Lf310 Residential Lease PDF Form

The Lf310 Residential Lease form is a crucial document for both landlords and tenants, outlining the terms of their rental agreement. At its core, this form identifies the parties involved—the landlord and tenant—and specifies the residential premises being rented. It emphasizes that each tenant is jointly responsible for fulfilling the lease obligations, including the payment of rent. The form also details the intended use of the premises, restricting it to residential purposes and outlining occupancy limits to prevent unauthorized guests. Additionally, it establishes the rental term, payment schedule, and conditions for late payments, including associated fees. Security deposits are addressed, ensuring tenants understand their responsibilities regarding these funds, while also clarifying which utilities are covered by the landlord. Importantly, the lease prohibits subletting or assigning the rental agreement without written consent, thus protecting the landlord's interests. Overall, the Lf310 Residential Lease form serves as a comprehensive guide for managing the landlord-tenant relationship, ensuring clarity and mutual understanding of rights and responsibilities.

Common mistakes

-

Omitting Names: Failing to clearly fill in the names of both the Tenant and Landlord in Clause 1 can lead to confusion about who is responsible for the agreement.

-

Missing Premises Address: Not specifying the complete address of the rental property in Clause 2 can create issues regarding the location of the lease.

-

Neglecting Occupancy Limits: Ignoring the occupancy limits outlined in Clause 3 may result in unauthorized guests and potential breaches of the lease.

-

Incorrect Rent Amount: Entering the wrong monthly rent amount in Clause 5 can lead to disputes over payment and expectations.

-

Not Specifying Payment Methods: Failing to specify how rent will be paid can cause confusion. Ensure to select an appropriate method in Clause 5.

-

Overlooking Late Charges: Not understanding or neglecting to fill in the details about late charges in Clause 6 can lead to unexpected fees.

-

Ignoring Security Deposit Rules: Not adhering to the rules regarding the security deposit in Clause 8, such as using it for last month’s rent without consent, can result in disputes.

-

Utility Responsibilities: Failing to clarify which utilities are the responsibility of the Tenant and which are covered by the Landlord in Clause 9 can lead to unexpected bills.

-

Subletting Violations: Not recognizing the prohibition against subletting in Clause 10 can result in lease termination if violated.

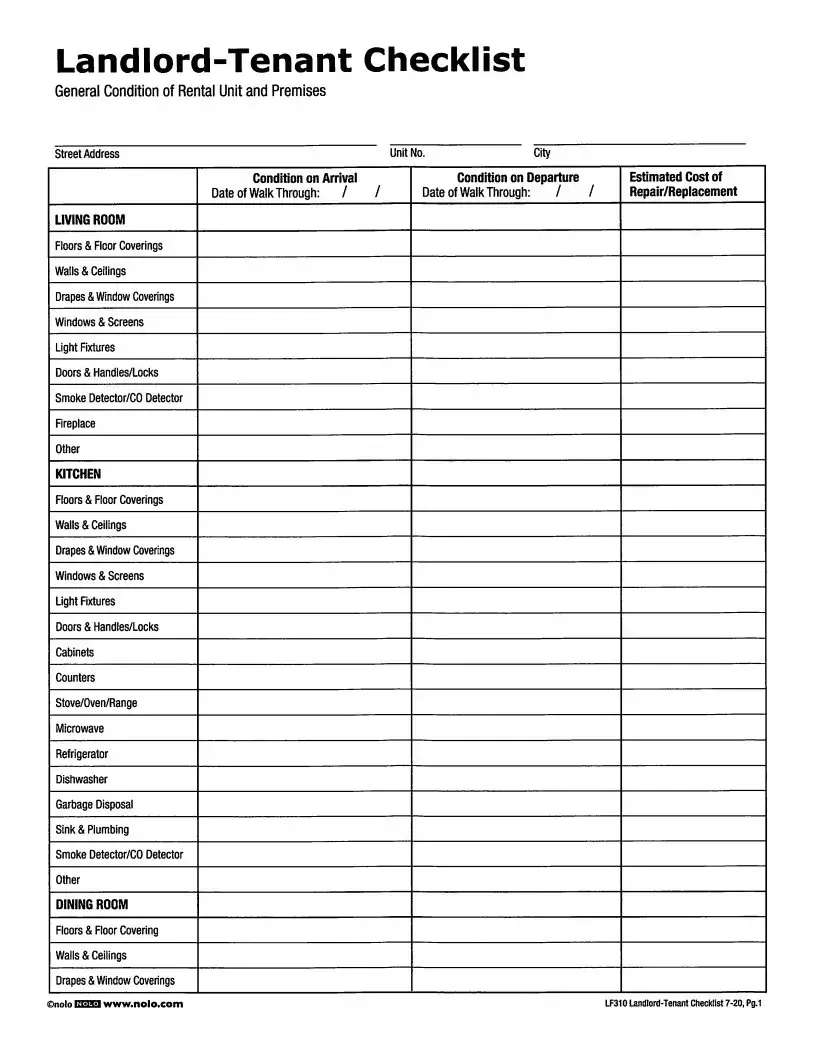

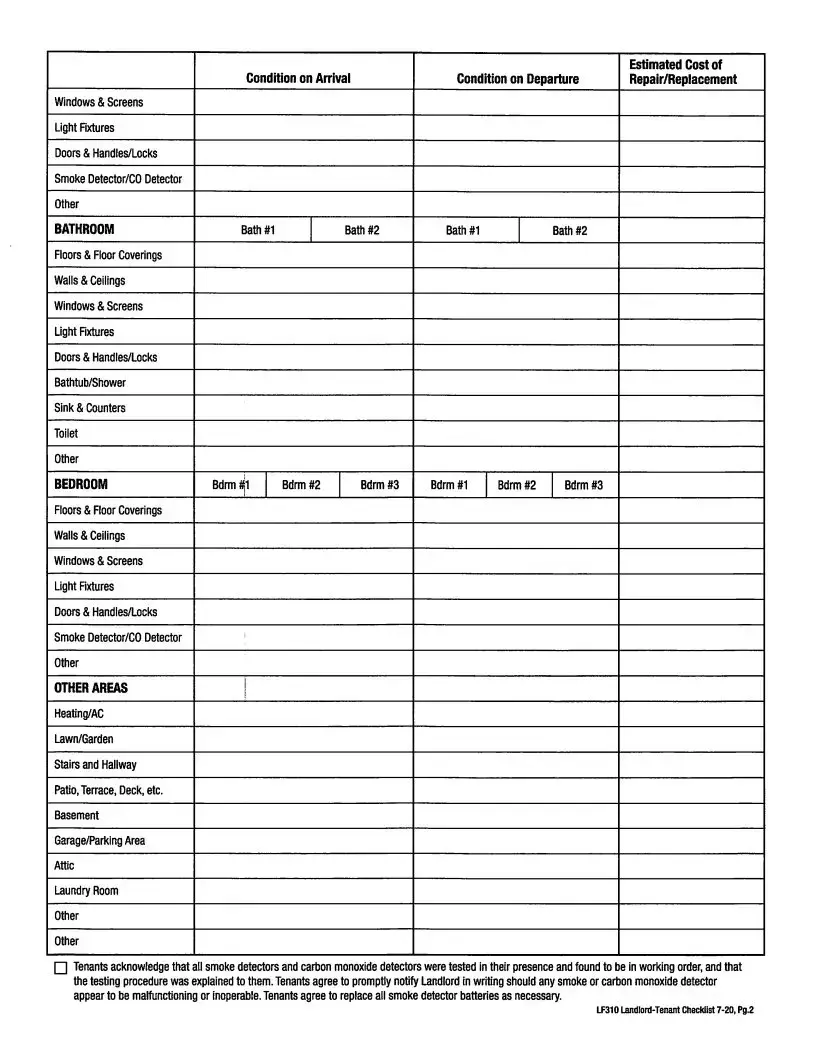

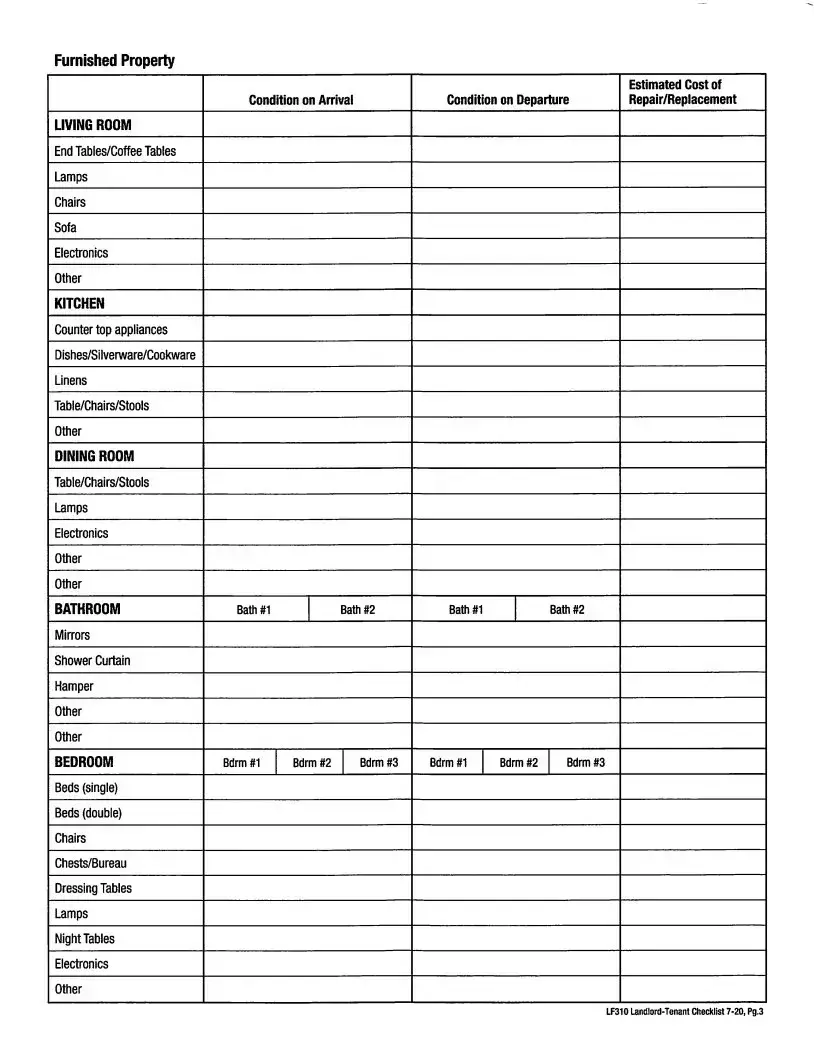

Example - Lf310 Residential Lease Form

More About Lf310 Residential Lease

What is the Lf310 Residential Lease form?

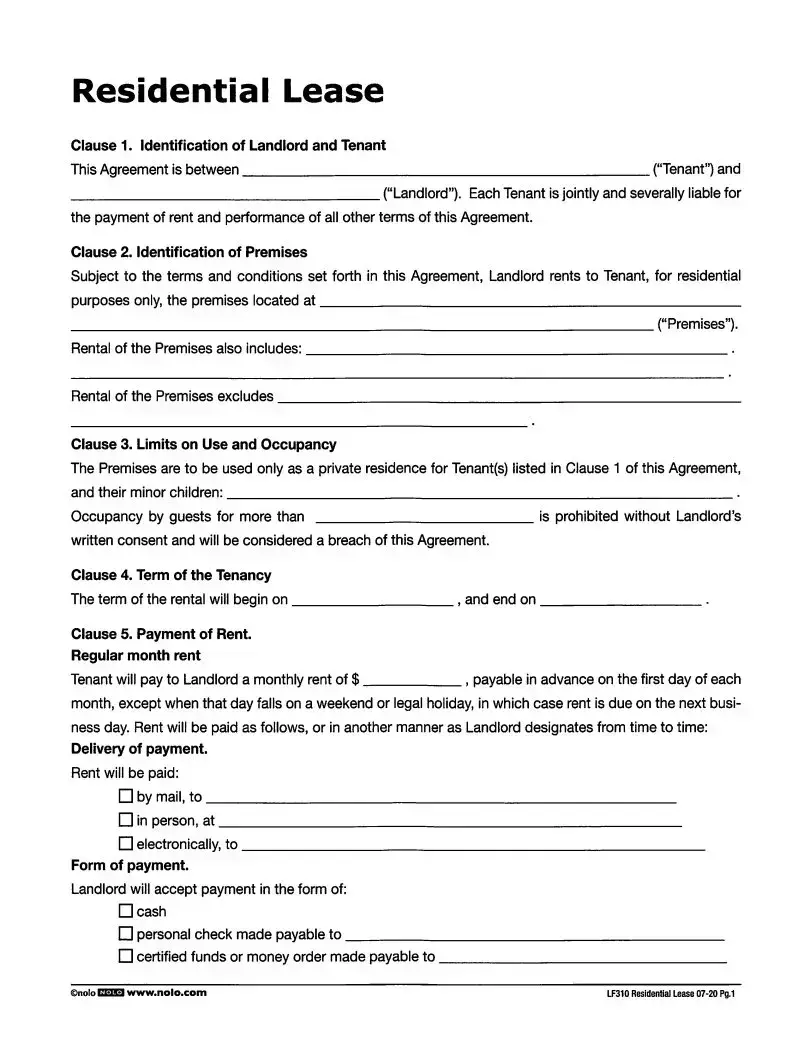

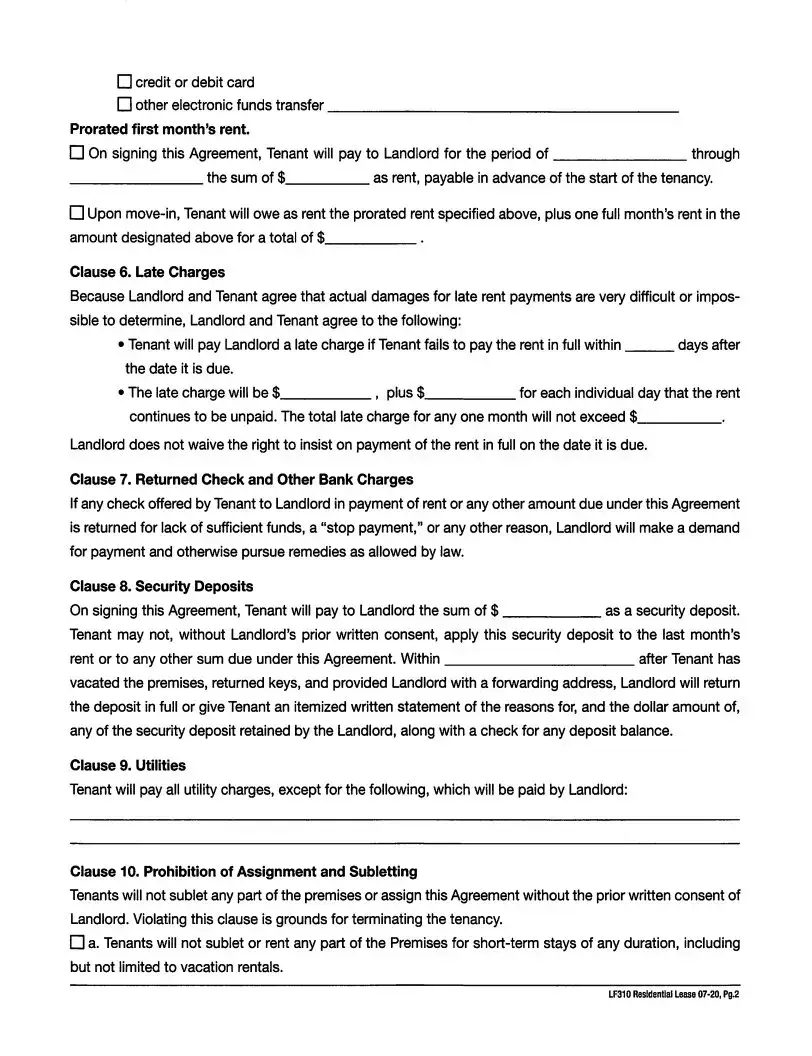

The Lf310 Residential Lease form is a legal document used in the United States to outline the terms and conditions of a rental agreement between a landlord and tenant. It specifies important details such as the identification of both parties, the rental premises, payment terms, and rules regarding the use of the property. This form helps protect the rights of both the landlord and tenant, ensuring clarity and mutual understanding.

Who is responsible for paying rent?

According to the Lf310 form, each tenant listed in the agreement is jointly and severally liable for the payment of rent. This means that if there are multiple tenants, they are all responsible for the full rent amount. If one tenant fails to pay, the landlord can seek the total amount from any of the tenants, making it crucial for all parties to understand their financial obligations.

What are the rules regarding occupancy?

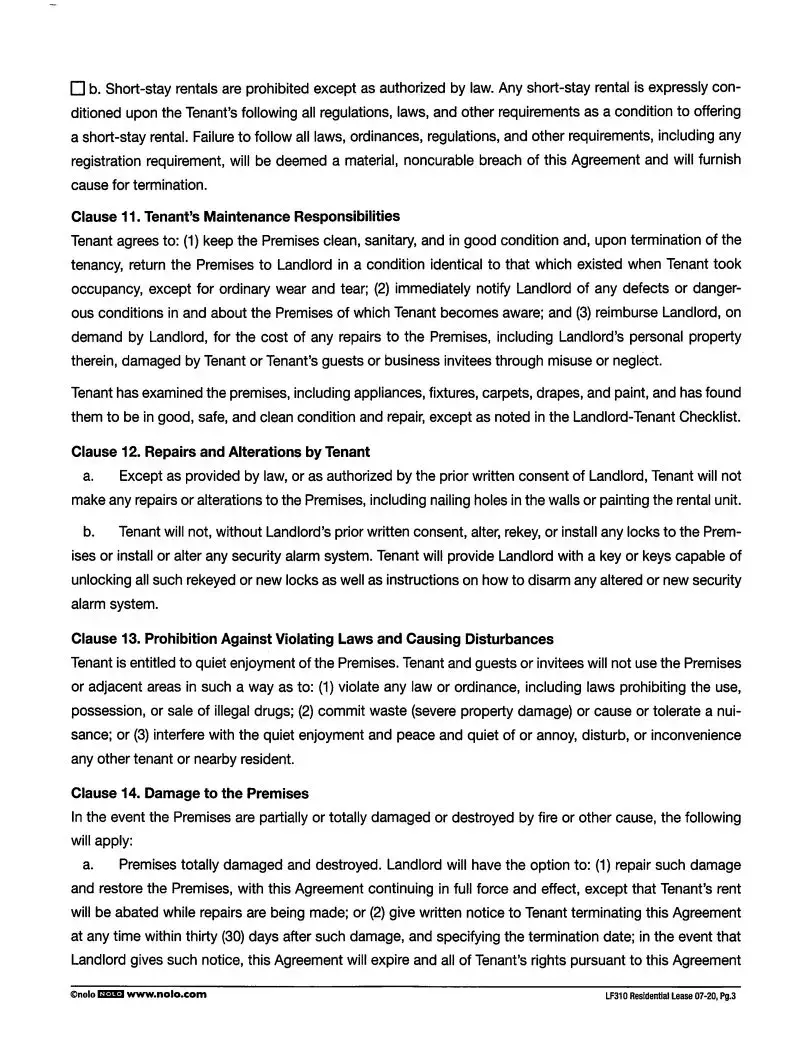

The lease stipulates that the premises are to be used solely as a private residence for the tenants and their minor children. Guests may visit, but if they stay longer than what is agreed upon, it could be considered a breach of the lease. This rule helps maintain the property’s integrity and ensures that the landlord's expectations are met.

How is rent payment structured?

Rent is due on the first day of each month and must be paid in advance. If the first falls on a weekend or holiday, the payment is due the next business day. The lease specifies how rent can be paid, whether by mail, in person, or electronically, and it outlines acceptable forms of payment, including cash, checks, and electronic transfers.

What happens if rent is paid late?

If rent is not paid within the specified number of days after its due date, a late charge will apply. The lease clearly states the amount of the late fee and how it accumulates each day the payment remains unpaid. This clause encourages timely payments and helps the landlord manage their finances effectively.

What is a security deposit, and how is it handled?

The security deposit is a sum paid by the tenant at the signing of the lease to cover potential damages or unpaid rent. The tenant cannot use this deposit as the last month’s rent without written consent from the landlord. After the tenant vacates the premises, the landlord must return the deposit or provide an itemized statement of any deductions within a specified timeframe.

Can tenants sublet the property?

Tenants are prohibited from subletting any part of the premises or assigning the lease without the landlord’s prior written consent. This rule is in place to maintain control over who occupies the property and to ensure that the landlord is aware of all residents living in the unit.

What utilities are tenants responsible for?

Typically, tenants are responsible for all utility charges unless otherwise stated in the lease. The landlord may agree to cover specific utilities, but this should be clearly outlined in the agreement. Understanding who pays for what can prevent misunderstandings and financial disputes later on.

Key takeaways

When filling out and using the LF310 Residential Lease form, it is important to keep the following key takeaways in mind:

- Identification of Parties: Clearly specify the names of both the Tenant and the Landlord in Clause 1. Each Tenant is jointly responsible for fulfilling the lease terms.

- Defined Premises: In Clause 2, accurately identify the rental property. This ensures both parties understand the location and nature of the lease.

- Usage Restrictions: Clause 3 outlines that the property is for residential use only. Any unauthorized guests may lead to a breach of the agreement.

- Payment Details: Clause 5 provides specifics on rent payment. Note the due date and the acceptable forms of payment to avoid late fees.

- Security Deposit: According to Clause 8, a security deposit is required upon signing. Understand the conditions for its return after vacating the premises.

- Subletting Rules: Clause 10 prohibits subletting without written consent. Violating this rule could result in termination of the lease.

Form Attributes

| Fact Name | Details |

|---|---|

| Identification of Parties | The LF310 Residential Lease form requires clear identification of both the Tenant and the Landlord, establishing that each Tenant is jointly responsible for rent and other obligations. |

| Use of Premises | The lease specifies that the premises are to be used solely as a private residence for the listed Tenant(s) and their minor children, prohibiting any unauthorized guests. |

| Payment of Rent | Rent is due on the first day of each month, with specific provisions for payment methods, including cash, checks, and electronic transfers. |

| Late Charges | If rent is not paid within a specified number of days, a late charge will be incurred. The total late fee for any month is capped, ensuring clarity for both parties. |

| Security Deposits | A security deposit is required upon signing the lease. Landlords must return this deposit or provide an itemized statement of deductions within a specified timeframe after the Tenant vacates. |

| Governing Law | This lease form is governed by the laws of the state where the property is located, ensuring compliance with local regulations and tenant rights. |

Other PDF Forms

Gifting a Car in Louisiana - Asking questions when filling out the form can lead to better outcomes.

A Georgia Power of Attorney form is a legal document that gives one person the authority to act on behalf of another. This authority can cover a wide range of activities, from managing finances to making healthcare decisions. It's a crucial tool for planning and managing personal affairs, especially in unforeseen circumstances. For more information on how to create this important document, you can visit OnlineLawDocs.com.

Texas Temporary Tag - Check the official Texas DMV website for the latest version of the form.

Dos and Don'ts

When filling out the LF310 Residential Lease form, it is important to approach the process with care. Below are ten things to consider, including what to do and what to avoid.

- Do ensure that all names of tenants and the landlord are correctly spelled and clearly stated in Clause 1.

- Do accurately describe the premises in Clause 2, including the full address.

- Do specify the rental amount clearly in Clause 5, ensuring there are no discrepancies.

- Do understand the payment terms, including due dates and accepted payment methods.

- Do read and comprehend the terms regarding late charges and returned checks in Clauses 6 and 7.

- Don’t leave any sections blank; every part of the form should be filled out completely.

- Don’t forget to review the utility responsibilities outlined in Clause 9 to avoid misunderstandings.

- Don’t ignore the prohibition of subletting and assignment in Clause 10; this could lead to tenancy termination.

- Don’t attempt to modify the lease terms without the landlord’s written consent.

- Don’t assume that verbal agreements are valid; always get everything in writing.

By following these guidelines, tenants and landlords can help ensure a smoother leasing process and avoid potential disputes.