Valid Last Will and Testament Form for Illinois

Creating a Last Will and Testament is a crucial step in ensuring that one's wishes regarding the distribution of assets and care of dependents are honored after passing. In Illinois, the Last Will and Testament form serves as a legally binding document that outlines how an individual's estate should be managed and distributed upon their death. This form typically includes essential components such as the testator's identification, the appointment of an executor, and specific bequests to beneficiaries. It also addresses guardianship for minor children, should the need arise. Furthermore, the document must adhere to state laws regarding signatures and witnesses to be considered valid. Understanding these key elements can help individuals navigate the process of creating a will that reflects their intentions and provides clarity for their loved ones during a challenging time.

Common mistakes

-

Not naming an executor: Failing to designate an executor can lead to confusion and disputes among family members. The executor is responsible for carrying out your wishes, so it’s crucial to choose someone you trust.

-

Overlooking witness requirements: In Illinois, a will must be signed by at least two witnesses who are not beneficiaries. Ignoring this requirement can render the will invalid.

-

Being vague about assets: Clearly listing your assets is essential. If you leave descriptions too vague, it may lead to misunderstandings or disputes among heirs.

-

Not updating the will: Life changes such as marriage, divorce, or the birth of a child require updates to your will. Failing to do so can result in unintended distributions of your estate.

Example - Illinois Last Will and Testament Form

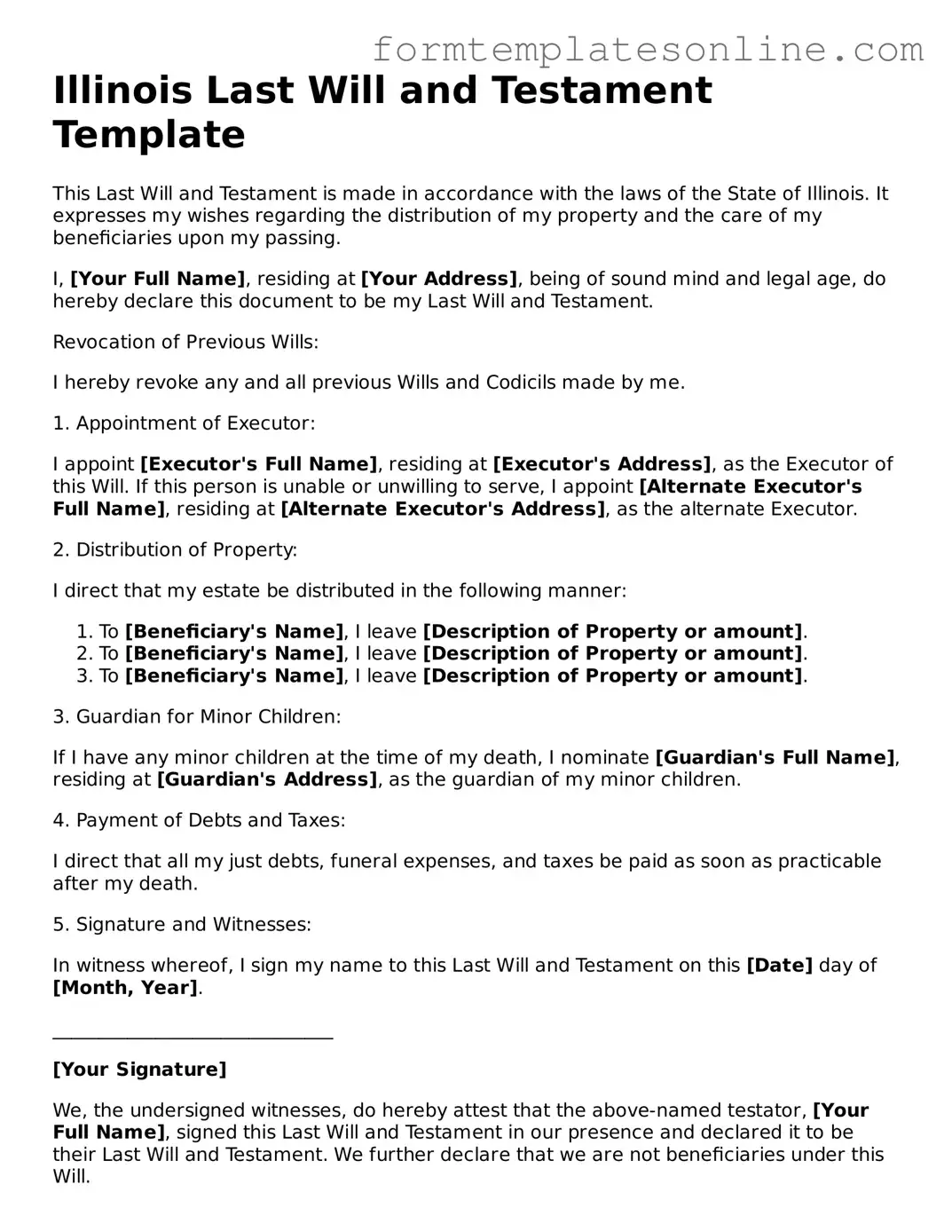

Illinois Last Will and Testament Template

This Last Will and Testament is made in accordance with the laws of the State of Illinois. It expresses my wishes regarding the distribution of my property and the care of my beneficiaries upon my passing.

I, [Your Full Name], residing at [Your Address], being of sound mind and legal age, do hereby declare this document to be my Last Will and Testament.

Revocation of Previous Wills:

I hereby revoke any and all previous Wills and Codicils made by me.

1. Appointment of Executor:

I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of this Will. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Full Name], residing at [Alternate Executor's Address], as the alternate Executor.

2. Distribution of Property:

I direct that my estate be distributed in the following manner:

- To [Beneficiary's Name], I leave [Description of Property or amount].

- To [Beneficiary's Name], I leave [Description of Property or amount].

- To [Beneficiary's Name], I leave [Description of Property or amount].

3. Guardian for Minor Children:

If I have any minor children at the time of my death, I nominate [Guardian's Full Name], residing at [Guardian's Address], as the guardian of my minor children.

4. Payment of Debts and Taxes:

I direct that all my just debts, funeral expenses, and taxes be paid as soon as practicable after my death.

5. Signature and Witnesses:

In witness whereof, I sign my name to this Last Will and Testament on this [Date] day of [Month, Year].

______________________________

[Your Signature]

We, the undersigned witnesses, do hereby attest that the above-named testator, [Your Full Name], signed this Last Will and Testament in our presence and declared it to be their Last Will and Testament. We further declare that we are not beneficiaries under this Will.

______________________________

[Witness 1's Name] - [Date]

______________________________

[Witness 2's Name] - [Date]

This document is a template designed to provide a clear framework for your Last Will and Testament in Illinois. It's recommended to consult with a legal professional to ensure compliance with state laws and to address any specific needs.

More About Illinois Last Will and Testament

What is a Last Will and Testament in Illinois?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Illinois, this document allows individuals to specify beneficiaries, appoint guardians for minor children, and name an executor to manage the estate. It is an essential tool for ensuring that a person's wishes are honored and can help avoid disputes among heirs.

Who can create a Last Will and Testament in Illinois?

In Illinois, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. This means that the person must be capable of understanding the nature and consequences of making a will. There are no residency requirements, so even non-residents can create a will that is valid in Illinois, as long as it complies with state laws.

What are the requirements for a valid Last Will and Testament in Illinois?

For a Last Will and Testament to be valid in Illinois, it must be in writing and signed by the testator (the person making the will). Additionally, the will must be witnessed by at least two individuals who are present at the same time. These witnesses must also sign the will, affirming that they witnessed the testator's signature. It is advisable that witnesses are not beneficiaries of the will to avoid potential conflicts of interest.

Can I change or revoke my Last Will and Testament?

Yes, individuals can change or revoke their Last Will and Testament at any time while they are still alive. This can be done by creating a new will that explicitly revokes the previous one or by making amendments, known as codicils, to the existing will. It is important to follow the same formalities as the original will when making changes to ensure that the new document is valid.

What happens if I die without a Last Will and Testament in Illinois?

If a person dies without a Last Will and Testament, they are considered to have died "intestate." In this case, Illinois state law dictates how the deceased's assets will be distributed. Typically, the estate will be divided among the surviving spouse and children, but the specific distribution can vary based on the family situation. This can lead to delays and potential disputes among family members.

Can I use a template for my Last Will and Testament?

Yes, many individuals choose to use templates for their Last Will and Testament. However, it is crucial to ensure that the template complies with Illinois laws. While templates can be helpful, they may not address specific personal circumstances or unique wishes. Consulting with a legal professional can provide guidance tailored to individual needs.

What is the role of an executor in a Last Will and Testament?

The executor is the person appointed in the will to manage the deceased's estate. This role includes gathering assets, paying debts and taxes, and distributing the remaining assets to beneficiaries according to the terms of the will. The executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries, ensuring that all actions comply with the law.

How can I ensure my Last Will and Testament is executed properly?

To ensure that a Last Will and Testament is executed properly, it is important to follow all legal requirements, including proper signing and witnessing. Keeping the will in a safe place and informing the executor and family members of its location can also help. Additionally, reviewing the will periodically and updating it as life circumstances change can help ensure that it accurately reflects current wishes.

Is it necessary to hire a lawyer to create a Last Will and Testament in Illinois?

While it is not legally required to hire a lawyer to create a Last Will and Testament in Illinois, doing so can provide valuable assistance. A lawyer can help ensure that the will complies with state laws, address specific needs, and minimize the likelihood of future disputes. For individuals with complex estates or unique circumstances, consulting a lawyer is often advisable.

Key takeaways

When filling out and using the Illinois Last Will and Testament form, it is essential to understand several key points. Here are ten important takeaways to keep in mind:

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in Illinois.

- Written Document: The will must be in writing. Oral wills are not recognized in Illinois.

- Signature Requirement: You must sign the will at the end. If you cannot sign, you may direct someone else to sign on your behalf in your presence.

- Witnesses: Illinois requires at least two witnesses who are present at the same time. They must also sign the will.

- Revocation: A will can be revoked by creating a new will or by destroying the original document. Be clear about your intentions to avoid confusion.

- Executor Designation: Choose an executor to manage your estate. This person will ensure your wishes are carried out after your death.

- Clear Instructions: Provide clear instructions regarding the distribution of your assets. Vague language can lead to disputes among heirs.

- Specific Bequests: If you want to leave specific items to individuals, list them clearly to avoid misunderstandings.

- Legal Advice: Consider consulting with an attorney. They can help ensure your will meets all legal requirements and reflects your wishes accurately.

- Storage: Keep your will in a safe place and inform your executor where it can be found. This ensures it can be accessed when needed.

By following these guidelines, you can create a will that effectively communicates your wishes and helps prevent potential conflicts among your loved ones.

File Details

| Fact Name | Description |

|---|---|

| Legal Requirement | The Illinois Last Will and Testament must be in writing and signed by the testator. |

| Witnesses | At least two witnesses are required to sign the will in the presence of the testator. |

| Age Requirement | The testator must be at least 18 years old to create a valid will in Illinois. |

| Revocation | A will can be revoked by the testator at any time, typically through a new will or by destroying the old one. |

| Governing Law | The Illinois Probate Act of 1975 governs the creation and execution of wills in Illinois. |

| Holographic Wills | Illinois recognizes holographic wills, which are handwritten and do not require witnesses, under certain conditions. |

Consider Some Other Last Will and Testament Forms for US States

Wills in Florida - Ensures that the person's wishes are honored after their passing.

Free Ohio Will Template - Can help protect family heirlooms and specific assets from being mismanaged.

How to Get a Will in Pa - Establishes an executor to manage and distribute the estate according to the will.

The Wisconsin Homeschool Letter of Intent form is a crucial document that parents must submit to officially declare their intention to homeschool their children. This form serves as a formal notification to the local school district, ensuring compliance with state education laws. By completing this form, parents take an important step in shaping their children's educational journey, making it essential to access the Homeschool Letter of Intent form for proper submission.

Free Will Forms to Print - Encourages individuals to reflect on their legacy and how they wish to be remembered.

Dos and Don'ts

When preparing to fill out the Illinois Last Will and Testament form, it is essential to approach the task with care and attention to detail. Below is a list of things you should and shouldn't do during this important process.

- Do ensure that you are of sound mind and legal age (18 years or older) when creating your will.

- Do clearly identify yourself in the document, including your full name and address.

- Do specify how you wish your assets to be distributed among your beneficiaries.

- Do sign your will in the presence of at least two witnesses, who should also sign the document.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to keep your will in a safe place and inform your executor of its location.

Taking these steps can help ensure that your wishes are honored and that the process goes smoothly for your loved ones.