Valid Deed in Lieu of Foreclosure Form for Illinois

When homeowners in Illinois face the possibility of foreclosure, they often seek alternatives to protect their financial futures. One such option is the Deed in Lieu of Foreclosure. This legal process allows a homeowner to voluntarily transfer their property title to the lender, effectively settling the mortgage debt without going through the lengthy and often stressful foreclosure process. By completing the Deed in Lieu of Foreclosure form, homeowners can potentially avoid the negative impacts of foreclosure on their credit score and regain some control over their financial situation. This form outlines essential details, including the property description, the parties involved, and any existing liens or encumbrances. Additionally, it may address the lender's acceptance of the deed and the conditions under which the transfer takes place. Understanding the nuances of this form can empower homeowners to make informed decisions during challenging times.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. Ensure that names, addresses, and property descriptions are fully filled out.

-

Incorrect Legal Description: Using an inaccurate or outdated legal description of the property can lead to complications. Always verify the legal description with public records.

-

Not Signing the Document: A deed must be signed by the grantor. Omitting a signature can invalidate the entire document.

-

Missing Notarization: Failing to have the deed notarized is a frequent oversight. Notarization is essential for the document to be legally binding.

-

Improper Witnesses: Some individuals may neglect to have the appropriate witnesses present during the signing. Check state requirements for witness signatures.

-

Forgetting to Date the Document: A date is crucial for establishing the timeline of the deed. Without a date, the validity may be questioned.

-

Ignoring Local Laws: Each jurisdiction may have specific requirements. Familiarize yourself with local laws to avoid non-compliance.

-

Not Keeping Copies: Failing to retain copies of the signed deed can create issues later. Always keep a record for your files.

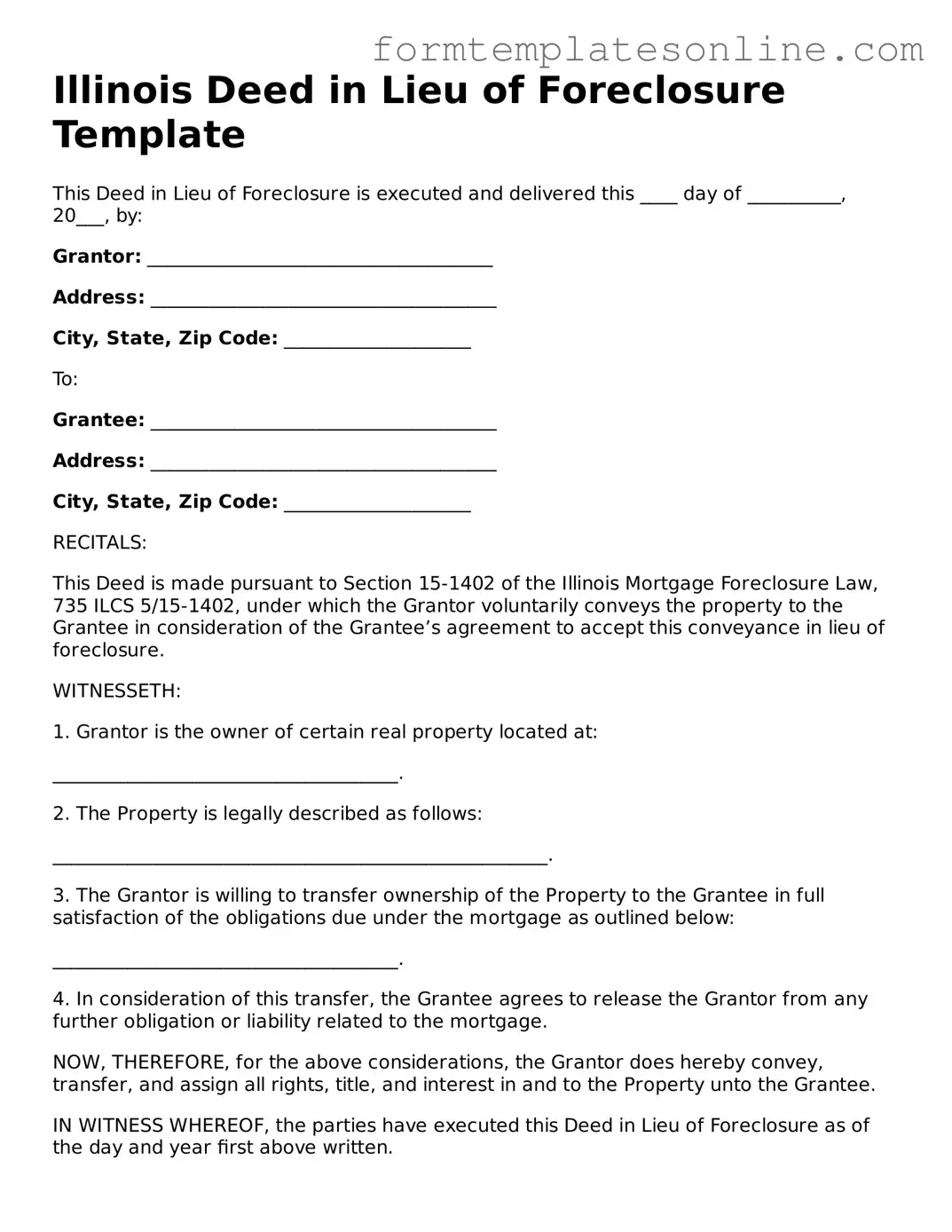

Example - Illinois Deed in Lieu of Foreclosure Form

Illinois Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed and delivered this ____ day of __________, 20___, by:

Grantor: _____________________________________

Address: _____________________________________

City, State, Zip Code: ____________________

To:

Grantee: _____________________________________

Address: _____________________________________

City, State, Zip Code: ____________________

RECITALS:

This Deed is made pursuant to Section 15-1402 of the Illinois Mortgage Foreclosure Law, 735 ILCS 5/15-1402, under which the Grantor voluntarily conveys the property to the Grantee in consideration of the Grantee’s agreement to accept this conveyance in lieu of foreclosure.

WITNESSETH:

1. Grantor is the owner of certain real property located at:

_____________________________________.

2. The Property is legally described as follows:

_____________________________________________________.

3. The Grantor is willing to transfer ownership of the Property to the Grantee in full satisfaction of the obligations due under the mortgage as outlined below:

_____________________________________.

4. In consideration of this transfer, the Grantee agrees to release the Grantor from any further obligation or liability related to the mortgage.

NOW, THEREFORE, for the above considerations, the Grantor does hereby convey, transfer, and assign all rights, title, and interest in and to the Property unto the Grantee.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor Signature: ________________________________

Date: ________________________________________

Grantee Signature: ________________________________

Date: ________________________________________

STATE OF ILLINOIS

COUNTY OF _____________________

Before me, a notary public, personally appeared _______________ (Grantor) and _______________ (Grantee), who acknowledged that they executed the above instrument for the purposes therein contained.

Given under my hand and seal this ____ day of ___________, 20__.

Notary Public Signature: _________________________

My Commission Expires: _________________________

More About Illinois Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender in exchange for the cancellation of the mortgage debt. This option is often considered when a homeowner is unable to keep up with mortgage payments and wants to avoid the lengthy and costly foreclosure process. By agreeing to a Deed in Lieu, the homeowner can potentially protect their credit score and expedite the transition away from the property.

Who is eligible to use a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure typically depends on the lender's policies and the homeowner's financial situation. Generally, homeowners who are facing financial hardship, such as job loss or medical expenses, may qualify. However, the property must be free of liens or other claims. Lenders will often require the homeowner to demonstrate that they have exhausted other options, like loan modification or short sale, before approving a Deed in Lieu.

What are the benefits of a Deed in Lieu of Foreclosure?

One of the primary benefits of a Deed in Lieu of Foreclosure is that it can help homeowners avoid the negative consequences of a foreclosure. This option can lead to a quicker resolution, allowing individuals to move on with their lives. Additionally, it may result in less damage to the homeowner's credit score compared to a foreclosure. It can also relieve the burden of property maintenance and associated costs, as the lender takes possession of the property.

What are the risks associated with a Deed in Lieu of Foreclosure?

While a Deed in Lieu can be beneficial, there are risks involved. Homeowners may still face tax implications, as the IRS may consider forgiven debt as taxable income. Additionally, the lender may not agree to release the homeowner from all liability, especially if there are other debts tied to the property. It is crucial for homeowners to fully understand the implications and consult with a financial advisor or legal professional before proceeding.

How does the process of obtaining a Deed in Lieu of Foreclosure work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu. The lender will typically require documentation of the homeowner's financial situation, including income, expenses, and reasons for default. Once the lender reviews the information and approves the request, the parties will execute the Deed in Lieu of Foreclosure. The homeowner must then vacate the property, and the lender will handle the transfer of ownership.

Can a Deed in Lieu of Foreclosure affect my ability to buy another home?

A Deed in Lieu of Foreclosure can impact a homeowner's ability to purchase another home, but the effects are generally less severe than those of a foreclosure. Lenders typically consider the time elapsed since the Deed in Lieu was executed and the homeowner's credit history when assessing future mortgage applications. Homeowners may find it easier to qualify for a new loan after a Deed in Lieu, especially if they have taken steps to rebuild their credit.

Key takeaways

Filling out and using the Illinois Deed in Lieu of Foreclosure form can be a straightforward process, but it is important to understand the key aspects involved. Here are some essential takeaways:

- The Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer property ownership to the lender to avoid foreclosure.

- Both parties must agree to the terms outlined in the deed. This agreement typically occurs when the borrower is unable to keep up with mortgage payments.

- It is crucial to ensure that all outstanding debts related to the property are clearly addressed in the agreement.

- Before signing, the borrower should consider consulting with a legal professional to understand the implications of the deed.

- The deed must be executed properly, including signatures from both the borrower and the lender, to be legally binding.

- Once the deed is recorded with the county, the lender takes possession of the property, and the borrower is released from the mortgage obligation.

- Using this deed can provide a quicker resolution than traditional foreclosure, potentially preserving the borrower’s credit score.

File Details

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | The Illinois Deed in Lieu of Foreclosure is governed by the Illinois Mortgage Foreclosure Law (765 ILCS 905). |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify for a deed in lieu of foreclosure. |

| Process | The process typically involves negotiating with the lender, completing the necessary paperwork, and transferring the deed. |

| Benefits | One major benefit is that it allows homeowners to avoid the lengthy and costly foreclosure process. |

| Impact on Credit | A deed in lieu of foreclosure can negatively affect a homeowner's credit score, but it may be less damaging than a full foreclosure. |

| Deficiency Judgments | In Illinois, a lender may not pursue a deficiency judgment if they accept a deed in lieu of foreclosure. |

| Tax Implications | Homeowners may face tax implications on any forgiven debt, so consulting a tax professional is advisable. |

| Title Issues | Before proceeding, homeowners should ensure there are no other liens on the property that could complicate the deed transfer. |

| Alternatives | Alternatives to a deed in lieu of foreclosure include loan modification, short sale, or filing for bankruptcy. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

California Property Surrender Deed - The transfer of the title marks the official end of the mortgage obligation.

In addition to understanding the fundamental aspects of the Georgia Lease Agreement form, it’s beneficial to access resources that provide further clarity; for example, information available at OnlineLawDocs.com can be invaluable for both landlords and tenants navigating their rights and responsibilities.

Georgia Foreclosure Laws - The lender may agree to various forms of assistance during the transition process.

Dos and Don'ts

When filling out the Illinois Deed in Lieu of Foreclosure form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are ten things to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Don't rush through the process; take your time to ensure accuracy.

- Do provide accurate information regarding the property and parties involved.

- Don't leave any required fields blank; incomplete forms can cause delays.

- Do consult with a legal professional if you have questions about the form.

- Don't sign the form until all parties have agreed to the terms.

- Do keep a copy of the completed form for your records.

- Don't forget to date the document when signing it.

- Do ensure that all signatures are notarized, if required.

- Don't ignore any additional documentation that may need to accompany the form.

By following these guidelines, you can help facilitate a smoother transaction and minimize potential issues down the line.