Independent Contractor Pay Stub PDF Form

The Independent Contractor Pay Stub form serves as an essential tool for both contractors and businesses in managing payments and ensuring transparency in financial transactions. This form typically includes vital information such as the contractor's name, address, and identification number, along with the business's details. Additionally, it outlines the payment period, the total amount earned, and any deductions that may apply. By providing a clear breakdown of earnings and deductions, the pay stub helps contractors track their income and facilitates accurate tax reporting. Furthermore, it can serve as proof of income for contractors seeking loans or other financial services. Understanding the components of this form is crucial for both parties to maintain compliance with tax regulations and to foster a professional working relationship.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details, such as their name, address, and Social Security number. This can lead to issues with tax reporting and payments.

-

Miscalculating Hours Worked: Some contractors underestimate or overestimate the number of hours they worked. Accurate tracking is essential for proper compensation.

-

Omitting Payment Details: It is crucial to include payment terms, such as the rate per hour or project. Missing this information can create confusion regarding compensation.

-

Failing to Include Deductions: Contractors often overlook necessary deductions, such as taxes or insurance. This can result in unexpected liabilities later.

-

Not Keeping Copies: Some individuals neglect to keep copies of their pay stubs. Retaining these documents is important for personal records and tax purposes.

-

Ignoring State Regulations: Each state may have specific requirements for pay stubs. Failing to adhere to these regulations can lead to legal complications.

-

Submitting Incomplete Forms: A common mistake is sending in a pay stub that is not fully completed. Ensure all sections are filled out to avoid processing delays.

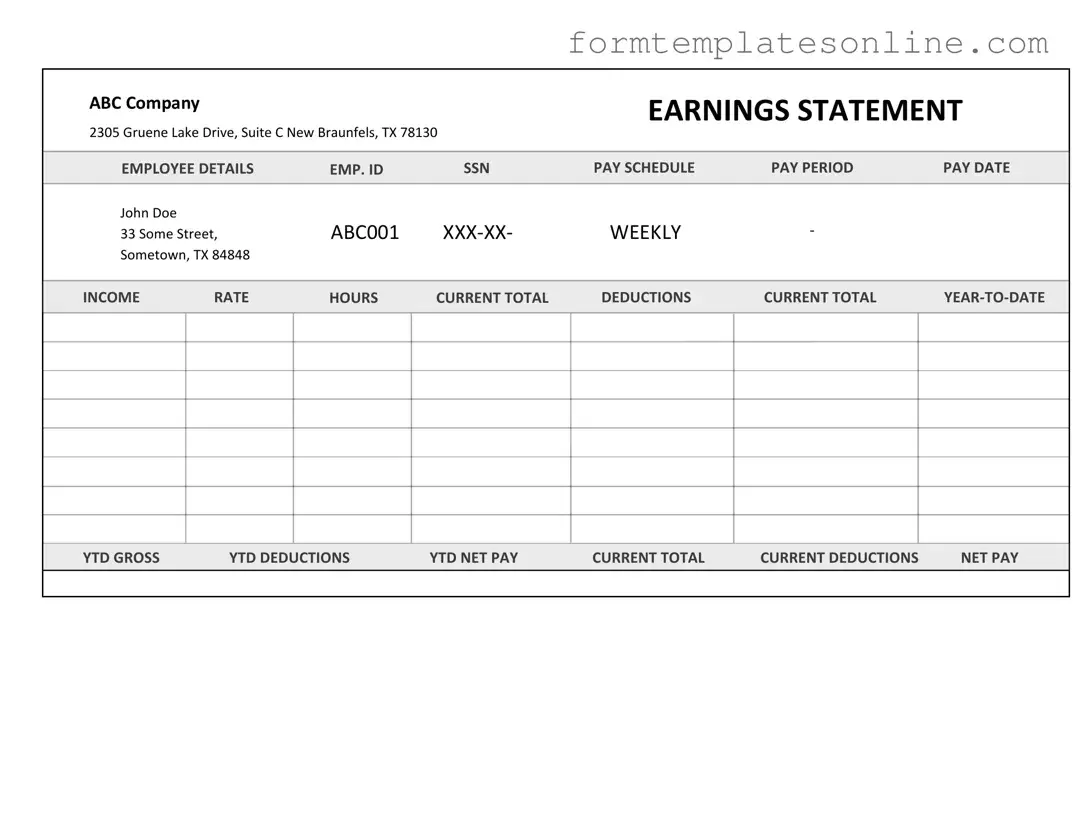

Example - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

More About Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub form?

The Independent Contractor Pay Stub form is a document that provides a detailed breakdown of payments made to independent contractors. It serves as a record of earnings, taxes withheld (if applicable), and any deductions. This form helps contractors keep track of their income and can be useful for tax reporting purposes.

Who should use the Independent Contractor Pay Stub form?

This form is designed for independent contractors who provide services to businesses or individuals. If you are self-employed and receive payments for your work, using this pay stub can help you maintain clear financial records. It's beneficial for both the contractor and the client, ensuring transparency in financial transactions.

What information is included on the pay stub?

A typical Independent Contractor Pay Stub includes the contractor's name, address, and contact information. It also lists the client's details, payment date, amount earned, any deductions, and the net amount received. Additionally, it may contain a breakdown of hours worked or services rendered, depending on the nature of the contract.

Do independent contractors need to issue pay stubs?

While it's not legally required for independent contractors to issue pay stubs, doing so is highly recommended. Providing a pay stub enhances professionalism and helps maintain a clear record of payments. It also aids in financial planning and tax preparation, making it easier to report income accurately.

How can I create an Independent Contractor Pay Stub?

Creating a pay stub can be done using various templates available online, or you can use accounting software that includes pay stub generation features. Simply input the necessary information, such as your name, payment details, and any deductions. Make sure to review the final document for accuracy before sharing it with your client.

Is there a specific format for the Independent Contractor Pay Stub?

There is no one-size-fits-all format for an Independent Contractor Pay Stub. However, it should be clear and easy to read. Common elements include the contractor’s and client’s information, payment date, gross earnings, deductions, and net pay. The layout should be organized to allow for easy understanding of the financial details.

How often should I issue pay stubs?

The frequency of issuing pay stubs can vary based on your agreement with the client. Many contractors choose to provide a pay stub after each payment is made, while others may do so on a monthly basis. It's essential to establish a routine that works for both you and your client, ensuring that records are kept up-to-date.

Can I use an Independent Contractor Pay Stub for tax purposes?

Yes, the Independent Contractor Pay Stub can be used for tax purposes. It provides a clear record of your income, which is essential when filing taxes. While independent contractors typically report income on a Schedule C, having a pay stub helps to substantiate your earnings and any deductions you may claim. Always keep copies of your pay stubs for your records.

Key takeaways

When filling out and using the Independent Contractor Pay Stub form, keep these key points in mind:

- Accurate Information: Always provide accurate details about the contractor's name, address, and Social Security number or Tax ID.

- Payment Details: Clearly list the payment period and the amount paid to the contractor.

- Deduction Clarity: Include any deductions taken from the payment, such as taxes or fees, to ensure transparency.

- Payment Method: Indicate how the payment was made, whether by check, direct deposit, or another method.

- Record Keeping: Keep a copy of each pay stub for your records. This is important for tax purposes.

- Compliance: Ensure that the form complies with local and federal laws regarding independent contractor payments.

- Review Regularly: Regularly review and update the form to reflect any changes in payment rates or contractor information.

- Consult Professionals: If unsure about any part of the form, consider consulting a tax professional or legal advisor for guidance.

Form Attributes

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. |

| Purpose | This form helps contractors keep track of their income and provides a record for tax purposes. |

| Required Information | The pay stub typically includes the contractor's name, address, payment period, total earnings, and any deductions. |

| Tax Implications | Independent contractors are responsible for paying their own taxes, including self-employment tax. |

| State-Specific Forms | Some states may have specific requirements for pay stubs, governed by labor laws. For example, California's Labor Code Section 226 mandates detailed pay stubs. |

| Record Keeping | Contractors should retain pay stubs for at least three years for tax and record-keeping purposes. |

| Format | The pay stub can be provided in paper or electronic format, depending on the agreement between the contractor and the client. |

Other PDF Forms

What Is a Construction Proposal - By clearly defining the roles and responsibilities, the form aids in team organization.

Lyft Inspection Form Pass - Check for any unusual noises coming from the engine.

The Wisconsin Homeschool Letter of Intent form is a crucial document that parents must submit to officially declare their intention to homeschool their children. This form serves as a formal notification to the local school district, ensuring compliance with state education laws. By completing this form, parents take an important step in shaping their children's educational journey, and they can find the necessary details in the Homeschool Letter of Intent form.

Who Can Write Esa Letters - This letter is not a certification but rather a statement of need from a qualified professional.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, attention to detail is crucial. Here are some important dos and don’ts to keep in mind:

- Do ensure all personal information is accurate, including your name and address.

- Do clearly list the services provided and the corresponding payment amounts.

- Do keep a copy of the completed pay stub for your records.

- Do double-check calculations to avoid errors in total pay.

- Don't leave any fields blank; fill in all required information.

- Don't use vague descriptions for services rendered; be specific.

- Don't forget to sign and date the form where indicated.

- Don't submit the form without reviewing it for mistakes.