Gift Letter PDF Form

When it comes to securing a mortgage or making a significant financial transaction, the Gift Letter form plays a crucial role in clarifying the source of funds. This document is often used when someone receives money from a family member or friend to help with a down payment or other related expenses. By providing a clear declaration, the Gift Letter helps lenders understand that the funds are indeed a gift and not a loan, which could complicate the borrower’s financial situation. Typically, the form includes essential details such as the giver's name, relationship to the recipient, the amount of the gift, and a statement confirming that the money does not need to be repaid. Additionally, it may require the giver’s signature, adding a layer of authenticity. Understanding the Gift Letter form is essential for anyone looking to navigate the home-buying process smoothly, as it ensures transparency and compliance with lender requirements.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. This includes the names of both the giver and the recipient, the amount of the gift, and the date the gift was made. Omitting any of this information can lead to delays or complications in the transaction.

-

Incorrect Signatures: Another frequent error is not having the necessary signatures. The gift letter must be signed by the giver to validate the gift. Without this signature, the letter may not be accepted by financial institutions.

-

Misunderstanding the Purpose: Some individuals fill out the form without fully understanding its purpose. A gift letter serves to confirm that the funds are indeed a gift and not a loan. Mislabeling the funds can cause issues during the mortgage approval process.

-

Failure to Provide Documentation: Lastly, many people neglect to include supporting documentation. Providing bank statements or transaction records can strengthen the legitimacy of the gift. Without this evidence, the recipient may face scrutiny from lenders.

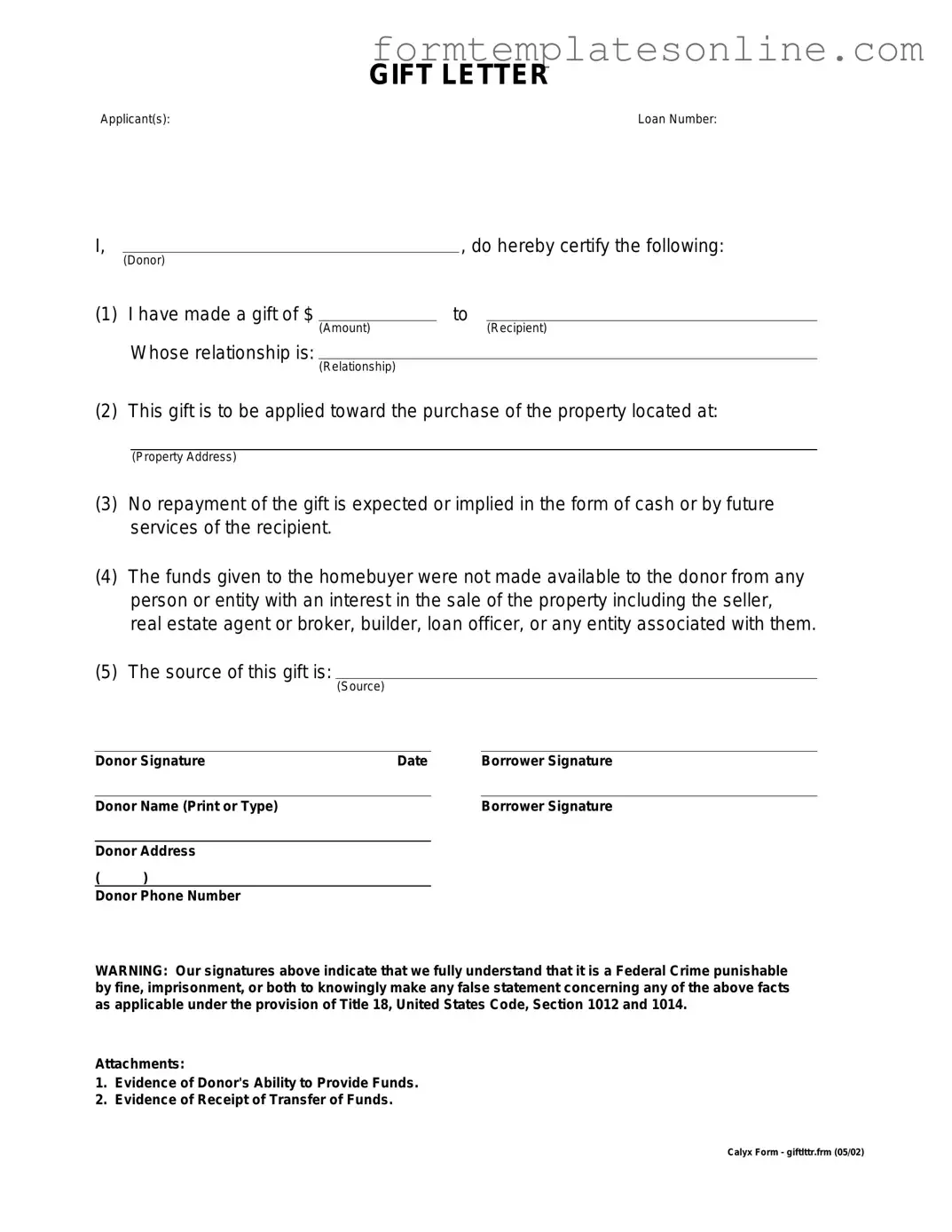

Example - Gift Letter Form

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

More About Gift Letter

What is a Gift Letter form?

A Gift Letter form is a document that outlines a financial gift given to someone, typically in the context of purchasing a home. It serves to clarify that the funds are a gift and not a loan, ensuring that the recipient does not have to repay the amount. This is important for mortgage lenders, as they want to confirm the source of the down payment funds.

Who typically uses a Gift Letter form?

Gift Letter forms are commonly used by homebuyers who receive financial assistance from family members or friends for their down payment. Lenders often require this documentation to verify that the funds are indeed a gift, which can help the buyer qualify for a mortgage.

What information is included in a Gift Letter form?

A Gift Letter form usually includes the names of the donor and recipient, the amount of the gift, the relationship between the two parties, and a statement confirming that the funds are a gift. Additionally, the donor may need to provide their contact information and sign the letter to validate it.

Is a Gift Letter form required by lenders?

While not all lenders require a Gift Letter form, many do, especially if the buyer's down payment comes entirely from a gift. It is always best to check with your lender to understand their specific requirements regarding gift funds.

Can anyone give a gift for a down payment?

Generally, anyone can give a gift for a down payment, but lenders often prefer that the donor be a close family member, such as a parent, sibling, or grandparent. Some lenders may have specific guidelines about who qualifies as an acceptable donor, so it's wise to review those details beforehand.

What happens if the Gift Letter form is not provided?

If a Gift Letter form is not provided when required, the lender may question the source of the down payment funds. This could lead to delays in the mortgage approval process or even a denial of the loan. Therefore, it is crucial to submit this documentation if requested.

Are there tax implications for the donor?

Yes, there can be tax implications for the donor. In the United States, gifts above a certain threshold may be subject to gift tax. However, many people do not reach this threshold, and there are annual exclusions that apply. It’s advisable for the donor to consult a tax professional to understand their obligations and any potential tax consequences.

Key takeaways

When filling out and using the Gift Letter form, consider the following key takeaways:

- Provide Accurate Information: Ensure that all details, including the donor's name, address, and relationship to the recipient, are correct. This information is essential for clarity and verification.

- State the Gift Amount: Clearly indicate the amount of the gift. This helps in establishing the nature of the transaction and its impact on the recipient’s financial situation.

- Signature Requirement: The donor must sign the letter to validate the gift. A signature confirms that the donor agrees to the terms and acknowledges that the funds are a gift, not a loan.

- Use for Financial Transactions: The Gift Letter is often required for mortgage applications. Lenders may request this document to ensure that the recipient has sufficient funds without incurring additional debt.

Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Gift Letter is a document that confirms a monetary gift given to an individual, often used in real estate transactions to verify funds for a down payment. |

| Purpose | The primary purpose of a Gift Letter is to provide evidence to lenders that the funds are a gift and do not need to be repaid, ensuring compliance with mortgage requirements. |

| Content Requirements | Typically, a Gift Letter should include the donor's name, recipient's name, amount of the gift, and a statement confirming that the funds are a gift and not a loan. |

| State-Specific Forms | Some states may have specific requirements for Gift Letters. For example, in California, the governing law requires a clear declaration of the donor's intent. |

| Tax Implications | Gift recipients may need to consider tax implications, as gifts above a certain amount may require the donor to file a gift tax return under federal law. |

Other PDF Forms

Geico Partners - Multiple supplement requests must be filed separately as per GEICO guidelines.

Understanding the importance of having a reliable agent is essential when considering a New York Durable Power of Attorney, as this document can significantly ease the burden on loved ones during challenging times. By utilizing the resources available through OnlineLawDocs.com, individuals can ensure that their financial decisions are managed effectively, safeguarding their interests even when they are unable to act on their own behalf.

Melaleuca Cancellation Form - If you were misinformed about the program, share your experience with us.

Financial Affidavit Short Form Florida - The quick format is designed to save time while still capturing necessary details.

Dos and Don'ts

When filling out the Gift Letter form, it's important to follow certain guidelines to ensure clarity and compliance. Here are eight things to keep in mind:

- Do clearly state the relationship between the donor and the recipient.

- Do specify the amount of the gift in both numerical and written form.

- Do include the date the gift was given.

- Do ensure that the letter is signed by the donor.

- Don't use vague language that could lead to misunderstandings.

- Don't omit any required information, such as the donor's address.

- Don't alter the form's structure or format in any way.

- Don't forget to keep a copy of the signed letter for your records.