Valid Quitclaim Deed Form for Florida

The Florida Quitclaim Deed is a vital legal document used in real estate transactions, particularly when transferring property ownership. Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. Instead, it simply conveys whatever interest the grantor has, if any, to the grantee. This form is often utilized in situations such as transferring property between family members, clearing up title issues, or in divorce settlements. The document must be completed with specific information, including the names of the parties involved, a legal description of the property, and the date of transfer. Once signed and notarized, the quitclaim deed should be recorded with the county clerk to ensure that the transfer is legally recognized. Understanding the nuances of this form can help individuals navigate property transfers smoothly and avoid potential disputes down the line.

Common mistakes

-

Inaccurate Property Description: One common mistake is providing an incomplete or inaccurate description of the property. This can lead to confusion and potential legal issues. Ensure that the legal description matches the one on the property’s title.

-

Missing Signatures: All parties involved in the transaction must sign the Quitclaim Deed. Failing to include all necessary signatures can render the document invalid. Double-check that everyone has signed before submission.

-

Not Including a Notary: A Quitclaim Deed must be notarized to be legally binding. Neglecting to have the document notarized can result in complications during the transfer process. Seek a notary public to ensure this step is completed.

-

Improper Execution: The form must be executed according to state laws. This includes following the correct order of signing and witnessing. Inadequate execution may lead to disputes or rejection by the county clerk.

-

Failure to Record the Deed: After completing the Quitclaim Deed, it is crucial to file it with the appropriate county office. Failing to record the deed can result in issues with property ownership and rights. Always ensure that the document is filed promptly.

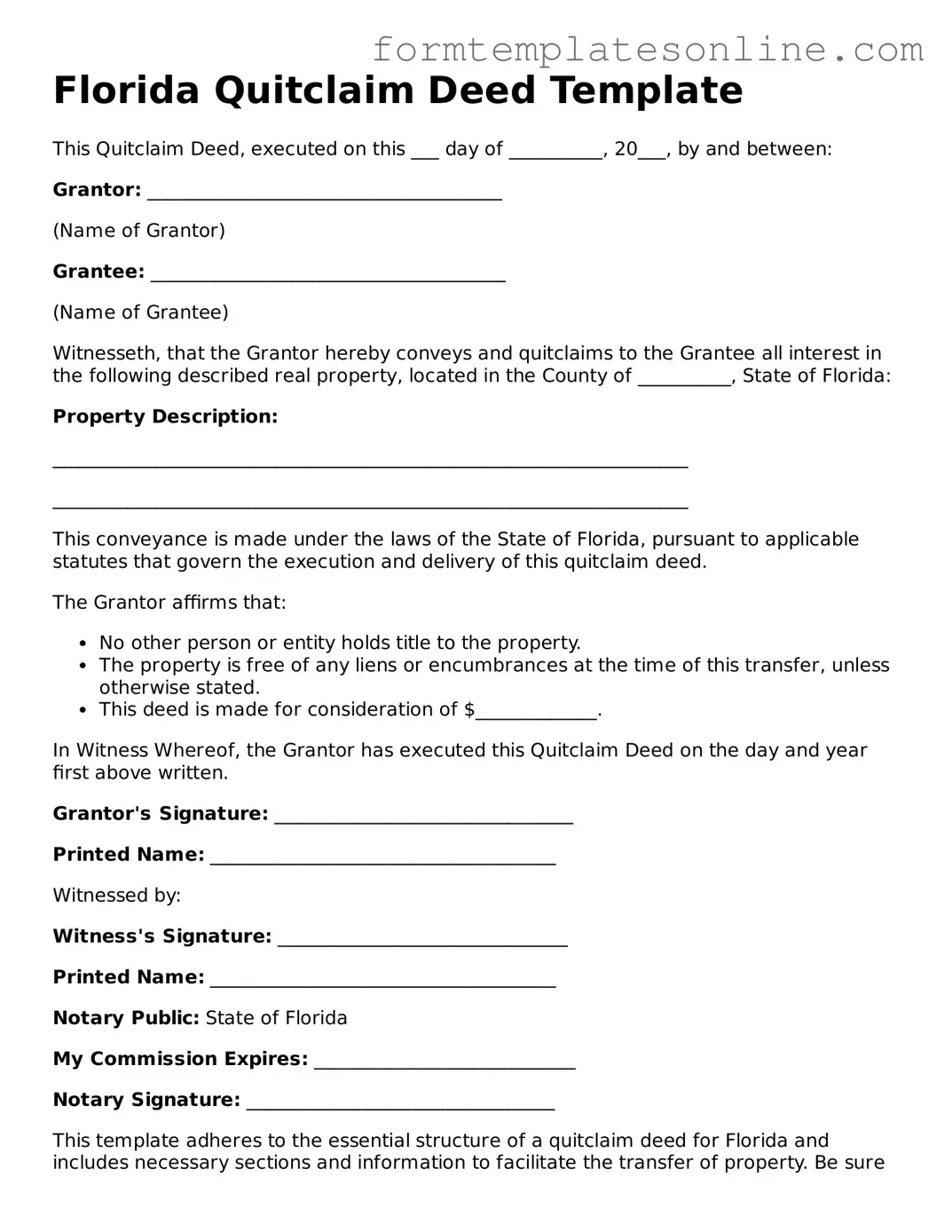

Example - Florida Quitclaim Deed Form

Florida Quitclaim Deed Template

This Quitclaim Deed, executed on this ___ day of __________, 20___, by and between:

Grantor: ______________________________________

(Name of Grantor)

Grantee: ______________________________________

(Name of Grantee)

Witnesseth, that the Grantor hereby conveys and quitclaims to the Grantee all interest in the following described real property, located in the County of __________, State of Florida:

Property Description:

____________________________________________________________________

____________________________________________________________________

This conveyance is made under the laws of the State of Florida, pursuant to applicable statutes that govern the execution and delivery of this quitclaim deed.

The Grantor affirms that:

- No other person or entity holds title to the property.

- The property is free of any liens or encumbrances at the time of this transfer, unless otherwise stated.

- This deed is made for consideration of $_____________.

In Witness Whereof, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor's Signature: ________________________________

Printed Name: _____________________________________

Witnessed by:

Witness's Signature: _______________________________

Printed Name: _____________________________________

Notary Public: State of Florida

My Commission Expires: ____________________________

Notary Signature: _________________________________

This template adheres to the essential structure of a quitclaim deed for Florida and includes necessary sections and information to facilitate the transfer of property. Be sure to fill in the blanks accurately to ensure validity and compliance with local laws.More About Florida Quitclaim Deed

What is a Quitclaim Deed in Florida?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. In Florida, this type of deed is often used among family members or in situations where the parties know each other well. It provides no guarantee that the property is free of liens or other claims. Essentially, it transfers whatever interest the seller has in the property, if any, to the buyer.

How do I complete a Quitclaim Deed in Florida?

To complete a Quitclaim Deed, you need to fill out the form with specific details. This includes the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a description of the property, and the date of the transfer. Make sure to sign the document in front of a notary public. It’s also a good idea to check if your county requires any additional information or specific forms.

Do I need to have the Quitclaim Deed notarized?

Yes, in Florida, a Quitclaim Deed must be signed in front of a notary public. This step is crucial for the deed to be legally recognized. After notarization, you should also record the deed with the local county clerk’s office to ensure the transfer is public and official.

What are the tax implications of using a Quitclaim Deed?

Using a Quitclaim Deed may have tax implications. In Florida, transferring property can trigger documentary stamp taxes, depending on the value of the property. However, transfers between family members or certain types of transfers may be exempt. It’s wise to consult with a tax professional to understand any potential tax responsibilities before completing the deed.

Can I use a Quitclaim Deed to remove someone from the title?

Yes, a Quitclaim Deed can be used to remove someone from the title of a property. If one co-owner wants to transfer their interest to the other, they can do so using this type of deed. However, both parties should agree to this transfer, and it’s advisable to consult with a legal professional to ensure that the process is handled correctly.

What happens if there are liens on the property?

When using a Quitclaim Deed, the new owner takes on the property with all its existing issues, including liens. This means that if there are any unpaid debts or claims against the property, the new owner may be responsible for addressing them. It's essential to conduct a title search before the transfer to understand any potential liabilities associated with the property.

Key takeaways

When filling out and using the Florida Quitclaim Deed form, keep these key takeaways in mind:

- Understand the Purpose: A Quitclaim Deed is used to transfer ownership of property without guaranteeing that the title is clear. It is often used between family members or in divorce settlements.

- Identify the Parties: Clearly list the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide Accurate Property Description: Include a complete legal description of the property. This is essential for the deed to be valid.

- Signatures Required: The grantor must sign the deed in the presence of a notary public. The grantee's signature is not required.

- Notarization: Ensure that the deed is notarized. This step is crucial for the document to be legally recognized.

- Filing the Deed: After signing, the Quitclaim Deed must be filed with the county clerk's office where the property is located.

- Consider Tax Implications: Transferring property may have tax consequences. Consult a tax professional if needed.

- Keep Copies: Always keep a copy of the signed and filed Quitclaim Deed for your records.

- Consult Legal Help if Necessary: If you have questions or concerns, consider seeking legal advice to ensure proper handling of the deed.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Florida Quitclaim Deed transfers ownership of property without guaranteeing the title's validity. |

| Governing Law | The Florida Quitclaim Deed is governed by Florida Statutes, Chapter 689. |

| Use Cases | Commonly used in divorce settlements, property transfers between family members, or clearing up title issues. |

| No Warranty | The grantor does not guarantee that they hold clear title to the property. |

| Signature Requirement | The deed must be signed by the grantor in front of a notary public. |

| Recording | To be effective against third parties, the deed should be recorded with the county clerk's office. |

| Tax Implications | Transfer taxes may apply, depending on the property's value and local regulations. |

Consider Some Other Quitclaim Deed Forms for US States

Quick Claim Deed Form - A Quitclaim Deed is a legal document that transfers ownership of property from one party to another without any warranties.

Quit Claim Deed Blank Form - This tool is often utilized in case of adding or removing names from the title of a property.

Quit Claim Deed Form Ny Pdf - A Quitclaim Deed may be used to add or remove a name on a property title.

Dos and Don'ts

When filling out a Florida Quitclaim Deed form, it’s important to follow certain guidelines to ensure the document is completed correctly. Here are six key things to do and avoid:

- Do clearly identify the grantor and grantee. Make sure to include full names and addresses.

- Do provide a legal description of the property. This should be accurate and detailed to avoid any confusion.

- Do sign the form in the presence of a notary public. This step is crucial for the deed to be valid.

- Do check for any outstanding liens or encumbrances on the property before completing the deed.

- Don't leave any sections blank. Every part of the form should be filled out to prevent delays or issues.

- Don't forget to record the deed with the county clerk's office after it has been signed and notarized.