Valid Real Estate Purchase Agreement Form for Illinois

The Illinois Real Estate Purchase Agreement form serves as a crucial document in the home buying process, outlining the terms and conditions agreed upon by both the buyer and the seller. This form typically includes essential details such as the purchase price, the property description, and the closing date. It also addresses contingencies, which are conditions that must be met for the sale to proceed, such as financing approval or a satisfactory home inspection. Additionally, the agreement often specifies the earnest money deposit, demonstrating the buyer's commitment to the transaction. By clearly defining responsibilities and expectations, the Illinois Real Estate Purchase Agreement helps protect the interests of both parties, reducing the likelihood of misunderstandings or disputes. Understanding this form is vital for anyone involved in a real estate transaction in Illinois, as it lays the groundwork for a successful sale and transfer of property ownership.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or complications. Every section needs to be addressed, including the buyer's and seller's names, property details, and purchase price.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create confusion. It's essential to include the correct address, legal description, and any relevant details about the property.

-

Missing Signatures: Not obtaining the necessary signatures from all parties involved can invalidate the agreement. Ensure that both the buyer and seller sign the document, as well as any required witnesses.

-

Ignoring Contingencies: Overlooking important contingencies, such as financing or inspection clauses, can lead to problems later. Clearly outline any conditions that must be met for the sale to proceed.

-

Not Specifying Closing Costs: Failing to detail who is responsible for closing costs can lead to disputes. Clearly state how these costs will be divided between the buyer and seller.

-

Using Outdated Forms: Utilizing an outdated version of the purchase agreement can cause legal issues. Always ensure that the most current form is being used, as laws and regulations may change.

-

Neglecting to Review the Agreement: Skipping a thorough review of the completed agreement can result in overlooked errors. It's wise to read through the document carefully before submission, and consider having a legal professional review it as well.

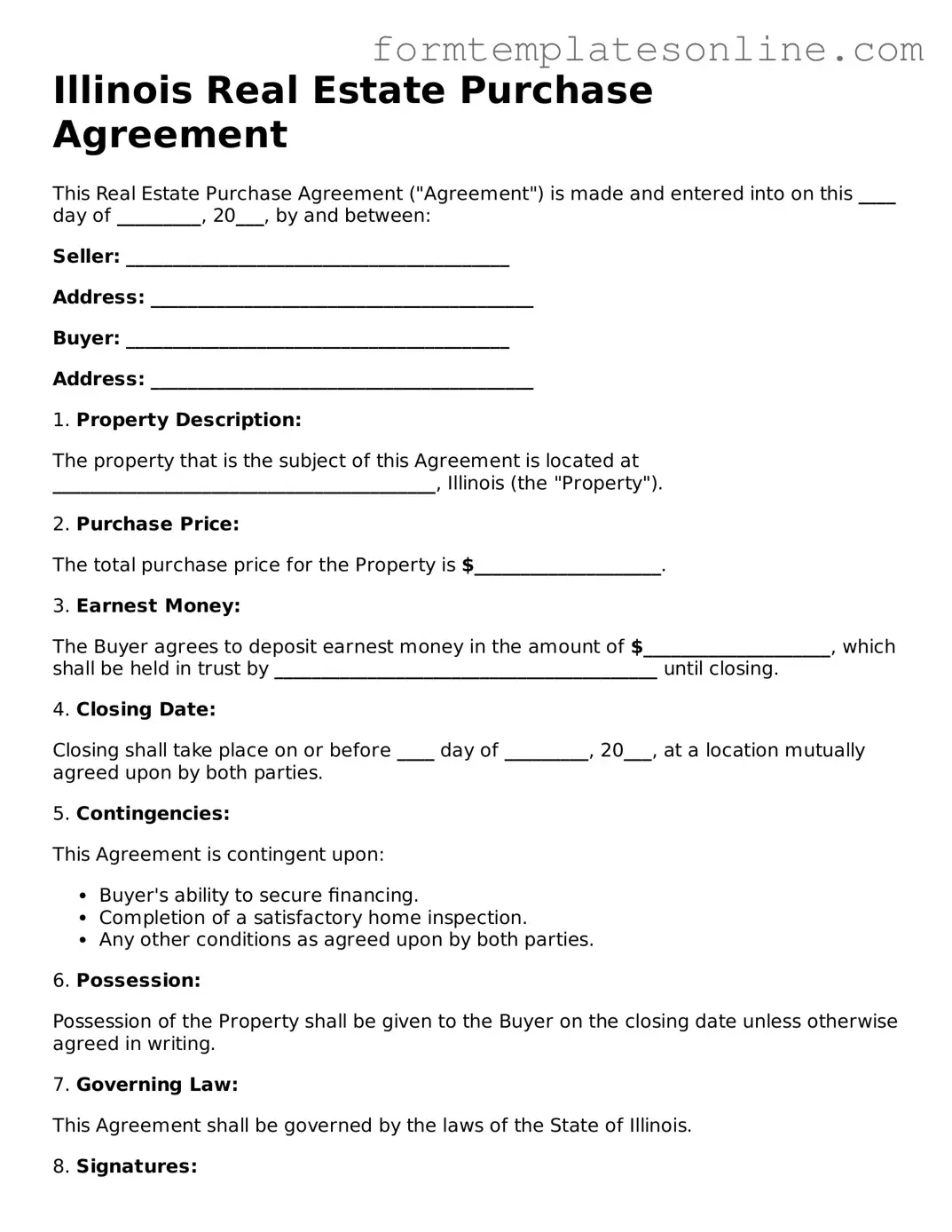

Example - Illinois Real Estate Purchase Agreement Form

Illinois Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into on this ____ day of _________, 20___, by and between:

Seller: _________________________________________

Address: _________________________________________

Buyer: _________________________________________

Address: _________________________________________

1. Property Description:

The property that is the subject of this Agreement is located at _________________________________________, Illinois (the "Property").

2. Purchase Price:

The total purchase price for the Property is $____________________.

3. Earnest Money:

The Buyer agrees to deposit earnest money in the amount of $____________________, which shall be held in trust by _________________________________________ until closing.

4. Closing Date:

Closing shall take place on or before ____ day of _________, 20___, at a location mutually agreed upon by both parties.

5. Contingencies:

This Agreement is contingent upon:

- Buyer's ability to secure financing.

- Completion of a satisfactory home inspection.

- Any other conditions as agreed upon by both parties.

6. Possession:

Possession of the Property shall be given to the Buyer on the closing date unless otherwise agreed in writing.

7. Governing Law:

This Agreement shall be governed by the laws of the State of Illinois.

8. Signatures:

By signing below, the parties agree to the terms and conditions outlined in this Agreement.

Seller Signature: ________________________________ Date: ____________

Buyer Signature: ________________________________ Date: ____________

This Agreement constitutes the entire agreement between the parties and supersedes all prior discussions and agreements.

More About Illinois Real Estate Purchase Agreement

What is the Illinois Real Estate Purchase Agreement form?

The Illinois Real Estate Purchase Agreement form is a legal document used in real estate transactions within the state of Illinois. This form outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. It includes essential details such as the purchase price, financing arrangements, contingencies, and the closing date. This agreement serves to protect the interests of both parties and provides a clear framework for the transaction.

What key elements should be included in the agreement?

Several important elements must be included in the Illinois Real Estate Purchase Agreement. First, the names and contact information of both the buyer and seller should be clearly stated. Next, a detailed description of the property, including its address and any included fixtures or personal property, is necessary. Additionally, the purchase price, earnest money deposit, and financing terms must be outlined. It's also crucial to specify any contingencies, such as home inspections or financing approvals, as well as the timeline for closing the sale.

Are there any contingencies that can be included in the agreement?

Yes, contingencies are an essential part of the Illinois Real Estate Purchase Agreement. They allow buyers to set conditions that must be met for the sale to proceed. Common contingencies include home inspections, which allow buyers to assess the property's condition, and financing contingencies, which ensure that buyers can secure a mortgage. Other contingencies may involve the sale of the buyer's current home or specific repairs to be made by the seller before closing. Including these contingencies protects buyers and provides an opportunity to back out if necessary.

What happens if one party wants to back out of the agreement?

If one party wishes to back out of the agreement, the consequences depend on the terms outlined in the contract and the timing of the withdrawal. If a buyer decides to withdraw before the contingencies are satisfied, they may forfeit their earnest money deposit. However, if the buyer has a valid reason based on the contingencies included in the agreement, they may be able to cancel without penalty. Sellers also have rights and obligations, so it’s essential for both parties to understand their options and consult with a real estate professional if needed.

Key takeaways

Ensure all parties involved in the transaction are clearly identified. This includes the buyer, seller, and any agents representing them.

Accurately describe the property being sold. Include the address, legal description, and any relevant details that clarify what is being purchased.

Specify the purchase price. Clearly state the amount the buyer is willing to pay for the property and outline any deposits or earnest money required.

Outline the terms of the sale. This should cover financing details, contingencies, and any conditions that must be met for the sale to proceed.

Include a timeline for the transaction. Establish key dates, such as the closing date and any deadlines for inspections or financing approvals.

Review the disclosure requirements. Sellers must provide information about the property's condition, including any known defects or issues.

Consider consulting with a real estate attorney or agent. Their expertise can help navigate any complexities and ensure the agreement is legally sound.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Real Estate Purchase Agreement form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Governing Laws | This agreement is governed by the laws of the State of Illinois, specifically the Illinois Compiled Statutes related to real estate transactions. |

| Key Components | It typically includes sections on purchase price, financing, contingencies, and closing dates, ensuring both parties understand their obligations. |

| Contingencies | Common contingencies may include home inspections, financing approval, and the sale of the buyer’s current home, protecting the buyer's interests. |

| Earnest Money | The agreement often requires an earnest money deposit, which shows the buyer's commitment to the purchase and is applied to the purchase price at closing. |

| Disclosure Requirements | Sellers must provide certain disclosures regarding the property's condition, ensuring transparency and informed decision-making for the buyer. |

| Signatures | Both parties must sign the agreement for it to be legally binding, demonstrating mutual consent to the terms outlined in the document. |

Consider Some Other Real Estate Purchase Agreement Forms for US States

Real Estate Contract Georgia - Includes contingencies for the buyer financing approval.

Having a clear understanding of the terms, parties involved, and expectations is crucial in any borrowing situation, and for those interested in drafting or reviewing such documents, resources like OnlineLawDocs.com provide essential templates and guidance.

Purchase Agreement Michigan - It governs the allocation of closing costs between the parties.

Dos and Don'ts

When filling out the Illinois Real Estate Purchase Agreement form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn't do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property and the parties involved.

- Do include all necessary details, such as purchase price and closing date.

- Do sign and date the agreement where required.

- Do keep a copy of the completed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific in your descriptions.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore deadlines; be aware of timelines for offers and responses.