Valid Operating Agreement Form for Florida

In the vibrant business landscape of Florida, the Operating Agreement serves as a crucial document for limited liability companies (LLCs). This essential form outlines the internal workings and management structure of the LLC, providing clarity on the roles and responsibilities of its members. It addresses key aspects such as profit distribution, decision-making processes, and the procedures for adding or removing members. By establishing these guidelines, the Operating Agreement not only helps prevent conflicts among members but also reinforces the limited liability status of the business, protecting personal assets from business liabilities. Moreover, while Florida law does not mandate an Operating Agreement, having one in place is highly advisable, as it can streamline operations and provide a clear framework for governance. Understanding the nuances of this document is vital for anyone looking to form or manage an LLC in the Sunshine State.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or issues in the future. Ensure that all sections are filled out completely.

-

Incorrect Member Names: Listing members with incorrect names or misspellings can create confusion. Double-check the spelling of each member’s name.

-

Missing Signatures: Each member must sign the agreement. Omitting signatures can render the document invalid.

-

Not Specifying Ownership Percentages: Clearly outline each member’s ownership percentage. Vague or missing percentages can lead to disputes later.

-

Ignoring State Requirements: Florida has specific laws regarding operating agreements. Be sure to comply with all state regulations to avoid legal complications.

-

Overlooking Amendment Procedures: Include a process for making changes to the agreement. Failing to do so can complicate future modifications.

-

Neglecting to Define Roles: Clearly outline the roles and responsibilities of each member. Ambiguity can lead to misunderstandings and conflicts.

-

Not Including a Dissolution Clause: Specify the process for dissolving the business. Without this, members may face challenges if the business needs to close.

-

Forgetting to Review the Agreement: After filling out the form, review it carefully. Errors can often be caught during a thorough review.

Example - Florida Operating Agreement Form

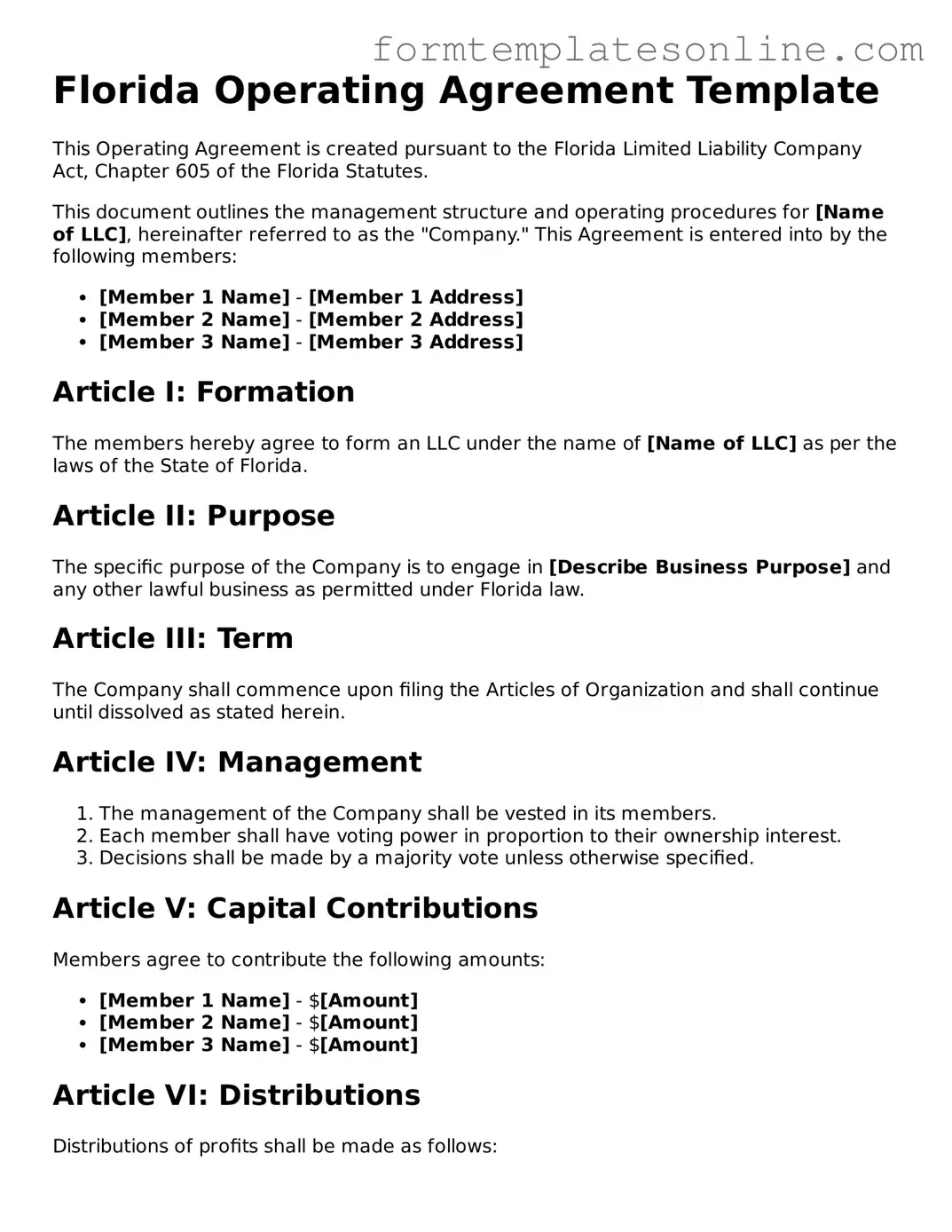

Florida Operating Agreement Template

This Operating Agreement is created pursuant to the Florida Limited Liability Company Act, Chapter 605 of the Florida Statutes.

This document outlines the management structure and operating procedures for [Name of LLC], hereinafter referred to as the "Company." This Agreement is entered into by the following members:

- [Member 1 Name] - [Member 1 Address]

- [Member 2 Name] - [Member 2 Address]

- [Member 3 Name] - [Member 3 Address]

Article I: Formation

The members hereby agree to form an LLC under the name of [Name of LLC] as per the laws of the State of Florida.

Article II: Purpose

The specific purpose of the Company is to engage in [Describe Business Purpose] and any other lawful business as permitted under Florida law.

Article III: Term

The Company shall commence upon filing the Articles of Organization and shall continue until dissolved as stated herein.

Article IV: Management

- The management of the Company shall be vested in its members.

- Each member shall have voting power in proportion to their ownership interest.

- Decisions shall be made by a majority vote unless otherwise specified.

Article V: Capital Contributions

Members agree to contribute the following amounts:

- [Member 1 Name] - $[Amount]

- [Member 2 Name] - $[Amount]

- [Member 3 Name] - $[Amount]

Article VI: Distributions

Distributions of profits shall be made as follows:

- Proportional to each member's ownership interest.

- At times agreed upon by the members.

Article VII: Amendment

This Operating Agreement may be amended only by a written agreement signed by all members.

Article VIII: Miscellaneous

In the event of dissolution, assets shall be distributed in accordance with members' ownership interests after settling debts and obligations.

Signatures

By signing below, the members acknowledge that they have read and agree to the terms outlined in this Operating Agreement.

- [Member 1 Name] - Signature: ______________________ Date: ___________

- [Member 2 Name] - Signature: ______________________ Date: ___________

- [Member 3 Name] - Signature: ______________________ Date: ___________

This Operating Agreement is executed as of the _____ day of __________, 20__.

More About Florida Operating Agreement

What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. It serves as an internal guideline for the members of the LLC and helps to define their rights, responsibilities, and obligations.

Is an Operating Agreement required in Florida?

No, Florida law does not require LLCs to have an Operating Agreement. However, having one is highly recommended. It provides clarity and can help prevent disputes among members. It also helps protect your limited liability status by demonstrating that your LLC is a separate entity.

What should be included in a Florida Operating Agreement?

An Operating Agreement typically includes details such as the LLC's name, purpose, duration, management structure, voting rights, and how profits and losses will be distributed. It may also address procedures for adding or removing members and what happens if a member leaves the company.

Can I change the Operating Agreement later?

Yes, you can amend the Operating Agreement if needed. It’s important to follow the procedures outlined in the agreement for making changes. Usually, this requires a vote from the members or written consent. Keeping the document updated ensures it reflects the current structure and agreements of the LLC.

How does an Operating Agreement protect members?

An Operating Agreement protects members by clearly defining roles and responsibilities. It can help prevent misunderstandings and disputes by outlining how decisions are made and how profits are shared. This clarity can be crucial if legal issues arise or if a member wants to exit the LLC.

Do I need a lawyer to draft my Operating Agreement?

While it's not mandatory to hire a lawyer, it can be beneficial. A legal professional can ensure that your Operating Agreement complies with Florida laws and meets your specific needs. If your LLC has multiple members or complex operations, consulting a lawyer may be a wise choice.

How many members can be included in a Florida LLC Operating Agreement?

There is no limit to the number of members in a Florida LLC. Your Operating Agreement should clearly outline the roles and responsibilities of each member, regardless of how many there are. This helps maintain organization and accountability within the company.

Is it necessary to file the Operating Agreement with the state?

No, you do not need to file your Operating Agreement with the Florida state government. It is an internal document, meant for the members of the LLC. However, it is essential to keep it in a safe place and ensure that all members have access to it.

What happens if there is no Operating Agreement?

If there is no Operating Agreement, Florida's default LLC laws will govern the company. This may not align with the members' intentions and can lead to confusion or disputes. Having an Operating Agreement helps establish clear guidelines and can save time and money in the long run.

Can I use a template for my Operating Agreement?

Yes, you can use a template as a starting point for your Operating Agreement. Many templates are available online. However, it’s important to customize the template to fit your LLC's specific needs. Consider consulting a legal professional to ensure that your agreement is comprehensive and compliant with Florida laws.

Key takeaways

When filling out and using the Florida Operating Agreement form, consider the following key takeaways:

- Define Your Business Structure: Clearly outline the type of business entity, whether it’s a single-member LLC or a multi-member LLC.

- Member Roles and Responsibilities: Specify the roles of each member, including their responsibilities and decision-making powers.

- Capital Contributions: Detail the initial contributions made by each member, including cash, property, or services.

- Profit and Loss Distribution: Establish how profits and losses will be allocated among members, ensuring it reflects the members' contributions.

- Management Structure: Decide whether the LLC will be member-managed or manager-managed, and clarify the management process.

- Amendments and Dissolution: Include provisions for how the agreement can be amended and the process for dissolving the LLC if necessary.

By following these guidelines, you can create a comprehensive and effective Operating Agreement that meets your business needs.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Florida Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. |

| Governing Law | This agreement is governed by the Florida Limited Liability Company Act, specifically Chapter 605 of the Florida Statutes. |

| Member Rights | The Operating Agreement defines the rights and responsibilities of each member, ensuring clarity in ownership and decision-making processes. |

| Flexibility | Florida law allows LLCs to customize their Operating Agreements, providing flexibility in how they manage operations and distribute profits. |

| Importance | Having a well-drafted Operating Agreement is crucial for preventing disputes among members and protecting personal assets from business liabilities. |

Consider Some Other Operating Agreement Forms for US States

Cost for Llc - The agreement may include terms related to financing and loans.

For businesses looking to formalize their relationships with skilled workers, understanding the nuances of the Independent Contractor Agreement form can be invaluable. This vital document helps clarify expectations for both parties, ensuring a professional arrangement. For more specific guidance, you can explore the efficient Independent Contractor Agreement insights.

How to Get My Llc - This document is critical for ensuring smooth business operations.

Dos and Don'ts

When filling out the Florida Operating Agreement form, it is essential to approach the task with care. Here are some important do's and don'ts to keep in mind:

- Do ensure that all member names and addresses are accurate.

- Do specify the management structure clearly to avoid future disputes.

- Do review the document thoroughly for any errors or omissions.

- Do seek legal advice if you are unsure about any terms or conditions.

- Don't leave any sections blank; incomplete forms can lead to complications.

- Don't use vague language; clarity is crucial in legal documents.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to keep a copy of the signed agreement for your records.