Valid Promissory Note Form for Florida

The Florida Promissory Note form serves as a crucial financial instrument for individuals and businesses engaged in lending and borrowing activities. This document outlines the borrower's promise to repay a specified amount of money to the lender, typically including details such as the principal amount, interest rate, repayment schedule, and any applicable fees. It also clarifies the rights and obligations of both parties, ensuring that the lender has legal recourse in the event of default. Additionally, the form may specify whether the note is secured or unsecured, impacting the lender's ability to reclaim funds in case of non-payment. Understanding the nuances of this form is essential for anyone involved in financial transactions in Florida, as it helps establish clear expectations and protects the interests of both borrowers and lenders.

Common mistakes

-

Not Including All Necessary Information: Many people forget to fill out crucial details like the names of the borrower and lender, the loan amount, and the interest rate. Each piece of information is vital for the note to be legally binding.

-

Omitting Dates: Failing to specify the date when the note is signed can lead to confusion later. Always include the date to establish a clear timeline for the loan agreement.

-

Ignoring Payment Terms: Some individuals neglect to clearly outline the payment schedule. Specify how often payments are due, whether they are monthly or quarterly, and the total duration of the loan.

-

Forgetting to Include Default Terms: It's crucial to outline what happens if the borrower defaults. This can include late fees or the right to demand immediate payment of the full balance. Not addressing this can lead to complications.

-

Not Signing the Document: A common oversight is forgetting to sign the promissory note. Without signatures from both parties, the note may not hold up in court.

-

Neglecting Witnesses or Notarization: Depending on the amount of the loan, some may need a witness or notary. Failing to have these can affect the enforceability of the note.

-

Using Ambiguous Language: Clarity is key in legal documents. Avoid vague terms that can lead to misunderstandings. Instead, use clear and concise language to ensure everyone understands their obligations.

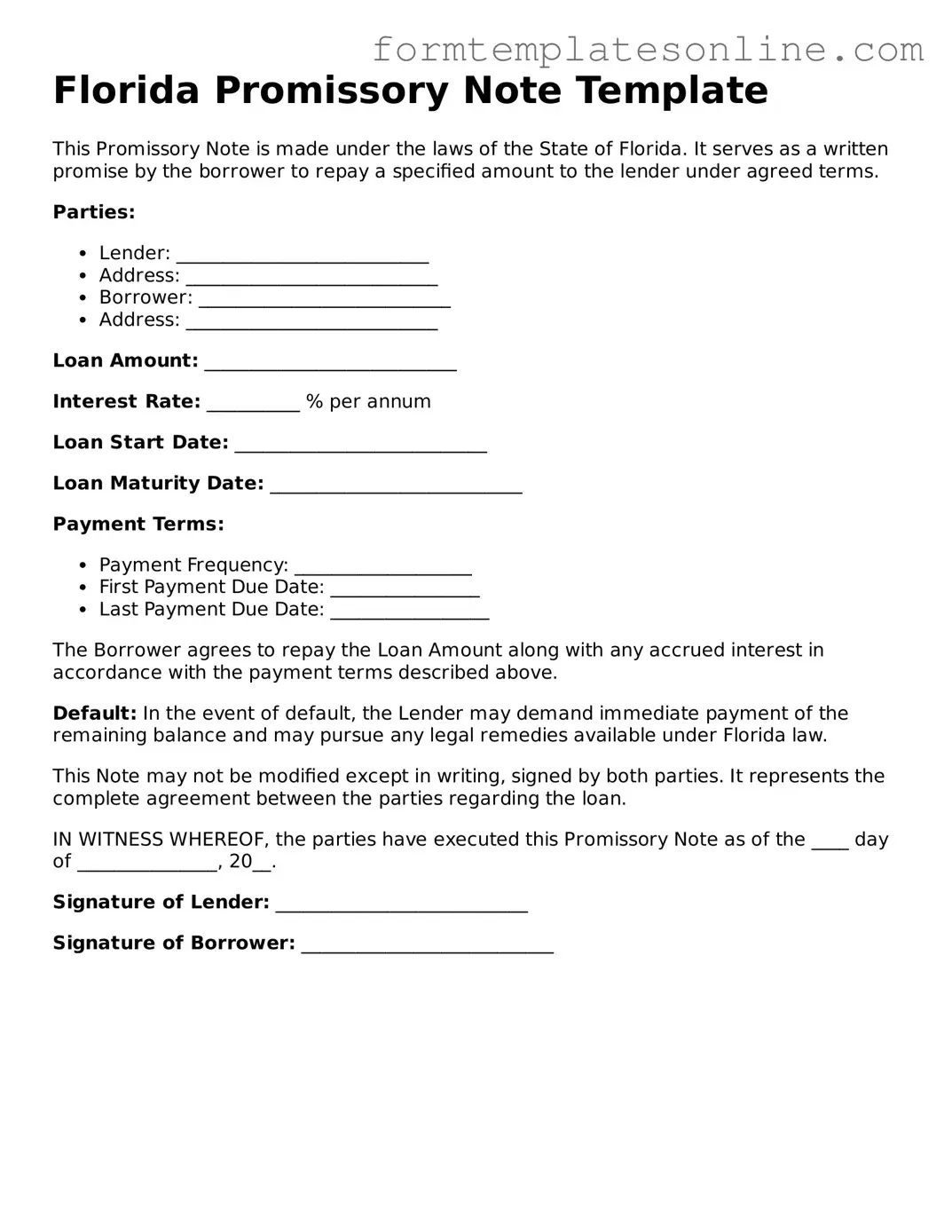

Example - Florida Promissory Note Form

Florida Promissory Note Template

This Promissory Note is made under the laws of the State of Florida. It serves as a written promise by the borrower to repay a specified amount to the lender under agreed terms.

Parties:

- Lender: ___________________________

- Address: ___________________________

- Borrower: ___________________________

- Address: ___________________________

Loan Amount: ___________________________

Interest Rate: __________ % per annum

Loan Start Date: ___________________________

Loan Maturity Date: ___________________________

Payment Terms:

- Payment Frequency: ___________________

- First Payment Due Date: ________________

- Last Payment Due Date: _________________

The Borrower agrees to repay the Loan Amount along with any accrued interest in accordance with the payment terms described above.

Default: In the event of default, the Lender may demand immediate payment of the remaining balance and may pursue any legal remedies available under Florida law.

This Note may not be modified except in writing, signed by both parties. It represents the complete agreement between the parties regarding the loan.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the ____ day of _______________, 20__.

Signature of Lender: ___________________________

Signature of Borrower: ___________________________

More About Florida Promissory Note

What is a Florida Promissory Note?

A Florida Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party under agreed-upon terms. It outlines the loan amount, interest rate, repayment schedule, and any penalties for late payments. This document serves as a legal record of the debt and the obligations of both parties involved.

Who typically uses a Promissory Note in Florida?

Individuals, businesses, and financial institutions commonly use Promissory Notes. They are often utilized in personal loans between friends or family members, as well as in formal lending situations involving banks or private lenders. The document helps protect the lender's interests while providing the borrower with clear repayment terms.

What information should be included in a Florida Promissory Note?

A complete Florida Promissory Note should include the following details: the names and addresses of the borrower and lender, the principal amount of the loan, the interest rate, repayment schedule, due dates, and any late fees or penalties. Additionally, the document should specify whether the loan is secured or unsecured.

Is a Florida Promissory Note legally binding?

Yes, a Florida Promissory Note is legally binding as long as it meets the necessary requirements for a contract. This includes mutual consent, a lawful purpose, and consideration (something of value exchanged). Both parties must sign the document for it to be enforceable in a court of law.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This helps prevent disputes regarding the terms of the agreement later on.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has several options. They may pursue collection efforts, which can include sending demand letters or hiring a collection agency. If necessary, the lender can also take legal action to recover the owed amount, which may involve filing a lawsuit in court.

Do I need a lawyer to create a Florida Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can provide valuable guidance. A legal professional can ensure that the document complies with Florida laws and adequately protects your interests. This is particularly important for larger loans or complex agreements.

Can a Promissory Note be used for business loans?

Yes, a Promissory Note can be used for business loans. Businesses often use this document to formalize loans from investors, banks, or other financial institutions. It is essential to clearly outline the terms of the loan to avoid misunderstandings and ensure compliance with business regulations.

What is the difference between a secured and unsecured Promissory Note?

A secured Promissory Note is backed by collateral, such as property or assets, which the lender can claim if the borrower defaults. An unsecured Promissory Note does not have any collateral backing it, making it riskier for the lender. The terms and interest rates may differ based on the type of note.

Where can I find a Florida Promissory Note template?

Florida Promissory Note templates are available online through various legal document websites. It is crucial to choose a reputable source to ensure the template complies with Florida laws. Alternatively, consulting a lawyer can provide a customized document tailored to your specific needs.

Key takeaways

When filling out and using the Florida Promissory Note form, several key points should be considered to ensure clarity and enforceability.

- The form must include the names of both the borrower and the lender, clearly identifying all parties involved.

- Specify the principal amount being borrowed. This figure should be clearly stated in both numeric and written form.

- Include the interest rate, if applicable. The rate should comply with Florida's usury laws to avoid legal complications.

- Outline the repayment terms. This includes the payment schedule, due dates, and the total duration of the loan.

- Consider including a clause for late payments. This can specify penalties or additional fees if payments are not made on time.

- Both parties should sign the document. Signatures should be dated to confirm the agreement was executed on a specific date.

File Details

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Florida Uniform Commercial Code governs promissory notes in Florida. |

| Parties Involved | Typically involves a borrower (maker) and a lender (payee). |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable. |

| Payment Terms | Payment terms, including due dates and installment amounts, must be clearly stated. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make payments. |

| Transferability | Promissory notes can be transferred or sold to another party unless stated otherwise. |

| Signature Requirement | The note must be signed by the borrower to be legally enforceable. |

| Notarization | While notarization is not required, it can add an extra layer of authenticity. |

| Legal Remedies | If the borrower defaults, the lender may seek legal remedies, including filing a lawsuit. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Ohio - This document is vital for any loan, ensuring both parties are aligned on expectations.

For individuals seeking to understand the intricacies of legal correspondence, utilizing a comprehensive Cease and Desist Letter can be invaluable. This form empowers you to effectively communicate your demands and expectations, ensuring that the recipient is fully aware of the potential consequences of non-compliance. For more details, you can explore this guide on Cease and Desist Letter procedures.

Promissory Note Illinois - They may also include provisions for converting the loan into equity in certain circumstances.

Dos and Don'ts

When filling out the Florida Promissory Note form, it's important to be careful and thorough. Here are some guidelines to help you navigate the process smoothly.

- Do read the entire form carefully before starting to fill it out. Understanding the terms is crucial.

- Don't leave any required fields blank. Incomplete forms can lead to delays or rejection.

- Do provide accurate information. Double-check names, addresses, and amounts to ensure everything is correct.

- Don't use abbreviations or informal language. Clarity is key in legal documents.

- Do sign and date the form where indicated. An unsigned document is not legally binding.

- Don't forget to keep a copy for your records. Having a copy can be helpful in the future.

Following these tips can help ensure that your Promissory Note is completed correctly and is legally enforceable.