Attorney-Approved Lady Bird Deed Template

The Lady Bird Deed, also known as an enhanced life estate deed, serves as a unique estate planning tool that can significantly simplify the transfer of property upon an individual's passing. This form allows property owners to retain control over their real estate during their lifetime while designating beneficiaries to automatically receive the property after their death, avoiding the often lengthy and costly probate process. One of the most appealing features of the Lady Bird Deed is that it enables the original owner to sell, mortgage, or otherwise manage the property without needing consent from the beneficiaries. Furthermore, this deed can provide certain protections against creditors, making it an attractive option for those looking to safeguard their assets. Understanding the nuances of the Lady Bird Deed is essential for anyone considering estate planning, as it can offer flexibility and peace of mind for both property owners and their heirs.

State-specific Lady Bird Deed Documents

Common mistakes

-

Not Including Full Names: One common mistake is failing to write the full legal names of all parties involved. Nicknames or abbreviations can lead to confusion and potential legal issues.

-

Incorrect Property Description: The property must be described accurately. Omitting details or using vague descriptions can create problems later on.

-

Forgetting to Sign: It may seem obvious, but forgetting to sign the deed is a frequent error. A deed without a signature is not valid.

-

Improper Witnesses: Some states require witnesses to the signing of the deed. Not having the correct number of witnesses or having unqualified witnesses can invalidate the deed.

-

Not Notarizing: Many jurisdictions require notarization. Failing to have the deed notarized can lead to issues with its acceptance.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Lady Bird Deeds. Ignoring these specific requirements can result in complications.

-

Leaving Out Future Beneficiaries: It's important to clearly state who will inherit the property. Omitting this information can lead to disputes after the property owner’s death.

-

Failing to Update the Deed: Life changes such as marriage, divorce, or death should prompt a review and possible update of the deed. Neglecting this can lead to unintended consequences.

-

Not Consulting a Professional: Attempting to fill out the deed without professional guidance can lead to mistakes. Seeking help can provide clarity and ensure accuracy.

-

Assuming All States Recognize Lady Bird Deeds: Not all states accept Lady Bird Deeds. Assuming they do without verifying can lead to wasted time and effort.

Example - Lady Bird Deed Form

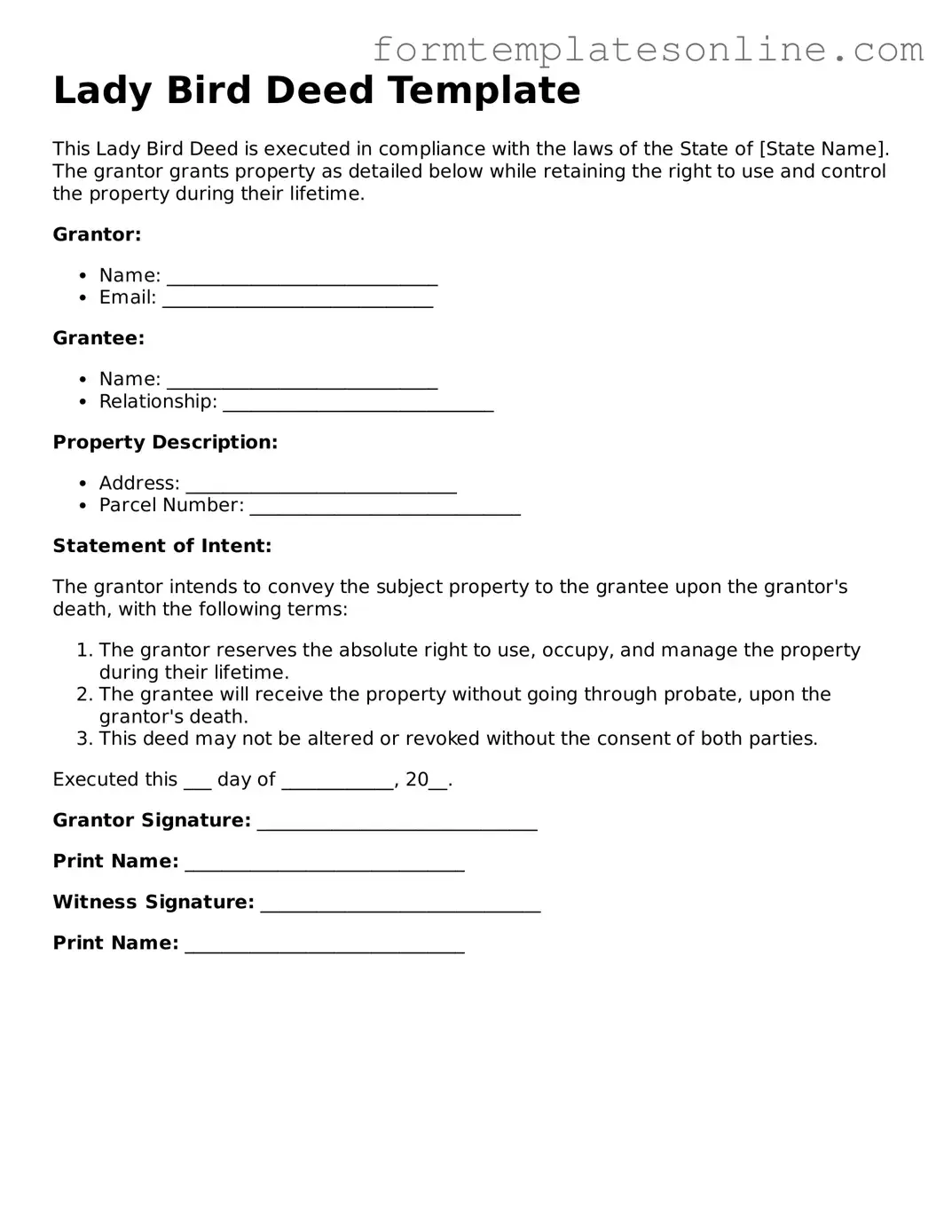

Lady Bird Deed Template

This Lady Bird Deed is executed in compliance with the laws of the State of [State Name]. The grantor grants property as detailed below while retaining the right to use and control the property during their lifetime.

Grantor:

- Name: _____________________________

- Email: _____________________________

Grantee:

- Name: _____________________________

- Relationship: _____________________________

Property Description:

- Address: _____________________________

- Parcel Number: _____________________________

Statement of Intent:

The grantor intends to convey the subject property to the grantee upon the grantor's death, with the following terms:

- The grantor reserves the absolute right to use, occupy, and manage the property during their lifetime.

- The grantee will receive the property without going through probate, upon the grantor's death.

- This deed may not be altered or revoked without the consent of both parties.

Executed this ___ day of ____________, 20__.

Grantor Signature: ______________________________

Print Name: ______________________________

Witness Signature: ______________________________

Print Name: ______________________________

More About Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed is a type of property deed that allows a property owner to transfer their real estate to their beneficiaries while retaining control over the property during their lifetime. This deed is particularly popular in some states because it helps avoid probate, which can be a lengthy and costly process. With a Lady Bird Deed, the original owner can sell, mortgage, or change the property without needing consent from the beneficiaries.

What are the benefits of using a Lady Bird Deed?

One of the main benefits of a Lady Bird Deed is that it allows for a smooth transfer of property upon the owner's death, bypassing the probate process. This can save time and money for the beneficiaries. Additionally, the property remains part of the owner's estate for tax purposes, which can be advantageous for capital gains tax. The owner retains the right to live in the property and make decisions about it, ensuring they maintain control until their passing.

Are there any drawbacks to a Lady Bird Deed?

While a Lady Bird Deed has many advantages, it also has some potential drawbacks. For instance, if the property owner needs to qualify for Medicaid, the property may still be considered an asset, which could affect eligibility. Additionally, if the owner decides to sell the property, they may need to revoke the Lady Bird Deed, which can complicate matters. It's essential to consider these factors and consult with a professional before proceeding.

Who can benefit from a Lady Bird Deed?

Individuals who want to ensure a smooth transition of property to their heirs without the hassle of probate may find a Lady Bird Deed beneficial. This can include seniors looking to pass their home to children or other family members. It is also useful for those who want to maintain control over their property while still planning for the future. However, it’s important to assess individual circumstances and consult with a legal expert to determine if this option is suitable.

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves drafting the deed to include specific language that indicates the property owner's intent to transfer the property upon their death. This deed must be signed and notarized, and it should be filed with the appropriate local government office, such as the county clerk. Each state may have different requirements, so it’s advisable to work with an attorney or a qualified professional to ensure compliance with local laws.

Key takeaways

When considering the use of a Lady Bird Deed, it's essential to understand its implications and benefits. Below are key takeaways to keep in mind.

- Ownership Retention: The property owner retains full control over the property during their lifetime, including the ability to sell or mortgage it.

- Automatic Transfer: Upon the owner's passing, the property automatically transfers to the designated beneficiaries without the need for probate.

- Tax Benefits: A Lady Bird Deed may provide potential tax advantages, as the property receives a stepped-up basis for the beneficiaries.

- Medicaid Protection: This deed can help protect the property from being counted as an asset for Medicaid eligibility, depending on state laws.

- Flexibility: The owner can change beneficiaries or revoke the deed at any time before their death, allowing for flexibility in estate planning.

- Simple Process: Filling out the Lady Bird Deed form is generally straightforward, but it is advisable to consult with a professional to ensure accuracy.

Understanding these key points can help in making informed decisions about property transfer and estate planning.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to beneficiaries while retaining the right to use the property during their lifetime. |

| Governing Law | In the United States, the use of Lady Bird Deeds is primarily governed by state law. States like Florida and Texas recognize and allow the use of this type of deed. |

| Tax Benefits | One significant advantage of a Lady Bird Deed is that it may help avoid probate, potentially saving time and money for the beneficiaries. |

| Retained Rights | The property owner retains the right to sell, mortgage, or change the beneficiaries without needing consent from them. |

| Medicaid Planning | Lady Bird Deeds can be used as a strategy in Medicaid planning to protect the property from being counted as an asset for eligibility purposes. |

| Limitations | Not all states recognize Lady Bird Deeds. It's important to consult local laws and regulations to ensure compliance and validity. |

More Lady Bird Deed Types:

Where Can I Get a Quit Claim Deed Form - The form should include a legal description of the property for clarity and accuracy.

For those navigating the waters of boat ownership, understanding the importance of a reliable boat bill of sale document is crucial for secure transactions. For more information, consider exploring our guide on the essential aspects of the Boat Bill of Sale requirements.

What Is a Deed in Lieu of Foreclosure - Transfer of the property usually requires that the homeowner vacate the premises and return the keys to the lender.

Dos and Don'ts

When filling out a Lady Bird Deed form, it’s essential to get it right. Here are five important dos and don’ts to keep in mind:

- Do ensure you have the correct legal description of the property.

- Do list all owners and their respective interests in the property.

- Do clearly state your intentions regarding the transfer of property upon death.

- Don't leave any sections blank; incomplete forms can lead to issues.

- Don't forget to have the deed notarized to ensure its validity.