Valid Durable Power of Attorney Form for Illinois

The Illinois Durable Power of Attorney form is a vital legal document that allows individuals to appoint someone they trust to make decisions on their behalf in the event they become incapacitated. This form covers a range of important areas, including financial, medical, and personal matters. By designating an agent, or attorney-in-fact, the principal ensures that their wishes are honored even when they cannot communicate them directly. The form remains effective even if the principal becomes mentally or physically unable to manage their own affairs, providing peace of mind for both the individual and their loved ones. It is essential to understand the different powers that can be granted, as well as the responsibilities that come with being an agent. Additionally, the Illinois Durable Power of Attorney form must meet specific legal requirements to be valid, such as being signed in the presence of a witness and notarized. This document not only facilitates decision-making but also helps to prevent potential disputes among family members regarding the principal's care and financial management.

Common mistakes

-

Not naming an alternate agent. Many individuals overlook the importance of appointing an alternate agent. This can lead to complications if the primary agent is unable or unwilling to act on your behalf.

-

Failing to specify the powers granted. Some people do not clearly outline the powers they wish to grant to their agent. This lack of specificity can create confusion and limit the agent's ability to make decisions in your best interest.

-

Inadequate witness signatures. The Illinois Durable Power of Attorney form requires proper witnessing. Failing to have the document signed by the appropriate number of witnesses can render it invalid.

-

Not dating the document. A common mistake is neglecting to date the form. Without a date, it may be difficult to determine when the authority was granted, which can lead to disputes.

-

Using outdated forms. Some individuals may use an old version of the Durable Power of Attorney form. It is essential to ensure that the form being used complies with the current Illinois laws.

-

Overlooking the agent's qualifications. Choosing an agent without considering their ability to handle financial or medical matters can result in poor decision-making. It is vital to select someone trustworthy and capable.

-

Not discussing the decision with the agent. Failing to communicate your wishes and expectations with your chosen agent can lead to misunderstandings and unintended actions.

-

Neglecting to revoke previous powers of attorney. If you have previously executed a Durable Power of Attorney, it is crucial to formally revoke it before creating a new one. Otherwise, conflicting directives may arise.

-

Forgetting to keep copies of the document. After the form is completed, individuals often forget to make copies. Keeping copies ensures that the agent and relevant parties have access to the document when needed.

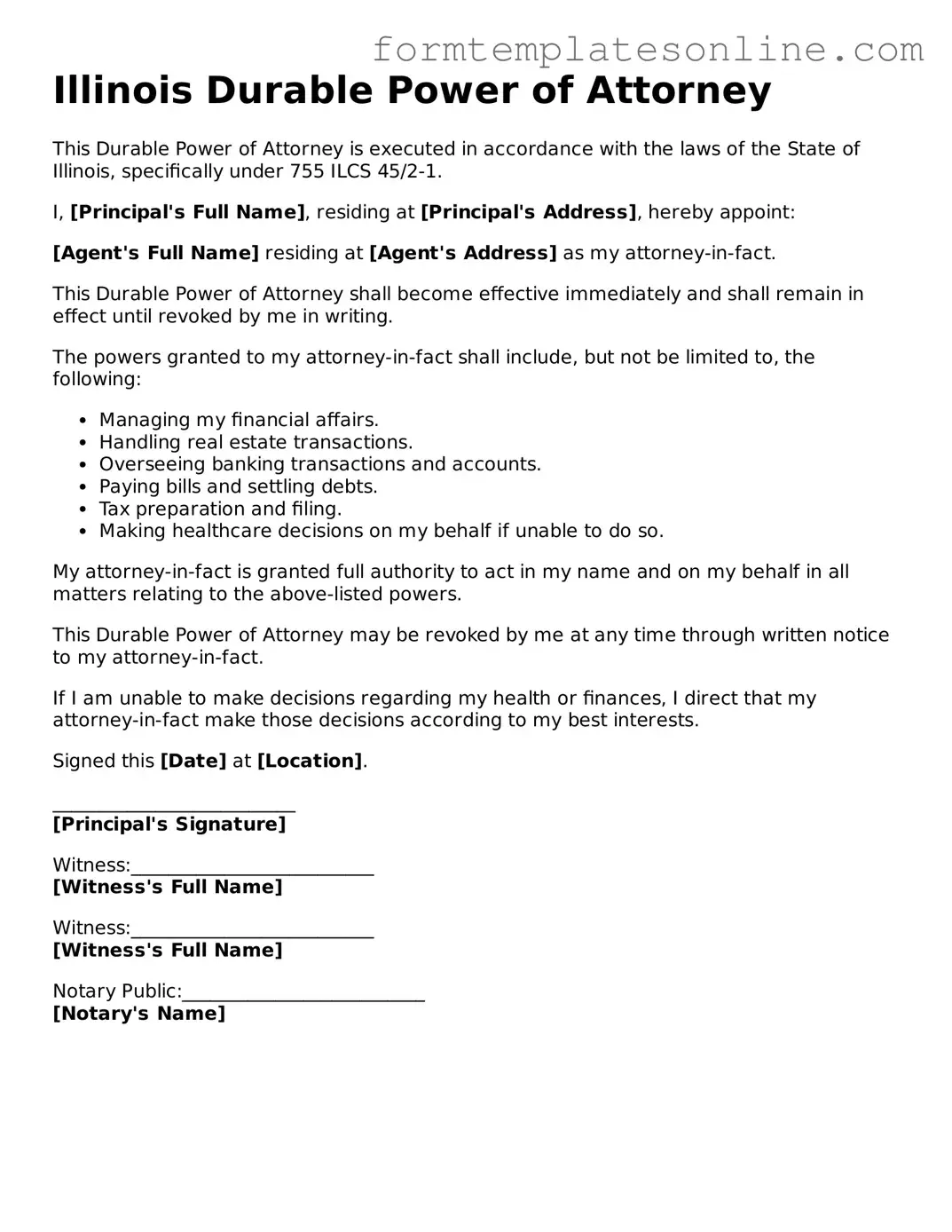

Example - Illinois Durable Power of Attorney Form

Illinois Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the State of Illinois, specifically under 755 ILCS 45/2-1.

I, [Principal's Full Name], residing at [Principal's Address], hereby appoint:

[Agent's Full Name] residing at [Agent's Address] as my attorney-in-fact.

This Durable Power of Attorney shall become effective immediately and shall remain in effect until revoked by me in writing.

The powers granted to my attorney-in-fact shall include, but not be limited to, the following:

- Managing my financial affairs.

- Handling real estate transactions.

- Overseeing banking transactions and accounts.

- Paying bills and settling debts.

- Tax preparation and filing.

- Making healthcare decisions on my behalf if unable to do so.

My attorney-in-fact is granted full authority to act in my name and on my behalf in all matters relating to the above-listed powers.

This Durable Power of Attorney may be revoked by me at any time through written notice to my attorney-in-fact.

If I am unable to make decisions regarding my health or finances, I direct that my attorney-in-fact make those decisions according to my best interests.

Signed this [Date] at [Location].

__________________________

[Principal's Signature]

Witness:__________________________

[Witness's Full Name]

Witness:__________________________

[Witness's Full Name]

Notary Public:__________________________

[Notary's Name]

More About Illinois Durable Power of Attorney

What is a Durable Power of Attorney in Illinois?

A Durable Power of Attorney is a legal document that allows you to appoint someone to make financial or medical decisions on your behalf if you become unable to do so. This document remains effective even if you become incapacitated, which is what makes it "durable." It provides peace of mind knowing that someone you trust will handle your affairs according to your wishes.

Who can be appointed as an agent under the Durable Power of Attorney?

You can choose anyone you trust to act as your agent, as long as they are at least 18 years old and competent. Common choices include family members, close friends, or professionals like attorneys or financial advisors. It’s essential to select someone who understands your values and will act in your best interest.

How do I create a Durable Power of Attorney in Illinois?

To create a Durable Power of Attorney in Illinois, you must fill out a specific form that complies with state laws. You can find templates online or consult with an attorney for assistance. Once completed, you must sign the document in the presence of a notary public or two witnesses, who must also sign. This ensures the document is legally binding.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time, as long as you are still competent. To do this, you should create a written notice of revocation and inform your agent and any institutions that may have a copy of the original document. It’s a good idea to destroy the original document to prevent any confusion.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including managing bank accounts, making investment decisions, paying bills, and handling real estate transactions. For medical decisions, you can specify whether your agent can make choices about your healthcare, including end-of-life care. It’s important to clearly outline the powers you wish to grant to avoid any misunderstandings.

Is a Durable Power of Attorney the same as a Living Will?

No, a Durable Power of Attorney and a Living Will serve different purposes. A Durable Power of Attorney allows someone to make decisions on your behalf, while a Living Will outlines your preferences regarding medical treatment in case you cannot communicate your wishes. Both documents can be essential parts of your overall estate planning.

Do I need an attorney to create a Durable Power of Attorney?

While it’s not required to hire an attorney, consulting one can be beneficial, especially if your situation is complex. An attorney can help ensure that the document meets all legal requirements and accurately reflects your wishes. If you choose to do it yourself, make sure to follow all guidelines carefully to avoid any issues.

What happens if I don’t have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney, your loved ones may need to go through a court process to gain the authority to make decisions on your behalf. This can be time-consuming and may not align with your wishes. Having a Durable Power of Attorney in place can save your family from this stress and ensure your preferences are honored.

Key takeaways

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make financial or healthcare decisions on your behalf if you become unable to do so yourself.

- Choose Your Agent Wisely: Select a trusted individual who understands your values and wishes. This person will have significant authority over your affairs.

- Be Specific: Clearly outline the powers you wish to grant. You can limit the authority to specific tasks or decisions, ensuring your agent acts within your preferences.

- Sign and Date the Document: To be valid, the form must be signed and dated by you. In Illinois, it’s also advisable to have the document notarized or witnessed to avoid potential disputes.

- Review Regularly: Life circumstances change. Regularly review and update your Durable Power of Attorney to reflect any new wishes or changes in your relationships.

File Details

| Fact Name | Description |

|---|---|

| Definition | An Illinois Durable Power of Attorney is a legal document that allows an individual to designate someone else to make financial and health care decisions on their behalf if they become incapacitated. |

| Governing Law | The Illinois Durable Power of Attorney is governed by the Illinois Power of Attorney Act (755 ILCS 45/1-1 et seq.). |

| Durability | This document remains effective even if the principal becomes incapacitated, distinguishing it from a regular power of attorney, which would become void under such circumstances. |

| Principal | The person creating the Durable Power of Attorney is referred to as the principal. This individual retains the right to revoke or modify the document as long as they are competent. |

| Agent | The agent, also known as the attorney-in-fact, is the person designated by the principal to act on their behalf. The principal can choose anyone they trust, including family members or friends. |

| Signing Requirements | To be valid, the document must be signed by the principal in the presence of a notary public or two witnesses who are not related to the principal. |

| Healthcare Decisions | In addition to financial matters, a Durable Power of Attorney can also grant the agent authority to make health care decisions, which includes choices about medical treatment and end-of-life care. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent. This can be done by creating a new document or by providing a written notice of revocation. |

Consider Some Other Durable Power of Attorney Forms for US States

Pa Durable Power of Attorney Form - A Durable Power of Attorney is a proactive step in planning for future financial needs.

Michigan Power of Attorney - A Durable Power of Attorney allows someone to make decisions on your behalf if you become incapacitated.

How Do I Get Power of Attorney in Florida - Choosing someone you trust as your agent is crucial to ensure your affairs are managed properly.

Dos and Don'ts

When filling out the Illinois Durable Power of Attorney form, it’s important to approach the process with care. Here are nine things to consider, including both dos and don’ts.

- Do clearly identify the person you are designating as your agent. Ensure their full name and contact information are accurate.

- Don’t leave any sections blank. Incomplete forms can lead to confusion or invalidate the document.

- Do specify the powers you are granting. Be clear about what decisions your agent can make on your behalf.

- Don’t use vague language. Ambiguities can create misunderstandings or disputes later on.

- Do sign the document in the presence of a notary public. This adds an extra layer of validation to your form.

- Don’t forget to date the form. An undated document may raise questions about its validity.

- Do discuss your wishes with your agent beforehand. This ensures they understand your preferences and can act accordingly.

- Don’t assume your agent knows your wishes without discussion. Clear communication is key to effective representation.

- Do keep a copy of the completed form in a safe place. Share copies with your agent and any relevant family members.