Valid Quitclaim Deed Form for Georgia

When it comes to transferring property ownership in Georgia, the Quitclaim Deed form serves as a straightforward option for individuals looking to convey their interest in real estate without the complexities often associated with other types of deeds. This form is particularly useful in situations where the parties know each other, such as family members or friends, and trust that the transfer will be honored. Unlike warranty deeds, which guarantee that the title is free of claims, a Quitclaim Deed offers no such assurances, making it essential for both the grantor and grantee to understand the implications of this type of transfer. The form itself includes vital information such as the names of the parties involved, a description of the property, and the signature of the person transferring their interest. Additionally, it must be notarized to be legally binding. While it may seem simple, utilizing a Quitclaim Deed requires careful consideration, especially regarding any existing liens or claims on the property. This article will delve deeper into the nuances of the Georgia Quitclaim Deed form, providing clarity on its use, benefits, and potential pitfalls to ensure a smooth transaction for all parties involved.

Common mistakes

-

Not Providing Complete Information: One common mistake is leaving out essential details. Ensure that both the grantor (the person transferring the property) and the grantee (the person receiving the property) are fully identified. This includes their full names and addresses.

-

Incorrect Property Description: Failing to accurately describe the property can lead to complications. The legal description should match what is recorded in the county records. Double-check that it includes the lot number, block number, and any other pertinent details.

-

Not Signing the Deed: A Quitclaim Deed must be signed by the grantor. Without a signature, the document is invalid. Make sure that the grantor signs in the appropriate place, and consider having the signature notarized.

-

Improper Notarization: If notarization is required, it must be done correctly. The notary public should sign and stamp the document in the designated area. An improperly notarized deed can create issues during the transfer process.

-

Forgetting to Date the Document: The date on which the Quitclaim Deed is signed is crucial. Without a date, it may be difficult to determine when the transfer took place, which can lead to disputes later on.

-

Not Recording the Deed: After filling out the Quitclaim Deed, it is important to record it with the appropriate county office. Failing to do so means the transfer may not be legally recognized, which can create problems in the future.

-

Ignoring Local Laws and Requirements: Each county may have specific rules regarding Quitclaim Deeds. It is essential to check local regulations to ensure compliance. Ignoring these can result in delays or rejection of the deed.

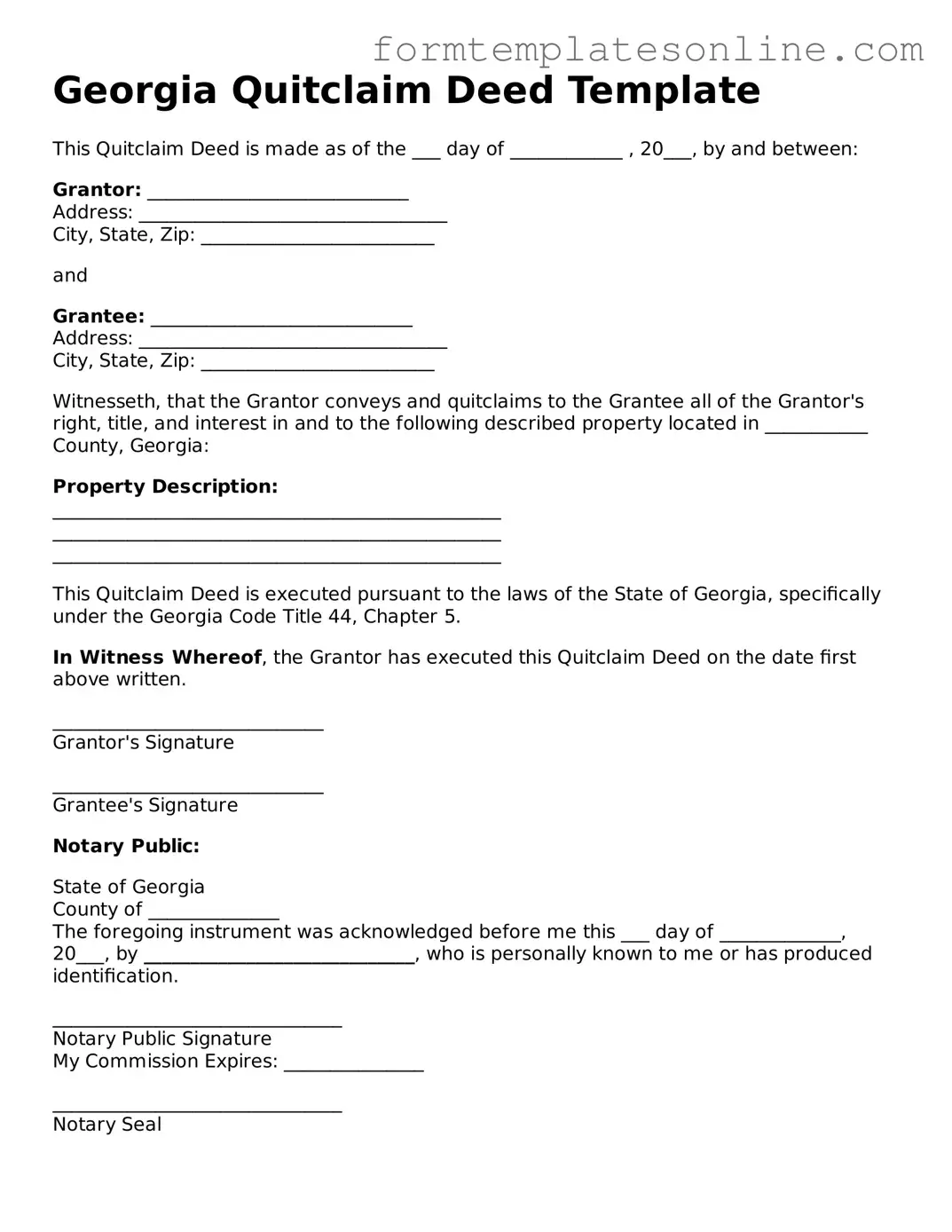

Example - Georgia Quitclaim Deed Form

Georgia Quitclaim Deed Template

This Quitclaim Deed is made as of the ___ day of ____________ , 20___, by and between:

Grantor: ____________________________

Address: _________________________________

City, State, Zip: _________________________

and

Grantee: ____________________________

Address: _________________________________

City, State, Zip: _________________________

Witnesseth, that the Grantor conveys and quitclaims to the Grantee all of the Grantor's right, title, and interest in and to the following described property located in ___________ County, Georgia:

Property Description:

________________________________________________

________________________________________________

________________________________________________

This Quitclaim Deed is executed pursuant to the laws of the State of Georgia, specifically under the Georgia Code Title 44, Chapter 5.

In Witness Whereof, the Grantor has executed this Quitclaim Deed on the date first above written.

_____________________________

Grantor's Signature

_____________________________

Grantee's Signature

Notary Public:

State of Georgia

County of ______________

The foregoing instrument was acknowledged before me this ___ day of _____________, 20___, by _____________________________, who is personally known to me or has produced identification.

_______________________________

Notary Public Signature

My Commission Expires: _______________

_______________________________

Notary Seal

More About Georgia Quitclaim Deed

What is a Quitclaim Deed in Georgia?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. In Georgia, this type of deed does not guarantee that the property title is clear or free of claims. It simply conveys whatever interest the grantor has in the property, if any. This makes it a common choice for transferring property between family members or in situations where the parties trust each other.

How do I complete a Quitclaim Deed in Georgia?

To complete a Quitclaim Deed, you will need to provide specific information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer. The document must be signed by the grantor in front of a notary public. It is also advisable to check local requirements, as some counties may have additional stipulations.

Do I need to have the Quitclaim Deed notarized?

Yes, in Georgia, the Quitclaim Deed must be notarized to be legally valid. The grantor must sign the deed in the presence of a notary public, who will then affix their seal. This step ensures that the identities of the parties are verified and that the document can be recorded in the county where the property is located.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed and a Warranty Deed are not the same. A Warranty Deed offers more protection to the grantee because it guarantees that the grantor holds a clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed makes no such guarantees, which is why it is often used in less formal transactions.

Can I use a Quitclaim Deed to transfer property to myself?

Yes, you can use a Quitclaim Deed to transfer property from your name to another name, including your own. This may be useful in certain situations, such as when changing the title for estate planning purposes or correcting a title error. However, it is wise to consult with a legal professional before proceeding.

What are the tax implications of using a Quitclaim Deed in Georgia?

Generally, transferring property through a Quitclaim Deed may not trigger a tax liability, especially if it is between family members. However, it is important to consider potential gift tax implications if the property is transferred without adequate compensation. Consulting a tax advisor or attorney is advisable to understand any specific tax consequences.

How do I record a Quitclaim Deed in Georgia?

After completing and notarizing the Quitclaim Deed, it must be recorded with the clerk of the superior court in the county where the property is located. There may be a small fee for recording the deed. Once recorded, the deed becomes part of the public record, providing legal notice of the ownership transfer.

Can a Quitclaim Deed be contested?

Yes, a Quitclaim Deed can be contested, but doing so can be complicated. Grounds for contesting may include fraud, lack of capacity, or undue influence at the time of signing. If someone believes that the deed was not executed properly or that the grantor did not have the right to transfer the property, they may pursue legal action. Seeking legal advice is essential in such cases.

Key takeaways

When filling out and using the Georgia Quitclaim Deed form, there are several important points to keep in mind. Below are key takeaways that will help ensure a smooth process.

- Understand the Purpose: A quitclaim deed transfers ownership of property without any guarantees. It is often used between family members or in situations where the seller is not sure of the property title's validity.

- Complete the Form Accurately: Ensure that all fields are filled out correctly, including the names of the grantor (the person giving the property) and the grantee (the person receiving the property).

- Provide a Legal Description: The property must be described accurately. This includes the street address and the legal description as recorded in the county’s property records.

- Signatures are Essential: Both the grantor and the grantee should sign the form. If there are multiple grantors, all must sign to validate the deed.

- Notarization Required: The deed must be notarized to be legally binding. A notary public will verify the identities of the signers and witness the signing.

- File with the County: After completing and notarizing the deed, it must be filed with the county clerk’s office in the county where the property is located.

- Keep Copies: Always retain copies of the completed deed for your records. This is important for future reference and to prove ownership if needed.

By following these key points, you can navigate the process of using a Georgia Quitclaim Deed form with confidence.

File Details

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real property from one party to another without any warranties or guarantees. |

| Governing Law | The quitclaim deed in Georgia is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30 et seq. |

| Purpose | This type of deed is often used to transfer property between family members, in divorce settlements, or to clear up title issues. |

| Consideration | While consideration is not required, it is common to include a nominal amount, such as $10, to validate the transaction. |

| Execution Requirements | The deed must be signed by the grantor (the person transferring the property) in front of a notary public. |

| Recording | To ensure the deed is legally recognized, it should be recorded in the county where the property is located. |

| Limitations | A quitclaim deed does not guarantee that the grantor has clear title to the property; it simply transfers whatever interest the grantor may have. |

| Tax Implications | Although a quitclaim deed may not incur transfer taxes in Georgia, it is advisable to consult with a tax professional regarding potential implications. |

Consider Some Other Quitclaim Deed Forms for US States

House Deed Transfer - Use this form to add someone to the title of your property.

Michigan Quit Claim Deed Pdf - A Quitclaim Deed can be recorded with the local government to finalize the transfer legally.

Dos and Don'ts

When filling out the Georgia Quitclaim Deed form, it's crucial to ensure accuracy and compliance with state requirements. Here’s a helpful list of dos and don’ts to guide you through the process.

- Do provide complete and accurate information about the property and parties involved.

- Do ensure the form is signed by the grantor in front of a notary public.

- Do include a legal description of the property, not just the address.

- Do check for any outstanding liens or claims against the property before proceeding.

- Don't leave any fields blank; incomplete forms can lead to delays.

- Don't forget to date the document at the time of signing.

- Don't use white-out or erasers on the form; any corrections should be initialed.

- Don't submit the deed without first making a copy for your records.

Following these guidelines will help ensure a smoother process when completing your Quitclaim Deed in Georgia. Take your time and double-check your work to avoid any complications.