Valid Motor Vehicle Bill of Sale Form for Illinois

The Illinois Motor Vehicle Bill of Sale form serves as an essential document in the process of buying or selling a vehicle in the state. This form provides a written record of the transaction, capturing vital details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN). Both the buyer and seller must complete the form, ensuring that it includes their names, addresses, and signatures. The bill of sale not only acts as proof of purchase but also aids in the transfer of ownership and can be important for tax purposes. Additionally, it may include information about the sale price and any warranties or conditions associated with the vehicle. By having this document on hand, individuals can protect their interests and facilitate a smoother transaction when engaging in vehicle sales in Illinois.

Common mistakes

-

Incorrect Vehicle Information: Many people fail to accurately fill out the vehicle details, such as the make, model, year, and VIN. This information must match the vehicle’s title to avoid complications.

-

Missing Signatures: Both the seller and buyer must sign the bill of sale. Omitting one of the signatures can lead to disputes or issues with registration.

-

Failure to Date the Document: Not including the date on the bill of sale can create confusion about when the transaction occurred, which may affect tax liabilities or ownership claims.

-

Incomplete Payment Information: It’s essential to specify the sale price and payment method. Leaving this information out can lead to misunderstandings about the terms of the sale.

-

Not Providing a Copy: Many sellers forget to provide a copy of the signed bill of sale to the buyer. This document serves as proof of purchase and is crucial for the buyer’s records.

-

Ignoring State Requirements: Some individuals overlook specific state requirements for the bill of sale. Familiarizing yourself with Illinois regulations can prevent legal issues later on.

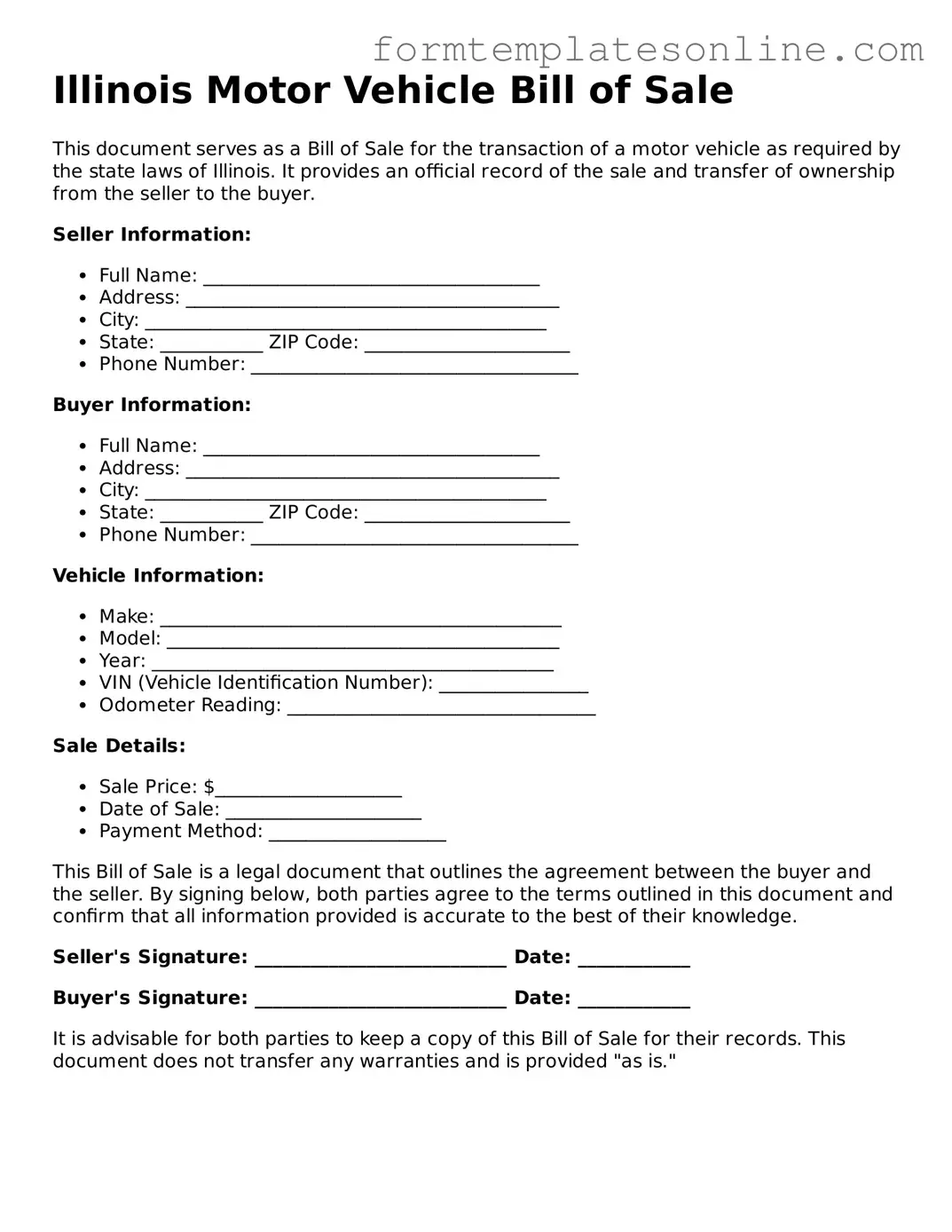

Example - Illinois Motor Vehicle Bill of Sale Form

Illinois Motor Vehicle Bill of Sale

This document serves as a Bill of Sale for the transaction of a motor vehicle as required by the state laws of Illinois. It provides an official record of the sale and transfer of ownership from the seller to the buyer.

Seller Information:

- Full Name: ____________________________________

- Address: ________________________________________

- City: ___________________________________________

- State: ___________ ZIP Code: ______________________

- Phone Number: ___________________________________

Buyer Information:

- Full Name: ____________________________________

- Address: ________________________________________

- City: ___________________________________________

- State: ___________ ZIP Code: ______________________

- Phone Number: ___________________________________

Vehicle Information:

- Make: ___________________________________________

- Model: __________________________________________

- Year: ___________________________________________

- VIN (Vehicle Identification Number): ________________

- Odometer Reading: _________________________________

Sale Details:

- Sale Price: $____________________

- Date of Sale: _____________________

- Payment Method: ___________________

This Bill of Sale is a legal document that outlines the agreement between the buyer and the seller. By signing below, both parties agree to the terms outlined in this document and confirm that all information provided is accurate to the best of their knowledge.

Seller's Signature: ___________________________ Date: ____________

Buyer's Signature: ___________________________ Date: ____________

It is advisable for both parties to keep a copy of this Bill of Sale for their records. This document does not transfer any warranties and is provided "as is."

More About Illinois Motor Vehicle Bill of Sale

What is the Illinois Motor Vehicle Bill of Sale form?

The Illinois Motor Vehicle Bill of Sale form is a document used to record the sale of a vehicle in the state of Illinois. It serves as proof of the transaction between the buyer and seller. This form includes important details such as the vehicle's make, model, year, VIN (Vehicle Identification Number), and the sale price. Both parties should sign the form to validate the transaction, making it a crucial part of the buying and selling process.

Is the Bill of Sale required to register a vehicle in Illinois?

While the Bill of Sale is not strictly required to register a vehicle in Illinois, it is highly recommended. Having this document can simplify the registration process and provide proof of ownership. When you go to register your vehicle, the Illinois Secretary of State’s office may ask for it, especially if there is no title available. It helps establish a clear chain of ownership and can be beneficial in case of disputes.

Can I create my own Bill of Sale for my vehicle in Illinois?

Yes, you can create your own Bill of Sale for a vehicle in Illinois. However, it must include specific information to be effective. Essential details include the names and addresses of both the buyer and seller, the vehicle's description (make, model, year, and VIN), the sale price, and the date of the transaction. Both parties should sign the document. Using a standard form can help ensure you include all necessary information.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The seller should provide the buyer with the original document, as it serves as proof of the sale. The buyer will need this document when registering the vehicle with the Illinois Secretary of State. Additionally, if the vehicle has a title, the seller should sign it over to the buyer at the same time.

Key takeaways

When filling out and using the Illinois Motor Vehicle Bill of Sale form, consider the following key takeaways:

- Required Information: Include essential details such as the names and addresses of both the buyer and seller, vehicle identification number (VIN), make, model, year, and sale price.

- Signatures: Both the buyer and seller must sign the form to validate the transaction. Ensure signatures are dated.

- Notarization: While notarization is not mandatory, it can provide an extra layer of security and authenticity to the document.

- Record Keeping: Both parties should keep a copy of the completed Bill of Sale for their records. This serves as proof of the transaction.

- Sales Tax: The buyer may be responsible for paying sales tax when registering the vehicle. The Bill of Sale can be used to calculate the tax amount.

- Title Transfer: This document is often required when transferring the vehicle title to the new owner. Ensure the title is also signed over to the buyer.

- Completeness: Double-check all entries for accuracy. Incomplete or incorrect information can lead to complications during registration.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Motor Vehicle Bill of Sale form serves as a legal document that records the sale of a motor vehicle between a buyer and a seller. |

| Governing Law | This form is governed by the Illinois Vehicle Code, specifically 625 ILCS 5/3-202. |

| Required Information | The form must include details such as the vehicle identification number (VIN), make, model, year, and odometer reading at the time of sale. |

| Signatures | Both the seller and buyer must sign the Bill of Sale to validate the transaction. This ensures that both parties agree to the terms of the sale. |

| Notarization | While notarization is not required, it is recommended to provide additional verification of the identities of the parties involved. |

| Tax Implications | The Bill of Sale may be used to calculate sales tax owed on the purchase of the vehicle, which is typically paid at the time of registration. |

| Record Keeping | Both the buyer and seller should retain a copy of the Bill of Sale for their records, as it serves as proof of the transaction and ownership transfer. |

Consider Some Other Motor Vehicle Bill of Sale Forms for US States

Ohio Title Application - Provides an official record for tax purposes post-sale.

Bill of Sale Michigan Template - Can highlight any known issues with the vehicle for full transparency.

Dos and Don'ts

When filling out the Illinois Motor Vehicle Bill of Sale form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are seven things to keep in mind:

- Do: Provide accurate information about the vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

- Do: Include the sale price clearly to avoid any confusion later on.

- Do: Sign the form, as both the buyer and seller need to provide their signatures for the sale to be valid.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Don't: Leave any sections blank; all required fields should be filled out completely.

- Don't: Use white-out or erase any information; if a mistake is made, it's better to cross it out and write the correct information.

- Don't: Forget to check local regulations that might require additional information or specific forms.