Valid Promissory Note Form for Georgia

The Georgia Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the borrowing and lending of money. This document outlines the borrower's promise to repay a specified amount to the lender, typically within a defined timeframe. Key elements of the form include the principal amount, interest rate, repayment schedule, and any applicable fees or penalties for late payments. Additionally, it may specify whether the note is secured or unsecured, which impacts the lender's recourse in case of default. The form also includes space for signatures from both parties, ensuring that the agreement is legally binding. By clearly laying out the terms of the loan, the Georgia Promissory Note helps to prevent misunderstandings and provides a framework for resolving disputes should they arise. Understanding this form is essential for anyone involved in a lending arrangement in Georgia, as it establishes the legal obligations of both the borrower and the lender.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. This can lead to delays or even the rejection of the note.

-

Incorrect Dates: Entering the wrong date can create confusion regarding the payment schedule. Always double-check the dates before submitting.

-

Missing Signatures: Both the borrower and lender must sign the document. Omitting a signature can invalidate the agreement.

-

Ambiguous Terms: Using vague language when describing the loan terms can lead to misunderstandings. Clearly state the amount, interest rate, and repayment schedule.

-

Improper Witnessing: Some people overlook the need for a witness or notary. Depending on the situation, this step may be crucial for the document's legality.

-

Ignoring State Laws: Each state has specific regulations regarding promissory notes. Not adhering to Georgia's laws can render the document unenforceable.

-

Failing to Keep Copies: After filling out the form, it is essential to keep copies for both parties. This ensures that everyone has a record of the agreement.

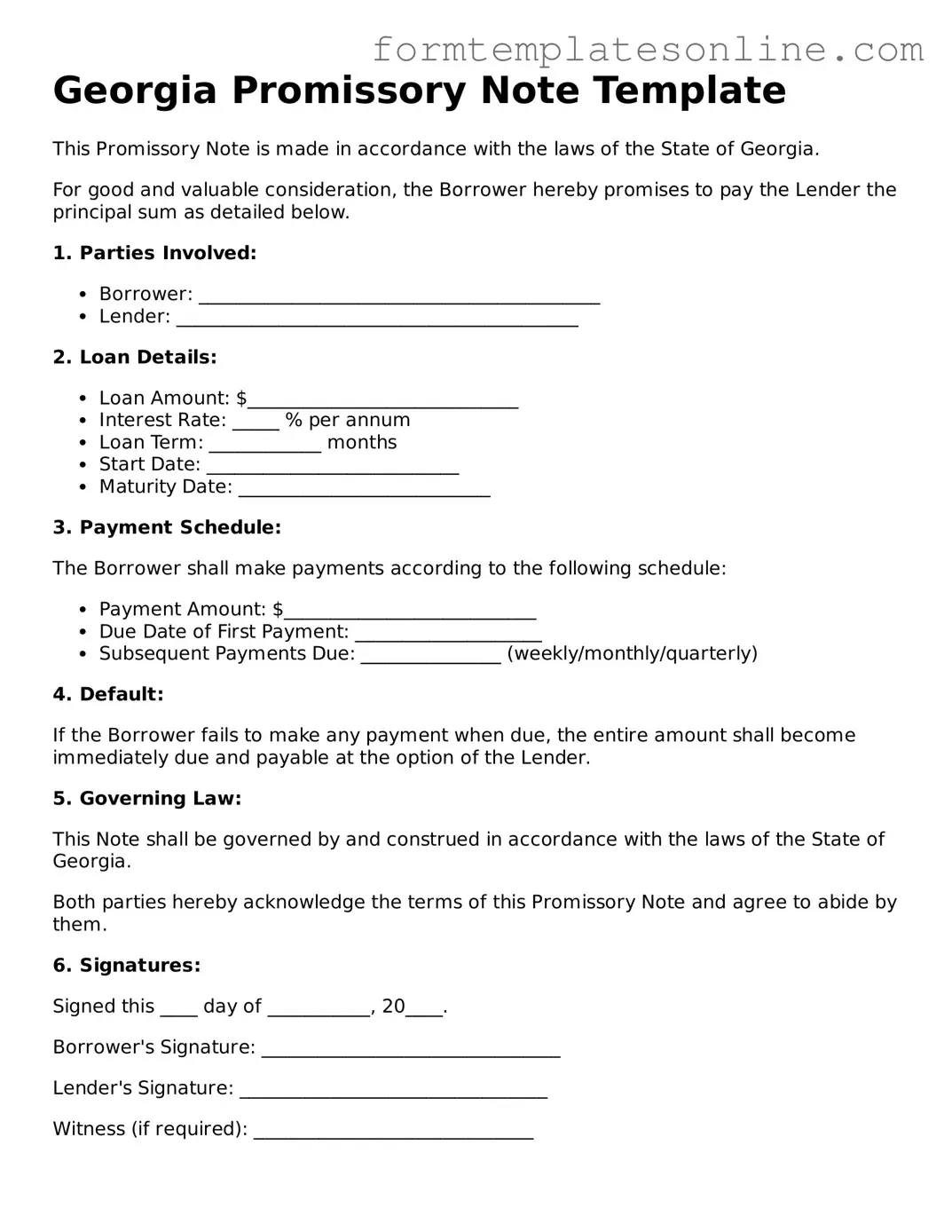

Example - Georgia Promissory Note Form

Georgia Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of Georgia.

For good and valuable consideration, the Borrower hereby promises to pay the Lender the principal sum as detailed below.

1. Parties Involved:

- Borrower: ___________________________________________

- Lender: ___________________________________________

2. Loan Details:

- Loan Amount: $_____________________________

- Interest Rate: _____ % per annum

- Loan Term: ____________ months

- Start Date: ___________________________

- Maturity Date: ___________________________

3. Payment Schedule:

The Borrower shall make payments according to the following schedule:

- Payment Amount: $___________________________

- Due Date of First Payment: ____________________

- Subsequent Payments Due: _______________ (weekly/monthly/quarterly)

4. Default:

If the Borrower fails to make any payment when due, the entire amount shall become immediately due and payable at the option of the Lender.

5. Governing Law:

This Note shall be governed by and construed in accordance with the laws of the State of Georgia.

Both parties hereby acknowledge the terms of this Promissory Note and agree to abide by them.

6. Signatures:

Signed this ____ day of ___________, 20____.

Borrower's Signature: ________________________________

Lender's Signature: _________________________________

Witness (if required): ______________________________

More About Georgia Promissory Note

What is a Georgia Promissory Note?

A Georgia Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a defined time or on demand. This document outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments.

Who can use a Promissory Note in Georgia?

Any individual or business can use a Promissory Note in Georgia. It is commonly used between friends, family members, or business partners. However, it is essential to ensure that both parties understand the terms and conditions outlined in the note.

What are the essential components of a Georgia Promissory Note?

A typical Georgia Promissory Note includes the names of the borrower and lender, the principal amount, the interest rate, the repayment schedule, and the maturity date. It may also include provisions for late fees, prepayment, and default consequences.

Is a Promissory Note legally binding in Georgia?

Yes, a Promissory Note is legally binding in Georgia as long as it meets certain requirements. Both parties must agree to the terms, and the document should be signed by the borrower. In some cases, having the note notarized can add an extra layer of protection.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised note to avoid misunderstandings in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or seeking a judgment against the borrower. The specific consequences should be outlined in the Promissory Note itself.

Do I need a lawyer to create a Promissory Note in Georgia?

While it is not required to have a lawyer to create a Promissory Note, it is often a good idea. A legal professional can help ensure that the document is clear, enforceable, and compliant with Georgia laws.

Where can I find a template for a Georgia Promissory Note?

Templates for Georgia Promissory Notes can be found online. Many legal websites offer free or paid templates. It is crucial to choose a template that meets your specific needs and complies with Georgia law.

Key takeaways

When dealing with a Georgia Promissory Note, understanding the key components can make the process smoother. Here are some essential takeaways to keep in mind:

- Understand the Purpose: A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a future date. It serves as a legal document that outlines the terms of the loan.

- Identify the Parties: Clearly state who is lending the money (the lender) and who is borrowing it (the borrower). This helps prevent confusion later on.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure should be accurate to avoid disputes in the future.

- Include Interest Rates: If applicable, specify the interest rate on the loan. Be sure to clarify whether it is fixed or variable, as this affects repayment amounts.

- Outline Payment Terms: Detail how and when payments will be made. This includes the payment schedule, whether it’s monthly, quarterly, or otherwise, and the due dates.

- Address Default Conditions: Define what constitutes a default on the loan. This can include missed payments or failure to meet other obligations outlined in the note.

- Signatures Are Essential: Both parties must sign the document for it to be legally binding. Ensure that the signatures are dated, as this provides a clear timeline of the agreement.

By keeping these points in mind, you can effectively navigate the process of filling out and utilizing a Georgia Promissory Note. Always consider consulting with a professional if you have questions or need assistance.

File Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money at a specified time or on demand. |

| Governing Law | The Georgia Promissory Note is governed by Georgia state law, specifically O.C.G.A. § 10-3-1 et seq. |

| Parties Involved | The document typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rates | Interest rates can be fixed or variable and should be clearly stated in the note. |

| Payment Terms | Payment terms must be outlined, including due dates and the total amount owed. |

| Signatures | Both parties must sign the note for it to be legally binding. |

| Default Clause | A default clause may be included to specify what happens if the borrower fails to make payments. |

| Transferability | Promissory notes can often be transferred or sold to other parties unless otherwise stated. |

| Notarization | While notarization is not required, it can add an extra layer of authenticity and may be beneficial in legal disputes. |

Consider Some Other Promissory Note Forms for US States

Loan Agreement Template Texas - The note's stipulations should be aligned with state lending regulations.

The Georgia Lease Agreement form is a legally binding document that outlines the terms and conditions under which a rental property is leased by the landlord to the tenant. This detailed agreement serves to protect the interests of both parties involved in the rental transaction. For more information about this critical document, you can visit OnlineLawDocs.com, as understanding the specifics of this form is crucial for anyone embarking on a lease arrangement in Georgia.

Promissory Note Illinois - In some cases, a Promissory Note might include specific terms about the loan’s use.

Dos and Don'ts

When filling out the Georgia Promissory Note form, it's important to be careful and thorough. Here are some key dos and don'ts to keep in mind:

- Do provide accurate information about the borrower and lender.

- Do clearly state the loan amount and interest rate.

- Do specify the repayment terms, including due dates.

- Do include any late fees or penalties for missed payments.

- Don't leave any fields blank; complete all required sections.

- Don't use vague language; be precise in your wording.

- Don't forget to sign and date the document.

- Don't ignore the need for witnesses or notarization if required.