Valid Loan Agreement Form for Georgia

When it comes to borrowing money in Georgia, a Loan Agreement form serves as a crucial document that outlines the terms and conditions of the loan. This form typically includes essential details such as the names of the borrower and lender, the loan amount, the interest rate, and the repayment schedule. It also specifies any collateral involved, which provides security for the lender in case the borrower defaults. Furthermore, the agreement may address late payment penalties, prepayment options, and the governing laws that apply to the transaction. Understanding these components is vital for both parties, as it helps establish clear expectations and legal protections. By clearly defining the rights and responsibilities of each party, the Loan Agreement form plays a pivotal role in ensuring a smooth lending process and minimizing potential disputes down the road.

Common mistakes

-

Incomplete Information: Many individuals neglect to fill out all required fields. Missing information can delay processing and may lead to rejection of the application. Always double-check that every section is complete.

-

Incorrect Personal Details: Mistakes in personal information, such as misspelled names or incorrect Social Security numbers, can create significant issues. Ensure that all details match your official documents.

-

Failure to Read Terms: Some borrowers skip over the terms and conditions. Understanding the loan's interest rates, repayment schedule, and any fees is crucial. Take the time to read and comprehend these details.

-

Neglecting to Sign: Forgetting to sign the agreement is a common oversight. Without a signature, the document is not legally binding. Always confirm that your signature is present before submission.

-

Not Keeping a Copy: After submitting the form, failing to keep a copy for personal records can lead to confusion later. Retaining a copy helps track the loan's terms and your obligations.

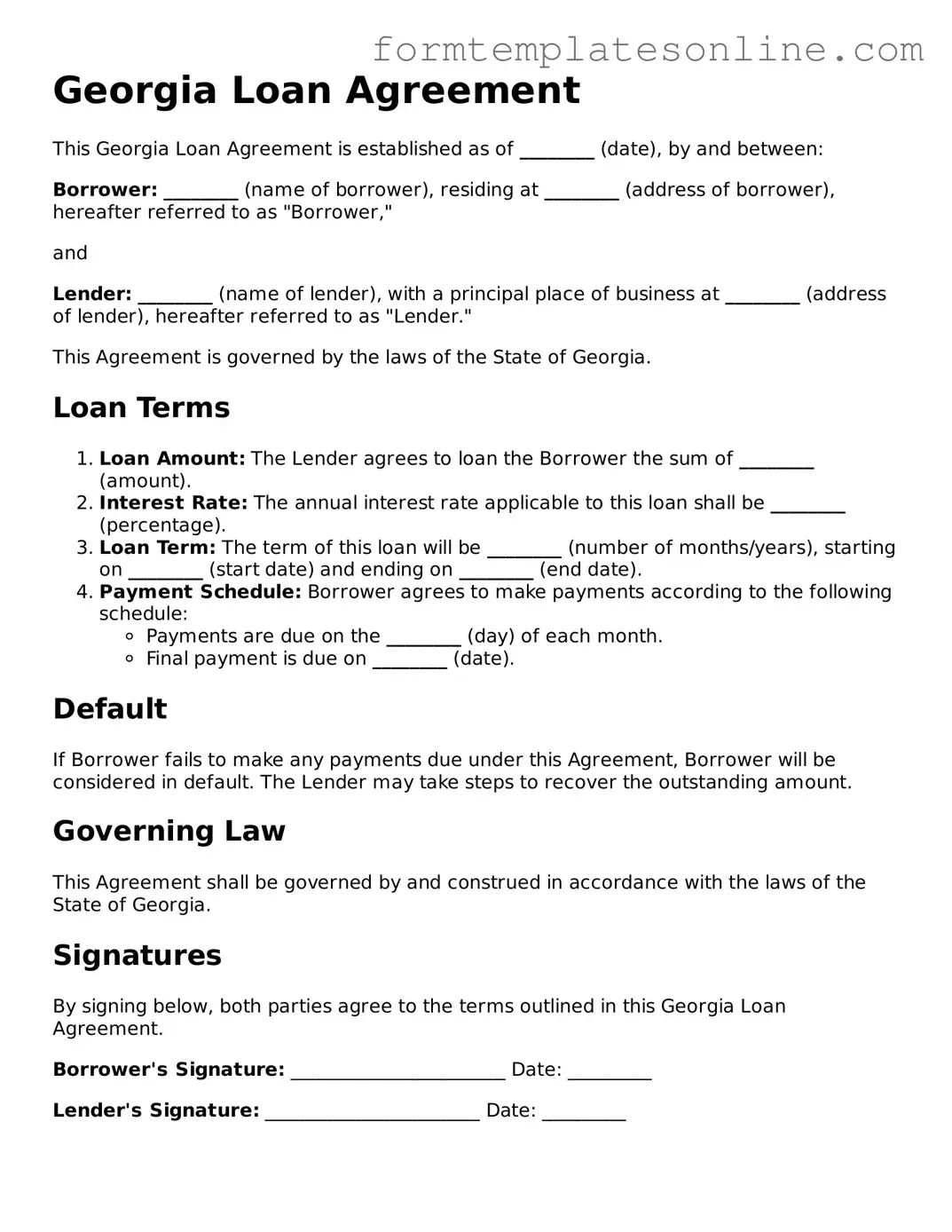

Example - Georgia Loan Agreement Form

Georgia Loan Agreement

This Georgia Loan Agreement is established as of ________ (date), by and between:

Borrower: ________ (name of borrower), residing at ________ (address of borrower), hereafter referred to as "Borrower,"

and

Lender: ________ (name of lender), with a principal place of business at ________ (address of lender), hereafter referred to as "Lender."

This Agreement is governed by the laws of the State of Georgia.

Loan Terms

- Loan Amount: The Lender agrees to loan the Borrower the sum of ________ (amount).

- Interest Rate: The annual interest rate applicable to this loan shall be ________ (percentage).

- Loan Term: The term of this loan will be ________ (number of months/years), starting on ________ (start date) and ending on ________ (end date).

- Payment Schedule: Borrower agrees to make payments according to the following schedule:

- Payments are due on the ________ (day) of each month.

- Final payment is due on ________ (date).

Default

If Borrower fails to make any payments due under this Agreement, Borrower will be considered in default. The Lender may take steps to recover the outstanding amount.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

Signatures

By signing below, both parties agree to the terms outlined in this Georgia Loan Agreement.

Borrower's Signature: _______________________ Date: _________

Lender's Signature: _______________________ Date: _________

More About Georgia Loan Agreement

What is the Georgia Loan Agreement form?

The Georgia Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is provided in the state of Georgia. It serves as a binding contract between the lender and the borrower, detailing the loan amount, interest rates, repayment schedule, and any other relevant provisions.

Who needs to use the Georgia Loan Agreement form?

This form is necessary for anyone lending or borrowing money in Georgia. It protects both parties by clearly stating their rights and obligations. Individuals, businesses, and organizations can all benefit from using this agreement to ensure clarity and legal protection in financial transactions.

What information is required to complete the form?

To complete the Georgia Loan Agreement form, you will need to provide specific details, including the names and addresses of both the lender and borrower, the loan amount, interest rate, repayment terms, and any collateral involved. Additional clauses may also be included to address late payments or default scenarios.

Is the Georgia Loan Agreement form legally binding?

Yes, once both parties sign the Georgia Loan Agreement form, it becomes a legally binding contract. This means that both the lender and borrower are obligated to adhere to the terms outlined in the document. Failing to do so could result in legal consequences.

Can the terms of the loan be modified after signing?

Yes, the terms of the loan can be modified, but any changes must be documented in writing and signed by both parties. This ensures that all modifications are clear and legally enforceable, maintaining the integrity of the original agreement.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options, which may include initiating legal action to recover the owed amount. The specifics of these actions should be outlined in the Loan Agreement. It is crucial for both parties to understand the consequences of defaulting before entering into the agreement.

Is it necessary to have a witness or notary for the agreement?

While not always required, having a witness or a notary public can add an extra layer of validity to the Georgia Loan Agreement form. This can help prevent disputes about the authenticity of signatures and the agreement itself, providing additional protection for both parties.

Where can I obtain the Georgia Loan Agreement form?

The Georgia Loan Agreement form can be obtained from various sources, including legal stationery stores, online legal document providers, or local attorneys. It is essential to ensure that the version you use complies with current Georgia laws and regulations.

Can I use the Georgia Loan Agreement form for personal loans?

Yes, the Georgia Loan Agreement form is suitable for personal loans. Whether you are lending money to a friend or family member, using this form helps clarify expectations and responsibilities, reducing the risk of misunderstandings or conflicts in the future.

Key takeaways

When filling out and using the Georgia Loan Agreement form, it’s important to keep several key points in mind. Here are ten takeaways to help guide you through the process:

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. This ensures that everyone involved is properly identified.

- Loan Amount: Specify the exact amount of money being loaned. This figure should be clear and unambiguous.

- Interest Rate: Include the interest rate applicable to the loan. This can be either fixed or variable, but it must be clearly defined.

- Repayment Terms: Outline the repayment schedule. Indicate how often payments are due, the amount of each payment, and the total duration of the loan.

- Late Fees: Detail any fees that may be incurred for late payments. This helps borrowers understand the consequences of missing a payment.

- Default Conditions: Clearly define what constitutes a default on the loan. This might include missed payments or failure to meet other obligations.

- Governing Law: Specify that the agreement will be governed by Georgia law. This is important for resolving any potential disputes.

- Signatures: Ensure that both parties sign and date the agreement. This signifies acceptance of the terms outlined in the document.

- Witness or Notary: Consider having the agreement witnessed or notarized. This adds an extra layer of legitimacy to the document.

- Keep Copies: After the agreement is signed, both parties should retain a copy. This is essential for record-keeping and future reference.

By paying attention to these key points, you can create a clear and effective loan agreement that protects both the lender and the borrower. Understanding the details will help ensure a smooth transaction.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Georgia Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Georgia. |

| Parties Involved | The form identifies the lender and the borrower, both of whom must provide their legal names and addresses. |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement. |

| Repayment Terms | The agreement outlines the repayment schedule, including the due dates and any applicable interest rates. |

| Signatures | Both parties must sign the document to indicate their acceptance of the terms outlined in the agreement. |

Consider Some Other Loan Agreement Forms for US States

New York Promissory Note - It may include a waiver of certain rights or claims by either party.

Florida Promissory Note Template - Details the process for lenders to reclaim collateral if necessary.

The Georgia Lease Agreement form is essential for ensuring clarity in rental transactions, and for further details on this important document, you can visit OnlineLawDocs.com. This legally binding agreement outlines the terms and conditions that govern the relationship between the landlord and the tenant, safeguarding the interests of both parties involved in the lease.

Texas Promissory Note Requirements - The document often includes a section for amendments to the original terms.

Free Promissory Note Template California - A loan agreement is a document that outlines the terms of borrowing money.

Dos and Don'ts

When filling out the Georgia Loan Agreement form, it's essential to approach the task with care. Here’s a list of things you should and shouldn't do to ensure a smooth process.

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all numbers and figures for correctness.

- Do sign and date the form in the designated areas.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; this could lead to processing issues.

- Don't use abbreviations or shorthand unless specified in the instructions.

- Don't rush through the form; take your time to ensure accuracy.

- Don't forget to review the terms and conditions before signing.

- Don't submit the form without checking for any errors or omissions.