Valid Deed in Lieu of Foreclosure Form for Georgia

In the state of Georgia, homeowners facing the possibility of foreclosure have an alternative option that can help ease their financial burden: the Deed in Lieu of Foreclosure form. This legal document allows a homeowner to voluntarily transfer ownership of their property back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By doing so, the homeowner can potentially mitigate damage to their credit score and may even be able to negotiate favorable terms with the lender, such as the possibility of debt forgiveness. The form itself typically includes essential details such as the names of the parties involved, a description of the property, and any specific terms agreed upon during the negotiation process. It is crucial for homeowners to understand that while this option can provide a smoother exit from a difficult situation, it also carries implications that should be carefully considered. Engaging with a knowledgeable professional can help clarify these aspects and guide homeowners through the process, ensuring that they make informed decisions about their financial future.

Common mistakes

-

Not fully understanding the form: Many people fill out the Deed in Lieu of Foreclosure form without fully grasping its implications. This document transfers property ownership to the lender, which can have long-term effects on credit and future homeownership.

-

Incorrect property description: Failing to provide a precise legal description of the property can lead to complications. Ensure that the property is accurately described as it appears on the original deed.

-

Missing signatures: It's common for individuals to overlook the need for all required signatures. Both the borrower and any co-borrowers must sign the form for it to be valid.

-

Not including the date: Forgetting to date the form can create confusion about when the transfer took place. Always include the date to establish a clear timeline.

-

Neglecting to notify all parties: Some people forget to inform all relevant parties about the deed transfer. This includes co-borrowers and any interested family members.

-

Not consulting a professional: Skipping legal or financial advice can lead to mistakes. Consulting a real estate attorney or financial advisor can help clarify the process and implications.

-

Overlooking tax implications: Failing to consider potential tax consequences of the deed transfer can result in unexpected liabilities. It's essential to understand how this may affect your taxes.

-

Assuming the lender will accept it: Some individuals mistakenly believe that submitting the form guarantees acceptance by the lender. Always check with the lender to confirm their willingness to accept a deed in lieu of foreclosure.

-

Ignoring local laws: Each state has specific regulations regarding deeds in lieu of foreclosure. Ignoring these local laws can lead to invalidation of the document.

-

Not keeping copies: After completing the form, some people forget to keep copies for their records. Always retain a copy for future reference and proof of the transaction.

Example - Georgia Deed in Lieu of Foreclosure Form

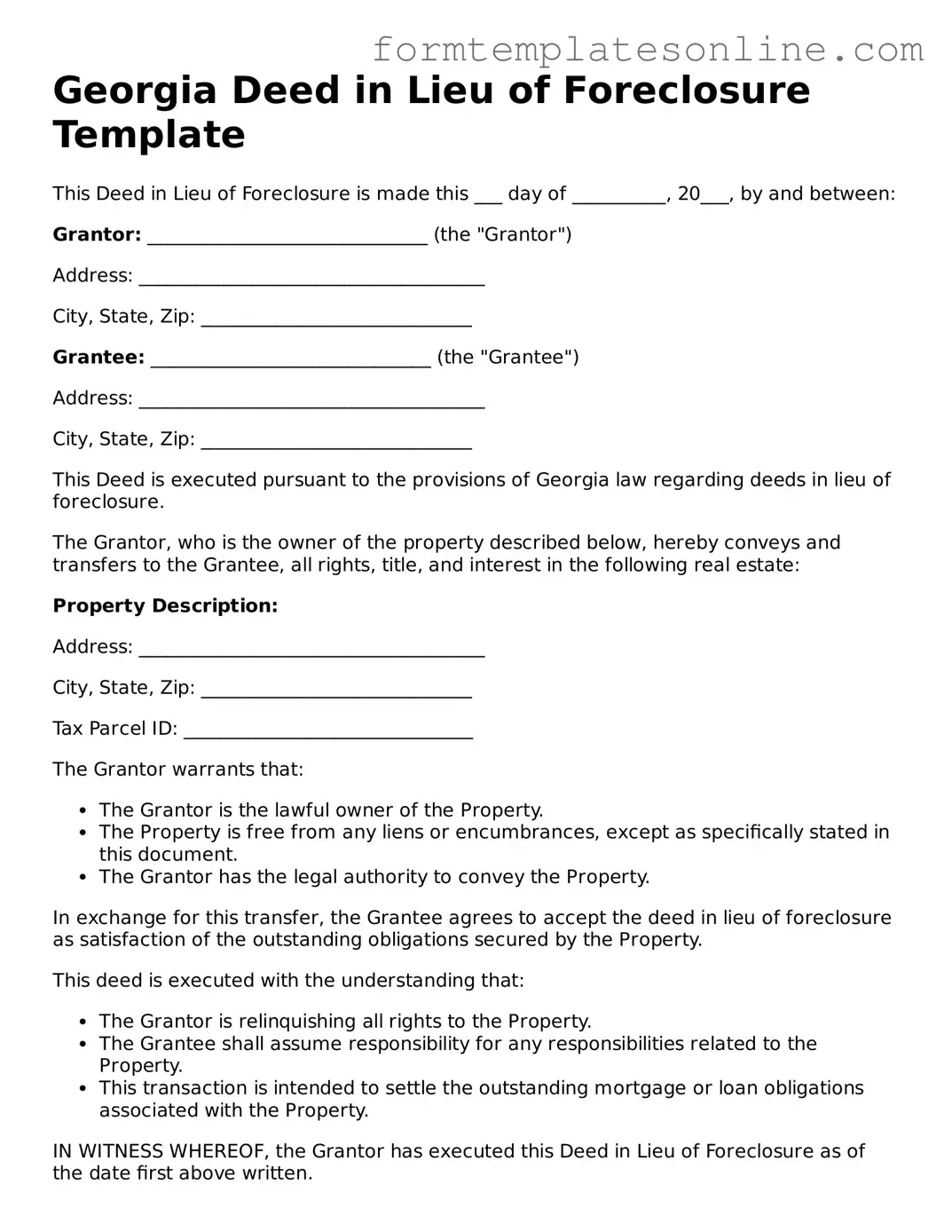

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20___, by and between:

Grantor: ______________________________ (the "Grantor")

Address: _____________________________________

City, State, Zip: _____________________________

Grantee: ______________________________ (the "Grantee")

Address: _____________________________________

City, State, Zip: _____________________________

This Deed is executed pursuant to the provisions of Georgia law regarding deeds in lieu of foreclosure.

The Grantor, who is the owner of the property described below, hereby conveys and transfers to the Grantee, all rights, title, and interest in the following real estate:

Property Description:

Address: _____________________________________

City, State, Zip: _____________________________

Tax Parcel ID: _______________________________

The Grantor warrants that:

- The Grantor is the lawful owner of the Property.

- The Property is free from any liens or encumbrances, except as specifically stated in this document.

- The Grantor has the legal authority to convey the Property.

In exchange for this transfer, the Grantee agrees to accept the deed in lieu of foreclosure as satisfaction of the outstanding obligations secured by the Property.

This deed is executed with the understanding that:

- The Grantor is relinquishing all rights to the Property.

- The Grantee shall assume responsibility for any responsibilities related to the Property.

- This transaction is intended to settle the outstanding mortgage or loan obligations associated with the Property.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

_______________________________

Grantor Signature

_______________________________

Print Name

_______________________________

Date

_______________________________

Grantee Signature

_______________________________

Print Name

_______________________________

Date

STATE OF GEORGIA, COUNTY OF __________:

On this ___ day of __________, 20___, before me personally came _________________________, who acknowledged that he/she executed the foregoing instrument for the purposes therein contained.

_______________________________

Notary Public Signature

My commission expires: ________________

More About Georgia Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Georgia?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the title of their property to the lender in order to avoid foreclosure. This option can be beneficial for both parties, as it allows the homeowner to walk away from their mortgage obligation while the lender can take possession of the property without going through the lengthy and costly foreclosure process.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure typically requires that the homeowner is facing financial hardship and is unable to continue making mortgage payments. Additionally, the property must be free of any liens or encumbrances that would complicate the transfer. Lenders often look for homeowners who have exhausted other options, such as loan modifications or repayment plans.

What are the advantages of a Deed in Lieu of Foreclosure?

There are several advantages to this option. First, it can help homeowners avoid the negative impact of a foreclosure on their credit score. Second, it often allows for a quicker resolution than a traditional foreclosure process. Lastly, some lenders may offer relocation assistance or other incentives to homeowners who choose this route, making the transition smoother.

Are there any disadvantages to consider?

Yes, there are potential downsides. A Deed in Lieu of Foreclosure may still affect your credit score, although typically less severely than a foreclosure. Additionally, if there are other liens on the property, the lender may not accept the deed. Homeowners should also be aware that this option may not relieve them of all financial obligations, particularly if there is a deficiency balance after the property is sold.

How does the process work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation and the property’s status. If approved, the homeowner will sign the necessary documents to transfer ownership. It’s important to ensure that all terms are clearly understood before proceeding, as this is a significant decision.

What should I do before proceeding with a Deed in Lieu of Foreclosure?

Before moving forward, it is wise to consult with a legal or financial advisor to fully understand the implications. Homeowners should gather all relevant financial documents and consider their long-term goals. Additionally, reaching out to a housing counselor can provide valuable guidance on available options and potential alternatives.

Can I still live in my home after signing a Deed in Lieu of Foreclosure?

Generally, once the Deed in Lieu of Foreclosure is signed and the title is transferred, the homeowner must vacate the property. However, some lenders may allow a period of time for the homeowner to remain in the home, often referred to as a “grace period.” This can vary based on the lender’s policies, so it’s important to clarify this detail during discussions with the lender.

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form can be a straightforward process, but there are important aspects to consider. Here are some key takeaways:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure. This can help both parties by simplifying the process.

- Eligibility Requirements: Not all borrowers qualify. Check if you meet the lender's criteria, which often includes being unable to keep up with mortgage payments.

- Consult a Professional: It’s wise to seek legal advice or work with a real estate professional. They can help you understand the implications and ensure the form is filled out correctly.

- Review the Form Carefully: Take time to read through the entire form before signing. Ensure all information is accurate and complete to avoid future complications.

- Negotiate Terms: Before finalizing the deed, discuss any potential terms with your lender. This may include the possibility of debt forgiveness or other arrangements.

- Document Everything: Keep copies of all documents related to the deed. This includes the signed deed, correspondence with the lender, and any agreements made.

By following these guidelines, individuals can navigate the Deed in Lieu of Foreclosure process more effectively.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Georgia law, specifically under the Georgia Code Title 44, Chapter 14. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify for this option. |

| Benefits | This option can help homeowners avoid the lengthy foreclosure process and may have less impact on credit scores. |

| Requirements | Typically, lenders will require the borrower to be current on property taxes and to have a clear title before accepting a deed in lieu. |

| Process | The borrower must submit a formal request to the lender, who will then review the situation and may accept the deed. |

| Alternatives | Homeowners may also consider options like short sales or loan modifications as alternatives to a deed in lieu. |

| Impact on Debt | While a deed in lieu can relieve the borrower of the property, it may not eliminate all debt, especially if there is a deficiency judgment. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu of Foreclosure Sample - The form takes the place of foreclosure proceedings, often resulting in a more amicable resolution between the lender and homeowner.

Will I Owe Money After a Deed in Lieu of Foreclosure - Signing a Deed in Lieu allows borrowers to exit their mortgage responsibilities without lengthy litigation.

A New York Bill of Sale form is a legal document that serves to transfer ownership of personal property from one individual to another. This form provides essential details about the transaction, ensuring clarity and protection for both parties involved. To access a template for this important document, you can visit documentonline.org/blank-new-york-bill-of-sale. Understanding how to properly use this form can simplify the buying and selling process in New York.

Foreclosure Vs Deed in Lieu - A Deed in Lieu of Foreclosure can help prevent a lengthy and costly foreclosure process.

Deed in Lieu Vs Foreclosure - This form is an essential tool for navigating the complexities of property ownership and foreclosure alternatives.

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Below are some important dos and don'ts to consider.

- Do ensure that all parties involved are clearly identified, including the borrower and the lender.

- Do provide accurate property information, including the legal description and address.

- Do seek legal advice if there are any uncertainties regarding the implications of the deed.

- Do sign and date the form in the presence of a notary public to validate the document.

- Don't leave any sections of the form blank; incomplete forms can lead to delays or complications.

- Don't misrepresent any information, as this can have legal repercussions.

- Don't rush through the process; take the time to review the form thoroughly before submission.

- Don't forget to keep copies of the completed form for your records.