Attorney-Approved Gift Deed Template

The Gift Deed form serves as a crucial legal document for individuals wishing to transfer ownership of property or assets without any exchange of money. This form outlines the intentions of the donor, the individual giving the gift, and the recipient, who will receive the property. Essential elements of the Gift Deed include a clear description of the property being transferred, the names and addresses of both parties, and any specific conditions or restrictions that may apply to the gift. Additionally, the form often requires signatures from witnesses to validate the transaction. Understanding the nuances of this document is vital, as it ensures that the gift is legally recognized and protects the interests of both the giver and the receiver. Properly executed, a Gift Deed can facilitate a smooth transfer of assets, making it an important tool in estate planning and personal transactions.

State-specific Gift Deed Documents

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. This includes not listing the full names of both the giver and the recipient, or neglecting to include important details about the property being gifted.

-

Not Signing the Document: A Gift Deed must be signed by the giver to be valid. Sometimes, people forget to sign the document or assume that a witness signature is sufficient. Without the giver's signature, the deed may not hold up legally.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can lead to confusion. It's essential to include specific details such as the address, parcel number, or any other identifying information that clearly defines the property being gifted.

-

Failing to Record the Deed: After filling out the Gift Deed, some individuals neglect to record it with the appropriate local government office. Recording the deed is crucial because it provides public notice of the transfer and protects the recipient's ownership rights.

Example - Gift Deed Form

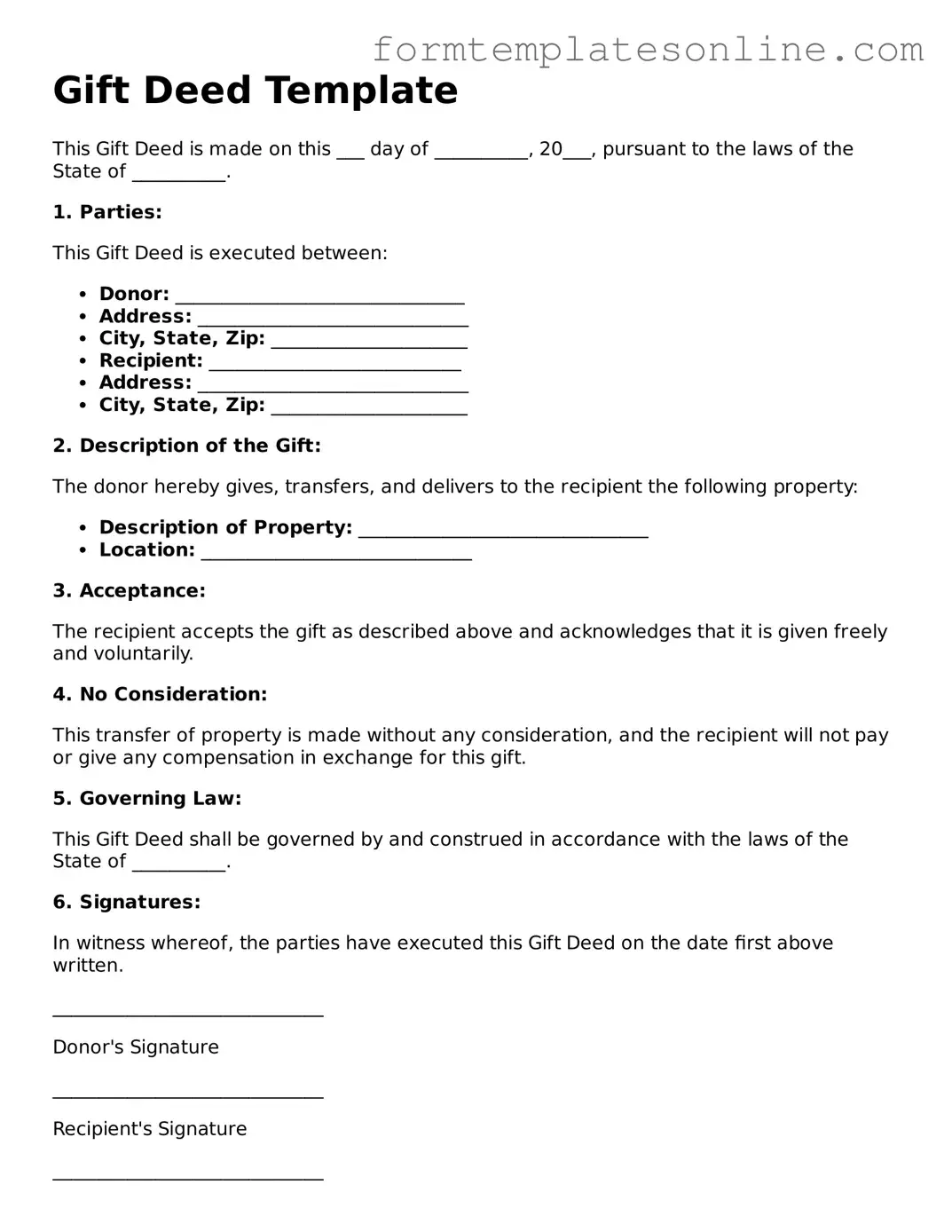

Gift Deed Template

This Gift Deed is made on this ___ day of __________, 20___, pursuant to the laws of the State of __________.

1. Parties:

This Gift Deed is executed between:

- Donor: _______________________________

- Address: _____________________________

- City, State, Zip: _____________________

- Recipient: ___________________________

- Address: _____________________________

- City, State, Zip: _____________________

2. Description of the Gift:

The donor hereby gives, transfers, and delivers to the recipient the following property:

- Description of Property: _______________________________

- Location: _____________________________

3. Acceptance:

The recipient accepts the gift as described above and acknowledges that it is given freely and voluntarily.

4. No Consideration:

This transfer of property is made without any consideration, and the recipient will not pay or give any compensation in exchange for this gift.

5. Governing Law:

This Gift Deed shall be governed by and construed in accordance with the laws of the State of __________.

6. Signatures:

In witness whereof, the parties have executed this Gift Deed on the date first above written.

_____________________________

Donor's Signature

_____________________________

Recipient's Signature

_____________________________

Date

_____________________________

Witness's Signature (if required in state)

_____________________________

Date

More About Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money. This transfer is made voluntarily and is often used for personal gifts between family members or friends. The deed must be signed by the giver (donor) and accepted by the recipient (donee) to be valid.

What types of property can be transferred using a Gift Deed?

Various types of property can be transferred through a Gift Deed, including real estate, vehicles, jewelry, and bank accounts. However, it is essential to ensure that the property is legally owned by the donor and that there are no outstanding liens or claims against it before proceeding with the transfer.

Do I need to pay taxes on a gift received through a Gift Deed?

Generally, the recipient of a gift may be subject to gift tax regulations. In the U.S., the donor is typically responsible for paying any applicable gift taxes, but the recipient should be aware of the tax implications. It's advisable to consult a tax professional to understand the specific tax obligations related to the gift.

Is a Gift Deed revocable?

Once a Gift Deed is executed and accepted, it is usually irrevocable. This means that the donor cannot take back the gift unless specific conditions are met, such as fraud or undue influence. However, it’s essential to consider that some states may have different rules regarding the revocation of gifts.

What information is required in a Gift Deed?

A Gift Deed should include essential details such as the names and addresses of both the donor and the donee, a clear description of the property being gifted, the date of the gift, and any conditions attached to the gift. Proper identification of the property helps avoid future disputes.

Do I need witnesses for a Gift Deed?

While not always required, having witnesses can strengthen the validity of a Gift Deed. Some states may require the signatures of witnesses or notarization to ensure the document is legally binding. Check your local laws to determine the specific requirements in your area.

How do I execute a Gift Deed?

To execute a Gift Deed, the donor must complete the document with all required information and sign it. The donee should also sign to acknowledge acceptance of the gift. Once completed, the deed may need to be recorded with the appropriate local government office, especially if it involves real property, to provide public notice of the transfer.

Key takeaways

When filling out and using a Gift Deed form, several important considerations come into play. Understanding these can help ensure that the process is smooth and legally sound.

- Clear Identification of Parties: Clearly identify the donor (the person giving the gift) and the recipient (the person receiving the gift). Include full names and addresses to avoid any confusion.

- Detailed Description of the Gift: Provide a detailed description of the property or item being gifted. This should include specifics like location, size, and any relevant identification numbers.

- Intent to Gift: Clearly state the donor's intention to gift the property without any expectation of payment or compensation. This establishes the nature of the transaction.

- Signature Requirements: Ensure that the Gift Deed is signed by the donor. Depending on state laws, the recipient's signature may also be required. Witnesses or notarization might be necessary in some jurisdictions.

- Record Keeping: Once completed, consider recording the Gift Deed with the appropriate local government office. This can provide legal protection and establish public record of the transfer.

By keeping these key takeaways in mind, individuals can navigate the process of creating and executing a Gift Deed more effectively.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that allows one person to transfer ownership of property to another without any exchange of money. |

| Consideration | No monetary consideration is required for a Gift Deed, distinguishing it from other types of property transfers. |

| Governing Law | The laws governing Gift Deeds vary by state. For example, in California, the relevant statutes are found in the California Civil Code. |

| Requirements | A valid Gift Deed must be in writing, signed by the donor, and typically requires witnesses or notarization depending on state law. |

| Revocability | Generally, a Gift Deed is irrevocable once executed, meaning the donor cannot take back the gift without consent from the recipient. |

| Tax Implications | Gifts may have tax implications, including potential gift tax liabilities for the donor, depending on the value of the property transferred. |

| Recording | It is advisable to record the Gift Deed with the appropriate county office to provide public notice of the transfer and protect the recipient's ownership rights. |

| Legal Advice | Consulting with a legal professional is recommended to ensure compliance with state laws and to address any specific circumstances related to the gift. |

More Gift Deed Types:

California Corrective Deed - It may be required before a property can be sold or transferred.

The New York Boat Bill of Sale form is a crucial document used to transfer ownership of a boat from one party to another. This form provides essential details about the vessel, including its make, model, and hull identification number. Properly completing this document ensures a smooth transaction and establishes clear ownership records. For more information, you can visit documentonline.org/blank-new-york-boat-bill-of-sale.

What Is a Deed in Lieu of Foreclosure - A Deed in Lieu of Foreclosure can help homeowners avoid the stigma associated with foreclosure records.

Title Companies and Transfer on Death Deeds - The form can facilitate the transfer of property to family members, friends, or organizations as desired.

Dos and Don'ts

When filling out a Gift Deed form, it’s important to follow certain guidelines. Here’s a list of things you should and shouldn’t do:

- Do clearly state the full names of the giver and receiver.

- Do provide accurate property descriptions.

- Do include the date of the gift.

- Do have the document signed in front of a notary.

- Do keep a copy of the completed deed for your records.

- Don't leave any sections blank.

- Don't use vague language when describing the gift.

- Don't forget to check local laws regarding gift deeds.

- Don't rush the process; take your time to ensure accuracy.

- Don't assume that verbal agreements are sufficient.