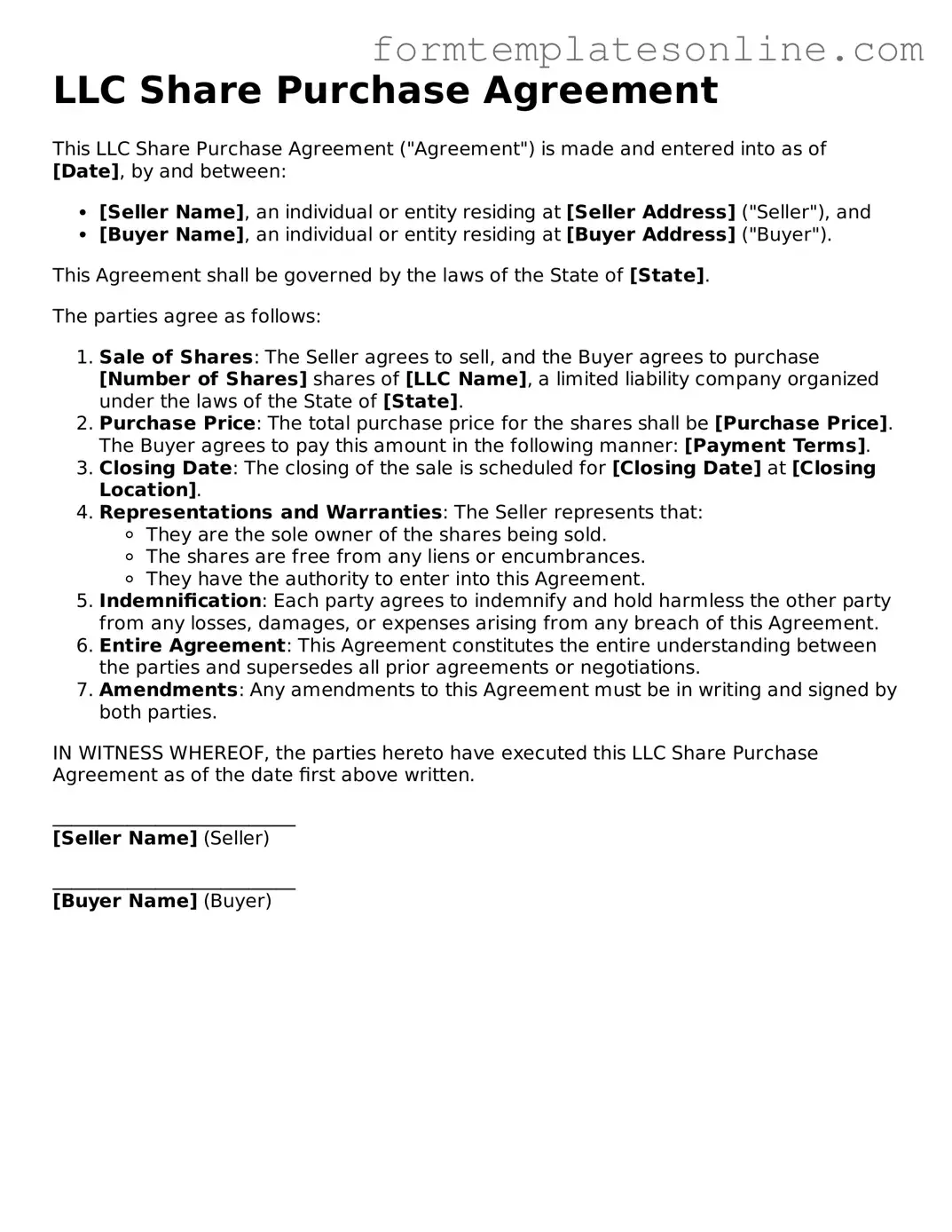

LLC Share Purchase Agreement

This LLC Share Purchase Agreement ("Agreement") is made and entered into as of [Date], by and between:

- [Seller Name], an individual or entity residing at [Seller Address] ("Seller"), and

- [Buyer Name], an individual or entity residing at [Buyer Address] ("Buyer").

This Agreement shall be governed by the laws of the State of [State].

The parties agree as follows:

- Sale of Shares: The Seller agrees to sell, and the Buyer agrees to purchase [Number of Shares] shares of [LLC Name], a limited liability company organized under the laws of the State of [State].

- Purchase Price: The total purchase price for the shares shall be [Purchase Price]. The Buyer agrees to pay this amount in the following manner: [Payment Terms].

- Closing Date: The closing of the sale is scheduled for [Closing Date] at [Closing Location].

- Representations and Warranties: The Seller represents that:

- They are the sole owner of the shares being sold.

- The shares are free from any liens or encumbrances.

- They have the authority to enter into this Agreement.

- Indemnification: Each party agrees to indemnify and hold harmless the other party from any losses, damages, or expenses arising from any breach of this Agreement.

- Entire Agreement: This Agreement constitutes the entire understanding between the parties and supersedes all prior agreements or negotiations.

- Amendments: Any amendments to this Agreement must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this LLC Share Purchase Agreement as of the date first above written.

__________________________

[Seller Name] (Seller)

__________________________

[Buyer Name] (Buyer)

More About LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy shares in a Limited Liability Company (LLC) from another party. This agreement is crucial as it protects the interests of both the buyer and the seller. It typically includes details such as the purchase price, payment terms, and any representations or warranties made by the seller regarding the shares being sold. By clearly defining these elements, the agreement helps prevent misunderstandings and disputes in the future.

Why is it important to have an LLC Share Purchase Agreement?

Having an LLC Share Purchase Agreement is essential for several reasons. First, it provides a clear record of the transaction, which can be referenced later if any issues arise. Second, it helps ensure that both parties are aware of their rights and obligations, which can foster trust and transparency. Additionally, this agreement can address potential future scenarios, such as what happens if one party wants to sell their shares again. Overall, it serves as a safeguard for both buyers and sellers, making the transaction smoother and more secure.

What key elements should be included in an LLC Share Purchase Agreement?

Several key elements should be included in an LLC Share Purchase Agreement to ensure its effectiveness. First, the names and contact information of both the buyer and seller should be clearly stated. Next, the number of shares being sold and the purchase price must be outlined. It's also important to include payment terms, such as whether the payment will be made in full upfront or in installments. Additionally, any representations and warranties from the seller regarding the shares should be included, along with any conditions that must be met before the sale can be finalized. Finally, the agreement should specify the governing law, which indicates which state's laws will apply in case of disputes.

Can an LLC Share Purchase Agreement be modified after it is signed?

Yes, an LLC Share Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. This typically involves creating an amendment to the original agreement, which should be documented in writing and signed by both the buyer and the seller. It's important to note that any modifications should be made carefully to avoid confusion or legal issues down the line. Clear communication and mutual consent are key to ensuring that the modified agreement accurately reflects the new terms and conditions agreed upon by both parties.

Key takeaways

When engaging in the process of filling out and using the LLC Share Purchase Agreement form, there are several important considerations to keep in mind. Here are key takeaways to help guide you:

- Understand the Purpose: The LLC Share Purchase Agreement outlines the terms under which shares of the LLC are bought and sold. It serves to protect both the buyer and seller.

- Identify the Parties: Clearly state the names and roles of all parties involved in the transaction. This ensures everyone knows their responsibilities and rights.

- Detail the Purchase Price: Specify the agreed-upon price for the shares. This should be clear to avoid any misunderstandings later on.

- Include Payment Terms: Outline how and when the payment will be made. This can include details about deposits, installments, or lump-sum payments.

- Address Representations and Warranties: Both parties should make certain promises about the shares being sold. This can include confirming that the shares are free of liens or encumbrances.

- Consider Conditions Precedent: Identify any conditions that must be met before the sale can be completed. This might include approvals or other requirements.

- Review and Sign: Before finalizing the agreement, ensure that all parties review the document thoroughly. Signatures should be obtained from all involved to validate the agreement.

By keeping these takeaways in mind, individuals can navigate the complexities of the LLC Share Purchase Agreement with greater confidence and clarity.

File Details

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement outlines the terms under which shares of a limited liability company are bought and sold. |

| Purpose | This agreement serves to protect the interests of both the buyer and the seller during the transaction. |

| Parties Involved | The agreement typically involves the seller, the buyer, and the LLC itself. |

| Governing Law | The governing law may vary by state; for example, California law may apply if the LLC is registered in California. |

| Key Terms | Common terms include purchase price, payment method, and closing date. |

| Representations and Warranties | The seller usually provides assurances regarding the ownership and condition of the shares being sold. |

| Conditions Precedent | Certain conditions must be met before the sale can be finalized, such as regulatory approvals. |

| Confidentiality | Many agreements include clauses to protect sensitive information shared during negotiations. |

| Dispute Resolution | Provisions may be included to outline how disputes will be resolved, such as through mediation or arbitration. |

| Amendments | Any changes to the agreement must typically be made in writing and signed by all parties involved. |

Other Templates:

Batting Order - Support coaching decisions with solid data from the chart.

For those looking to establish a solid foundation for future investments, an important document to consider is an "Investment Letter of Intent" that outlines the initial terms of the agreement. This key document helps ensure clarity before the final contract is drawn up, and you can find more information on creating one at a structured Investment Letter of Intent template.

Availability Sheet - Indicate if you have another job affecting availability.

Dos and Don'ts

When filling out the LLC Share Purchase Agreement form, it is essential to approach the task with care and attention. The following list outlines key actions to take and avoid during this process.

- Do carefully read all instructions provided with the form.

- Do ensure that all parties involved are clearly identified.

- Do provide accurate and complete information regarding the shares being purchased.

- Do consult with a legal professional if there are any uncertainties.

- Don't leave any sections of the form blank unless specifically instructed to do so.

- Don't use vague language; be precise in your descriptions and terms.

- Don't rush through the process; take the time to review your entries for accuracy.