Valid Articles of Incorporation Form for Georgia

In the state of Georgia, the Articles of Incorporation form serves as a foundational document for establishing a corporation. This essential paperwork outlines key details about the business, including its name, purpose, and duration. It also requires the identification of the registered agent, who will act as the corporation's official point of contact for legal matters. Furthermore, the form necessitates the listing of the initial directors, providing a clear governance structure from the outset. Notably, the Articles of Incorporation must specify the number of shares the corporation is authorized to issue, which is crucial for potential investors and shareholders. By completing this form accurately, individuals can ensure compliance with state regulations and lay the groundwork for a successful business venture. Understanding these components is vital for anyone looking to navigate the incorporation process in Georgia effectively.

Common mistakes

-

Incorrect Business Name: Failing to ensure that the chosen business name is unique and not already in use by another entity in Georgia can lead to rejection of the application.

-

Missing Registered Agent Information: Omitting the name and address of the registered agent can result in delays. The registered agent must be a resident of Georgia or a business authorized to conduct business in the state.

-

Inaccurate Purpose Statement: Providing a vague or overly broad purpose statement can cause confusion. It is important to clearly define the business's intended activities.

-

Incorrect Number of Shares: Not specifying the correct number of shares or the par value of shares can lead to complications. Ensure that this information aligns with the business structure.

-

Omitting Incorporator Information: Failing to include the names and addresses of the incorporators can result in the form being deemed incomplete.

-

Not Signing the Form: Forgetting to sign the Articles of Incorporation can lead to immediate rejection. All incorporators must sign the document.

-

Improper Filing Fee: Submitting an incorrect filing fee can delay the process. It is crucial to check the current fee schedule before submitting the form.

-

Failure to Review for Errors: Not reviewing the form for typos or inaccuracies can lead to unnecessary complications. A thorough review before submission is essential.

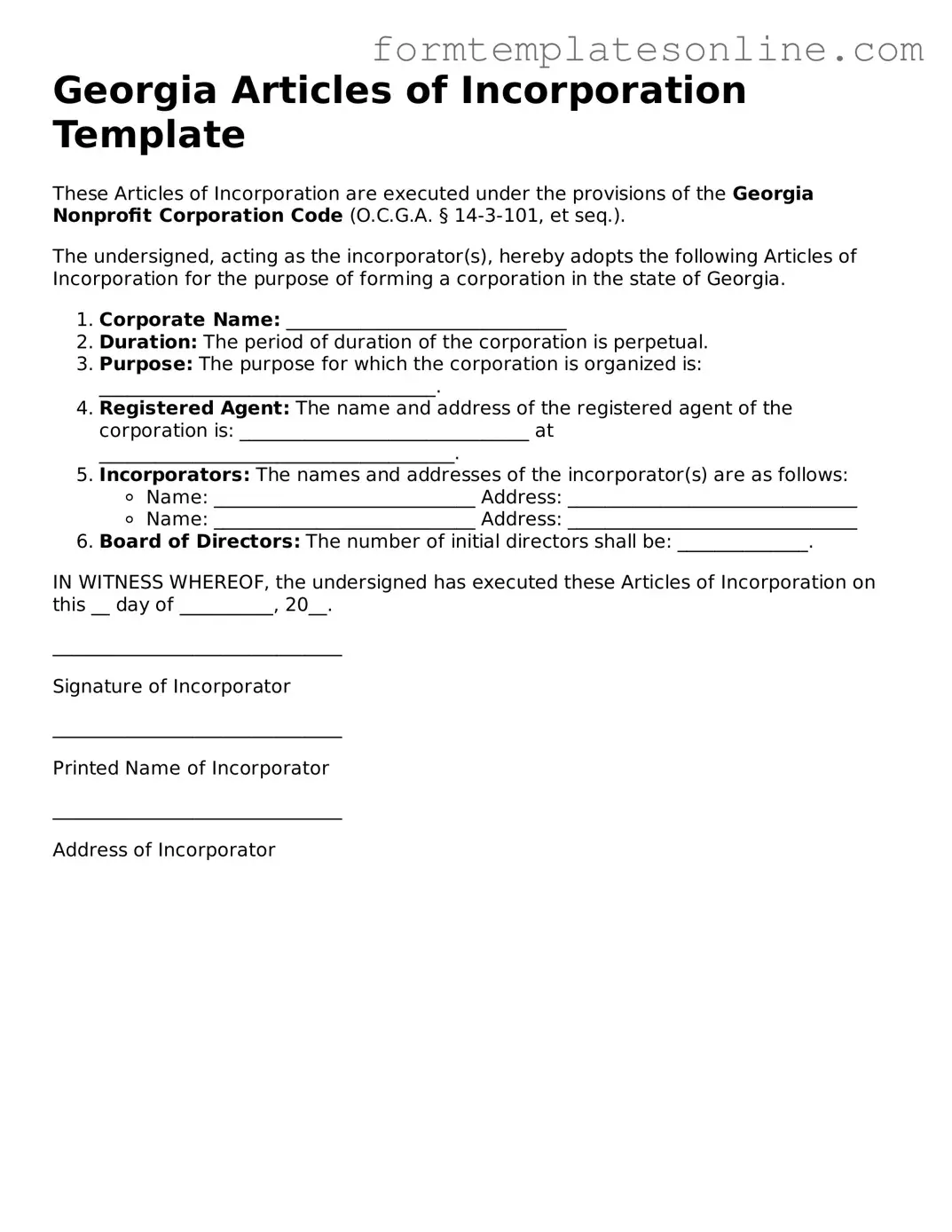

Example - Georgia Articles of Incorporation Form

Georgia Articles of Incorporation Template

These Articles of Incorporation are executed under the provisions of the Georgia Nonprofit Corporation Code (O.C.G.A. § 14-3-101, et seq.).

The undersigned, acting as the incorporator(s), hereby adopts the following Articles of Incorporation for the purpose of forming a corporation in the state of Georgia.

- Corporate Name: ______________________________

- Duration: The period of duration of the corporation is perpetual.

- Purpose: The purpose for which the corporation is organized is: ____________________________________.

- Registered Agent: The name and address of the registered agent of the corporation is: _______________________________ at ______________________________________.

- Incorporators: The names and addresses of the incorporator(s) are as follows:

- Name: ____________________________ Address: _______________________________

- Name: ____________________________ Address: _______________________________

- Board of Directors: The number of initial directors shall be: ______________.

IN WITNESS WHEREOF, the undersigned has executed these Articles of Incorporation on this __ day of __________, 20__.

_______________________________

Signature of Incorporator

_______________________________

Printed Name of Incorporator

_______________________________

Address of Incorporator

More About Georgia Articles of Incorporation

What is the Georgia Articles of Incorporation form?

The Georgia Articles of Incorporation form is a legal document required to establish a corporation in the state of Georgia. This form outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the Georgia Secretary of State is a crucial step in the incorporation process.

Who needs to file the Articles of Incorporation?

Any individual or group wishing to create a corporation in Georgia must file the Articles of Incorporation. This includes businesses, non-profit organizations, and professional corporations. It is important for the founders to ensure compliance with state laws to protect their interests and establish the corporation legally.

What information is required on the form?

The form requires several key pieces of information. This includes the corporation's name, the purpose of the business, the address of the principal office, the registered agent's name and address, the number of shares authorized, and the names and addresses of the incorporators. Providing accurate information is vital for the processing of the application.

How much does it cost to file the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Georgia typically ranges from $100 to $200, depending on the type of corporation being formed. Additional fees may apply for expedited processing or if you choose to reserve a corporate name. It is advisable to check the Georgia Secretary of State's website for the most current fee schedule.

How do I file the Articles of Incorporation?

Filing can be done online through the Georgia Secretary of State's website, or you can submit a paper form by mail. If filing online, create an account on the Secretary of State’s portal, complete the form, and pay the filing fee. For paper submissions, print the completed form, sign it, and send it along with the payment to the appropriate address.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Typically, online submissions are processed faster than paper filings, often within a few business days. However, during peak periods or if there are issues with the application, it may take longer. Checking the status online can provide updates on your submission.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. This may be necessary if there are changes in the corporation's name, purpose, or structure. To amend, you must file a specific amendment form with the Georgia Secretary of State and pay the applicable fee.

What is the difference between a corporation and an LLC?

A corporation and a Limited Liability Company (LLC) are both business structures, but they differ in terms of formation, taxation, and management. Corporations are more formal and require a board of directors, while LLCs offer more flexibility in management and are typically simpler to operate. Choosing the right structure depends on your business goals and needs.

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to have a lawyer to file the Articles of Incorporation, consulting with one can be beneficial. A lawyer can help ensure that the form is filled out correctly and that your corporation complies with all relevant laws and regulations. This can save time and prevent potential legal issues in the future.

What happens after my Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, your corporation is officially formed. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. Following this, it is essential to fulfill ongoing requirements, such as obtaining necessary licenses, holding initial meetings, and filing annual reports to maintain good standing.

Key takeaways

When filling out and using the Georgia Articles of Incorporation form, there are several important aspects to consider. Here are key takeaways to keep in mind:

- The form must be completed accurately to ensure proper registration of your corporation.

- Include the name of your corporation, which must be unique and not already in use by another entity in Georgia.

- Designate a registered agent who will receive legal documents on behalf of the corporation.

- Specify the purpose of your corporation clearly, as this information is essential for legal compliance.

- List the initial board of directors, providing their names and addresses.

- Filing fees must be paid at the time of submission, so be prepared for this expense.

- Consider the option of filing online, which can expedite the process and provide immediate confirmation.

- Once filed, keep a copy of the Articles of Incorporation for your records, as it serves as proof of your corporation's existence.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Articles of Incorporation form is used to legally establish a corporation in the state of Georgia. |

| Governing Law | The form is governed by the Georgia Business Corporation Code, specifically O.C.G.A. § 14-2-201. |

| Filing Requirement | Filing the Articles of Incorporation with the Georgia Secretary of State is mandatory for incorporation. |

| Information Needed | The form requires basic information, including the corporation's name, registered agent, and purpose of the corporation. |

| Filing Fee | A filing fee must be paid at the time of submission, which varies based on the type of corporation. |

Consider Some Other Articles of Incorporation Forms for US States

Llc Filing Ohio - Filing Articles of Incorporation can expedite the process of starting a business.

When engaging in the sale of a boat, it is imperative to use the New York Boat Bill of Sale form to facilitate the transfer of ownership. This essential document outlines important details about the vessel, such as its make, model, and hull identification number. You can create or download the form at documentonline.org/blank-new-york-boat-bill-of-sale/, ensuring that the transaction proceeds smoothly and that ownership records are well-established.

Form California Llc - Specifies the process for making bylaws and any amendments.

Florida Corporation - Specifies the rights of shareholders.

Dos and Don'ts

When filling out the Georgia Articles of Incorporation form, it is essential to approach the process with care. Here are some important dos and don'ts to keep in mind.

- Do ensure that you have a clear understanding of your business structure before starting the application.

- Do provide accurate and complete information for all required fields.

- Do include the name of your corporation that complies with Georgia naming requirements.

- Do designate a registered agent who will receive legal documents on behalf of the corporation.

- Don't use abbreviations or terms that are not permitted in your corporation's name.

- Don't forget to include the purpose of your corporation; this should be specific enough to convey your business intent.

- Don't overlook the importance of reviewing the completed form for errors before submission.

Following these guidelines can help streamline the incorporation process and ensure compliance with Georgia law.