Valid Loan Agreement Form for Illinois

When navigating the world of personal or business loans in Illinois, understanding the Illinois Loan Agreement form is essential. This document serves as a crucial tool for both lenders and borrowers, outlining the terms and conditions of the loan. It typically includes key elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the form may specify the rights and responsibilities of each party, ensuring clarity and mutual understanding. By addressing potential scenarios like late payments or defaults, the agreement aims to protect both the lender's investment and the borrower's interests. Familiarity with this form not only streamlines the borrowing process but also helps individuals and businesses make informed financial decisions, paving the way for successful transactions.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. Missing names, addresses, or loan amounts can lead to delays or rejections.

-

Incorrect Dates: Entering the wrong dates, such as the loan start or end date, can create confusion and complicate the agreement.

-

Failure to Read Terms: Some people skip reading the loan terms and conditions. Understanding these is crucial to avoid unexpected obligations.

-

Not Including Signatures: Neglecting to sign the agreement is a common oversight. Without signatures, the document is not legally binding.

-

Ignoring Witness Requirements: Some loan agreements require witnesses. Failing to include them can invalidate the agreement.

-

Providing Inaccurate Financial Information: Misstating income or debts can lead to issues with loan approval. Accurate financial details are essential.

-

Not Keeping Copies: After submitting the form, individuals often forget to keep a copy for their records. Having a copy is important for future reference.

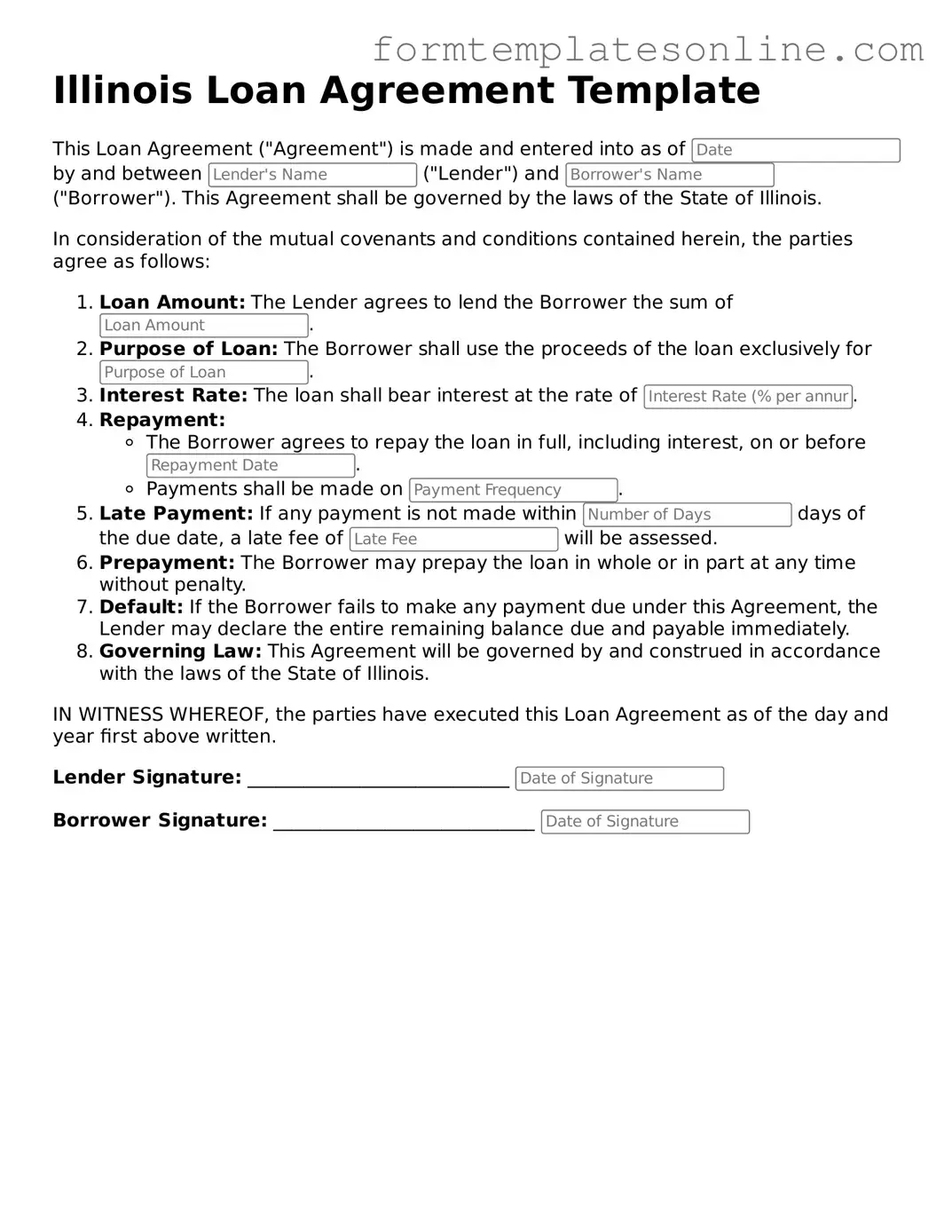

Example - Illinois Loan Agreement Form

Illinois Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of by and between ("Lender") and ("Borrower"). This Agreement shall be governed by the laws of the State of Illinois.

In consideration of the mutual covenants and conditions contained herein, the parties agree as follows:

- Loan Amount: The Lender agrees to lend the Borrower the sum of .

- Purpose of Loan: The Borrower shall use the proceeds of the loan exclusively for .

- Interest Rate: The loan shall bear interest at the rate of .

- Repayment:

- The Borrower agrees to repay the loan in full, including interest, on or before .

- Payments shall be made on .

- Late Payment: If any payment is not made within days of the due date, a late fee of will be assessed.

- Prepayment: The Borrower may prepay the loan in whole or in part at any time without penalty.

- Default: If the Borrower fails to make any payment due under this Agreement, the Lender may declare the entire remaining balance due and payable immediately.

- Governing Law: This Agreement will be governed by and construed in accordance with the laws of the State of Illinois.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the day and year first above written.

Lender Signature: ____________________________

Borrower Signature: ____________________________

More About Illinois Loan Agreement

What is an Illinois Loan Agreement form?

An Illinois Loan Agreement form is a legal document used to outline the terms and conditions of a loan between a lender and a borrower in the state of Illinois. This form specifies important details such as the loan amount, interest rate, repayment schedule, and any collateral involved.

Who can use an Illinois Loan Agreement?

Any individual or business in Illinois can use a Loan Agreement. Whether you are lending money to a friend, family member, or a business, having a written agreement helps protect both parties and clarifies expectations.

What information is typically included in the Loan Agreement?

The agreement generally includes the names and contact information of both parties, the loan amount, interest rate, repayment terms, due dates, and any penalties for late payments. It may also detail what happens if the borrower defaults on the loan.

Is it necessary to have a Loan Agreement in writing?

While verbal agreements can be legally binding, having a written Loan Agreement is highly recommended. A written document provides clear evidence of the terms and helps prevent misunderstandings or disputes in the future.

Do I need a lawyer to create a Loan Agreement?

You do not necessarily need a lawyer to create a Loan Agreement, as many templates are available online. However, consulting with a lawyer can ensure that the agreement meets legal requirements and adequately protects your interests.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as agreed, the lender may have several options. These can include pursuing legal action, negotiating a new repayment plan, or collecting any collateral specified in the agreement. The specific actions depend on the terms outlined in the Loan Agreement.

Can the Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to avoid confusion later.

Is the Loan Agreement enforceable in court?

Yes, a properly drafted Loan Agreement is generally enforceable in court. If a dispute arises, the agreement serves as evidence of the terms agreed upon by both parties, making it easier to resolve any issues legally.

What should I do if I have more questions about the Loan Agreement?

If you have more questions about the Loan Agreement or need assistance, consider reaching out to a legal professional. They can provide guidance tailored to your specific situation and help ensure that your interests are protected.

Key takeaways

When dealing with the Illinois Loan Agreement form, it’s essential to understand its key components and how to use it effectively. Here are some important takeaways:

- Clarity is Crucial: Ensure that all terms of the loan are clearly defined. This includes the loan amount, interest rate, repayment schedule, and any fees. Ambiguity can lead to misunderstandings down the line.

- Identify the Parties: Clearly identify both the lender and the borrower. Include full names and addresses to avoid any confusion about who is involved in the agreement.

- Document the Purpose: Specify the purpose of the loan. This can help both parties understand the context and expectations surrounding the agreement.

- Include Default Terms: Outline what happens in the event of a default. This might include late fees, acceleration of the loan, or other consequences. Being upfront about these terms can prevent disputes later.

- Seek Legal Advice: While filling out the form may seem straightforward, consulting with a legal professional can provide peace of mind. They can help ensure that the agreement complies with state laws and protects your interests.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Illinois. |

| Parties Involved | The form requires the names and addresses of both the lender and the borrower. |

| Loan Amount | The specific amount of money being loaned must be clearly stated in the agreement. |

| Interest Rate | The form should specify the interest rate applicable to the loan, if any. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment methods, are included. |

| Default Conditions | The agreement outlines what constitutes a default and the consequences that follow. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | The form may include provisions for how amendments to the agreement can be made. |

Consider Some Other Loan Agreement Forms for US States

New York Promissory Note - Provisions for securing the loan with collateral may be included.

Texas Promissory Note Requirements - The Loan Agreement may specify governing law, indicating the jurisdiction that applies in disputes.

The Georgia Deed form is a crucial document used in real estate transactions within the state of Georgia. It legally transfers property ownership from the seller to the buyer. For more information on the specifics of the Georgia Deed form, you can visit OnlineLawDocs.com, where valuable resources are available to help ensure clarity and compliance in your transactions.

Promissory Note Template Georgia - It can support better financial planning for both borrowers and lenders.

Dos and Don'ts

When filling out the Illinois Loan Agreement form, it’s important to ensure accuracy and clarity. Here are some key dos and don’ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about both the lender and borrower.

- Do check for any specific state requirements that may apply.

- Do ensure all signatures are present and dated.

- Do keep a copy of the completed agreement for your records.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't forget to review the terms of the loan carefully.

- Don't rush through the process; take your time to avoid mistakes.

- Don't ignore the importance of legal advice if needed.