Valid Real Estate Purchase Agreement Form for Georgia

The Georgia Real Estate Purchase Agreement form serves as a crucial document in the real estate transaction process, outlining the terms and conditions agreed upon by both the buyer and the seller. This form typically includes essential details such as the purchase price, financing arrangements, and property descriptions. Additionally, it addresses contingencies that may affect the sale, such as inspections, appraisals, and the buyer's ability to secure financing. Important dates, including the closing date and any deadlines for contingencies, are clearly specified to ensure both parties remain aligned throughout the transaction. The agreement also stipulates the responsibilities of each party, including disclosures and the handling of earnest money. By providing a structured framework for negotiations, the Georgia Real Estate Purchase Agreement helps minimize misunderstandings and protects the interests of both the buyer and the seller, making it a vital element in the real estate market of Georgia.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not only the address but also any relevant details like lot numbers or specific boundaries. A vague description can lead to confusion or disputes later on.

-

Missing Signatures: All parties involved in the transaction must sign the agreement. Often, buyers or sellers forget to sign or assume that a signature from one party is sufficient. Without the necessary signatures, the agreement may not be legally binding.

-

Incorrect Dates: Dates play a crucial role in real estate transactions. Failing to accurately fill in dates for the agreement's effective date, closing date, or other deadlines can create complications. Missing or incorrect dates can lead to misunderstandings or delays.

-

Omitting Contingencies: Contingencies are conditions that must be met for the sale to proceed. Not including important contingencies, such as financing or home inspection, can put buyers at risk. It’s essential to clearly outline these conditions to protect everyone involved.

-

Neglecting to Specify Inclusions and Exclusions: Buyers and sellers often forget to list what is included in the sale, such as appliances or fixtures. Conversely, they may not specify what is excluded. Clarity on these points helps avoid disputes later.

-

Ignoring Local Laws and Regulations: Every state has its own laws regarding real estate transactions. Failing to comply with Georgia's specific requirements can invalidate the agreement. It’s vital to understand local regulations to ensure everything is in order.

-

Rushing the Process: Filling out the form quickly can lead to mistakes. Taking time to carefully read and understand each section is crucial. Rushing can result in overlooked details that may cause problems down the line.

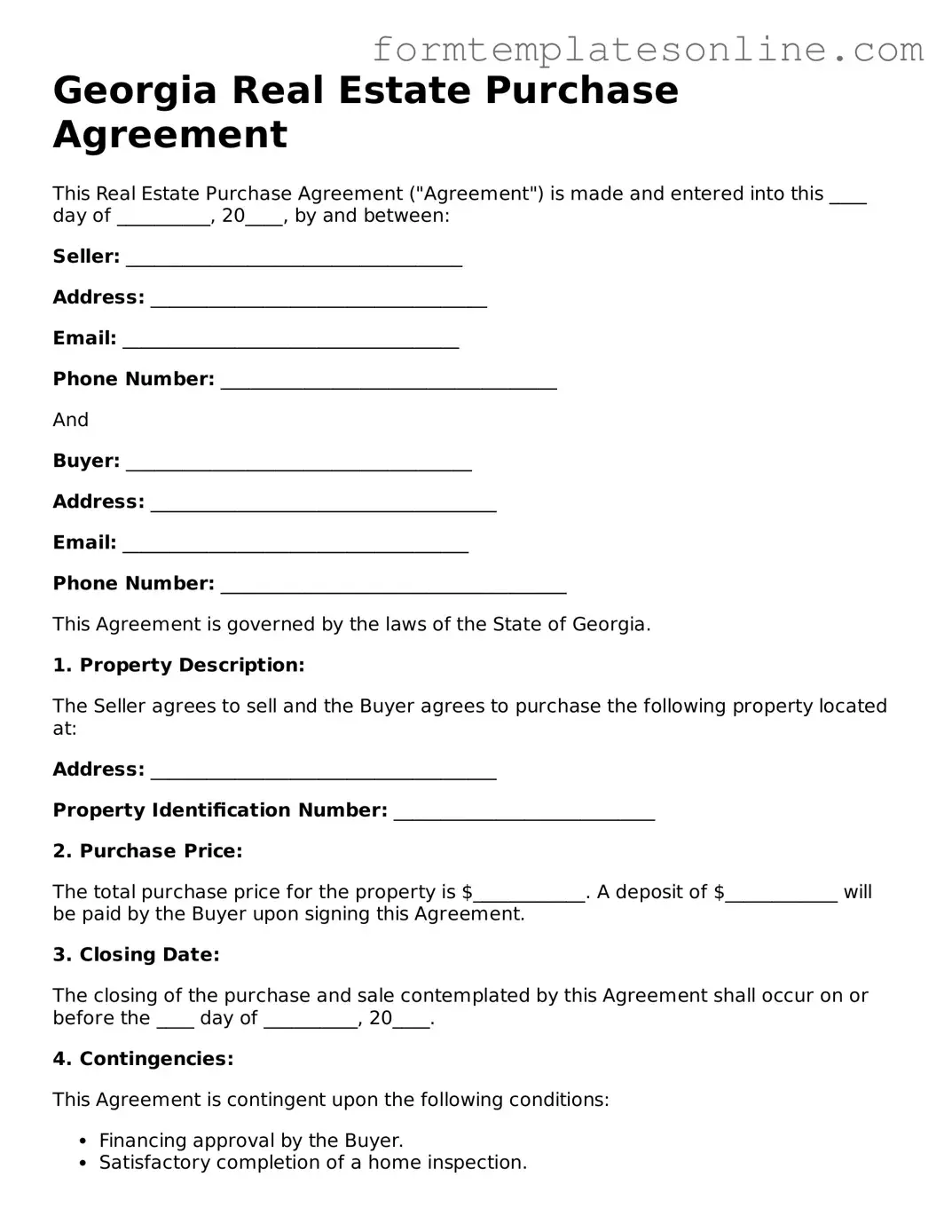

Example - Georgia Real Estate Purchase Agreement Form

Georgia Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into this ____ day of __________, 20____, by and between:

Seller: ____________________________________

Address: ____________________________________

Email: ____________________________________

Phone Number: ____________________________________

And

Buyer: _____________________________________

Address: _____________________________________

Email: _____________________________________

Phone Number: _____________________________________

This Agreement is governed by the laws of the State of Georgia.

1. Property Description:

The Seller agrees to sell and the Buyer agrees to purchase the following property located at:

Address: _____________________________________

Property Identification Number: ____________________________

2. Purchase Price:

The total purchase price for the property is $____________. A deposit of $____________ will be paid by the Buyer upon signing this Agreement.

3. Closing Date:

The closing of the purchase and sale contemplated by this Agreement shall occur on or before the ____ day of __________, 20____.

4. Contingencies:

This Agreement is contingent upon the following conditions:

- Financing approval by the Buyer.

- Satisfactory completion of a home inspection.

- Clear title and resolution of outstanding liens.

5. Possession:

Possession of the property shall be delivered to the Buyer on the date of closing, unless otherwise agreed upon by both parties.

6. Default:

If either party defaults in their obligations under this Agreement, the non-defaulting party may seek remedies available under Georgia law.

7. Additional Terms:

Any additional terms or conditions agreed upon by both parties should be documented here:

__________________________________________________________

__________________________________________________________

8. Signatures:

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first above written.

Seller's Signature: ________________________________ Date: ____________

Buyer's Signature: ________________________________ Date: ____________

More About Georgia Real Estate Purchase Agreement

What is a Georgia Real Estate Purchase Agreement?

The Georgia Real Estate Purchase Agreement is a legal document used to outline the terms and conditions of a real estate transaction in Georgia. This agreement serves as a binding contract between the buyer and seller, detailing the specifics of the sale, including the purchase price, financing terms, and any contingencies. It is crucial for both parties to understand the terms laid out in this document, as it governs the sale process and protects their interests.

What are the key components of the agreement?

A typical Georgia Real Estate Purchase Agreement includes several essential components. These typically cover the names of the parties involved, the property description, the purchase price, earnest money deposit details, closing date, and any contingencies such as inspections or financing. Additionally, the agreement may outline responsibilities for repairs, property taxes, and other obligations that arise before the sale is finalized. Understanding these components helps ensure a smoother transaction.

How does earnest money work in this agreement?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. In the Georgia Real Estate Purchase Agreement, the amount of earnest money is specified, and it typically ranges from 1% to 3% of the purchase price. This deposit is held in escrow and is credited toward the purchase price at closing. If the buyer backs out of the deal without a valid reason, the seller may be entitled to keep the earnest money as compensation for the time the property was off the market.

What contingencies can be included in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies in a Georgia Real Estate Purchase Agreement include financing contingencies, home inspection contingencies, and appraisal contingencies. For example, a buyer may include a contingency that allows them to withdraw from the agreement if the home inspection reveals significant issues. These contingencies protect the buyer and ensure that they are making a well-informed decision before finalizing the purchase.

What happens if either party breaches the agreement?

If either the buyer or seller fails to uphold their obligations as outlined in the agreement, it is considered a breach. In Georgia, the non-breaching party has several options. They may seek to enforce the contract, which could involve legal action to compel the other party to fulfill their obligations. Alternatively, they may choose to terminate the agreement and seek damages. It is essential for both parties to understand their rights and responsibilities to avoid potential disputes.

Is it necessary to hire a real estate attorney for this agreement?

Key takeaways

When dealing with the Georgia Real Estate Purchase Agreement form, it is essential to understand the key components and implications of the document. Here are nine important takeaways to consider:

- Understand the Basics: Familiarize yourself with the structure of the agreement, which typically includes terms of sale, property details, and buyer and seller information.

- Property Description: Clearly describe the property, including its address, legal description, and any fixtures or personal property included in the sale.

- Purchase Price: Specify the total purchase price and outline how it will be paid, including any deposits or financing arrangements.

- Contingencies: Identify any contingencies that must be met for the sale to proceed, such as financing, inspections, or appraisals.

- Closing Date: Establish a timeline for closing the transaction. This date is crucial for both parties to plan accordingly.

- Disclosure Obligations: Be aware of any required disclosures, such as lead paint or property condition, that must be provided to the buyer.

- Negotiation Terms: Understand that the agreement is negotiable. Both parties can discuss and modify terms before finalizing the contract.

- Legal Review: Consider having a legal professional review the agreement to ensure compliance with Georgia law and to protect your interests.

- Signatures: Ensure that all parties sign and date the agreement. Without proper signatures, the contract may not be enforceable.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Real Estate Purchase Agreement is governed by the laws of the State of Georgia. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Parties Involved | The agreement includes details about the buyer and seller, ensuring both parties are clearly identified. |

| Property Description | A detailed description of the property being sold is included, which may encompass the address and legal description. |

| Purchase Price | The form specifies the agreed-upon purchase price for the property, including any deposit requirements. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be satisfied for the sale to proceed. |

| Closing Date | The agreement outlines the anticipated closing date, which is when the property transfer will take place. |

| Default and Remedies | It details what happens if either party defaults on the agreement, including potential remedies available to the non-defaulting party. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Consider Some Other Real Estate Purchase Agreement Forms for US States

North Carolina Realtors - Buyers and sellers can negotiate terms within this comprehensive form.

The Georgia Lease Agreement form is a legally binding document that outlines the terms and conditions under which a rental property is leased by the landlord to the tenant. This detailed agreement serves to protect the interests of both parties involved in the rental transaction. Understanding the specifics of this form is crucial for anyone embarking on a lease arrangement in Georgia, and additional information can be found at OnlineLawDocs.com.

For Sale by Owner Contract Pdf - This form initiates the legal process of transferring property ownership.

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, it’s important to be careful and thorough. Here’s a list of things to do and avoid:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property, including the address and legal description.

- Do include all necessary signatures from all parties involved.

- Do specify the purchase price clearly.

- Do check for any additional terms or contingencies that need to be included.

- Do keep a copy of the completed agreement for your records.

- Don't leave any blank spaces that could lead to confusion.

- Don't use vague language; be specific in your terms.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to date the agreement.

- Don't ignore local laws or regulations that may affect the agreement.

- Don't sign the document without fully understanding all terms.