Valid Gift Deed Form for Georgia

The Georgia Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without monetary exchange. This document outlines the essential elements required for a valid gift, including the identification of the donor and the recipient, a clear description of the property being gifted, and the intent to make a gift without any expectation of payment. It also necessitates the signature of the donor, which signifies their voluntary decision to relinquish ownership. In Georgia, the execution of this form must be accompanied by proper notarization to ensure authenticity and prevent future disputes. Importantly, the Gift Deed form also addresses potential tax implications, as gifts may be subject to federal gift tax regulations. Understanding these components is vital for anyone considering a property transfer in Georgia, as it helps ensure that the process is legally sound and that the intentions of the parties involved are clearly documented.

Common mistakes

-

Not including the full legal names of both the donor and the recipient. This can lead to confusion and potential legal issues.

-

Failing to provide a complete and accurate description of the property being gifted. Omitting details can result in disputes later on.

-

Neglecting to sign the form in the presence of a notary public. Without notarization, the deed may not be considered valid.

-

Using outdated or incorrect versions of the Gift Deed form. Always ensure you are using the most current version to avoid complications.

-

Overlooking the requirement for witnesses. Some jurisdictions may require witnesses to the signing of the deed.

-

Not checking for any existing liens or mortgages on the property. This oversight can complicate the transfer process.

-

Ignoring state-specific laws or regulations regarding gift deeds. Each state may have unique requirements that must be followed.

-

Failing to record the Gift Deed with the county clerk's office. Recording the deed is essential for public notice and legal protection.

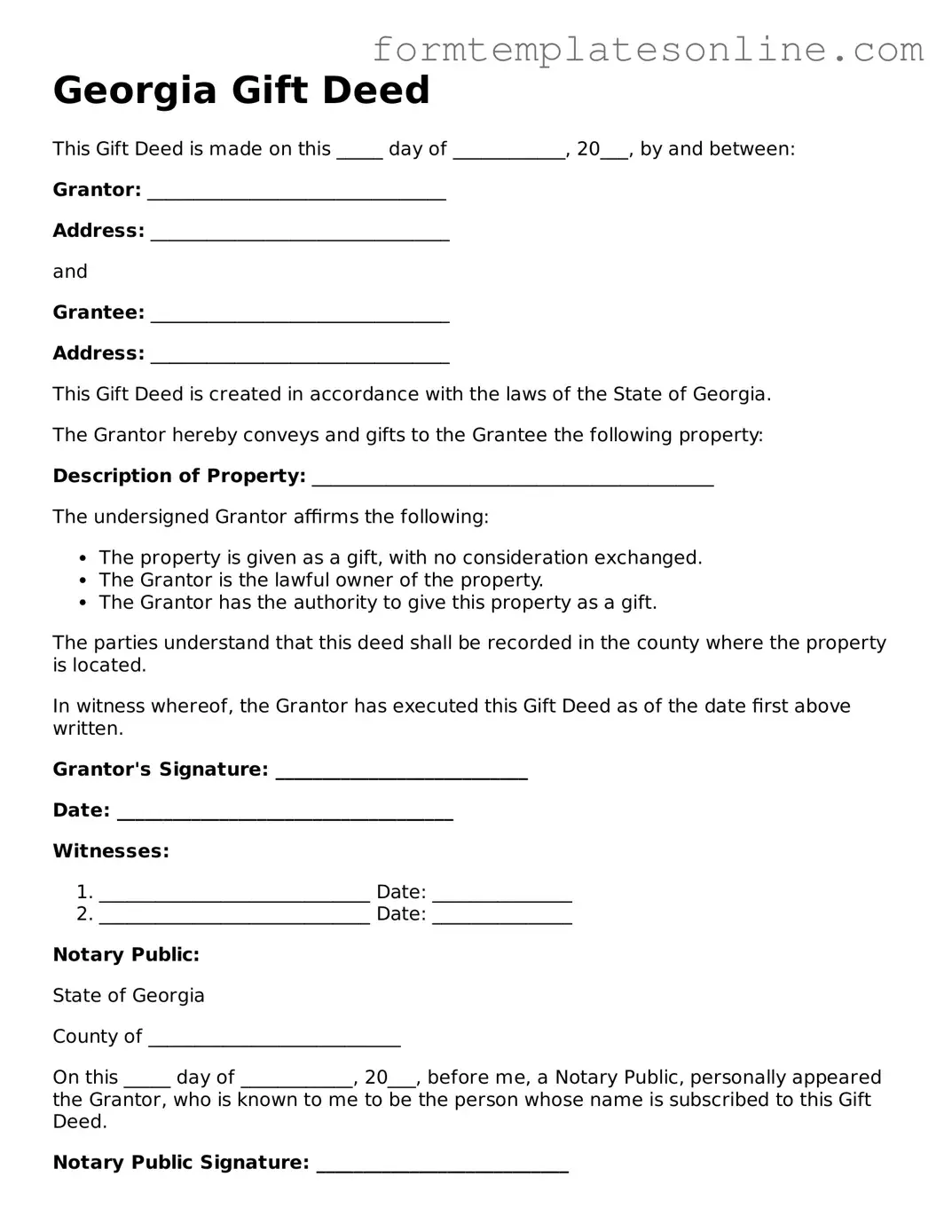

Example - Georgia Gift Deed Form

Georgia Gift Deed

This Gift Deed is made on this _____ day of ____________, 20___, by and between:

Grantor: ________________________________

Address: ________________________________

and

Grantee: ________________________________

Address: ________________________________

This Gift Deed is created in accordance with the laws of the State of Georgia.

The Grantor hereby conveys and gifts to the Grantee the following property:

Description of Property: ___________________________________________

The undersigned Grantor affirms the following:

- The property is given as a gift, with no consideration exchanged.

- The Grantor is the lawful owner of the property.

- The Grantor has the authority to give this property as a gift.

The parties understand that this deed shall be recorded in the county where the property is located.

In witness whereof, the Grantor has executed this Gift Deed as of the date first above written.

Grantor's Signature: ___________________________

Date: ____________________________________

Witnesses:

- _____________________________ Date: _______________

- _____________________________ Date: _______________

Notary Public:

State of Georgia

County of ___________________________

On this _____ day of ____________, 20___, before me, a Notary Public, personally appeared the Grantor, who is known to me to be the person whose name is subscribed to this Gift Deed.

Notary Public Signature: ___________________________

My Commission Expires: ___________________________

More About Georgia Gift Deed

What is a Georgia Gift Deed?

A Georgia Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. This type of deed is typically used when a property owner wishes to give a gift of real estate to a family member or friend. The deed must be properly executed and recorded to ensure the transfer is legally recognized.

What information is required to complete a Gift Deed?

To complete a Gift Deed in Georgia, you will need several key pieces of information. This includes the names and addresses of both the giver (donor) and the receiver (grantee), a legal description of the property being transferred, and any relevant tax information. Additionally, both parties must sign the deed in the presence of a notary public to validate the document.

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when transferring property through a Gift Deed. The IRS allows individuals to give a certain amount each year without incurring gift taxes. However, if the value of the property exceeds this annual exclusion amount, the donor may need to file a gift tax return. It's advisable to consult a tax professional to understand any potential tax liabilities associated with the gift.

How do I record a Gift Deed in Georgia?

To record a Gift Deed in Georgia, you must take the completed and notarized deed to the county clerk's office where the property is located. There, you will submit the deed for recording. There may be a small fee for this service. Once recorded, the deed becomes a public document, ensuring that the transfer of ownership is officially recognized.

Can a Gift Deed be revoked or changed after it is signed?

Once a Gift Deed is signed and recorded, it generally cannot be revoked or changed without the consent of the grantee. The donor loses control over the property once the gift is made. If circumstances change, the donor may need to seek legal advice to explore options, but it can be a complex process. Always consider the implications before executing a Gift Deed.

Key takeaways

When considering the Georgia Gift Deed form, understanding its nuances is essential for both the giver and the recipient. Here are some key takeaways to keep in mind:

- Definition of a Gift Deed: A Gift Deed is a legal document that allows a property owner to transfer ownership of real estate to another person without any exchange of money.

- Eligibility: Any individual who legally owns property in Georgia can execute a Gift Deed, provided they are of sound mind and legal age.

- Consideration: Unlike a traditional sale, a Gift Deed does not require monetary consideration, but it is important to document the intent to gift.

- Filling Out the Form: Complete all required fields accurately, including the names of both the donor and the recipient, as well as a detailed description of the property.

- Notarization: The Gift Deed must be signed in the presence of a notary public to ensure its validity and to prevent potential disputes.

- Recording the Deed: After execution, the Gift Deed should be recorded at the county clerk’s office where the property is located to establish a public record of the transfer.

- Tax Implications: Be aware of potential gift tax implications. While federal limits may apply, consulting a tax professional can provide clarity on specific situations.

- Revocation: Once executed, a Gift Deed is generally irrevocable. Understanding this permanence is crucial before proceeding with the transfer.

- Legal Advice: Seeking legal advice is advisable, especially for complex situations or when transferring property with significant value.

By keeping these key points in mind, individuals can navigate the process of using a Georgia Gift Deed more effectively and ensure a smooth transfer of property ownership.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property ownership as a gift without any payment. |

| Governing Law | The Gift Deed in Georgia is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30. |

| Requirements | The deed must be in writing, signed by the donor, and notarized to be valid. |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from a sale. |

| Tax Implications | Gifts may have tax implications for both the giver and the receiver; consult a tax professional. |

| Recording | The completed deed should be recorded in the county where the property is located to provide public notice. |

| Revocation | A gift deed can be revoked before it is delivered and accepted by the recipient. |

Consider Some Other Gift Deed Forms for US States

Transfer House Title - Signed by both parties to confirm agreement and acceptance.

In addition to its essential role in proving ownership, the Georgia Motorcycle Bill of Sale form can be obtained conveniently from resources like OnlineLawDocs.com, ensuring that both buyers and sellers have access to the necessary documentation to finalize their transaction smoothly.

Dos and Don'ts

When filling out the Georgia Gift Deed form, it is essential to approach the process with care and attention to detail. Here are some important do's and don'ts to consider:

- Do ensure that the names of both the donor and the recipient are clearly printed and spelled correctly.

- Do include a complete legal description of the property being gifted.

- Do sign the deed in front of a notary public to validate the document.

- Do check for any specific state requirements that may apply to your situation.

- Don't leave any sections of the form blank; every part must be filled out completely.

- Don't forget to date the document when signing it.

- Don't use abbreviations or informal language when describing the property.

- Don't overlook the need to file the deed with the county clerk's office after it is completed.