Valid Transfer-on-Death Deed Form for Illinois

The Illinois Transfer-on-Death Deed (TOD) form offers a streamlined way for property owners to transfer their real estate to designated beneficiaries without the need for probate. This legal document allows individuals to maintain full control over their property during their lifetime while ensuring a smooth transition upon their passing. By completing the TOD form, property owners can specify who will inherit their property, thereby avoiding the complexities and delays associated with traditional inheritance methods. The form must be properly executed, including signatures and notarization, to be valid. Additionally, it is essential to record the deed with the appropriate county office to ensure that the transfer is recognized legally. Understanding the nuances of the TOD form can help individuals make informed decisions about their estate planning and provide peace of mind for both themselves and their loved ones.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise description of the property. It’s essential to include the correct legal description, which can usually be found on the property deed. Omitting details or using vague terms can lead to confusion or disputes later on.

-

Not Naming Beneficiaries Clearly: When filling out the form, some people make the error of not clearly identifying the beneficiaries. It’s important to list the full names of all individuals who will inherit the property. Ambiguities in naming can create complications, especially if there are multiple beneficiaries.

-

Failing to Sign and Date the Deed: A Transfer-on-Death Deed must be signed and dated by the property owner. Neglecting to do so renders the document invalid. This step is crucial, as it confirms the owner’s intent to transfer the property upon their passing.

-

Not Recording the Deed: After completing the form, some individuals forget to record the deed with the county recorder’s office. This step is vital for the deed to take effect. Without recording, the deed may not be recognized, and the property could go through probate instead of transferring directly to the beneficiaries.

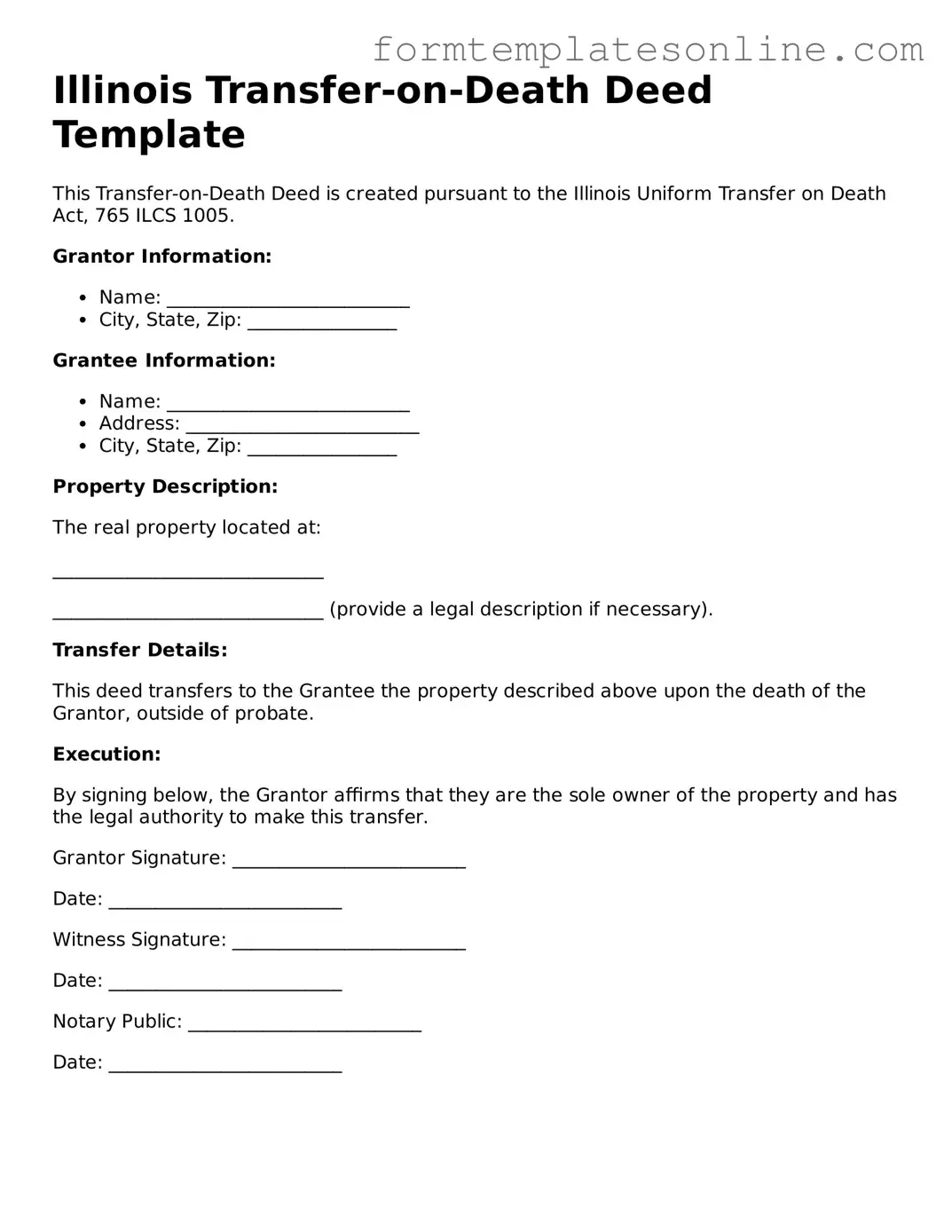

Example - Illinois Transfer-on-Death Deed Form

Illinois Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created pursuant to the Illinois Uniform Transfer on Death Act, 765 ILCS 1005.

Grantor Information:

- Name: __________________________

- City, State, Zip: ________________

Grantee Information:

- Name: __________________________

- Address: _________________________

- City, State, Zip: ________________

Property Description:

The real property located at:

_____________________________

_____________________________ (provide a legal description if necessary).

Transfer Details:

This deed transfers to the Grantee the property described above upon the death of the Grantor, outside of probate.

Execution:

By signing below, the Grantor affirms that they are the sole owner of the property and has the legal authority to make this transfer.

Grantor Signature: _________________________

Date: _________________________

Witness Signature: _________________________

Date: _________________________

Notary Public: _________________________

Date: _________________________

More About Illinois Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Illinois?

A Transfer-on-Death Deed (TOD Deed) allows property owners in Illinois to transfer their real estate to a designated beneficiary upon their death. This deed is a simple way to ensure that your property passes directly to your chosen heirs without going through probate, which can be a lengthy and costly process.

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must fill out the appropriate form, which can be obtained from the Illinois Secretary of State's website or local county recorder's office. You will need to provide details about the property, the beneficiary, and your signature. It's important to have the deed notarized to ensure its validity. Once completed, the deed must be recorded with the county recorder's office where the property is located.

Can I change the beneficiary after creating a Transfer-on-Death Deed?

Yes, you can change the beneficiary at any time. To do this, you must create a new Transfer-on-Death Deed that names the new beneficiary and record it with the county. Additionally, you can revoke the existing deed entirely if you no longer wish for that beneficiary to inherit the property.

What happens if the beneficiary predeceases me?

If the designated beneficiary passes away before you do, the property will not automatically transfer to them. Instead, the property will become part of your estate and will be distributed according to your will or, if you do not have a will, according to Illinois intestacy laws. It’s wise to name an alternate beneficiary to avoid complications.

Is a Transfer-on-Death Deed subject to creditors’ claims?

Yes, a Transfer-on-Death Deed does not protect the property from creditors. If you have outstanding debts, creditors may still make claims against the property during your lifetime or after your death. The property may be subject to claims before it is transferred to the beneficiary.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney assist you in creating a TOD Deed, it is highly recommended. An attorney can help ensure that the deed is filled out correctly and meets all legal requirements. This can prevent potential disputes or issues down the line.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for residential real estate in Illinois. This includes single-family homes, condominiums, and multi-family properties. However, it cannot be used for commercial properties, personal property, or vehicles. Always consult local laws or an attorney for specific guidance on your situation.

Key takeaways

Filling out and using the Illinois Transfer-on-Death Deed form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- The Transfer-on-Death Deed allows you to pass real estate directly to a beneficiary without going through probate.

- You must complete the form accurately to ensure it is valid. Double-check all names and property details.

- Sign the deed in front of a notary public. This step is crucial for the deed to be legally binding.

- File the completed deed with the county recorder's office where the property is located. This makes the deed official.

- Inform your beneficiary about the deed. They should know what to expect when the time comes.

- You can revoke or change the deed at any time while you are alive. Just follow the proper procedures.

- Be aware that the beneficiary will not have rights to the property until your passing.

- Consider consulting a legal professional if you have questions or unique circumstances regarding your property.

Using a Transfer-on-Death Deed can simplify the transfer of your property, but it's essential to follow the steps carefully.

File Details

| Fact Name | Description |

|---|---|

| Definition | The Illinois Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Eligibility | Any individual who owns real estate in Illinois can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the property owner, as long as they are alive and competent. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property after their death. |

| Filing Requirements | The deed must be recorded with the county recorder’s office in the county where the property is located. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes, and the property’s value is included in the deceased’s estate for tax purposes. |

Consider Some Other Transfer-on-Death Deed Forms for US States

Beneficiary Deed Georgia - No consideration or payment is required for the transfer of the property.

A Georgia Non-disclosure Agreement (NDA) form is a legal document designed to protect sensitive information from being shared or disclosed without authorization. This type of agreement is often used by businesses and individuals in Georgia to safeguard trade secrets, proprietary data, and other confidential information. By establishing a formal confidentiality agreement, both parties commit to maintaining discretion to ensure the information’s security. For more information on how to create an effective NDA, visit OnlineLawDocs.com.

Disadvantages of Transfer on Death Deed Illinois - With a Transfer-on-Death Deed, you can keep control of your property during your lifetime while ensuring a seamless transfer to your chosen beneficiary later on.

Dos and Don'ts

When filling out the Illinois Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things to do and avoid:

- Do ensure that you are the owner of the property listed on the deed.

- Do provide accurate and complete information about the property.

- Do include the full names of the beneficiaries.

- Do sign the deed in the presence of a notary public.

- Don't leave any sections of the form blank.

- Don't forget to record the deed with the county recorder's office.

- Don't use outdated forms; always use the most current version.