Attorney-Approved Investment Letter of Intent Template

The Investment Letter of Intent form serves as a crucial document in the realm of investment transactions. It outlines the preliminary terms and conditions agreed upon by the parties involved, signaling their intention to move forward with a potential investment. This form typically includes key details such as the amount of investment, the structure of the deal, and any conditions that must be met before finalizing the agreement. Additionally, it often specifies the timeline for due diligence and the expected closing date. By providing a framework for negotiation, the form helps to clarify the expectations of both the investor and the recipient of the investment. This initial agreement can also address confidentiality and exclusivity, ensuring that sensitive information remains protected while negotiations are underway. Overall, the Investment Letter of Intent is an important step that lays the groundwork for a successful investment relationship.

Common mistakes

-

Providing Incomplete Information: One common mistake is failing to fill out all required fields. Each section of the Investment Letter of Intent form is designed to gather specific information. Leaving any part blank can delay processing and may even lead to rejection of the application.

-

Using Incorrect Financial Figures: Accuracy is crucial when reporting financial data. Applicants sometimes miscalculate their investment amounts or provide outdated figures. Double-checking these numbers ensures that the information is current and reflects the applicant's true financial situation.

-

Neglecting to Sign the Form: A signature signifies agreement to the terms laid out in the form. Many individuals forget to sign or date their Investment Letter of Intent. Without a signature, the document is not legally binding, which can create complications in the investment process.

-

Failing to Review the Terms: Before submitting the form, it's essential to read through all terms and conditions. Some applicants skip this step, leading to misunderstandings about their obligations and rights. Taking the time to understand the document can prevent future disputes.

Example - Investment Letter of Intent Form

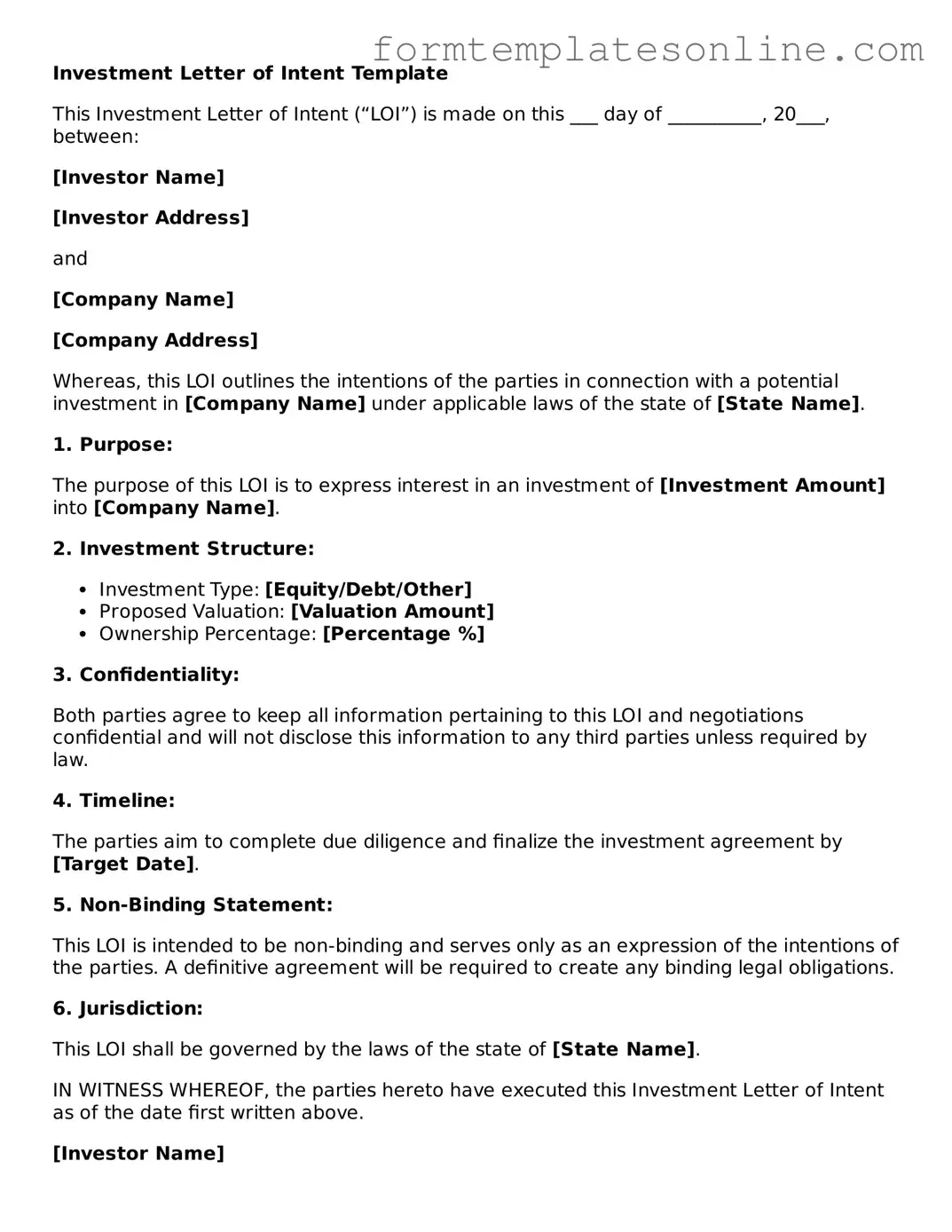

Investment Letter of Intent Template

This Investment Letter of Intent (“LOI”) is made on this ___ day of __________, 20___, between:

[Investor Name]

[Investor Address]

and

[Company Name]

[Company Address]

Whereas, this LOI outlines the intentions of the parties in connection with a potential investment in [Company Name] under applicable laws of the state of [State Name].

1. Purpose:

The purpose of this LOI is to express interest in an investment of [Investment Amount] into [Company Name].

2. Investment Structure:

- Investment Type: [Equity/Debt/Other]

- Proposed Valuation: [Valuation Amount]

- Ownership Percentage: [Percentage %]

3. Confidentiality:

Both parties agree to keep all information pertaining to this LOI and negotiations confidential and will not disclose this information to any third parties unless required by law.

4. Timeline:

The parties aim to complete due diligence and finalize the investment agreement by [Target Date].

5. Non-Binding Statement:

This LOI is intended to be non-binding and serves only as an expression of the intentions of the parties. A definitive agreement will be required to create any binding legal obligations.

6. Jurisdiction:

This LOI shall be governed by the laws of the state of [State Name].

IN WITNESS WHEREOF, the parties hereto have executed this Investment Letter of Intent as of the date first written above.

[Investor Name]

_________________________

Signature

[Company Name]

_________________________

Signature

More About Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between parties who intend to enter into a formal investment agreement. It serves as a non-binding agreement that expresses the interest of one party to invest in another, detailing the terms and conditions that will govern the potential investment. While it is not legally binding, it sets the stage for negotiations and helps clarify the intentions of both parties.

What information is typically included in an Investment Letter of Intent?

The LOI generally includes key details such as the amount of the proposed investment, the type of investment (equity, debt, etc.), timelines for the investment, and any conditions that must be met before the investment can be finalized. It may also outline confidentiality provisions, exclusivity clauses, and any preliminary due diligence requirements. This document acts as a roadmap for moving forward with the investment discussions.

Is the Investment Letter of Intent legally binding?

Most sections of an Investment Letter of Intent are non-binding, meaning they do not create enforceable obligations. However, certain provisions, such as confidentiality and exclusivity clauses, may be binding. It is crucial for both parties to understand which parts of the LOI are binding and which are not. This understanding helps prevent misunderstandings as negotiations progress.

How does an Investment Letter of Intent benefit both parties?

An LOI benefits both the investor and the company seeking investment. For the investor, it provides a clear outline of the terms they are considering, which helps in making informed decisions. For the company, it demonstrates the investor's interest and can help secure other funding sources. The LOI fosters open communication and sets expectations, making the negotiation process smoother.

What should I do after signing an Investment Letter of Intent?

After signing an LOI, the next steps typically involve conducting due diligence and negotiating the final investment agreement. Both parties should work closely to address any outstanding issues and clarify terms. It is advisable to consult with legal and financial advisors to ensure that all aspects of the investment are thoroughly reviewed and understood before finalizing the agreement.

Key takeaways

Filling out an Investment Letter of Intent (LOI) form can be a crucial step in securing funding or investment. Here are some key takeaways to keep in mind:

- Be Clear and Concise: Clearly state your intentions and goals. Avoid vague language.

- Include Essential Details: Provide necessary information such as the amount of investment, purpose, and timeline.

- Understand the Terms: Familiarize yourself with the terms and conditions outlined in the LOI.

- Specify Contingencies: Mention any conditions that must be met for the investment to proceed.

- Outline Responsibilities: Clearly define the roles and responsibilities of both parties involved.

- Seek Legal Advice: Consider consulting a legal expert to review the document before submission.

- Be Professional: Maintain a professional tone throughout the letter. This reflects your seriousness.

- Follow Up: After sending the LOI, follow up to ensure it was received and to address any questions.

- Keep Records: Save a copy of the LOI for your records and future reference.

- Be Prepared to Negotiate: Understand that the LOI may lead to negotiations, so be open to discussions.

By following these takeaways, you can effectively fill out and utilize the Investment Letter of Intent form to further your investment goals.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent outlines the preliminary terms of an investment agreement between parties. |

| Binding Nature | This document is typically non-binding, allowing parties to negotiate terms without legal obligation. |

| State-Specific Forms | Some states may require specific formats or additional disclosures; consult local laws for compliance. |

| Governing Laws | Investment agreements are often governed by state laws, which vary by jurisdiction; examples include Delaware and California. |

More Investment Letter of Intent Types:

Letter of Intent Homeschool Ny - Communicates educational intentions to local authorities.

Intent to Purchase - This document indicates a buyer's intention to purchase a specified asset or business.

Grant Letter of Intent - Engage the reader with a compelling narrative about your project.

Dos and Don'ts

When filling out an Investment Letter of Intent form, it's crucial to approach the task with care and attention. Here are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all numbers and figures for accuracy.

- Do seek clarification on any section you find confusing.

- Don't rush through the form; take your time to ensure quality.

- Don't leave any required fields blank; it could result in rejection.

- Don't use jargon or overly technical language that may confuse reviewers.

- Don't forget to sign and date the form before submission.