Valid Transfer-on-Death Deed Form for Florida

In the realm of estate planning, the Florida Transfer-on-Death Deed (TODD) form offers a unique and effective way to transfer real property upon the death of the owner, bypassing the often lengthy and costly probate process. This legal tool allows property owners to designate a beneficiary who will automatically receive the property title without the need for a will or court intervention. By completing and recording the TODD, individuals can maintain control over their property during their lifetime while ensuring a smooth transition to their chosen heir after their passing. Importantly, the form must be executed with specific requirements, including notarization and proper recording, to be valid. Moreover, it provides flexibility, as property owners can revoke or modify the deed at any time before their death. Understanding the nuances of this deed is crucial for anyone looking to streamline their estate planning and provide peace of mind for their loved ones.

Common mistakes

-

Incorrect Property Description: Failing to provide a precise legal description of the property can lead to confusion or disputes. It is essential to include the complete address and parcel number.

-

Not Naming Beneficiaries Clearly: Ambiguity in naming beneficiaries can result in unintended consequences. Ensure that each beneficiary is clearly identified, including full names and relationships.

-

Omitting Witness Signatures: The form requires signatures from two witnesses. Without these, the deed may not be valid, rendering the transfer ineffective.

-

Not Notarizing the Document: In Florida, a Transfer-on-Death Deed must be notarized. Failing to have the document notarized can invalidate the transfer.

-

Filing the Deed Late: It is crucial to file the deed with the county clerk's office promptly. Delaying this step can complicate the transfer process.

-

Using an Outdated Form: Laws can change, and using an outdated form may lead to issues. Always check for the most current version of the Transfer-on-Death Deed.

-

Failing to Understand Tax Implications: Many overlook potential tax consequences associated with the transfer. Consulting a tax advisor can help clarify any obligations.

-

Not Considering Future Changes: Life circumstances can change, and not updating the deed to reflect these changes can create complications down the line.

-

Ignoring State-Specific Requirements: Each state has its specific regulations regarding Transfer-on-Death Deeds. Ignoring Florida's unique requirements can result in an invalid deed.

-

Assuming the Process is Automatic: Many believe that simply filling out the form guarantees a smooth transfer. Understanding the entire process is vital to avoid pitfalls.

Example - Florida Transfer-on-Death Deed Form

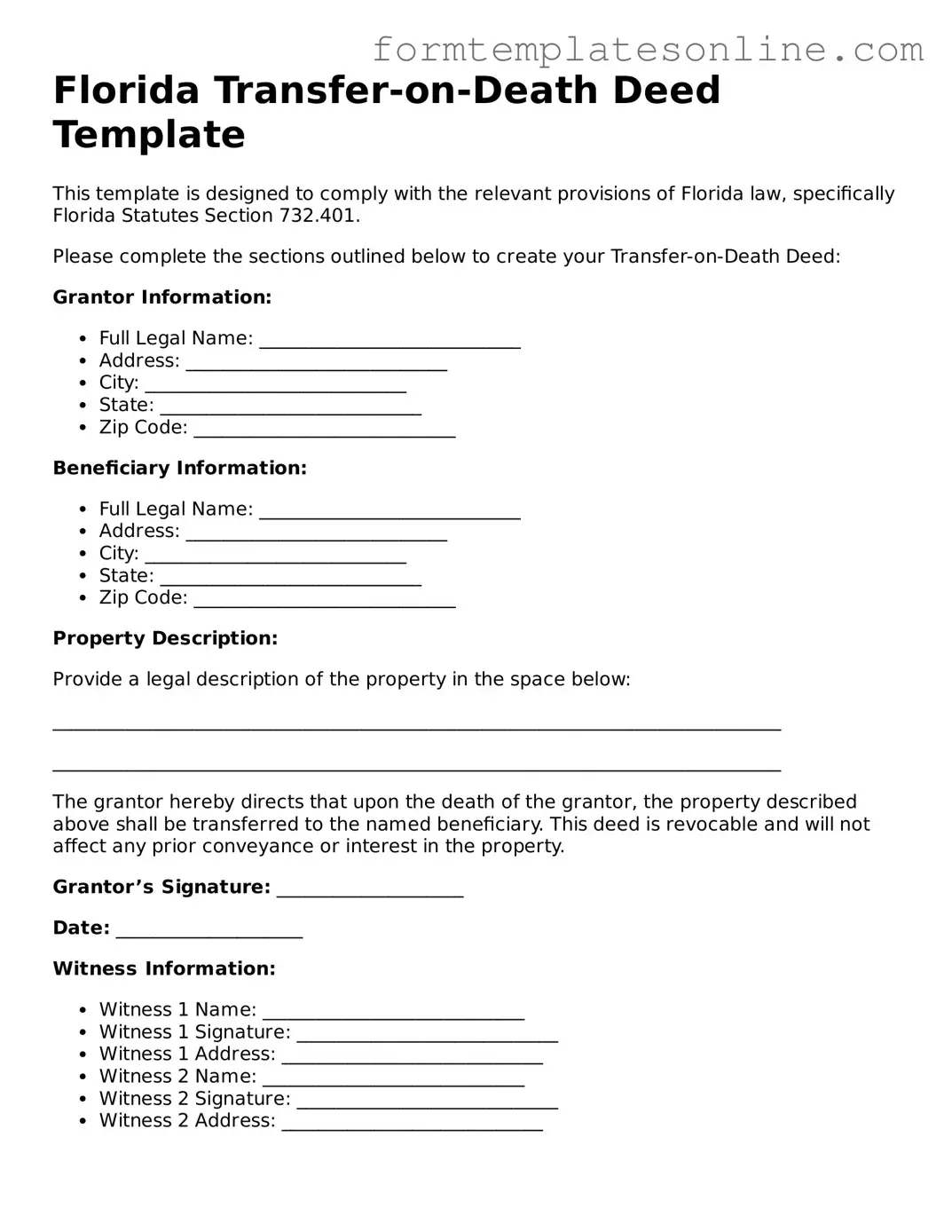

Florida Transfer-on-Death Deed Template

This template is designed to comply with the relevant provisions of Florida law, specifically Florida Statutes Section 732.401.

Please complete the sections outlined below to create your Transfer-on-Death Deed:

Grantor Information:

- Full Legal Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

Beneficiary Information:

- Full Legal Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

Property Description:

Provide a legal description of the property in the space below:

______________________________________________________________________________

______________________________________________________________________________

The grantor hereby directs that upon the death of the grantor, the property described above shall be transferred to the named beneficiary. This deed is revocable and will not affect any prior conveyance or interest in the property.

Grantor’s Signature: ____________________

Date: ____________________

Witness Information:

- Witness 1 Name: ____________________________

- Witness 1 Signature: ____________________________

- Witness 1 Address: ____________________________

- Witness 2 Name: ____________________________

- Witness 2 Signature: ____________________________

- Witness 2 Address: ____________________________

This deed must be recorded in the county where the property is located to ensure its validity. It is strongly recommended to consult with a legal professional to address any specific concerns or questions regarding the execution and recording of this deed.

More About Florida Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TODD) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This deed enables property owners in Florida to avoid probate, which can be a lengthy and costly process. The property remains in the owner's name during their lifetime, and the transfer occurs automatically upon death, provided the deed is properly executed and recorded.

Who can create a Transfer-on-Death Deed?

Any individual who holds title to real property in Florida can create a Transfer-on-Death Deed. This includes homeowners and property owners. However, it is essential that the person creating the deed has the legal capacity to do so, meaning they must be of sound mind and at least 18 years old. Additionally, the property must be located in Florida for the deed to be valid under state law.

How do I execute a Transfer-on-Death Deed?

To execute a Transfer-on-Death Deed, the property owner must complete the deed form, which includes the legal description of the property and the name of the beneficiary. The deed must be signed by the owner in the presence of a notary public. After signing, the deed must be recorded with the county clerk’s office in the county where the property is located. This recording is crucial as it makes the deed effective against third parties.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. The property owner may revoke the deed at any time before their death. This can be done by executing a new deed that explicitly states the revocation or by recording a formal revocation document with the county clerk’s office. It is important to ensure that any revocation is properly documented to avoid confusion regarding the intended transfer of the property.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed does not automatically transfer the property. Instead, the property will typically pass according to the property owner's will, or if there is no will, according to Florida's intestacy laws. Property owners may want to consider naming alternate beneficiaries in the deed to address this situation.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax implications for the property owner. The property remains part of the owner’s estate until their death. However, beneficiaries may be subject to property taxes once the transfer occurs. It is advisable to consult with a tax professional to understand any potential estate tax implications and ensure compliance with tax laws.

Key takeaways

Filling out and using the Florida Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways to guide you:

- Understand the Purpose: This deed allows property owners to transfer their property to beneficiaries upon their death, avoiding probate.

- Eligibility: Only certain types of property can be transferred using this deed, typically residential real estate.

- Beneficiaries: You can name one or more beneficiaries, and they do not need to be related to you.

- Form Requirements: The form must be completed accurately, including the legal description of the property.

- Signatures: The deed must be signed by the property owner in the presence of a notary public.

- Recording the Deed: After signing, the deed must be recorded with the county clerk’s office where the property is located.

- Revocation: You can revoke the deed at any time before your death by filing a new deed or a revocation form.

- No Immediate Effect: The transfer does not take effect until the property owner passes away.

- Tax Implications: Beneficiaries may be subject to property taxes and other obligations once the property is transferred.

- Consultation Recommended: It’s wise to consult with a legal professional to ensure the deed is filled out correctly and meets your needs.

By keeping these points in mind, you can navigate the process of using a Transfer-on-Death Deed with confidence and clarity.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | Florida Statutes, Chapter 732.401, governs the use of Transfer-on-Death Deeds in the state. |

| Eligibility | Any individual who owns real property in Florida can create a TOD Deed, provided they are of sound mind. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | A TOD Deed can be revoked at any time before the owner's death, allowing for flexibility in estate planning. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals who are not beneficiaries. |

| Recording | To be effective, the TOD Deed must be recorded in the county where the property is located before the owner's death. |

| Tax Implications | Beneficiaries may receive a step-up in basis for tax purposes, potentially reducing capital gains taxes upon sale of the property. |

| Limitations | A TOD Deed cannot be used for certain types of property, such as property held in a trust or jointly owned property with rights of survivorship. |

Consider Some Other Transfer-on-Death Deed Forms for US States

Where Can I Get a Tod Form - This deed prevents disputes among heirs by clearly stating who is entitled to the property after your passing.

When engaging in real estate transactions in Georgia, it is important to have a comprehensive understanding of the Georgia Deed form, as it facilitates the legal transfer of property ownership from seller to buyer. For further guidance and resources, you can refer to OnlineLawDocs.com.

Beneficiary Deed Georgia - Not all states allow a Transfer-on-Death Deed, necessitating local legal advice.

Does a Living Trust Avoid Probate in California - The deed uses the term "transfer on death," indicating its purpose and functionality in estate planning.

How to Avoid Probate in Pa - The beneficiaries will only inherit the property after the owner's passing.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it’s important to approach the process carefully. Here are some essential dos and don’ts to keep in mind:

- Do ensure that you are the legal owner of the property you wish to transfer.

- Do provide accurate information about the property, including the legal description.

- Do include the names and addresses of the beneficiaries clearly.

- Do sign the form in front of a notary public to validate the deed.

- Do file the completed deed with the county clerk’s office where the property is located.

- Don't forget to check for any outstanding liens or mortgages on the property.

- Don't leave any sections of the form blank; incomplete forms can lead to issues.

- Don't assume that the deed is automatically effective without proper filing.

- Don't overlook the importance of consulting with a legal professional if you have questions.