Valid Operating Agreement Form for Illinois

The Illinois Operating Agreement form serves as a crucial document for members of a limited liability company (LLC) in Illinois, outlining the internal structure and operational procedures of the business. This form addresses key aspects such as the management structure, member responsibilities, and profit distribution, ensuring that all parties have a clear understanding of their roles and obligations. Additionally, it can specify how decisions are made, how new members can be added, and the process for dissolving the company if necessary. By establishing these guidelines, the Operating Agreement helps prevent disputes among members and provides a framework for the LLC’s governance. While not legally required, having a well-drafted Operating Agreement is highly recommended, as it can enhance the legitimacy of the business and protect the interests of its members.

Common mistakes

-

Not including all members: It's crucial to list every member of the LLC in the Operating Agreement. Omitting a member can lead to disputes later on.

-

Failing to specify ownership percentages: Clearly stating each member's ownership percentage helps avoid confusion about profit distribution and decision-making authority.

-

Neglecting to outline management structure: Whether the LLC will be member-managed or manager-managed should be explicitly stated. This clarity can prevent management conflicts.

-

Ignoring voting rights: Define how voting will occur among members. Not addressing this can lead to disagreements on important business decisions.

-

Omitting procedures for adding or removing members: Including a process for changing membership ensures that the LLC can adapt as needed without legal complications.

-

Not addressing profit and loss distribution: Be specific about how profits and losses will be allocated among members. This avoids misunderstandings during financial distributions.

-

Forgetting to include a dispute resolution process: Having a plan for resolving disagreements can save time and money if conflicts arise among members.

-

Leaving out the duration of the LLC: Specify whether the LLC is intended to exist indefinitely or for a specific period. This can impact planning and operations.

-

Not reviewing the agreement regularly: An Operating Agreement should be a living document. Failing to revisit and update it can lead to outdated practices and potential legal issues.

Example - Illinois Operating Agreement Form

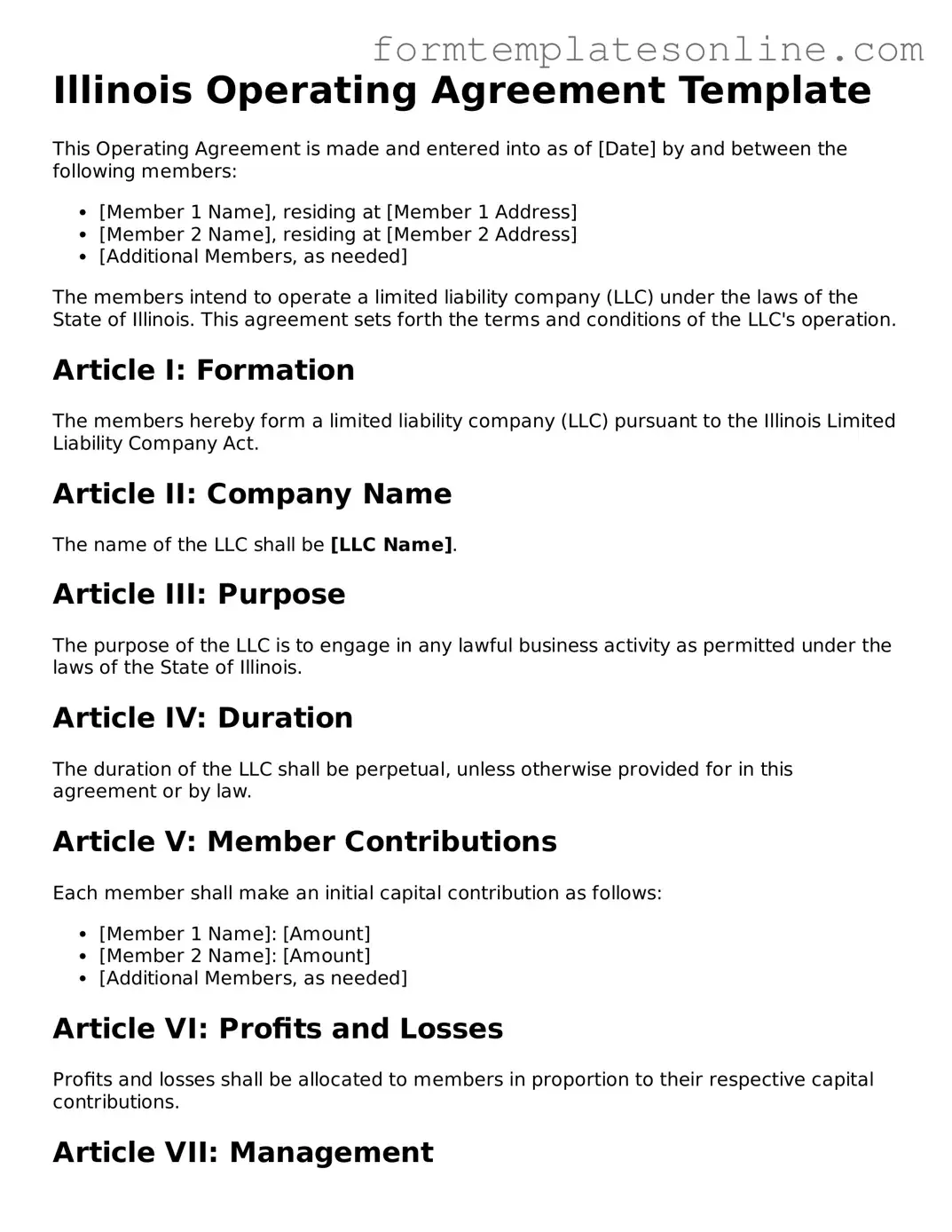

Illinois Operating Agreement Template

This Operating Agreement is made and entered into as of [Date] by and between the following members:

- [Member 1 Name], residing at [Member 1 Address]

- [Member 2 Name], residing at [Member 2 Address]

- [Additional Members, as needed]

The members intend to operate a limited liability company (LLC) under the laws of the State of Illinois. This agreement sets forth the terms and conditions of the LLC's operation.

Article I: Formation

The members hereby form a limited liability company (LLC) pursuant to the Illinois Limited Liability Company Act.

Article II: Company Name

The name of the LLC shall be [LLC Name].

Article III: Purpose

The purpose of the LLC is to engage in any lawful business activity as permitted under the laws of the State of Illinois.

Article IV: Duration

The duration of the LLC shall be perpetual, unless otherwise provided for in this agreement or by law.

Article V: Member Contributions

Each member shall make an initial capital contribution as follows:

- [Member 1 Name]: [Amount]

- [Member 2 Name]: [Amount]

- [Additional Members, as needed]

Article VI: Profits and Losses

Profits and losses shall be allocated to members in proportion to their respective capital contributions.

Article VII: Management

The LLC shall be managed by its members. Decisions shall be made by a majority vote of the members.

Article VIII: Indemnification

The LLC shall indemnify any member against any liabilities to the maximum extent allowed by Illinois law.

Article IX: Amendment

This Operating Agreement may only be amended by a written agreement signed by all members.

Article X: Miscellaneous

This agreement constitutes the entire understanding among the members and supersedes all previous agreements, oral or written.

IN WITNESS WHEREOF, the undersigned members have executed this Operating Agreement as of the date first above written.

_____________________________

[Member 1 Name]

_____________________________

[Member 2 Name]

_____________________________

[Additional Members, as needed]

More About Illinois Operating Agreement

What is an Illinois Operating Agreement?

An Illinois Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Illinois. This agreement serves as a blueprint for how the LLC will be run, detailing the roles and responsibilities of its members, decision-making processes, and distribution of profits and losses. While it is not required by state law, having an Operating Agreement is highly recommended as it helps prevent disputes among members and provides clarity in operations.

Is an Operating Agreement required in Illinois?

No, an Operating Agreement is not legally required for LLCs in Illinois. However, it is advisable to create one. Having an Operating Agreement can protect the limited liability status of the members and provide a clear framework for managing the business. In case of disputes or legal issues, this document can serve as evidence of the agreed-upon terms among members.

What should be included in an Illinois Operating Agreement?

An Illinois Operating Agreement should include several key elements. These typically encompass the name of the LLC, the purpose of the business, the names and addresses of the members, and the management structure (member-managed or manager-managed). Additionally, it should outline the procedures for adding new members, handling member departures, and resolving disputes. Profit and loss distribution, as well as voting rights, should also be clearly defined to ensure all members understand their rights and responsibilities.

How can I create an Operating Agreement for my LLC in Illinois?

Key takeaways

Filling out and utilizing the Illinois Operating Agreement form is an important step for any business entity operating as a limited liability company (LLC) in Illinois. Here are some key takeaways to consider:

- Understand the Purpose: The Operating Agreement serves as a foundational document that outlines the management structure, responsibilities, and operational procedures of the LLC. It helps prevent misunderstandings among members.

- Customize the Agreement: Each LLC is unique. Tailor the Operating Agreement to reflect the specific needs and goals of your business. This can include member roles, profit distribution, and decision-making processes.

- Legal Protection: Having a well-drafted Operating Agreement can provide legal protection for members. It clarifies the rights and obligations of each member, which can be crucial in disputes.

- Compliance with State Laws: Ensure that your Operating Agreement complies with Illinois state laws. This includes adhering to any specific provisions required by the Illinois Limited Liability Company Act.

- Review and Update Regularly: As your business evolves, so should your Operating Agreement. Regularly review and update the document to reflect changes in membership, management, or business objectives.

By paying attention to these key points, you can create a robust Operating Agreement that supports your LLC's success and fosters positive relationships among members.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Operating Agreement outlines the management structure and operating procedures for an LLC. |

| Governing Law | The agreement is governed by the Illinois Limited Liability Company Act (805 ILCS 180). |

| Member Rights | It specifies the rights and responsibilities of each member involved in the LLC. |

| Flexibility | The Operating Agreement allows for flexibility in management and profit distribution among members. |

| Internal Rules | It establishes internal rules for decision-making and dispute resolution. |

| Not Required | While it is not mandatory in Illinois, having an Operating Agreement is highly recommended. |

| Amendments | Members can amend the agreement as needed to reflect changes in the business or membership. |

| Confidentiality | The agreement can include confidentiality clauses to protect sensitive information. |

| Effective Date | The Operating Agreement becomes effective upon signing by all members unless stated otherwise. |

Consider Some Other Operating Agreement Forms for US States

Operating Agreement Llc Florida Template - This document can prevent misunderstandings regarding member roles.

North Carolina Llc Operating Agreement Template - This document can facilitate smoother business operations and transitions.

The Dirt Bike Bill of Sale form is a crucial document used when buying or selling a dirt bike in New York. This form serves to record the transaction, providing both parties with proof of ownership and details about the sale. For further information and resources, you can visit https://documentonline.org/blank-new-york-dirt-bike-bill-of-sale. Understanding its importance can help ensure a smooth and legal transfer of ownership.

Llc Operating Agreement Ohio - It details how profits and losses are shared among members.

Llc Operating Agreement Georgia - It may include provisions for adding or removing members.

Dos and Don'ts

When filling out the Illinois Operating Agreement form, it's essential to approach the task with care. Here are some key dos and don’ts to keep in mind:

- Do read the entire form carefully before you start filling it out.

- Do provide accurate information about all members and their roles.

- Do specify the management structure clearly to avoid future confusion.

- Do include provisions for dispute resolution to handle potential conflicts.

- Don't leave any sections blank; if a section doesn't apply, indicate that clearly.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't forget to have all members sign the agreement to make it valid.