Valid Loan Agreement Form for Florida

The Florida Loan Agreement form is a crucial document that outlines the terms and conditions of a loan transaction between a lender and a borrower. This form serves as a binding contract, detailing essential elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it specifies the rights and obligations of both parties, ensuring clarity and protection in the lending process. The agreement may also include provisions for late fees, default scenarios, and any applicable state laws governing the loan. By clearly defining these terms, the Florida Loan Agreement form helps to minimize misunderstandings and disputes, fostering a transparent relationship between the lender and borrower. Understanding the intricacies of this form is vital for anyone involved in a loan transaction in Florida, as it lays the groundwork for a legally enforceable agreement.

Common mistakes

-

Inaccurate Personal Information: One of the most common mistakes is providing incorrect personal details. This includes misspellings of names, wrong addresses, or incorrect Social Security numbers. Such errors can lead to delays in processing or even rejection of the loan application.

-

Failure to Read Terms and Conditions: Many individuals skim through the terms and conditions without fully understanding them. This oversight can result in unexpected fees or unfavorable loan terms that could have been avoided had the borrower taken the time to review the agreement thoroughly.

-

Inadequate Documentation: Applicants often neglect to include necessary documentation. This might include proof of income, identification, or other required financial statements. Missing documents can slow down the approval process or lead to outright denial of the loan.

-

Ignoring the Loan Amount and Interest Rate: Some borrowers fail to double-check the loan amount and interest rate they are agreeing to. It is crucial to ensure that these figures align with what was discussed with the lender. Misunderstandings in this area can lead to financial strain down the line.

Example - Florida Loan Agreement Form

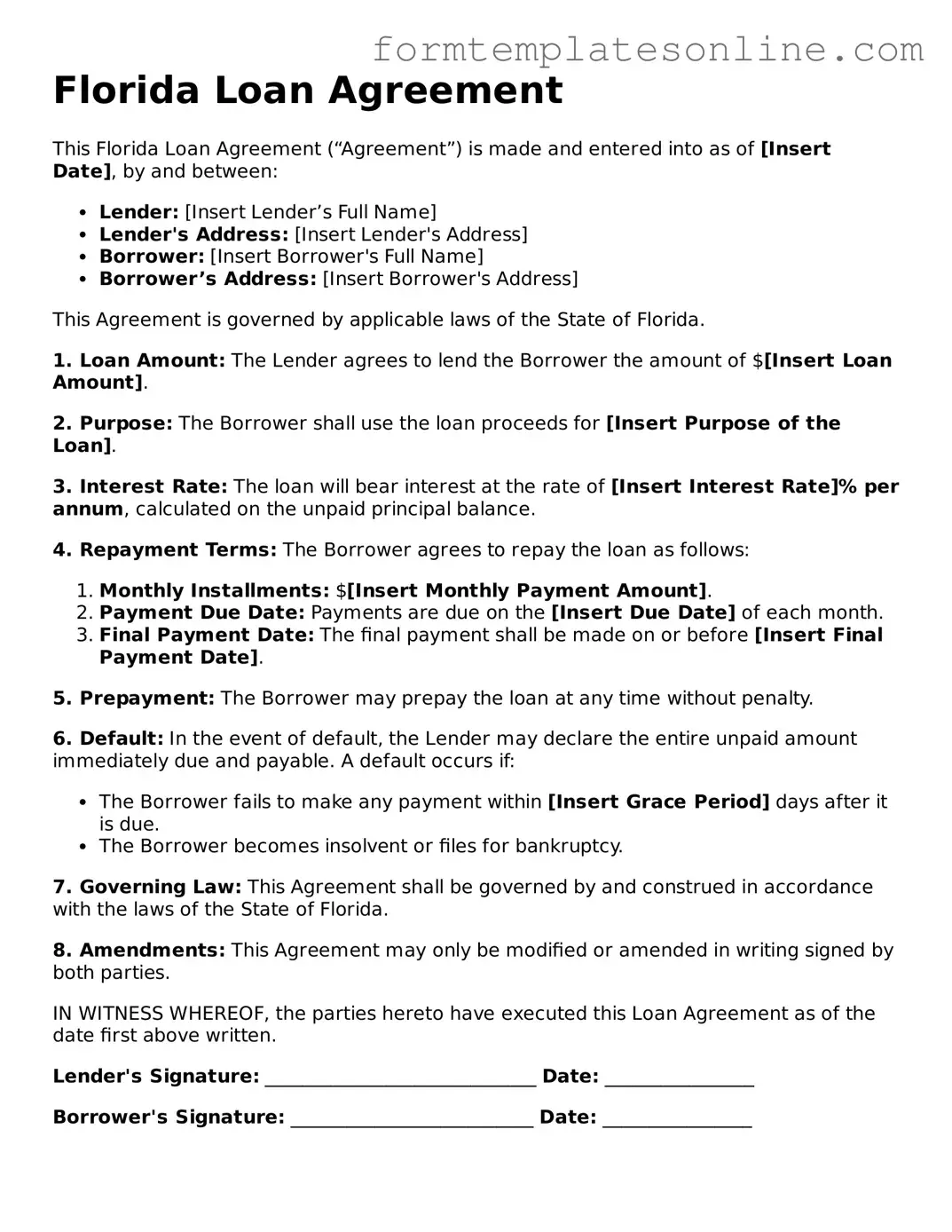

Florida Loan Agreement

This Florida Loan Agreement (“Agreement”) is made and entered into as of [Insert Date], by and between:

- Lender: [Insert Lender’s Full Name]

- Lender's Address: [Insert Lender's Address]

- Borrower: [Insert Borrower's Full Name]

- Borrower’s Address: [Insert Borrower's Address]

This Agreement is governed by applicable laws of the State of Florida.

1. Loan Amount: The Lender agrees to lend the Borrower the amount of $[Insert Loan Amount].

2. Purpose: The Borrower shall use the loan proceeds for [Insert Purpose of the Loan].

3. Interest Rate: The loan will bear interest at the rate of [Insert Interest Rate]% per annum, calculated on the unpaid principal balance.

4. Repayment Terms: The Borrower agrees to repay the loan as follows:

- Monthly Installments: $[Insert Monthly Payment Amount].

- Payment Due Date: Payments are due on the [Insert Due Date] of each month.

- Final Payment Date: The final payment shall be made on or before [Insert Final Payment Date].

5. Prepayment: The Borrower may prepay the loan at any time without penalty.

6. Default: In the event of default, the Lender may declare the entire unpaid amount immediately due and payable. A default occurs if:

- The Borrower fails to make any payment within [Insert Grace Period] days after it is due.

- The Borrower becomes insolvent or files for bankruptcy.

7. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

8. Amendments: This Agreement may only be modified or amended in writing signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the date first above written.

Lender's Signature: _____________________________ Date: ________________

Borrower's Signature: __________________________ Date: ________________

More About Florida Loan Agreement

What is a Florida Loan Agreement?

A Florida Loan Agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Florida. It specifies the amount of money being borrowed, the interest rate, repayment schedule, and any other relevant details. This agreement helps protect both parties by clearly defining their rights and responsibilities.

Who can create a Florida Loan Agreement?

Any individual or entity can create a Florida Loan Agreement, as long as they are legally allowed to enter into a contract. This includes individuals, businesses, and organizations. It is essential that both parties understand the terms and conditions before signing the agreement.

What information is typically included in a Loan Agreement?

A Loan Agreement generally includes the following information: names and addresses of the lender and borrower, loan amount, interest rate, repayment terms, due dates, and any collateral involved. It may also include provisions for late payments, default, and dispute resolution.

Do I need a lawyer to create a Florida Loan Agreement?

While it is not legally required to have a lawyer draft a Loan Agreement, it is often advisable. A lawyer can help ensure that the document meets all legal requirements and protects your interests. If you choose to create the agreement yourself, make sure to follow Florida laws and guidelines.

Can I modify a Loan Agreement after it has been signed?

Yes, a Loan Agreement can be modified after it has been signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the revised agreement to avoid confusion later on.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include charging late fees, demanding full repayment, or taking legal action to recover the owed amount. The specific consequences should be outlined in the Loan Agreement to provide clarity for both parties.

Is a Florida Loan Agreement enforceable in court?

Yes, a properly drafted and signed Loan Agreement is generally enforceable in a Florida court. However, if the agreement violates state laws or public policy, it may not be enforceable. Always ensure that the agreement complies with applicable regulations.

How can I ensure my Loan Agreement is fair?

To ensure fairness, both parties should openly discuss the terms and negotiate any points of concern. Consider seeking legal advice to review the agreement. Transparency about expectations and obligations will help create a balanced agreement that works for everyone involved.

What should I do if I have more questions about the Loan Agreement?

If you have further questions about the Loan Agreement, consider consulting a legal professional or a financial advisor. They can provide guidance tailored to your specific situation. Additionally, researching resources on Florida lending laws may offer helpful insights.

Key takeaways

When filling out and using the Florida Loan Agreement form, it is essential to keep several key points in mind to ensure clarity and legal compliance. Here are some important takeaways:

- Understand the Purpose: The Florida Loan Agreement serves as a legally binding contract between a lender and a borrower, outlining the terms of the loan.

- Identify the Parties: Clearly state the names and contact information of both the lender and the borrower to avoid confusion later.

- Detail the Loan Amount: Specify the exact amount being borrowed, as this is crucial for both parties to understand their obligations.

- Outline Interest Rates: Include the interest rate applicable to the loan. This should be clearly defined to avoid disputes regarding repayment amounts.

- Set Repayment Terms: Clearly state the repayment schedule, including due dates and any grace periods. This helps both parties manage their expectations.

- Include Default Terms: Specify what constitutes a default on the loan and the consequences that may follow. This protects the lender's interests.

- Signatures Required: Ensure that both parties sign and date the agreement. This signifies acceptance of the terms outlined in the document.

- Consult Legal Advice: It may be beneficial to seek legal counsel to review the agreement, ensuring that it complies with Florida laws and adequately protects both parties.

By keeping these key points in mind, both lenders and borrowers can navigate the loan agreement process more effectively, fostering a clearer understanding and reducing the likelihood of misunderstandings.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Loan Agreement is governed by the laws of the State of Florida. |

| Parties Involved | The agreement typically involves a lender and a borrower. |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement. |

| Interest Rate | The form outlines the interest rate applicable to the loan, which may be fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule and due dates are included. |

| Default Clauses | Provisions for what constitutes a default and the consequences are specified. |

| Collateral | If applicable, the agreement may list any collateral securing the loan. |

| Signatures | The form requires signatures from both parties to validate the agreement. |

Consider Some Other Loan Agreement Forms for US States

Free Promissory Note Template California - It includes the loan duration and due dates for repayments.

For those navigating the purchase or sale of a vessel, understanding the necessary documentation is critical. The important aspects of the Boat Bill of Sale are vital for ensuring a smooth transaction and complete ownership transfer in Florida.

Promissory Note Illinois - This form often includes space for additional provisions as needed.

Promissory Note Template Georgia - Legal terms can safeguard lenders against risky borrowers.

New York Promissory Note - Being clear and transparent in this document can lead to a positive lending experience.

Dos and Don'ts

When filling out a Florida Loan Agreement form, it’s important to approach the task with care. Here’s a handy list of things to do and avoid. This will help ensure that your agreement is clear and legally sound.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all figures and calculations.

- Do use clear and legible handwriting if filling it out by hand.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time.

- Don't leave any required fields blank.

- Don't use slang or abbreviations that may confuse the reader.

- Don't sign the document until you fully understand all terms.

- Don't ignore the importance of legal advice if needed.

By following these tips, you can navigate the Florida Loan Agreement form with confidence and clarity. Good luck!