Intent To Lien Florida PDF Form

The Intent to Lien Florida form serves as a crucial communication tool for contractors, suppliers, and service providers who have not received payment for their work on a property. This document is designed to notify property owners of an impending lien against their property, which can have serious financial implications. It includes essential details such as the date of the notice, the names and addresses of the property owner and general contractor, and a description of the property in question. The form explicitly states the amount owed for labor, materials, or services rendered, and it sets forth a timeline for the property owner to respond. Specifically, Florida law requires that this notice be sent at least 45 days before a lien is recorded, giving the property owner a chance to resolve the payment issue. Should the property owner fail to respond within 30 days, the contractor may proceed with filing a lien, which could lead to foreclosure proceedings and additional costs for the owner, including attorney fees. The form also includes a certificate of service, ensuring that the notice has been properly delivered, whether by mail or in person. Overall, this form is an important step in protecting the rights of those who provide services in the construction and improvement of properties in Florida.

Common mistakes

-

Incorrect Property Information: Failing to provide the correct street address and legal description of the property can lead to complications. Ensure that all details are accurate and match public records.

-

Missing Owner Information: Omitting the property owner's full legal name and mailing address can invalidate the notice. Double-check that this information is complete and correct.

-

Improper Notification Timeline: Not adhering to the required timeline for sending the notice can result in loss of rights. The notice must be sent at least 45 days before filing a lien. Make sure to keep track of dates.

-

Failure to Specify Amount Owed: Leaving the payment amount blank or inaccurately stating the owed amount can cause confusion. Clearly state the exact amount due for services rendered.

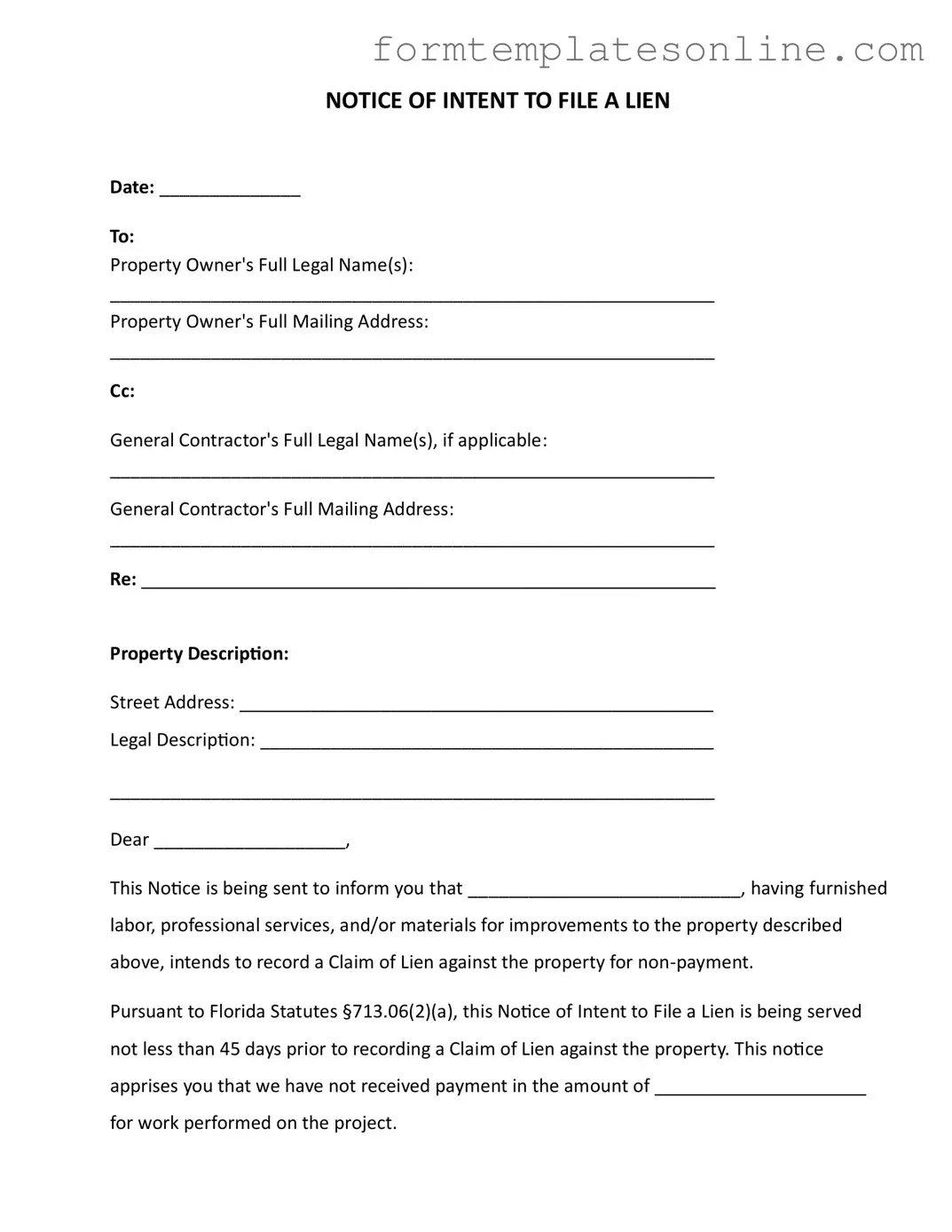

Example - Intent To Lien Florida Form

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

More About Intent To Lien Florida

What is the purpose of the Intent To Lien Florida form?

The Intent To Lien Florida form serves as a formal notification to property owners that a contractor or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice is a prerequisite under Florida law, specifically Florida Statutes §713.06(2)(a), and must be sent at least 45 days before the actual lien is recorded. It aims to inform the property owner of the outstanding payment and the potential consequences of failing to address the issue.

What information is required on the Intent To Lien form?

The form requires several key pieces of information. It includes the date of the notice, the full legal names and mailing addresses of the property owner and, if applicable, the general contractor. Additionally, it must contain a description of the property, including both the street address and the legal description. The form also specifies the amount owed for the work performed and includes a statement regarding the intent to file a lien if payment is not made. This information ensures clarity and provides the necessary details for all parties involved.

What happens if the property owner does not respond to the Intent To Lien notice?

If the property owner does not respond to the notice within 30 days, the contractor or supplier may proceed to record the lien against the property. This action can lead to serious consequences for the property owner, including potential foreclosure proceedings. The property owner may also incur additional costs, such as attorney fees and court costs, related to the lien. Therefore, it is important for the property owner to address the notice promptly to avoid these outcomes.

How can a property owner resolve the issue before a lien is filed?

A property owner can resolve the issue by contacting the contractor or supplier as soon as they receive the Intent To Lien notice. Open communication is crucial. The property owner should discuss the outstanding payment and try to arrange for payment or negotiate a resolution. If there are disputes regarding the payment or the work performed, it is advisable to address these concerns directly with the contractor to find a satisfactory solution before the situation escalates to a lien filing.

Key takeaways

- Understand the Purpose: The Intent to Lien form serves as a formal notice to property owners that a lien may be filed due to non-payment for services or materials provided.

- Timing is Critical: This notice must be sent at least 45 days before filing a Claim of Lien, ensuring compliance with Florida law.

- Include Complete Information: Fill out all required fields accurately, including the property owner's name, address, and a detailed description of the property.

- Document the Amount Due: Clearly state the amount owed for the work completed to avoid confusion and establish the basis for the lien.

- Respond Promptly: The property owner has 30 days to respond. Failure to do so may lead to the filing of a lien, which could result in foreclosure.

- Keep Copies: Retain a copy of the sent notice and any correspondence related to the payment request for your records.

- Service Method Matters: Choose a valid method for delivering the notice, such as certified mail or hand delivery, and document the method used for future reference.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of an impending Claim of Lien due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien in Florida. |

| Notice Period | According to Florida law, the notice must be served at least 45 days before the lien is recorded. |

| Consequences of Non-Payment | If payment is not made within 30 days, the property may be subject to foreclosure and additional costs, including attorney fees. |

Other PDF Forms

Navpers 1336 3 - All involved parties must remain informed about the requirements stated in the form.

A Georgia Quitclaim Deed form is a legal document used to transfer interest in real estate from one person to another without any guarantees about the title being clear. This form is often employed between family members or to clear up title issues, making it essential to consult resources such as OnlineLawDocs.com for a better understanding of its implications.

Chart Ms Word - The first column should clarify any relevant background information.

Dos and Don'ts

When filling out the Intent To Lien Florida form, there are important guidelines to follow. Here are seven things to do and not do:

- Do ensure that all fields are accurately filled out, including the property owner's full legal name and address.

- Do clearly state the amount owed for the work performed on the property.

- Do provide a detailed description of the property, including both the street address and legal description.

- Do send the notice at least 45 days before you intend to record a Claim of Lien.

- Don't forget to include your contact information, making it easy for the property owner to reach you.

- Don't use vague language; be specific about the services or materials provided.

- Don't ignore the requirement to certify that a copy of the notice was served to the property owner.