Valid Articles of Incorporation Form for Illinois

When starting a business in Illinois, one of the first crucial steps is to complete the Articles of Incorporation form. This document serves as the foundation for establishing a corporation and outlines essential details about the business. Key aspects of the form include the corporation's name, which must be unique and not misleadingly similar to existing entities. Additionally, it requires the purpose of the corporation, providing a brief description of the activities the business intends to engage in. The form also asks for the registered agent's name and address, ensuring that there is a designated individual or entity to receive legal documents on behalf of the corporation. Furthermore, it includes information about the initial board of directors, which is vital for governance. Lastly, the form may require details about the corporation's stock structure, specifying the types and number of shares the corporation is authorized to issue. Understanding these components is essential for anyone looking to navigate the incorporation process smoothly and effectively.

Common mistakes

-

Incorrect Business Name: One common mistake is failing to choose a unique name for the corporation. The name must not be similar to any existing business registered in Illinois. Before submitting, it’s crucial to conduct a name search through the Illinois Secretary of State’s website.

-

Missing Registered Agent Information: The form requires the name and address of a registered agent. Some individuals forget to include this information or provide incomplete details. The registered agent must be a person or business authorized to receive legal documents on behalf of the corporation.

-

Inaccurate Purpose Statement: Another frequent error is writing an unclear or overly broad purpose statement. The purpose of the corporation must be specific and aligned with the business activities. Vague descriptions can lead to complications during the approval process.

-

Failure to Sign the Document: The Articles of Incorporation must be signed by the incorporators. Some people overlook this step, thinking it is not necessary. A missing signature can result in rejection of the application.

Example - Illinois Articles of Incorporation Form

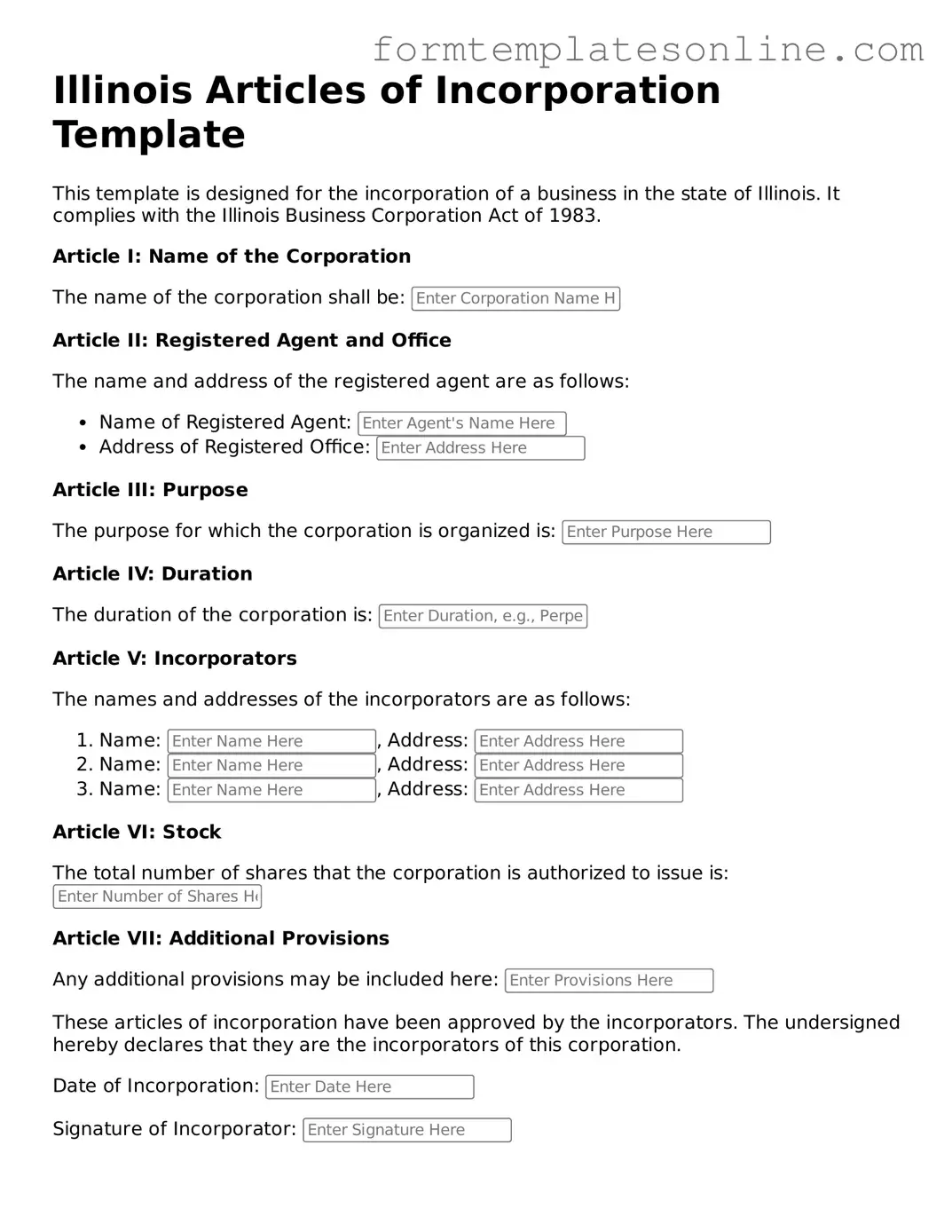

Illinois Articles of Incorporation Template

This template is designed for the incorporation of a business in the state of Illinois. It complies with the Illinois Business Corporation Act of 1983.

Article I: Name of the Corporation

The name of the corporation shall be:

Article II: Registered Agent and Office

The name and address of the registered agent are as follows:

- Name of Registered Agent:

- Address of Registered Office:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Duration

The duration of the corporation is:

Article V: Incorporators

The names and addresses of the incorporators are as follows:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article VI: Stock

The total number of shares that the corporation is authorized to issue is:

Article VII: Additional Provisions

Any additional provisions may be included here:

These articles of incorporation have been approved by the incorporators. The undersigned hereby declares that they are the incorporators of this corporation.

Date of Incorporation:

Signature of Incorporator:

More About Illinois Articles of Incorporation

What is the Illinois Articles of Incorporation form?

The Illinois Articles of Incorporation form is a legal document that establishes a corporation in the state of Illinois. It outlines basic information about the corporation, including its name, purpose, and registered agent. Filing this form is a crucial step in forming a corporation and provides the necessary legal recognition for the business entity.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Illinois must file the Articles of Incorporation. This includes businesses of all sizes, from small startups to larger enterprises. It’s essential for anyone planning to operate as a corporation to complete this step to ensure legal compliance.

What information is required on the form?

The form requires several key pieces of information. This includes the corporation's name, which must be unique and not too similar to existing businesses. Additionally, the purpose of the corporation, the address of the registered office, and the name and address of the registered agent must be provided. Some forms may also ask for the names and addresses of the incorporators.

How do I file the Articles of Incorporation?

Filing can be done online or by mail. If you choose to file online, you can visit the Illinois Secretary of State's website and complete the form there. For mail submissions, you can download the form, fill it out, and send it to the appropriate office along with the required filing fee. Make sure to check the current fee amount, as it may change.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Illinois varies depending on the type of corporation you are establishing. Typically, the fee is around $150, but it’s important to verify the current fee on the Illinois Secretary of State's website before submitting your form.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Generally, if you file online, you may receive confirmation within a few business days. Mail submissions may take longer, often several weeks. To ensure timely processing, it’s advisable to file online if possible and to check the current processing times on the Secretary of State’s website.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If there are changes needed, such as a change in the corporation's name or the registered agent, you will need to file an amendment form with the Illinois Secretary of State. There may be a fee associated with this amendment process.

Do I need a lawyer to file the Articles of Incorporation?

While it is not required to have a lawyer to file the Articles of Incorporation, many people choose to seek legal advice to ensure that everything is completed correctly. A lawyer can provide valuable insights and help avoid potential pitfalls during the incorporation process.

What happens after the Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, your corporation is officially recognized by the state of Illinois. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. Afterward, you will need to comply with other requirements, such as obtaining an Employer Identification Number (EIN) and setting up necessary business licenses.

Is there an annual requirement after filing the Articles of Incorporation?

Yes, corporations in Illinois are required to file an annual report with the Secretary of State. This report updates the state on the corporation’s status and any changes that may have occurred. There is typically a fee associated with this annual filing, so it’s important to stay on top of these requirements to maintain good standing.

Key takeaways

When filling out and using the Illinois Articles of Incorporation form, keep these key takeaways in mind:

- Understand the Purpose: The Articles of Incorporation establish your business as a corporation in Illinois, providing legal protection and benefits.

- Choose a Unique Name: Your corporation's name must be distinguishable from existing entities in Illinois. Check the name availability through the Secretary of State's website.

- Designate a Registered Agent: A registered agent is required to receive legal documents on behalf of your corporation. This can be an individual or a business entity authorized to do business in Illinois.

- Specify the Business Purpose: Clearly state the purpose of your corporation. This can be broad, but it should reflect your business activities.

- Include the Duration: Most corporations are set up to exist indefinitely, but you can specify a limited duration if desired.

- List the Incorporators: Include the names and addresses of the individuals who are forming the corporation. They must be at least 18 years old.

- Provide Share Information: Indicate the total number of shares the corporation is authorized to issue and the par value of those shares.

- File with the Secretary of State: Submit the completed form along with the required filing fee to the Illinois Secretary of State's office.

- Keep Copies: Retain copies of the filed Articles of Incorporation for your records. This documentation is essential for future business operations.

- Follow Up: After filing, check for confirmation from the Secretary of State. Ensure your corporation is officially recognized.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Articles of Incorporation form is used to officially create a corporation in the state of Illinois. |

| Governing Laws | This form is governed by the Illinois Business Corporation Act (805 ILCS 5). |

| Required Information | Key information such as the corporation's name, registered agent, and purpose must be included in the form. |

| Filing Fee | A filing fee is required upon submission, which varies depending on the type of corporation being formed. |

Consider Some Other Articles of Incorporation Forms for US States

Registration Certificate - The Articles are necessary for defining the scope of operations.

Llc Filing Ohio - It is often the first document a business owner completes when forming a corporation.

Dos and Don'ts

When filling out the Illinois Articles of Incorporation form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should do and five things you should avoid.

- Do: Provide accurate information about the corporation's name and address.

- Do: Include the names and addresses of the initial directors.

- Do: Specify the purpose of the corporation clearly.

- Do: Sign and date the form appropriately.

- Do: Double-check all information for completeness before submission.

- Don't: Use a name that is already in use by another corporation.

- Don't: Leave any required fields blank.

- Don't: Forget to include the registered agent's information.

- Don't: Submit the form without the necessary filing fee.

- Don't: Rush through the process; take your time to ensure everything is correct.