Valid Bill of Sale Form for Illinois

The Illinois Bill of Sale form serves as a vital document in the transfer of ownership for personal property, ensuring that both the buyer and seller have a clear record of the transaction. This form is particularly important in cases involving vehicles, boats, and other significant assets, as it provides legal protection and clarity for both parties. It typically includes essential details such as the names and addresses of the buyer and seller, a description of the item being sold, the sale price, and the date of the transaction. Additionally, the form may contain warranties or disclaimers regarding the condition of the item, which can help prevent disputes in the future. By documenting the transfer of ownership, the Illinois Bill of Sale helps to establish proof of purchase and can be crucial for registration or licensing purposes. Understanding the components and significance of this form is essential for anyone engaging in a sale or purchase of personal property in Illinois.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. Buyers and sellers must include their full names, addresses, and contact information. Leaving out even one piece of information can lead to confusion or disputes later on.

-

Incorrect Vehicle Information: When selling a vehicle, it’s crucial to accurately list the make, model, year, and Vehicle Identification Number (VIN). An error in this information can complicate the transfer of ownership.

-

Omitting Sale Price: The sale price should be clearly stated in the Bill of Sale. Not including this detail can raise questions about the legitimacy of the transaction and may affect tax assessments.

-

Not Signing the Document: Both parties must sign the Bill of Sale. A lack of signatures can render the document ineffective. This step is crucial for establishing a legally binding agreement.

-

Failure to Date the Document: It’s essential to include the date of the transaction. Without a date, it may be difficult to prove when the sale took place, which can be important for tax purposes or legal disputes.

-

Not Providing Copies: After completing the Bill of Sale, both the buyer and seller should retain a copy. Failing to do so can lead to misunderstandings about the terms of the sale.

-

Ignoring Local Laws: Different states may have specific requirements for a Bill of Sale. Ignoring these regulations can result in an invalid document. It’s vital to check Illinois laws to ensure compliance.

-

Not Including Additional Terms: If there are special conditions or warranties associated with the sale, they should be clearly stated. Omitting these terms can lead to disputes after the sale is finalized.

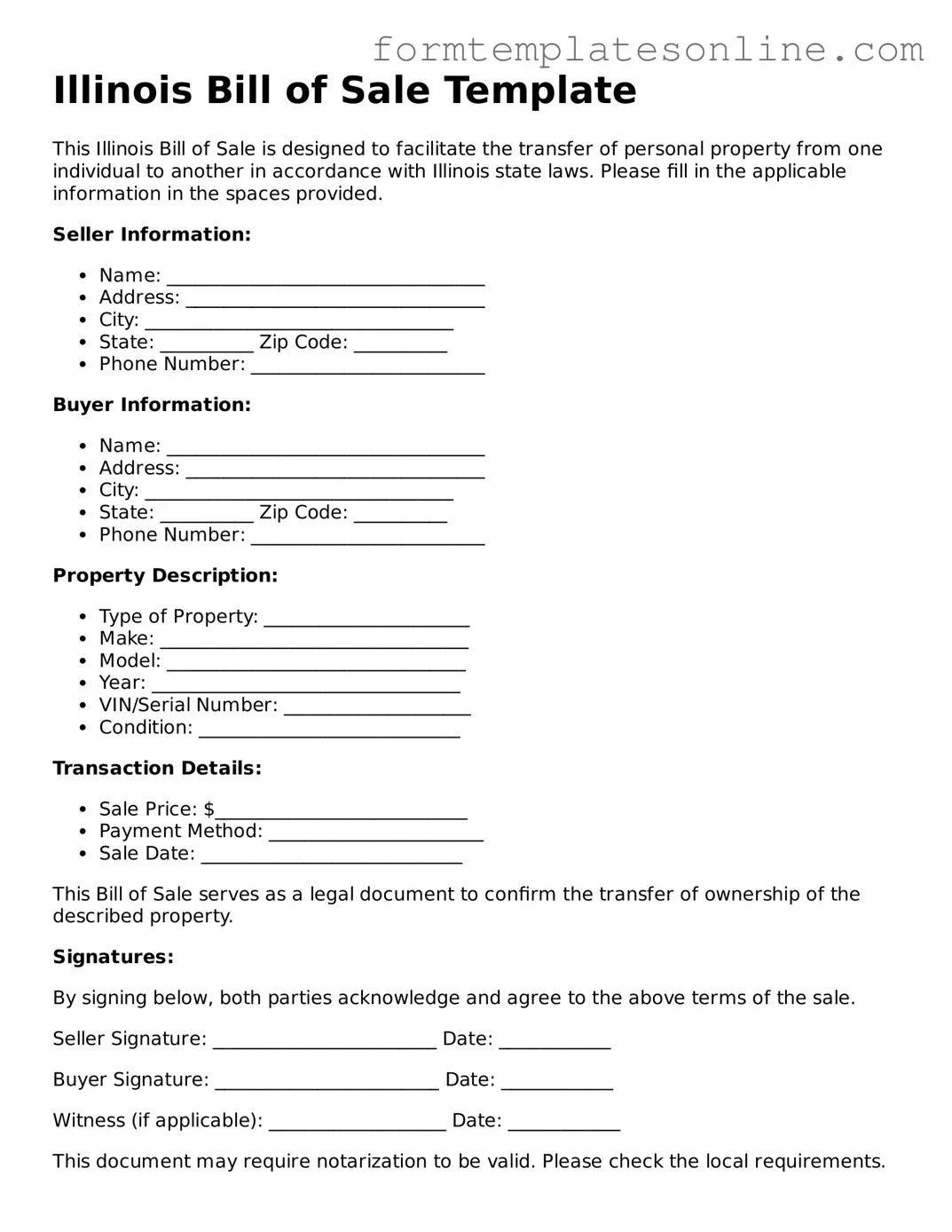

Example - Illinois Bill of Sale Form

Illinois Bill of Sale Template

This Illinois Bill of Sale is designed to facilitate the transfer of personal property from one individual to another in accordance with Illinois state laws. Please fill in the applicable information in the spaces provided.

Seller Information:

- Name: __________________________________

- Address: ________________________________

- City: _________________________________

- State: __________ Zip Code: __________

- Phone Number: _________________________

Buyer Information:

- Name: __________________________________

- Address: ________________________________

- City: _________________________________

- State: __________ Zip Code: __________

- Phone Number: _________________________

Property Description:

- Type of Property: ______________________

- Make: _________________________________

- Model: ________________________________

- Year: _________________________________

- VIN/Serial Number: ____________________

- Condition: ____________________________

Transaction Details:

- Sale Price: $___________________________

- Payment Method: _______________________

- Sale Date: ____________________________

This Bill of Sale serves as a legal document to confirm the transfer of ownership of the described property.

Signatures:

By signing below, both parties acknowledge and agree to the above terms of the sale.

Seller Signature: ________________________ Date: ____________

Buyer Signature: ________________________ Date: ____________

Witness (if applicable): ___________________ Date: ____________

This document may require notarization to be valid. Please check the local requirements.

More About Illinois Bill of Sale

What is an Illinois Bill of Sale form?

The Illinois Bill of Sale form is a legal document that records the transfer of ownership of personal property from one person to another. This form is commonly used for transactions involving vehicles, boats, and other significant items. It serves as proof of the sale and includes important details such as the buyer and seller's names, the description of the item being sold, and the sale price. Having a Bill of Sale can help both parties in case any disputes arise later regarding the transaction.

Is a Bill of Sale required in Illinois?

While a Bill of Sale is not legally required for all transactions in Illinois, it is highly recommended, especially for significant purchases. For vehicles, the state does require a Bill of Sale when transferring ownership to register the vehicle in the buyer's name. This document helps protect both the buyer and seller by providing a clear record of the transaction, which can be useful for tax purposes and future reference.

What information should be included in an Illinois Bill of Sale?

An effective Illinois Bill of Sale should include several key pieces of information. First, it should identify the buyer and seller by name and address. Next, a detailed description of the item being sold is crucial; this includes the make, model, year, and any identifying numbers, like a Vehicle Identification Number (VIN) for cars. Additionally, the sale price should be clearly stated, along with the date of the transaction. Lastly, both parties should sign the document to validate the sale.

Can I create my own Bill of Sale in Illinois?

Yes, you can create your own Bill of Sale in Illinois. There are no specific state forms that you must use, but it's essential to ensure that your document contains all the necessary information mentioned earlier. Many templates are available online that can help guide you in drafting a comprehensive Bill of Sale. However, if you're uncertain about the legal implications or need a more complex transaction, consulting with a legal professional can provide additional peace of mind.

Key takeaways

Ensure all required information is accurately filled out, including the names and addresses of both the buyer and seller.

Clearly describe the item being sold, including any identifying details such as make, model, and VIN for vehicles.

Both parties should sign and date the form to validate the transaction, making sure to keep a copy for their records.

A Bill of Sale serves as proof of ownership transfer, which may be necessary for registration or future sales.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one party to another. |

| Governing Law | The Illinois Bill of Sale is governed by the Illinois Uniform Commercial Code (UCC), specifically Article 2, which pertains to the sale of goods. |

| Required Information | Essential details include the names and addresses of both the buyer and seller, a description of the property, and the sale price. |

| Notarization | While notarization is not mandatory, having the Bill of Sale notarized can provide additional legal protection and verification of the transaction. |

Consider Some Other Bill of Sale Forms for US States

Bill of Sale Michigan - This form can help prevent future disputes regarding the ownership of the property.

North Carolina Vehicle Title - A Bill of Sale becomes particularly significant in sales that require legal inspections or approvals.

Print Bill of Sale - This document helps foster fair and transparent transactions between parties.

Dos and Don'ts

When filling out the Illinois Bill of Sale form, it is essential to approach the task with care and attention to detail. Here is a list of things you should and shouldn't do to ensure the process goes smoothly.

- Do double-check all information for accuracy before submission.

- Do include the full names and addresses of both the buyer and seller.

- Do provide a detailed description of the item being sold, including any identifying numbers.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any fields blank; fill in all required information.

- Don't use vague descriptions; be specific about the item.

- Don't forget to include the sale price, as this is crucial for record-keeping.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't overlook the importance of having both parties sign the document to validate the sale.