Valid Promissory Note Form for Illinois

In the realm of financial agreements, the Illinois Promissory Note stands out as a crucial document for both lenders and borrowers. This form serves as a written promise to repay a specified amount of money, typically with interest, within a designated timeframe. Clarity is key; the note outlines essential details such as the principal amount, interest rate, repayment schedule, and any applicable fees. Additionally, it may specify the consequences of default, ensuring that both parties understand their rights and obligations. The Illinois Promissory Note not only fosters transparency but also provides a legal framework that can protect the interests of both the lender and the borrower. Understanding its components is vital for anyone engaged in lending or borrowing, as it can help prevent misunderstandings and disputes down the line.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details, such as the names of the borrower and lender, can lead to confusion and potential disputes.

-

Incorrect Amount: Writing the wrong loan amount can create issues later. Always double-check the numerical and written amounts to ensure they match.

-

Missing Signatures: Both parties must sign the document. Omitting a signature can render the note unenforceable.

-

Not Dating the Document: A date is crucial. Without it, determining when the loan agreement was made can become problematic.

-

Failure to Specify Terms: Clearly outline repayment terms, including interest rates and due dates. Vague terms can lead to misunderstandings.

-

Ignoring State Laws: Each state has its own regulations regarding promissory notes. Not adhering to Illinois laws can affect the note's validity.

-

Not Including Default Terms: Specify what happens if the borrower defaults. This can protect the lender's interests.

-

Using Inconsistent Language: Consistency in terminology is key. Mixing terms can create ambiguity and confusion.

-

Not Keeping Copies: Both parties should retain a signed copy of the note. This ensures that both have access to the terms agreed upon.

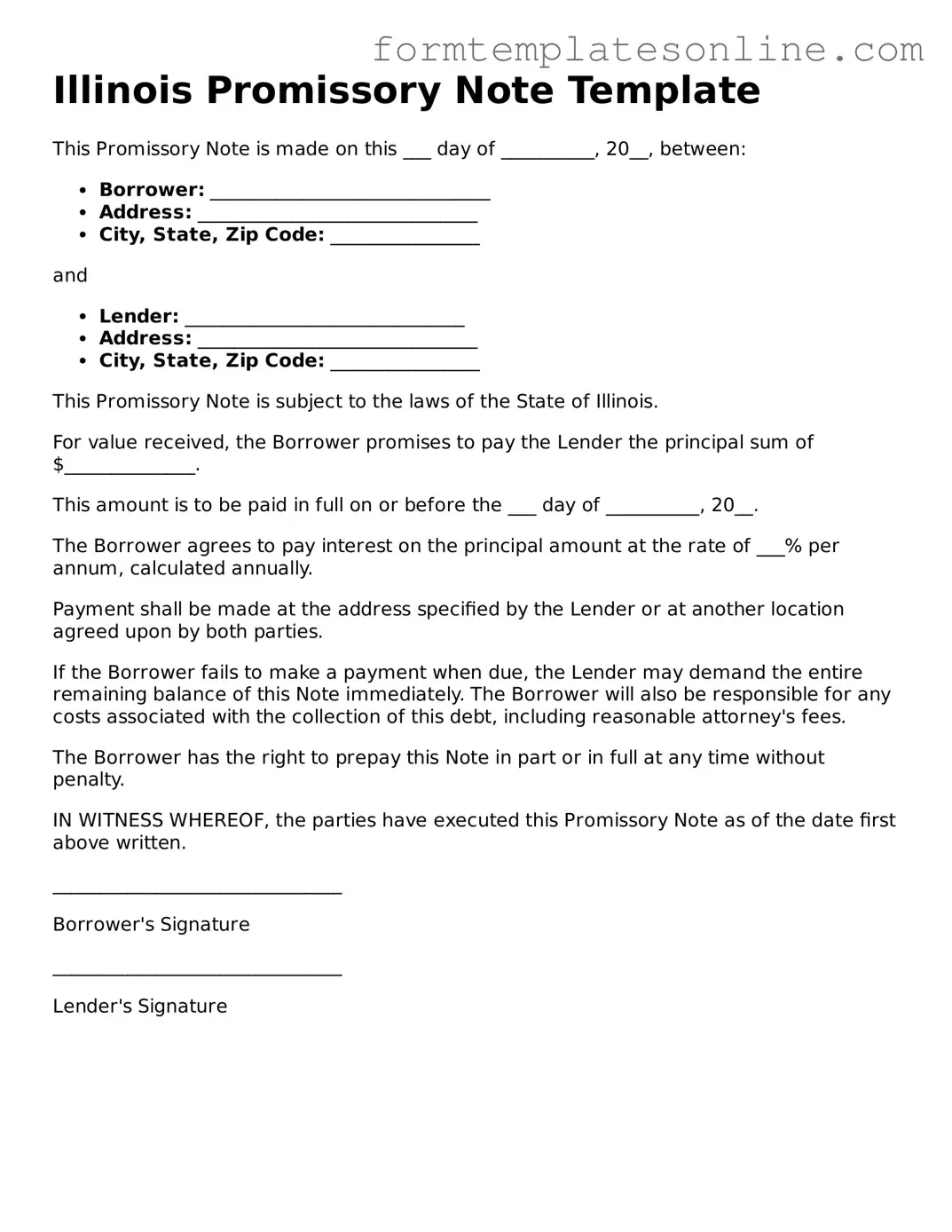

Example - Illinois Promissory Note Form

Illinois Promissory Note Template

This Promissory Note is made on this ___ day of __________, 20__, between:

- Borrower: ______________________________

- Address: ______________________________

- City, State, Zip Code: ________________

and

- Lender: ______________________________

- Address: ______________________________

- City, State, Zip Code: ________________

This Promissory Note is subject to the laws of the State of Illinois.

For value received, the Borrower promises to pay the Lender the principal sum of $______________.

This amount is to be paid in full on or before the ___ day of __________, 20__.

The Borrower agrees to pay interest on the principal amount at the rate of ___% per annum, calculated annually.

Payment shall be made at the address specified by the Lender or at another location agreed upon by both parties.

If the Borrower fails to make a payment when due, the Lender may demand the entire remaining balance of this Note immediately. The Borrower will also be responsible for any costs associated with the collection of this debt, including reasonable attorney's fees.

The Borrower has the right to prepay this Note in part or in full at any time without penalty.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

_______________________________

Borrower's Signature

_______________________________

Lender's Signature

More About Illinois Promissory Note

What is a Promissory Note in Illinois?

A Promissory Note is a legal document that outlines a promise to pay a specified amount of money to a designated party at a particular time or on demand. In Illinois, this document serves as evidence of a debt and includes details such as the principal amount, interest rate, repayment schedule, and any collateral involved.

Who can use a Promissory Note in Illinois?

Individuals, businesses, and organizations can utilize a Promissory Note in Illinois. Whether you are lending money to a friend, financing a business transaction, or securing a loan for personal use, this document is applicable in various situations where a debt relationship exists.

What information should be included in an Illinois Promissory Note?

An Illinois Promissory Note should include the names and addresses of the borrower and lender, the principal amount borrowed, the interest rate (if applicable), the repayment terms, and the date of the agreement. It may also specify any penalties for late payments or default, as well as details regarding collateral if the loan is secured.

Is a Promissory Note legally binding in Illinois?

Yes, a Promissory Note is legally binding in Illinois as long as it meets the necessary legal requirements. This includes the presence of mutual consent, consideration (something of value exchanged), and the capacity of the parties to enter into a contract. Properly executed, it can be enforced in a court of law.

Does a Promissory Note need to be notarized in Illinois?

While notarization is not strictly required for a Promissory Note to be valid in Illinois, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes regarding the validity of the signatures or the terms of the agreement.

What happens if the borrower defaults on the Promissory Note?

If a borrower defaults on a Promissory Note, the lender has several options. They may pursue legal action to recover the owed amount, which could involve filing a lawsuit. Additionally, if the loan is secured by collateral, the lender may have the right to seize that collateral as part of the repayment process.

Can a Promissory Note be modified in Illinois?

Yes, a Promissory Note can be modified in Illinois. Both parties must agree to the changes, and it is advisable to document any modifications in writing. This ensures clarity and helps prevent misunderstandings regarding the terms of the agreement.

What is the difference between a secured and unsecured Promissory Note?

A secured Promissory Note is backed by collateral, which means that if the borrower defaults, the lender can claim the collateral to recover their losses. An unsecured Promissory Note, on the other hand, does not involve collateral and relies solely on the borrower's promise to repay. The risk for the lender is higher in an unsecured note.

Where can I obtain a Promissory Note form in Illinois?

Promissory Note forms can be obtained from various sources, including online legal document providers, stationery stores, or through an attorney. It is important to ensure that the form complies with Illinois laws and includes all necessary information to be valid and enforceable.

Key takeaways

When filling out and utilizing the Illinois Promissory Note form, several important considerations can enhance your understanding and ensure proper use. Here are key takeaways to keep in mind:

- Understand the Purpose: A promissory note is a written promise to pay a specified amount of money at a designated time. Familiarity with its purpose is crucial.

- Identify the Parties: Clearly identify the borrower and lender in the document. This includes full names and addresses to avoid confusion.

- Specify the Amount: Clearly state the principal amount being borrowed. This figure should be accurate and reflect the actual loan amount.

- Outline the Terms of Repayment: Include detailed repayment terms, such as the payment schedule, due dates, and any grace periods.

- Include Interest Rates: If applicable, specify the interest rate. Ensure it complies with Illinois law to avoid legal issues.

- Consider Security: If the loan is secured, describe the collateral. This provides assurance to the lender and clarity to the borrower.

- Signatures Are Essential: Both parties must sign the document. This signifies agreement to the terms outlined in the note.

- Keep Copies: After signing, ensure that both parties retain copies of the promissory note for their records.

- Consult Legal Advice: If there are any uncertainties, seeking legal advice can clarify obligations and rights under the note.

- Understand Default Consequences: Be aware of what constitutes default and the potential repercussions for both parties involved.

By keeping these key points in mind, individuals can navigate the process of creating and utilizing a promissory note in Illinois with greater confidence and understanding.

File Details

| Fact Name | Description |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in the state of Illinois. |

| Parties Involved | The note involves two parties: the maker (the person who promises to pay) and the payee (the person who will receive the payment). |

| Interest Rate | The interest rate can be specified in the note. If not, Illinois law allows for a maximum of 5% per annum. |

| Payment Terms | Payment can be structured as a lump sum or in installments, depending on the agreement between the parties. |

| Signature Requirement | The maker must sign the promissory note for it to be legally binding. |

| Enforceability | A properly executed promissory note is enforceable in court if the terms are clear and agreed upon by both parties. |

| Default Consequences | If the maker defaults, the payee may pursue legal action to recover the owed amount, including interest and any applicable fees. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Template Georgia - This form holds the borrower legally accountable for repaying the borrowed amount.

In Georgia, utilizing a Georgia Motorcycle Bill of Sale form is crucial for ensuring a smooth transfer of motorcycle ownership, and you can find a reliable template at OnlineLawDocs.com. This document not only includes pertinent transaction details but also protects both the buyer and seller by providing proof of the purchase, which is necessary for registration and tax purposes.

Promissory Note New York - It is a straightforward document that avoids complex legal terminology.

Promissory Note Template California Word - A signed Promissory Note is often required to secure funding from investors or banks.

Dos and Don'ts

When filling out the Illinois Promissory Note form, it's important to be thorough and precise. Here are some essential dos and don’ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and lender.

- Do specify the loan amount clearly to avoid confusion.

- Do include the interest rate if applicable, and ensure it complies with state regulations.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific about repayment terms.

- Don't forget to sign and date the document to make it legally binding.