Valid Quitclaim Deed Form for Illinois

In the realm of real estate transactions, the Illinois Quitclaim Deed form serves as a vital instrument for property owners seeking to transfer their interest in a property without the complexities often associated with other types of deeds. This straightforward legal document allows individuals to relinquish their rights to a property, making it particularly useful in situations such as divorce settlements, inheritance transfers, or when one party wishes to remove themselves from joint ownership. Unlike warranty deeds, which provide guarantees about the title, quitclaim deeds offer no such assurances; instead, they merely convey whatever interest the grantor has at the time of the transfer. This simplicity can streamline the process, but it also necessitates a thorough understanding of the implications involved. Properly executing the form involves specific requirements, including the need for notarization and adherence to local recording laws, ensuring that the transaction is legally recognized. By grasping the essential elements of the Illinois Quitclaim Deed, individuals can navigate property transfers with greater confidence and clarity.

Common mistakes

-

Incorrect Names: Individuals often misspell their names or fail to use their full legal names. It is crucial to ensure that the names of all parties involved are accurate and match official identification documents.

-

Missing Signatures: All parties involved in the transaction must sign the Quitclaim Deed. Omitting a signature can render the document invalid.

-

Improper Notarization: The Quitclaim Deed must be notarized. Failing to have a notary public witness the signing can lead to complications in the future.

-

Incorrect Property Description: A detailed and accurate description of the property is essential. Errors in the legal description can lead to disputes or challenges in ownership.

-

Failure to Include Consideration: The form should indicate what consideration (payment or value) is being exchanged for the property. Not including this information can create ambiguity.

-

Omitting the Date: The date of execution must be clearly stated. Without a date, it may be difficult to establish when the transfer took place.

-

Not Checking Local Requirements: Different counties may have specific requirements for filing a Quitclaim Deed. Failing to check local regulations can lead to delays or rejections.

-

Neglecting to Record the Deed: After completing the Quitclaim Deed, it must be recorded with the appropriate county office. Not doing so can leave the property transfer unprotected.

-

Using an Outdated Form: It is important to use the most current version of the Quitclaim Deed form. Using an outdated form can lead to legal issues.

-

Not Seeking Legal Advice: Many individuals attempt to fill out the form without consulting a legal professional. Seeking guidance can help prevent costly mistakes.

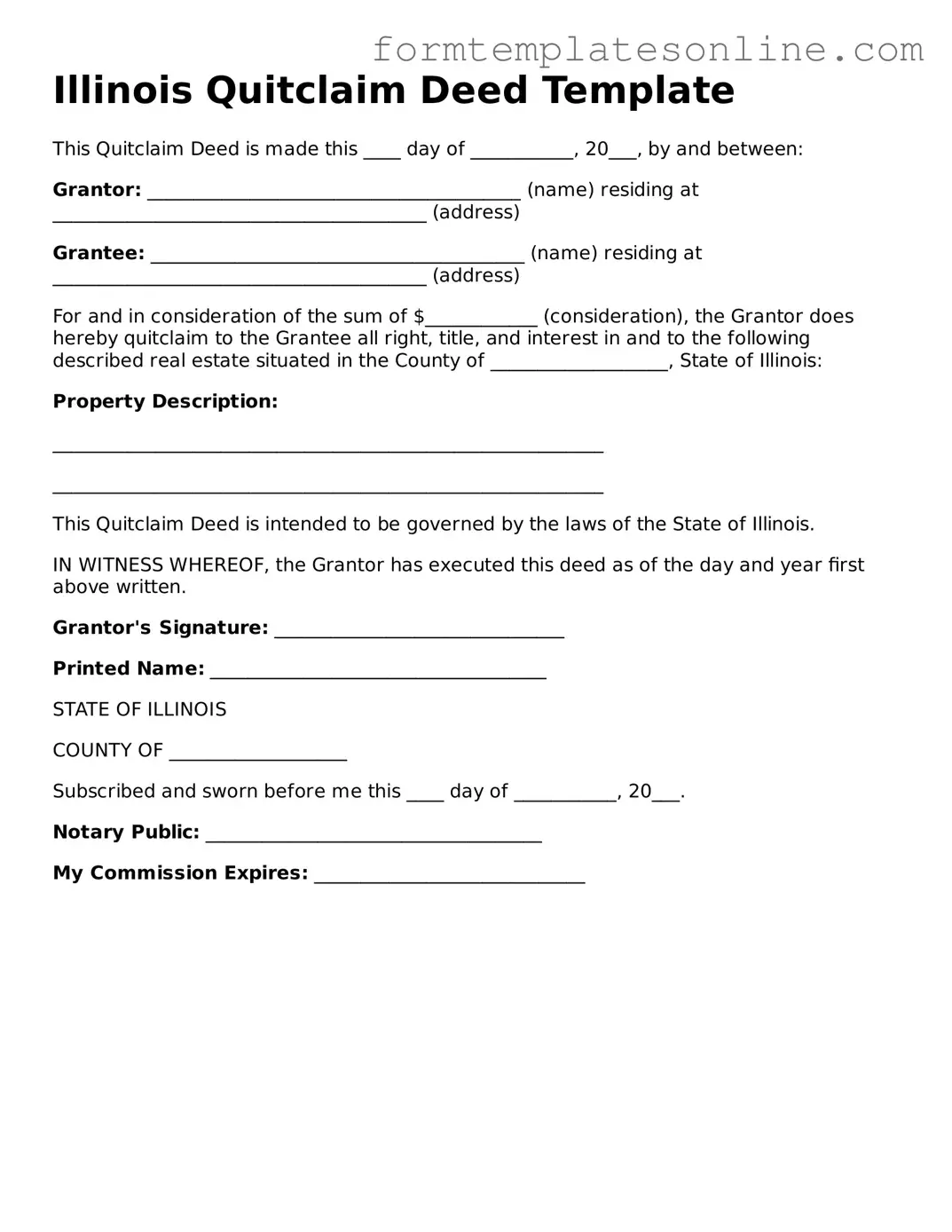

Example - Illinois Quitclaim Deed Form

Illinois Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of ___________, 20___, by and between:

Grantor: ________________________________________ (name) residing at ________________________________________ (address)

Grantee: ________________________________________ (name) residing at ________________________________________ (address)

For and in consideration of the sum of $____________ (consideration), the Grantor does hereby quitclaim to the Grantee all right, title, and interest in and to the following described real estate situated in the County of ___________________, State of Illinois:

Property Description:

___________________________________________________________

___________________________________________________________

This Quitclaim Deed is intended to be governed by the laws of the State of Illinois.

IN WITNESS WHEREOF, the Grantor has executed this deed as of the day and year first above written.

Grantor's Signature: _______________________________

Printed Name: ____________________________________

STATE OF ILLINOIS

COUNTY OF ___________________

Subscribed and sworn before me this ____ day of ___________, 20___.

Notary Public: ____________________________________

My Commission Expires: _____________________________

More About Illinois Quitclaim Deed

What is a Quitclaim Deed in Illinois?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In Illinois, this form allows the current owner, known as the grantor, to convey their interest in the property to the new owner, known as the grantee. It is important to note that a Quitclaim Deed does not guarantee that the grantor has a valid title to the property; it simply transfers whatever interest the grantor may have.

When should I use a Quitclaim Deed?

This type of deed is often used in situations where the parties know each other, such as transferring property between family members or during a divorce. It is also used to clear up title issues or to add or remove a name from the property title without a sale taking place.

What information is required on the Illinois Quitclaim Deed form?

The form must include the names and addresses of both the grantor and grantee, a legal description of the property, and the date of the transfer. Additionally, the form requires the grantor's signature, which must be notarized, to make the deed legally valid.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed offers guarantees about the title and ensures that the grantor has the right to transfer the property, while a Quitclaim Deed does not provide such assurances. It simply transfers whatever interest the grantor may have, if any.

Do I need to file the Quitclaim Deed with the county?

Yes, after the Quitclaim Deed is signed and notarized, it must be filed with the appropriate county recorder’s office where the property is located. Filing the deed officially records the change of ownership and protects the rights of the new owner.

Are there any fees associated with filing a Quitclaim Deed in Illinois?

Yes, there are typically fees associated with filing a Quitclaim Deed. The exact amount can vary by county, so it is advisable to check with the local recorder’s office for the specific fee schedule. Additionally, there may be other costs, such as notarization fees.

Can I revoke a Quitclaim Deed once it is filed?

Once a Quitclaim Deed is filed and recorded, it cannot be revoked or undone unilaterally. If the grantor wishes to regain ownership, they would need to execute a new deed transferring the property back, which may require the consent of the grantee.

What happens if the Quitclaim Deed is not properly executed?

If the Quitclaim Deed is not properly executed—meaning it lacks the necessary signatures, notarization, or legal description—it may be deemed invalid. This could lead to complications in property ownership and title disputes, making it essential to ensure all requirements are met before filing.

Can I use a Quitclaim Deed to transfer property into a trust?

Yes, a Quitclaim Deed can be used to transfer property into a trust. This is a common practice for estate planning purposes. The grantor would execute the Quitclaim Deed, naming the trust as the grantee, thereby transferring ownership of the property to the trust.

Do I need an attorney to complete a Quitclaim Deed?

While it is not legally required to have an attorney to complete a Quitclaim Deed, consulting with one is highly recommended. An attorney can help ensure that the deed is properly executed and that all legal requirements are met, thereby minimizing the risk of future disputes or issues with the property title.

Key takeaways

Filling out and using the Illinois Quitclaim Deed form requires attention to detail. Here are key takeaways to consider:

- Understand the Purpose: A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. It is often used between family members or in divorce settlements.

- Gather Required Information: You will need the names of the grantor (seller) and grantee (buyer), a legal description of the property, and the address of the property.

- Use Correct Legal Language: Ensure the deed clearly states the intent to transfer ownership. Avoid vague language that could lead to confusion.

- Complete the Form Accurately: Fill out the form completely and accurately. Errors can lead to delays or complications in the transfer process.

- Signatures Are Essential: The grantor must sign the deed in front of a notary public. This signature validates the transfer.

- Check for Additional Requirements: Some counties may have specific requirements or additional forms that need to be filed with the quitclaim deed.

- File the Deed Properly: After signing, file the completed quitclaim deed with the appropriate county recorder's office to make the transfer official.

- Consider Tax Implications: Understand any potential tax consequences that may arise from the transfer of property ownership.

- Consult a Professional: If you have questions or concerns, consider consulting a lawyer or real estate professional to ensure everything is handled correctly.

Taking these steps can help ensure a smooth property transfer process in Illinois.

File Details

| Fact Name | Description |

|---|---|

| Definition | An Illinois Quitclaim Deed is a legal document used to transfer ownership of real property without guaranteeing the title's validity. |

| Governing Law | The Illinois Quitclaim Deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Purpose | This deed is often used to clear up title issues or to transfer property between family members. |

| Requirements | The deed must be signed by the grantor and notarized to be legally effective. |

| Consideration | While consideration is not required, it is common to state a nominal amount, such as $1, to validate the transfer. |

| Recording | To protect the interests of the grantee, the deed should be recorded with the local county recorder's office. |

| Limitations | A quitclaim deed does not provide any warranties or guarantees about the property’s title, meaning the grantee assumes the risk. |

Consider Some Other Quitclaim Deed Forms for US States

Quit Claim Deed Form Ny Pdf - A Quitclaim Deed does not have to indicate a sale or payment; it can be a gift.

In addition to its protective features, a Hold Harmless Agreement can serve as a critical tool for individuals and businesses looking to mitigate risks in various scenarios, ensuring clarity in liability responsibilities. For those seeking to draft or understand such agreements more thoroughly, resources like OnlineLawDocs.com provide valuable guidance and templates.

Quitclaim Deed Ohio - This form can fast-track the process of transferring vacant lots or parcels.

Michigan Quit Claim Deed Pdf - The recipient of a Quitclaim Deed assumes any risk associated with the property's title.

Dos and Don'ts

When filling out the Illinois Quitclaim Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what you should and shouldn’t do:

- Do ensure that all names are spelled correctly. Mistakes can lead to complications in property transfer.

- Do include the legal description of the property. This is essential for identifying the exact location of the property.

- Do sign the form in front of a notary public. This step is crucial for the deed to be legally binding.

- Do provide the correct date of the transfer. This helps establish a clear timeline for the transaction.

- Don't leave any required fields blank. Incomplete forms may be rejected or cause delays.

- Don't use outdated forms. Always ensure you have the latest version of the Quitclaim Deed.

- Don't forget to check local recording requirements. Different counties may have specific rules regarding the submission of deeds.

- Don't assume that a Quitclaim Deed is the same as a warranty deed. Understand the differences to avoid future issues.