Valid Deed Form for Illinois

When it comes to transferring property ownership in Illinois, understanding the Illinois Deed form is crucial for both buyers and sellers. This legal document serves as the official record of the transfer, detailing essential information about the property and the parties involved. It typically includes the names of the grantor (the seller) and the grantee (the buyer), a description of the property, and the type of deed being used, such as a warranty deed or quitclaim deed. Each type of deed carries different implications for the level of protection and assurance provided to the buyer. Additionally, the form must be signed, often in the presence of a notary, to ensure its validity. Properly executing this document is not just a formality; it is a critical step in safeguarding your rights and interests in the property transaction. A well-prepared deed can prevent future disputes and complications, making it essential for anyone involved in real estate transactions in Illinois to grasp its significance and requirements.

Common mistakes

-

Incorrect Names: One of the most common mistakes is misspelling names or using incorrect legal names. Always double-check that the names of the grantor (seller) and grantee (buyer) are accurate and match their identification documents.

-

Missing Signatures: A deed must be signed by the grantor. Forgetting to sign can render the deed invalid. Ensure that all required parties have signed the document before submission.

-

Improper Notarization: A deed typically needs to be notarized. Failing to have a notary public witness the signatures can lead to issues with the deed's acceptance. Always check that the notarization is completed correctly.

-

Incorrect Property Description: The property must be described accurately, including the legal description. Omitting details or using vague language can create confusion or legal disputes later.

-

Omitting the Date: Not including the date of the transaction can complicate matters. It’s essential to indicate when the transfer of ownership takes place for legal clarity.

-

Failure to Include Consideration: The deed should state the consideration, or payment, made for the property. Leaving this out may raise questions about the legitimacy of the transaction.

-

Not Following Local Laws: Each county in Illinois may have specific requirements for deeds. Not adhering to these local rules can lead to delays or rejection of the deed.

-

Neglecting to Record the Deed: After completing the deed, it must be recorded with the county clerk’s office. Failing to do so means that the transfer of ownership may not be legally recognized.

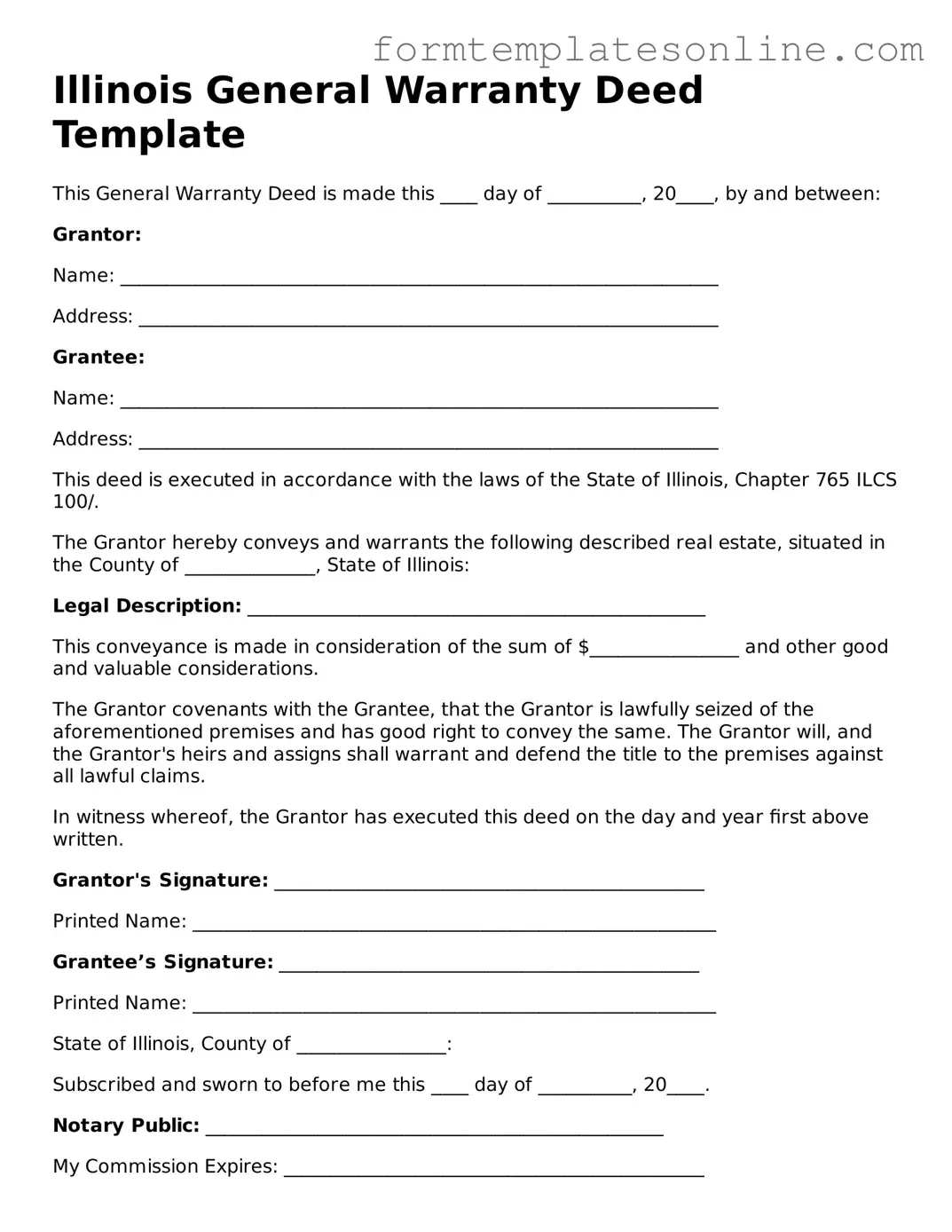

Example - Illinois Deed Form

Illinois General Warranty Deed Template

This General Warranty Deed is made this ____ day of __________, 20____, by and between:

Grantor:

Name: ________________________________________________________________

Address: ______________________________________________________________

Grantee:

Name: ________________________________________________________________

Address: ______________________________________________________________

This deed is executed in accordance with the laws of the State of Illinois, Chapter 765 ILCS 100/.

The Grantor hereby conveys and warrants the following described real estate, situated in the County of ______________, State of Illinois:

Legal Description: _________________________________________________

This conveyance is made in consideration of the sum of $________________ and other good and valuable considerations.

The Grantor covenants with the Grantee, that the Grantor is lawfully seized of the aforementioned premises and has good right to convey the same. The Grantor will, and the Grantor's heirs and assigns shall warrant and defend the title to the premises against all lawful claims.

In witness whereof, the Grantor has executed this deed on the day and year first above written.

Grantor's Signature: ______________________________________________

Printed Name: ________________________________________________________

Grantee’s Signature: _____________________________________________

Printed Name: ________________________________________________________

State of Illinois, County of ________________:

Subscribed and sworn to before me this ____ day of __________, 20____.

Notary Public: _________________________________________________

My Commission Expires: _____________________________________________

More About Illinois Deed

What is an Illinois Deed form?

An Illinois Deed form is a legal document used to transfer ownership of real property from one party to another in the state of Illinois. It outlines the details of the transaction, including the names of the parties involved, a description of the property, and the terms of the transfer. This document must be properly executed and recorded to be legally binding.

What types of Deed forms are available in Illinois?

Illinois offers several types of Deed forms, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides the highest level of protection to the buyer, ensuring that the seller has clear title to the property. A Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. A Special Warranty Deed offers some assurances but is limited to the seller’s ownership period.

Who needs to sign the Illinois Deed form?

Typically, the seller (grantor) must sign the Illinois Deed form. If the property is owned jointly, all owners must sign. Depending on the circumstances, a witness or notary may also be required to validate the signatures. The buyer (grantee) does not need to sign the deed for it to be effective.

How do I complete an Illinois Deed form?

To complete an Illinois Deed form, gather the necessary information, including the names and addresses of the grantor and grantee, a legal description of the property, and any applicable considerations or terms of the transfer. Fill out the form accurately, ensuring all required fields are completed. Finally, have the document signed and notarized as required.

Is a notary required for the Illinois Deed form?

Yes, a notary is typically required for the Illinois Deed form. The notary public verifies the identities of the signers and witnesses the signing of the document. This step is crucial for ensuring the deed's validity and for recording it with the county clerk's office.

How do I record an Illinois Deed form?

To record an Illinois Deed form, take the completed and notarized document to the county recorder’s office where the property is located. There may be a recording fee, so it’s advisable to check the specific requirements for your county. Once recorded, the deed becomes a matter of public record, providing legal proof of ownership.

What happens if I don’t record the Illinois Deed form?

If you do not record the Illinois Deed form, the transfer of ownership may not be legally recognized by third parties. This could lead to disputes over property rights or complications in future transactions. Recording the deed protects your ownership interest and ensures that the transaction is transparent.

Are there any taxes associated with transferring property in Illinois?

Yes, transferring property in Illinois may involve various taxes, including the Real Estate Transfer Tax. This tax is typically based on the sale price of the property and must be paid at the time of recording the deed. Additionally, there may be local taxes or fees, so it’s important to check with your local government for specific requirements.

Can I use a template for the Illinois Deed form?

While you can find templates for Illinois Deed forms online, it is crucial to ensure that the template complies with state laws and includes all necessary information. Using a generic template without proper guidance may lead to errors that could affect the validity of the deed. Consulting a legal professional is advisable to ensure accuracy.

What if I make a mistake on the Illinois Deed form?

If you make a mistake on the Illinois Deed form, it is important to correct it before the document is signed and recorded. Depending on the nature of the mistake, you may need to create a new deed or make an amendment. Errors can complicate the transfer process, so addressing them promptly is essential.

Key takeaways

When filling out and using the Illinois Deed form, it is essential to keep several key points in mind. These takeaways can help ensure that the process goes smoothly and that the document serves its intended purpose.

- Ensure that all parties involved are correctly identified. This includes the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Clearly describe the property being transferred. A precise legal description is necessary to avoid confusion and potential disputes in the future.

- Include the date of the transaction. This helps establish the timeline of the transfer and is crucial for record-keeping purposes.

- Consider the need for notarization. Many deeds require a notary public to witness the signatures to be legally valid.

- File the completed deed with the appropriate county recorder's office. This step is vital to ensure that the transfer is officially recognized and recorded in public records.

- Review local laws and regulations. Different jurisdictions may have specific requirements or variations for deed forms, so it is important to be aware of these.

File Details

| Fact Name | Details |

|---|---|

| Governing Law | The Illinois Deed form is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Types of Deeds | In Illinois, common types of deeds include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Signature Requirements | The deed must be signed by the grantor, and it is recommended that it be notarized for validity. |

| Recording | To protect the interests of the grantee, the deed should be recorded with the county recorder’s office. |

| Consideration | The deed should state the consideration (payment) for the transfer, even if it is nominal. |

| Legal Description | A complete legal description of the property must be included to ensure clarity and avoid disputes. |

Consider Some Other Deed Forms for US States

Quick Claim Deeds Georgia - A warranty deed guarantees that the seller holds clear title to the property being sold.

For those entering into a rental agreement, it is essential to familiarize oneself with the nuances of the Georgia Lease Agreement form, which is a legally binding document outlining the terms and conditions of the lease. By understanding this agreement, both landlords and tenants can protect their interests during the rental process. For more information, you can visit OnlineLawDocs.com.

What Does a Deed Look Like in Florida - Types of Deeds include warranty deeds, quitclaim deeds, and special warranty deeds.

Property Deed Form - Deeds provide a clear record of who owns a property and can be used in legal matters.

Dos and Don'ts

When filling out the Illinois Deed form, it is essential to approach the task with care and attention to detail. Here are ten important do's and don'ts to keep in mind:

- Do ensure that all names are spelled correctly. Accuracy is crucial to avoid future complications.

- Do include the complete legal description of the property. This helps to clearly identify the parcel being transferred.

- Do sign the deed in front of a notary public. A notary’s acknowledgment is often required for the deed to be valid.

- Do check for any outstanding liens or encumbrances on the property before proceeding.

- Do keep a copy of the completed deed for your records. This can be important for future reference.

- Don't leave any required fields blank. Incomplete forms may be rejected by the recorder’s office.

- Don't use abbreviations or shorthand in the legal description. Clarity is paramount.

- Don't forget to include the date of execution. This is necessary for legal purposes.

- Don't use white-out or any correction fluid on the form. Errors should be crossed out and corrected properly.

- Don't overlook the filing fees. Ensure you have the correct amount ready when submitting the deed.

By following these guidelines, you can help ensure that your Illinois Deed form is completed correctly and efficiently.