Valid Transfer-on-Death Deed Form for Georgia

In the state of Georgia, planning for the future often involves considering how to transfer property to loved ones without the complexities of probate. One effective tool for this purpose is the Transfer-on-Death Deed (TODD). This legal document allows property owners to designate beneficiaries who will automatically inherit the property upon the owner's death, bypassing the lengthy and sometimes costly probate process. By using a TODD, individuals can maintain full control over their property during their lifetime, ensuring that their wishes are honored without unnecessary delays or complications. Importantly, the form must be properly executed and recorded to be valid, which means attention to detail is crucial. This deed can apply to various types of real estate, including residential homes and vacant land, making it a versatile option for many property owners. Understanding the nuances of the Transfer-on-Death Deed can empower individuals to make informed decisions about their estate planning, ultimately providing peace of mind for both themselves and their beneficiaries.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not specifying the correct address, parcel number, or legal description. Without precise details, the deed may be deemed invalid.

-

Improper Signatures: All required parties must sign the deed. Often, individuals forget to include the signature of the property owner or do not have the necessary witnesses. This oversight can lead to complications later.

-

Not Notarizing the Document: The Transfer-on-Death Deed must be notarized to be legally binding. Some people neglect this step, thinking it is optional. Without notarization, the deed may not be recognized by the county.

-

Failure to Record the Deed: After filling out the form, it must be recorded with the appropriate county office. Many individuals fill out the deed but forget to submit it for recording, which means it won’t take effect.

-

Confusing Beneficiary Designations: It is crucial to clearly identify the beneficiaries. Mistakes occur when people use vague terms or fail to specify if beneficiaries are to receive equal shares. Clarity is key to avoiding disputes in the future.

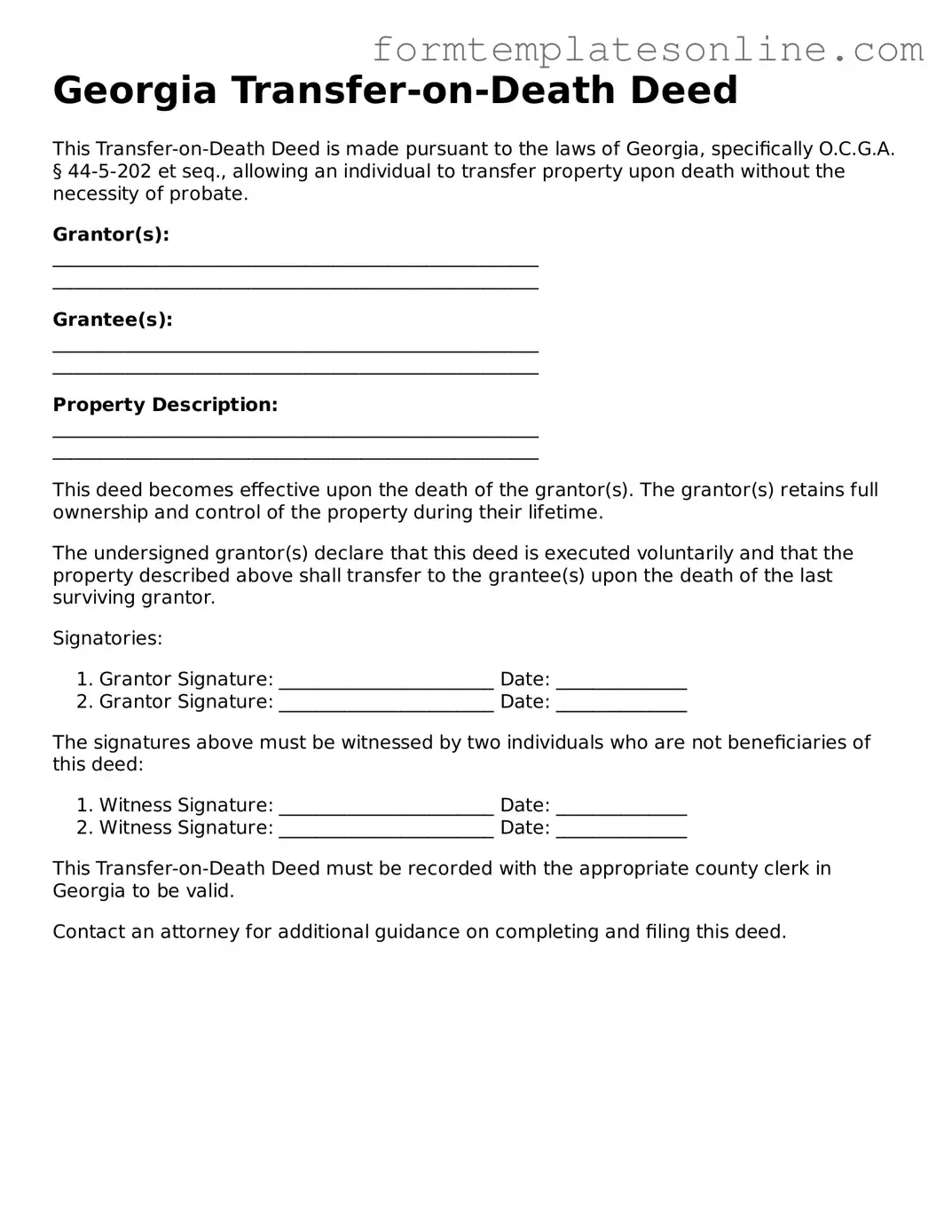

Example - Georgia Transfer-on-Death Deed Form

Georgia Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to the laws of Georgia, specifically O.C.G.A. § 44-5-202 et seq., allowing an individual to transfer property upon death without the necessity of probate.

Grantor(s):

____________________________________________________

____________________________________________________

Grantee(s):

____________________________________________________

____________________________________________________

Property Description:

____________________________________________________

____________________________________________________

This deed becomes effective upon the death of the grantor(s). The grantor(s) retains full ownership and control of the property during their lifetime.

The undersigned grantor(s) declare that this deed is executed voluntarily and that the property described above shall transfer to the grantee(s) upon the death of the last surviving grantor.

Signatories:

- Grantor Signature: _______________________ Date: ______________

- Grantor Signature: _______________________ Date: ______________

The signatures above must be witnessed by two individuals who are not beneficiaries of this deed:

- Witness Signature: _______________________ Date: ______________

- Witness Signature: _______________________ Date: ______________

This Transfer-on-Death Deed must be recorded with the appropriate county clerk in Georgia to be valid.

Contact an attorney for additional guidance on completing and filing this deed.

More About Georgia Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TOD Deed) allows property owners in Georgia to transfer their real estate to a designated beneficiary upon their death. This deed does not affect the owner's rights during their lifetime. The property remains under the owner's control until they pass away, at which point the beneficiary receives ownership automatically, avoiding probate.

Who can be a beneficiary on a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary on a TOD Deed. This includes family members, friends, or even organizations. However, it's important to ensure that the beneficiary is clearly identified to avoid any confusion later. You can also name multiple beneficiaries if desired.

How do I create a Transfer-on-Death Deed in Georgia?

To create a TOD Deed, you must complete the form with the required information, including your name, the property description, and the beneficiary's details. After filling it out, the deed must be signed in the presence of a notary public. Finally, it needs to be recorded at the county's Clerk of Superior Court where the property is located. This recording is essential for the deed to be valid.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time while you are still alive. To do this, you must create a new deed that either names a different beneficiary or states that the previous deed is revoked. Just like the original deed, the new or revoked deed must be signed and recorded to take effect.

What happens if I do not name a beneficiary in my Transfer-on-Death Deed?

If no beneficiary is named in the TOD Deed, the property will not transfer automatically upon your death. Instead, it will go through the probate process, where the court will determine how the property is distributed according to your will or state law if there is no will. To avoid this situation, it's crucial to name at least one beneficiary when creating the deed.

Key takeaways

When filling out and using the Georgia Transfer-on-Death Deed form, consider the following key takeaways:

- Purpose: This deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate.

- Eligibility: Only individuals can create a Transfer-on-Death Deed; entities like corporations or LLCs cannot.

- Property Types: The deed can be used for residential properties, vacant land, and certain other real estate types.

- Beneficiary Designation: Clearly name the beneficiaries. You can designate one or multiple individuals.

- Revocation: The deed can be revoked at any time before the property owner’s death. This requires a new deed to be executed.

- Execution Requirements: The deed must be signed in front of a notary public and filed with the county clerk's office to be effective.

- Taxes: Beneficiaries may be subject to taxes on the property after the transfer, so it’s important to understand potential tax implications.

- Consultation: It is advisable to consult with a legal professional to ensure the deed is filled out correctly and meets all legal requirements.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Transfer-on-Death Deed allows property owners to transfer real estate to a designated beneficiary upon their death, avoiding probate. |

| Governing Law | This deed is governed by Georgia Code Title 44, Chapter 6, Article 3. |

| Eligibility | Only individuals who own real property in Georgia can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the property owner, provided that the revocation is executed and recorded. |

| Beneficiary Designation | Property owners can name one or more beneficiaries, and they can specify different shares for each beneficiary. |

Consider Some Other Transfer-on-Death Deed Forms for US States

How to Avoid Probate in Pa - A Transfer-on-Death Deed allows individuals to transfer property upon death without going through probate.

A Georgia Power of Attorney form is a legal document that gives one person the authority to act on behalf of another. This authority can cover a wide range of activities, from managing finances to making healthcare decisions. It's a crucial tool for planning and managing personal affairs, especially in unforeseen circumstances. For more information, you can visit OnlineLawDocs.com.

Free Printable Transfer on Death Deed Form Florida - Some state laws allow for multiple beneficiaries to be named, providing flexibility in designating heirs.

Dos and Don'ts

When filling out the Georgia Transfer-on-Death Deed form, there are important steps to follow and mistakes to avoid. Here’s a straightforward list to guide you.

- Do ensure that the form is completed in full.

- Do provide accurate property details, including legal descriptions.

- Do sign the deed in front of a notary public.

- Do file the deed with the county clerk’s office where the property is located.

- Do inform your beneficiaries about the deed.

- Don’t use vague language when describing the property.

- Don’t forget to check for any local filing fees.

- Don’t leave out the date of execution.

- Don’t assume that verbal agreements will suffice.

Following these guidelines will help ensure that your Transfer-on-Death Deed is valid and effective. Take your time and double-check your work.